4 Best Health Insurance Companies for 2025

The best health insurance companies are Kaiser Permanente, Blue Cross Blue Shield, UnitedHealthcare and Aetna.

Find Cheap Health Insurance Quotes in Your Area

Best health insurance companies

Best companies | Editor rating |

Cost

| |

|---|---|---|---|

| Kaiser Permanente: Best overall | 4.0 | $507 | |

| BCBS: Best PPO health insurance | 4.0 | $621 | |

| UHC: Best self-employed health insurance | 4.0 | $631 | |

| Aetna: Best for serious healthcare needs | 4.0 | $587 | |

Kaiser Permanente is the best overall health insurance company. It has excellent service, and its plans cost an average of $507 per month before discounts.

Use HealthCare.gov to shop for health insurance for yourself or your family, if you don't get insurance through a job.

You can compare health plans where you live and see if you can qualify for discounted rates based on your income.

| 216 companies compared |

| Recommendations built on real data |

| Strong editorial integrity |

ValuePenguin's health insurance experts use data to help you understand how good an insurance company actually is, despite what the marketing says. We don't make money by promoting any specific companies. Instead, our analysis helps you comparison shop. See our full methodology.

Best health insurance overall: Kaiser Permanente

| Editor rating | |

| Rating on HealthCare.gov | 5 out of 5 |

| Complaints | 81% fewer than average |

| Average cost | $507/mo |

Kaiser Permanente has excellent service and cheap rates.

| Consistently high ratings for customer satisfaction |

| Streamlined access to high-quality medical care |

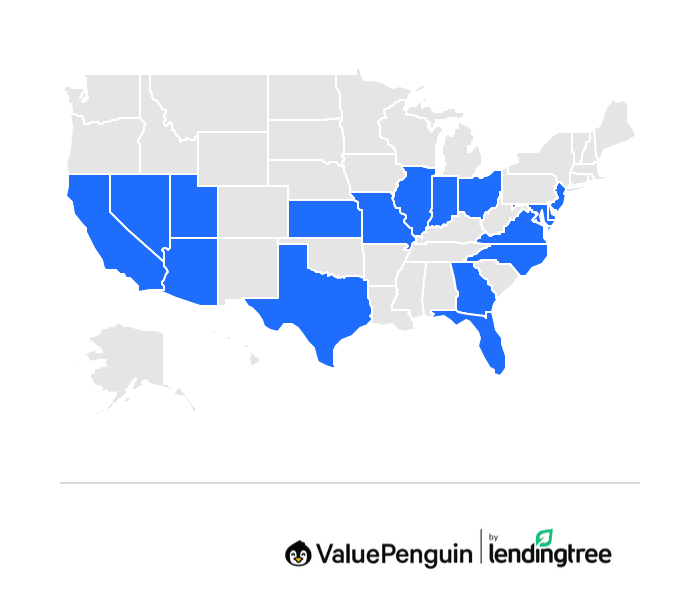

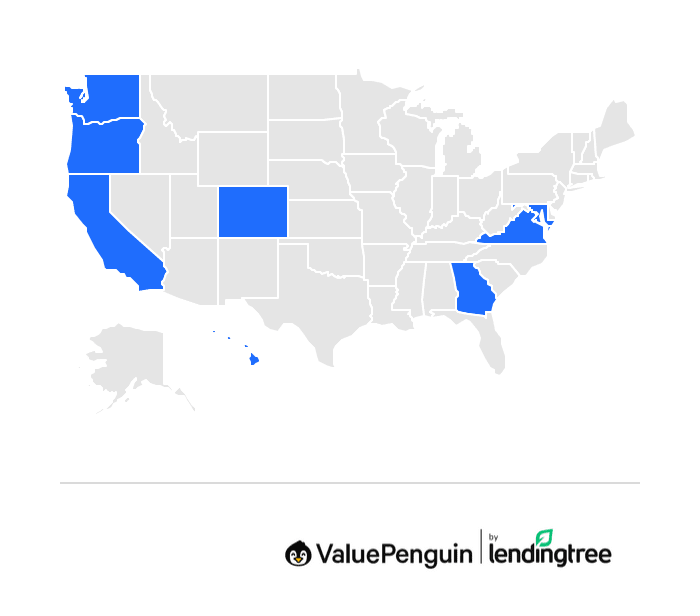

Kaiser Permanente sells insurance in eight states — California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia and Washington — and Washington, D.C.

