Best Cheap Health Insurance in Maryland for 2026

Kaiser Permanente has the best health insurance in Maryland. Gold plans start at $419 per month before discounts.

Find Cheap Health Insurance Quotes in Maryland

Best and cheapest health insurance in Maryland

Cheapest health insurance companies in Maryland

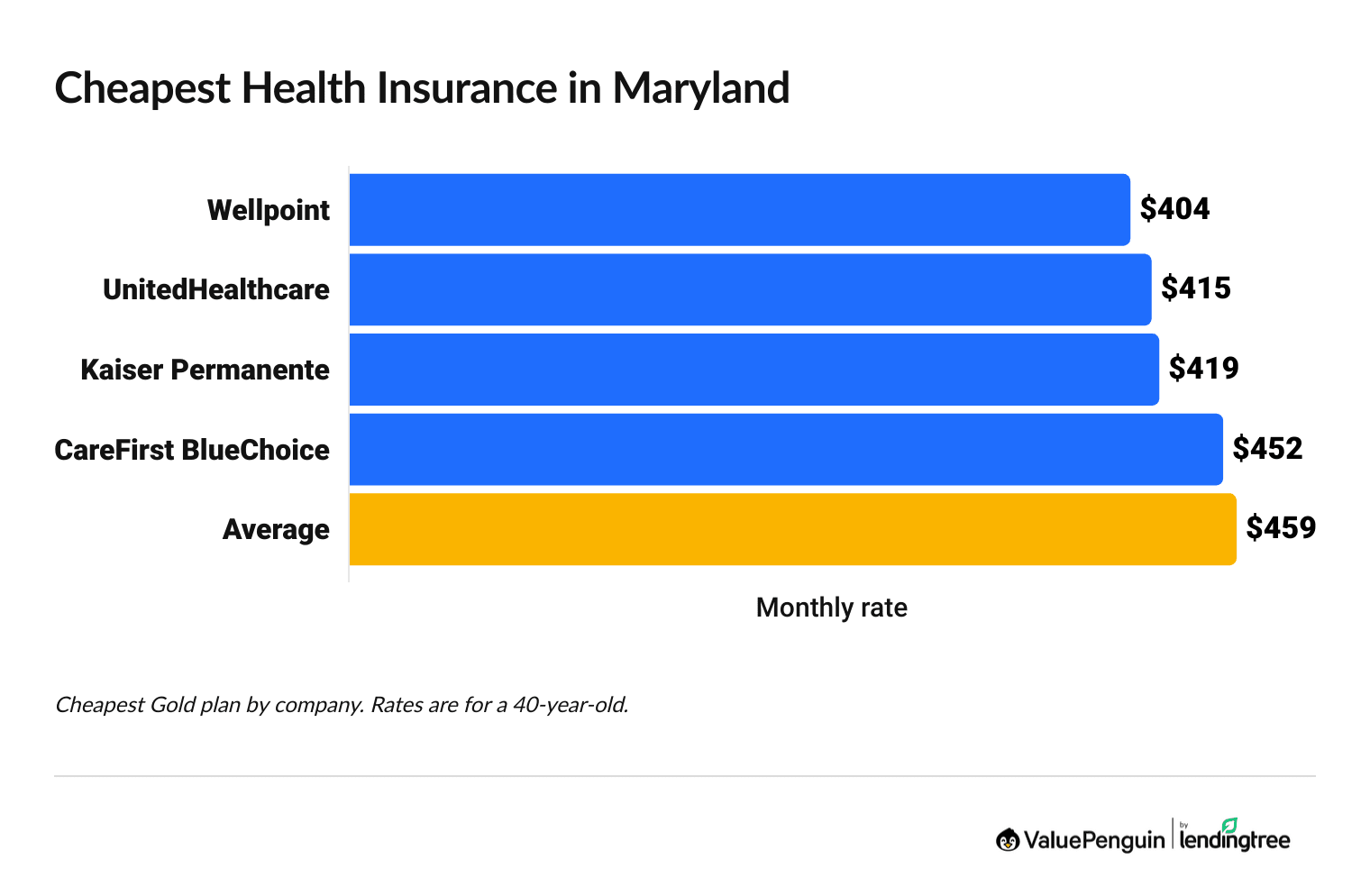

Wellpoint, UnitedHealthcare and Kaiser Permanente have the most affordable health insurance plans in Maryland, with Gold plans starting at $404 per month before discounts.

Find Cheap Health Insurance Quotes in Maryland

Affordable health insurance in Maryland

Company |

Cost

| |

|---|---|---|

| Wellpoint | $404-$455 | |

| UnitedHealthcare | $415-$435 | |

| Kaiser Permanente | $419-$488 | |

| CareFirst BCBS | $452-$649 | |

- Wellpoint has the cheapest health insurance in Maryland, with Gold plans starting at $404 per month. The company sells the cheapest option in every county in Maryland.

- UnitedHealthcare has the most affordable Silver plans everywhere in Maryland. Coverage starts at $403 per month.

- CareFirst, a Blue Cross Blue Shield (BCBS) company, has the most popular health plans in Maryland. Almost six in 10 Maryland residents have CareFirst health insurance.

Aetna is leaving Maryland

Aetna will leave the Maryland health marketplace at the end of 2025. If you're a current Aetna customer, you'll have to switch to a new company when open enrollment starts (Nov. 1 to Jan. 15).

Kaiser Permanente is a good alternative to Aetna because Kaiser has cheap rates and a strong reputation for customer service. Those people who want the cheapest rates should consider UnitedHealthcare.

Best health insurance companies in Maryland

Kaiser Permanente offers the best health insurance in Maryland.

Kaiser Permanente has a perfect 5-out-of-5-star plan quality rating from HealthCare.gov. Star ratings measure coverage quality, customer satisfaction and plan management.

Find Cheap Health Insurance Quotes in Maryland

Best-rated health insurance companies in MD

Company |

ACA rating

|

VP rating

|

|---|---|---|

| Kaiser Permanente | ||

| UnitedHealthcare | ||

| Wellpoint | N/A | |

| CareFirst BCBS |

Kaiser Permanente is unusual because it only covers medical services at Kaiser Permanente hospitals and clinics, unless you have a medical emergency. If you'd rather not go to one of their facilities located in the Baltimore or Washington, D.C., areas, then choose health insurance from CareFirst, which has a larger network of doctors and hospitals.

Best doctor network in Maryland: CareFirst

CareFirst is a good choice in Maryland if you want more flexibility about your doctors and don't mind paying more for insurance. CareFirst is part of the Blue Cross Blue Shield (BCBS) network, which means customers have access to the largest network of doctors in the nation.

CareFirst sells plans using two company names: CareFirst Blue Cross Blue Shield and CareFirst BlueChoice.

- The plans from CareFirst BCBS are more expensive because they let you see any doctor and still have some coverage. These are called PPO plans.

- CareFirst BlueChoice only sells HMO plans. These plans are cheaper, but you have to see certain doctors to have coverage, and you will need a referral before you see a specialist.

The downside is that CareFirst has a high rate of complaints. That means you have a higher chance of issues with getting claims paid or medical care approved.

How much is health insurance in Maryland?