Even though you can't get it in many places, it's still one of the largest health insurance companies in the U.S. because it's popular in the states where it is available.

If having access to a wide selection of doctors is important to you, consider Blue Cross Blue Shield, which lets you use your insurance with many of the doctors in the country.

Find Cheap Health Insurance in Your Area

Best PPO health insurance: Blue Cross Blue Shield (BCBS)

| Editor rating | |

| Rating on HealthCare.gov | 3.5 out of 5 |

| Complaints | 42% fewer than average |

| Average cost | $621/mo |

BCBS plans are flexible and let you go to almost any doctor.

| You can use your insurance with most doctors |

| Well-rated coverage with lots of perks and extra benefits |

Blue Cross Blue Shield is available in all 50 states and Washington, D.C. You can get a BCBS PPO plan in 20 states and D.C.

However, depending on which BCBS subsidiary operates in your state, the company could be called Florida Blue, Empire Blue Cross, Anthem or another name.

If you're looking for a lower-cost option, consider Aetna, which costs about $34 less per month, on average. Aetna plans also tend to have lower deductibles than Blue Cross Blue Shield plans. But you'll have a smaller network of doctors and fewer perks.

Best self-employed health insurance: UnitedHealthcare (UHC)

| Editor rating | |

| Rating on HealthCare.gov | 3 out of 5 |

| Complaints | 2.5 times more than average |

| Average cost | $631/mo |

UHC lets you buy many different kinds of plans in one place.

| Many plan options including health, dental and vision |

| Highly rated mobile app for managing your health needs |

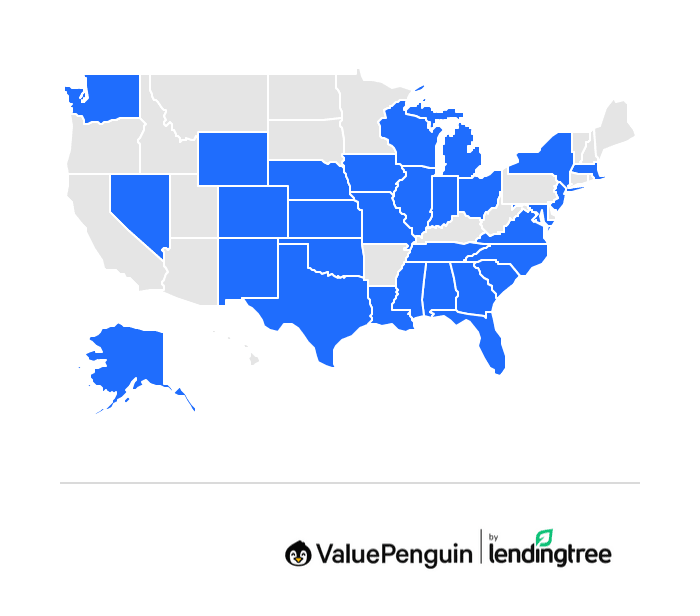

UnitedHealthcare sells health insurance on the marketplace in 30 states. For 2025, UHC plans are new in Indiana, Iowa, Nebraska, South Carolina, Wisconsin and Wyoming.

Aetna costs less than UnitedHealthcare and also has a good mobile app. But its resources and tools are more basic.

Best health insurance if you have serious healthcare needs: Aetna

| Editor rating | |

| Rating on HealthCare.gov | 3 out of 5 |

| Complaints | 85% fewer than average |

| Average cost | $587/mo |

Aetna plans have low average deductibles, so your coverage starts faster.

| Low deductibles mean you coverage starts faster |

| Low-cost visits to specialist doctors |

Kaiser Permanente and Blue Cross Blue Shield are also good options if you need ongoing medical care. Both companies get good Healthcare.gov ratings for medical coverage and service. But Blue Cross Blue Shield lets you go to most doctors. With a Kaiser plan, you have to go to a Kaiser office or hospital. Blue Cross Blue Shield's PPO plans also let you see any specialist and still have some coverage. With a Kaiser Permanente plan, you have to see Kaiser specialists, unless there's an emergency.

Find Cheap Health Insurance in Your Area

Worst health insurance companies

Oscar is the worst health insurance company of 2025 because of its low HealthCare.gov ratings.

Oscar's health insurance plans have a low rating on HealthCare.gov, with poor ratings for medical care. Oscar's customer service is often lacking, too. The second-biggest company within the Oscar brand has more than 10 times the number of complaints expected for a company its size. The largest Oscar company, which is only available in Florida, has good customer service, though, with about half the complaints of an average company.