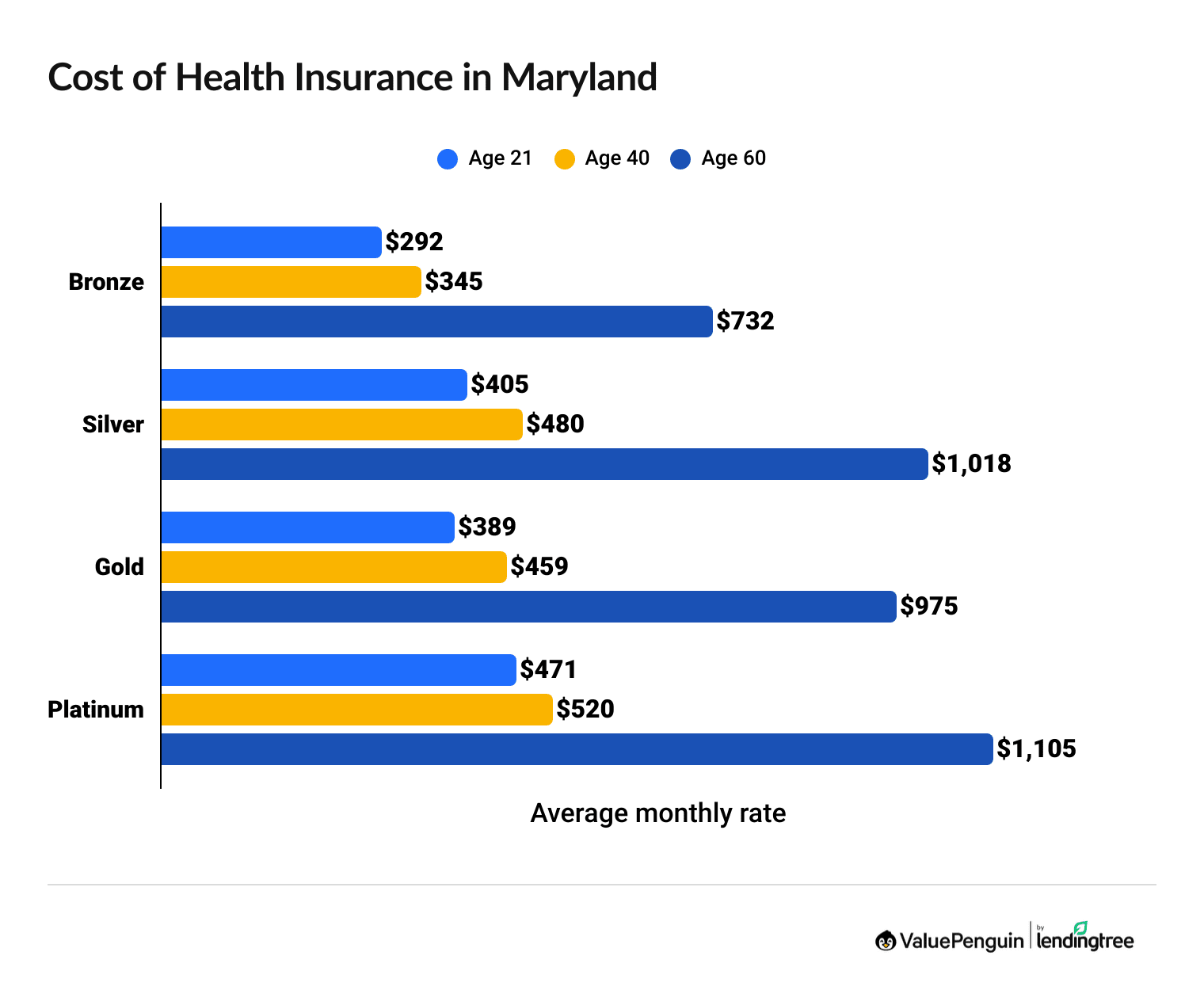

Health insurance in Maryland costs an average of $459 per month at full price or as little as $0 per month after discounts.

Find Cheap Health Insurance Quotes in Maryland

- In Maryland, Gold and Silver plans have roughly identical monthly costs. Get a Gold plan with its better benefits if your income is above $39,125 as an individual or $80,375 for a family of four. But if your income is lower, choose a Silver plan, because you'll qualify for a savings program called cost-sharing reductions (CSRs).

- Medical insurance gets more expensive as you age. Costs rise slowly when you're younger before climbing rapidly as you enter middle age. A 60-year-old in Maryland pays more than twice as much as a 40-year-old for the same level of coverage.

- Higher plan tiers tend to have more expensive monthly rates than lower plan tiers. But you pay less when you visit the doctor with higher plan tiers.

- Silver plans often cost more than Gold plans in Maryland despite offering less coverage. That's because you can get extra subsidies, called cost-sharing reductions, if you earn a low income and have a Silver plan.** You can't get extra subsidies with any other plan tier.

Health insurance discount changes in Maryland for 2026

Health insurance costs $459 in Maryland, but you could pay as little as $0 per month depending on your age and income.

Extra pandemic-era subsidies will expire at the end of 2025 unless Congress chooses to renew them. That means the cost of health insurance will increase significantly for many people in Maryland who are eligible for subsidies.

Maryland is making up some of the shortfall with state-level subsidies. People who earn less than $31,300 per year ($64,300 per year for a family of four) won't see any changes to the amount of subsidies they can get. If you make between $31,300 and $62,600 per year ($64,300 and $128,600 per year for a family of four), the state of Maryland will pay for half the cost of your expiring federal subsidies. No subsidies are available for individuals making more than $62,600 per year ($128,600 per year for a family of four).