The main issue with Ambetter is that customers often complain it's hard to find doctors and hospitals in the plan's network. The issue is bad enough that the company is facing a lawsuit about it. Before you consider Ambetter, call your doctors directly to make sure they take the plan you're thinking about buying.

Molina plans often have high deductibles, which means you have to pay a large portion of your medical bills yourself before your plan starts to help out. Even though Molina tends to be cheap in the states where it is available, most people will get better insurance with an affordable plan from one of the best health insurance companies.

How to find the best affordable health insurance

- Get health insurance through work: For most people, the best health insurance is through a job. That's because when you enroll in what's called group health insurance, you split the cost of the plan with your employer.

- Shop for marketplace health insurance plans: If you don't get insurance through a job, shop on HealthCare.gov or your state's marketplace to get the best health insurance for you or your family. All plans on the Affordable Care Act (ACA) marketplace will provide essential benefits including free checkups and screenings as soon as the plan begins.

- Find out if you can get discounted rates: You may qualify for cheaper rates on health insurance if you earn between $15,060 and $60,240 as a single person or between $31,200 and $124,800 as a family of four. You can only get these health insurance subsidies if you buy a plan on HealthCare.gov or your state marketplace. The size of your discount is based on your income, and many people can get plans for $10 or less.

Find the best health insurance in your state

What does health insurance cover?

A health insurance plan has to cover at least 10 common health situations, including checkups and prescriptions.

- Doctor visits

- Emergency care

- Hospital stays

- Pregnancy and baby care

- Mental health and substance use care

- Prescription medicines

- Rehab care and devices

- Lab work

- Preventive and chronic disease care

- Medical care for children

Many plans have more coverage, but all plans will cover at least these 10 things.

What does health insurance not cover?

- The full cost of your medical bills: You'll still have some medical costs, even when you have insurance. How much you'll pay for medical care is listed in the plan's paperwork as the deductible, copay or coinsurance.

- Vision and dental if you're an adult: You'll almost always need to get separate plans for dental insurance and vision insurance. However, you may be able to use the same company for all plans, which can simplify your coverage.

- Elective, cosmetic or experimental treatments: Insurance won't cover drugs that haven't been approved by the FDA or any treatment you get voluntarily, like LASIK.

How much does health insurance cost?