The state of Maryland is also offering extra help for residents between the ages of 18 and 37, called Maryland Premium Assistance. That means you'll pay less for health insurance in Maryland if you earn a low income and you're age 37 or younger.

Health insurance rates in Baltimore

Income | Age 25 | Age 40 |

|---|---|---|

| $0 | $45 | $50 |

| $134 | $217 | $222 |

| $149 | $341 | $349 |

| $154 | $367 | $458 |

| $326 | $414 | $880 |

Average cost for a Benchmark Silver plan after both federal and state subsidies are applied.

Where you live in Maryland may influence the amount of subsidies available to you. That means you may be eligible for higher or lower subsidy levels if you're in a different part of the state.

- Who can get subsidies? You can get subsidies if you make between $21,597 and $62,600 as a single person ($44,367 and $128,600 for a family of four). The less you make, the higher your subsidy.

- How do subsidies work? You can use your subsidy on any Bronze, Silver, Gold or Platinum plan bought through Maryland Health Connection. Subsidies can be applied to your monthly rate, or you can choose to get it as a lump sum at the end of the year when you file your taxes.

- How much do you save? ValuePenguin's subsidy calculator lets you find out how much you'll pay for health insurance after discounts.

Affordable Maryland health insurance plans by city

Welllpoint has the most affordable Gold health plans in Baltimore, at $404 per month on average.

Wellpoint sells the cheapest Gold and Silver plans in every county in Maryland. That includes large cities like Frederick, Gaithersburg and Rockville.

Cheapest health insurance plans by MD county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Allegany | Wellpoint Essential Gold | $404 |

| Anne Arundel | Wellpoint Essential Gold | $404 |

| Baltimore | Wellpoint Essential Gold | $404 |

| Baltimore City | Wellpoint Essential Gold | $404 |

| Calvert | Wellpoint Essential Gold | $404 |

Cheapest Gold plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Maryland

Best health insurance by level of coverage

The best health insurance level for you depends on the amount of medical care you need and your financial situation.

Platinum plans: Best for expensive medical issues

| Platinum plans pay for about 90% of your medical care. |

In Maryland, Platinum plans cost $520 per month and have a $0 deductible, on average.

Platinum health insurance plans are a good option if you need a lot of expensive medical care. For example, a Platinum plan might make financial sense if you have a serious illness.

While these plans have high monthly rates, you'll pay very little when you visit the doctor.

Gold plans: Best if you visit the doctor frequently

| Gold plans pay for about 80% of your medical care. |

Gold plans in Maryland cost $459 per month and have a $1,042 deductible, on average.

In Maryland, Gold plans and Silver plans have similar average monthly rates. Gold plans are supposed to cost more than Silver plans. However, insurance companies in Maryland have raised the price of Silver plans because Silver plans are eligible for extra discounts, called cost-sharing reductions.

Cost-sharing reductions help you pay for the costs you're responsible for when you visit the hospital. That means you're usually better off with a Silver plan that has CSRs. But Gold plans are always a better choice if you don't qualify for cost-sharing reductions.

Silver plans: Best for average medical needs

| Silver plans pay for about 70% of your medical care. |

In Maryland, Silver plans cost $480 per month and have a $3,597 deductible, on average.

Silver health plans offer a balance between average rates and middle-of-the-road costs you're responsible for paying when you visit the doctor. Silver plans are a good choice if you only visit the doctor a few times a year and you earn a low income.

Silver plans in Maryland cost about the same as Gold plans. For a Silver plan to make sense financially, you need to qualify for extra discounts, called cost-sharing reductions. Maryland residents are eligible for CSRs if they earn between $21,597 and $39,125 per year ($44,367 to $80,375 per year for a family of four).

On average, Silver plans have a much larger deductible than Gold plans. You would pay about $2,555 more on average before coverage starts with a Silver plan than with a Gold plan if you don't qualify for cost-sharing reductions.

Bronze plans: Best if you're young and healthy

| Bronze plans pay for about 60% of your medical care. |

In Maryland, Bronze plans cost $345 per month and have a $7,570 health insurance deductible, on average.

Bronze plans are a good option if you're in good health and you can afford a large, unexpected medical bill. These plans have affordable rates, but you'll have to pay more money before your coverage starts. It's not a good idea to buy a Bronze plan if you can't afford to cover your deductible from your savings.

It's important that you have enough in your savings account to comfortably pay for your deductible if you don't qualify for cost-sharing reductions.

Free and affordable health coverage if you have a low income

You may qualify for free coverage or extra discounts if you live in Maryland and earn a low income.

Medicaid: Free health insurance for Marylanders who earn a low income

If you live in Maryland and you earn around $22,000 per year or less (under about $44,000 per year for a family of four), you may be eligible for free government health insurance, called Medicaid.

Pregnant women, parents with young children and the disabled may qualify for Medicaid with higher incomes.

Silver plans with cost-sharing reductions: Best if you earn a low income but can't get Medicaid

| Silver plans will pay 74% to 90% of your medical costs if you have a low income. |

You may qualify for extra discounts, called cost-sharing reductions, if you have a Silver plan and you make between $21,597 and $39,125 per year (between $44,367 and $80,375 per year for a family of four).

CSRs help you pay for the costs you're responsible for when you visit the hospital, including your deductible, copays and coinsurance.

You can reduce your out-of-pocket costs by up to 90% with CSRs. That means a Silver plan with cost-sharing reductions is usually a better deal than a Gold plan.

Are health insurance rates going up in MD?

Health insurance in Maryland costs 12% more per month, on average, in 2026 compared to 2025.

Silver plans had the biggest increase, costing 16% more this year compared to last year. Gold plans got 12% more expensive, on average, and the cost of a Platinum plan increased by an average of 11%. Bronze plans rose the least, at 10%, on average. The cost of Silver health insurance in Maryland rose by an average of 31% between 2022 and 2026.

Bronze

Silver

Gold

Platinum

Year | Cost | Change |

|---|---|---|

| 2022 | $269 | – |

| 2023 | $281 | 4% |

| 2024 | $291 | 4% |

| 2025 | $313 | 8% |

| 2026 | $345 | 10% |

Monthly costs are for a 40-year-old. Expanded Bronze plans are included in 2024, 2025 and 2026 averages, when they're offered.

Bronze

Year | Cost | Change |

|---|---|---|

| 2022 | $269 | – |

| 2023 | $281 | 4% |

| 2024 | $291 | 4% |

| 2025 | $313 | 8% |

| 2026 | $345 | 10% |

Monthly costs are for a 40-year-old. Expanded Bronze plans are included in 2024, 2025 and 2026 averages, when they're offered.

Silver

Year | Cost | Change |

|---|---|---|

| 2022 | $365 | – |

| 2023 | $385 | 5% |

| 2024 | $384 | 0% |

| 2025 | $412 | 7% |

| 2026 | $480 | 16% |

Monthly costs are for a 40-year-old.

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $351 | – |

| 2023 | $374 | 7% |

| 2024 | $384 | 3% |

| 2025 | $411 | 7% |

| 2026 | $459 | 12% |

Monthly costs are for a 40-year-old.

Platinum

Year | Cost | Change |

|---|---|---|

| 2022 | $367 | – |

| 2023 | $403 | 10% |

| 2024 | $429 | 6% |

| 2025 | $470 | 10% |

| 2026 | $520 | 11% |

Monthly costs are for a 40-year-old.

Why is health insurance expensive in MD in 2026?

The main cause of higher medical insurance rates in 2026 is the rising cost of health care.

When it costs more to go to the doctor or get medications, health insurance companies have to pay more to cover the extra cost. To make up for that, they raise rates for everyone.

The high cost and widespread use of weight-loss drugs like Ozempic and Wegovy is also causing health insurance rates to go up.

Changes to discounts, called subsidies, are also making health insurance more expensive in 2026. Starting in 2021, people with low incomes could get bigger discounts, called "enhanced subsidies." But these extra discounts are going to expire at the end of 2025. Unless they're extended by Congress, the discounts won't be as big in 2026. That means you'll pay more for health insurance even if you still get discounts.

What to do if your rate goes up in 2026

- Shop around and get quotes. Look at all your other options on Maryland Health Connection, Maryland's state marketplace. You might find another company that has cheaper rates and good coverage. Just make sure your doctor accepts the plan before you buy it, unless you're willing to switch doctors.

- See if you get discounts. If you have a low income or your income has recently changed, check to see if you get subsidies. Even if the discounts are smaller in 2026, they'll still save you money if you qualify.