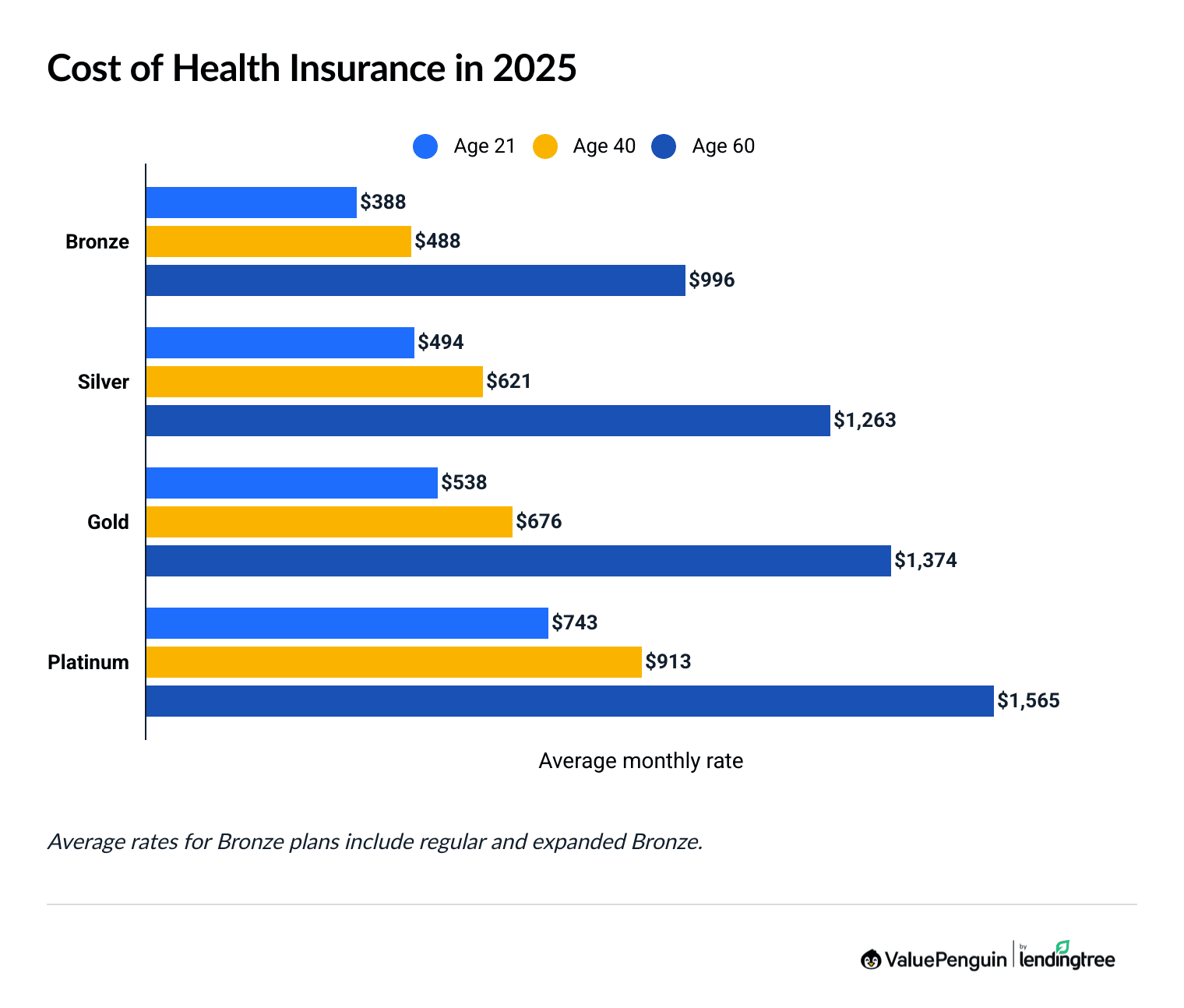

The average cost of health insurance is $621 per month before discounts.

How much you pay is based on:

- Your age: Health insurance gets more expensive as you get older.

- The level of coverage you buy: It costs more for a plan that pays for more of your medical costs.

- Your income: The size of your health insurance discount is based on how much you earn.

Find Cheap Health Insurance in Your Area

Cost of insurance based on age and coverage

You'll get the cheapest rates if you're young and choose a Bronze plan. Rates can get expensive as you get older or if you choose a high tier of coverage.

Health insurance rates after discounts

The average cost of health insurance is $74 per month if you qualify for health insurance discounts, which are called subsidies.

If you shop on HealthCare.gov, you won't pay more than 8.5% of your income for health insurance, and those with low incomes can pay less than $10 for a plan.

Typical health insurance costs after subsidies

Single person

Family of four

Income |

Monthly cost

|

|---|---|

| $25,000 | $13 |

| $35,000 | $96 |

| $50,000 | $283 |

| $75,000 | Full price |

Single person

Income |

Monthly cost

|

|---|---|

| $25,000 | $13 |

| $35,000 | $96 |

| $50,000 | $283 |

| $75,000 | Full price |

Family of four

Income |

Monthly cost

|

|---|---|

| $50,000 | $17 |

| $65,000 | $126 |

| $80,000 | $284 |

| $100,000 | $543 |

| $130,000 | $921 |

How to choose the best affordable health insurance

The best health insurance plan isn't always the cheapest you can find. Compare your options by coverage, extra perks and flexibility.

-

What's the best coverage level for you? Your medical needs usually determine the best level of coverage.

- Silver plans are a good middle ground for most people.

- If you expect to need expensive medical care or prescriptions, it's often worth it to get a Gold plan with better coverage. By paying more each month, you'll pay less at the doctor.

- If you're young and healthy, a Bronze plan can be a good way to save money and still have coverage if you get very sick.

- Do company extras help you save money? More expensive health insurance companies may give extra benefits like gym memberships, discounts and even cash rewards for healthy activities like exercising and checkups. Consider the value of these extras when comparing plans.

Which type of insurance plan is best?

- How coverage works: PPO and POS plans give you some level of coverage for any doctor or medical facility, even if it's not specifically listed on the plan. This is called having access to out-of-network medical care.

- Cost: You'll usually pay much more for PPO and POS plans. You'll also pay more when you go to an out-of-network doctor.

- When it's worth it: The extra cost for a PPO or POS plan is worth it if you want more flexibility about your medical care, need specialized treatment, or travel often and want access to routine care anywhere in the country.

Other health insurance plan types

Get an HMO or EPO plan if you're on a tight budget and are willing to give up some flexibility about which doctors you can use. These plans are cheaper and will usually only cover medical care if you go to a doctor that's in the plan's network.

Watch out for HMO or EPO plans that have a very small list of doctors. With these plans, it can be difficult to find a doctor near you or to get appointments.

Tip to make health care more affordable

Check that the doctors you usually see are in the plan's network, no matter what type of health insurance plan you choose.

Even if you have a PPO plan that will help pay for appointments with any doctor, it will be cheaper to see your doctors if they're in the plan's network.

How much will you pay at the doctor when using health insurance?

How to compare medical costs to find the best health insurance

-

If you need basic or moderate amounts of health care, first compare plans by their deductible.

A plan with a reasonably low deductible will help you start getting the plan's full benefits as soon as possible.

For example, say you are in good health, see the doctor a few times per year, and have an unexpected injury, like a broken leg. If the plan's deductible is too high, you might end up having to pay for all of the medical bills yourself. But with a lower deductible plan, your medical spending could reach the deductible, and you'll start splitting your bills with your insurance.

-

If you expect to have costly medical bills, compare plans by the out-of-pocket max.

Choosing a plan with a low out-of-pocket max will help you save the most by giving you a low cap to your medical expenses. This will be useful if you have ongoing or expensive medical needs.

But if you don't expect to need lots of medical care, you may not reach your plan's out-of-pocket max, which is why it could be better to compare plans by their deductible.

More of the best health insurance picks for specific needs

- Best health insurance for seniors: Medicare

- Best health insurance when unemployed: Medicaid

- Best health insurance for pregnancy: Blue Cross Blue Shield

- Best health insurance for mental health: UnitedHealthcare

Frequently asked questions

What is the best health insurance company to go with?

The best overall health insurance company is Kaiser Permanente because its plans are cheap and highly rated. If you can't get Kaiser, Blue Cross Blue Shield is also a good health insurance company that offers more flexibility in its coverage. You can get a Blue Cross Blue Shield plan no matter where you live in the United States.

What are the best and worst health insurance companies?

Kaiser Permanente is the best-rated health insurance company in the U.S. Good insurance companies include Blue Cross Blue Shield, UnitedHealthcare and Aetna. The worst-rated health insurance companies are Oscar, Molina and Ambetter. These ratings reflect each company's performance on the national level, but the best health insurance company can vary by state.

What factors should you consider when choosing a health insurance plan?

First, choose a well-rated company that sells plans in your area. Then, compare plans to match the level of medical coverage to the amount of medical care you expect to need. A good rule of thumb is that a Bronze plan is a good choice for someone young and healthy. Silver is a middle ground that's good for most people. If you expect to need a lot of medical care, a Gold-tier plan could help you save money on health care.

Methodology and data sources

To find the best health insurance companies, ValuePenguin experts compared thousands of plans based on independent rankings for:

- Affordability

- Quality of medical care

- Customer satisfaction

- Rate of complaints

The best companies get 4 stars or more from ValuePenguin editors. Avoid choosing a company with fewer than 3 stars because you could have problems with bad service and delayed claims processing.

ValuePenguin evaluated the largest health insurance companies across the following rankings:

- HealthCare.gov star ratings: HealthCare.gov assigns plans a score between 1 and 5 that reflects care quality and customer satisfaction. We averaged the overall performance rating of each state and company where data was available.

- AM Best: We also considered the financial health of companies. AM Best rankings were averaged based on each subsidiary's ability to pay medical claims. AM Best is a credit rating agency that gives health insurance companies a financial health score. A++ or "superior" is the top grade available. Usually, any company above A- is in an above-average financial situation.

- NAIC complaint index: The National Association of Insurance Commissioners (NAIC) complaint index determines if a company got fewer complaints than a typical company of its size. The ratio of complaints is a weighted average of all subsidiaries by total annual rates.

The costs of health insurance plans in 2025 use data from the Centers for Medicare & Medicaid Services (CMS) about private health insurance plans sold on HealthCare.gov as well as rates collected from state marketplaces. Costs are for a 40-year-old choosing a Silver health insurance plan.

Info on claim denials is from the CMS coverage transparency data for individual qualified health plans sold on the marketplace. Other estimates about rates after subsidies are from KFF.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.