- Change to a lower-tier plan. Going to a lower-tier plan, like Bronze, can help you get a cheaper monthly rate. But Bronze plans are usually only a good idea if you don't go to the doctor often and you have the money to pay for more of your health care bills. If you need help saving for medical costs, you can open an HSA. That's a new perk you can get with Bronze plans in 2026.

- Check if you can get Medicaid. If you have a very low income (under about $22,000 per year as an individual), you can get Medicaid in Maryland. Medicaid offers free or very cheap health care if you qualify.

Maryland insurance marketplace: Maryland Health Connection

All Obamacare health plans in Maryland offer certain important benefits and protections for customers.

- You don't need to meet your annual deductible before coverage starts for annual check-ups and preventive services.

- Companies can't consider your health history when setting rates or approving coverage.

- All marketplace plans have a limit on how much you'll spend on medical care in a single year, called an out-of-pocket maximum.

Short-term health insurance in Maryland

You can buy short-term health insurance for up to three months at a time in Maryland. You can't renew your short-term plan.

Short-term plans can help you bridge a temporary coverage gap. For example, short-term coverage might be a good idea if you miss open enrollment.

Keep in mind that if you lose your current insurance, you may qualify for a special enrollment period, which lets you get marketplace coverage outside open enrollment.

Pros of short-term health insurance in MD

Cons of short-term health insurance in MD

Health insurance enrollment by income level in Maryland

Three-quarters of Maryland residents who have marketplace coverage earn less than $60,240 per year.

People who earn a lower income will be most impacted by changes to subsidies in 2026. That's because most Maryland residents with marketplace coverage earn a below-average income.

Enrollment by income

Income | % of total enrollment |

|---|---|

| Less than $15,060 | 10% |

| $15,060 to $20,783 | 4% |

| $20,784 to $22,590 | 7% |

| $22,591 to $30,120 | 21% |

| $30,121 to $37,650 | 14% |

Enrollment in 2025 marketplace plans made during the 2024-2025 Open Enrollment period. Total may not be 100% due to rounding

Frequently asked questions

Who has the best health insurance in Maryland?

Kaiser Permanente has the best health plans in Maryland. Kaiser has a strong reputation for customer satisfaction and some of the cheapest plans in Maryland.

Why are health insurance rates going up in Maryland in 2026?

The cost of health insurance is going up in Maryland because of higher healthcare costs, more expensive prescription drugs and expiring health insurance subsidies. Health insurance rates in Maryland are going up by an average of 12% in 2026, which is a smaller increase than many other parts of the country because Maryland has extra state subsidies.

What's the cheapest health insurance in MD?

Wellpoint has the cheapest health insurance in Maryland. Wellpoint has the most affordable rates in every Maryland county, including Baltimore City.

How much is health insurance in Maryland per month?

Health insurance in Maryland costs $459 per month on average. The amount you'll pay for coverage depends on your age, plan tier, where you live, the discounts you qualify for and the company you choose.

Is $200 a month expensive for health insurance?

$200 per month for health insurance is cheap in Maryland. A 40-year-old pays $459 per month for a Gold plan, on average, and a 21-year-old pays an average of $389 per month for the same coverage. You could get a plan for $200 per month or cheaper if you get discounts for having a low income.

Maryland health insurance rate data for 2026 is from Maryland Health Connection. ValuePenguin used the state marketplace data to find average rates for different plan tiers, geographic locations and family sizes.

Rates

Rates are based on a 40-year-old with a Silver plan, unless otherwise noted. Rates for Bronze plans include regular and Expanded Bronze plans for 2024, 2025 and 2026, when the plans are available. Your costs and plan options will vary; plans aren't always available in all parts of a state or county.

Subsidies

Rates after subsidies are estimates for a 40-year-old with a Benchmark Silver plan and are based on how subsidies were structured before 2021. State-level subsidies were also included to arrive at cost estimates for individuals living in the city of Baltimore. The total cost in the state uses rates calculated by income, which are weighted using CMS data on the incomes of those who purchased plans during last year's open enrollment. The median was used for each income range. Unknown incomes were excluded from the calculations. Incomes of 100% of the federal poverty line and 500% of the federal poverty line were assumed for enrollees who earn less than 100% FPL and more than 500% FPL, respectively.

Ratings

ValuePenguin's experts rank companies based on cost, coverage options, customer satisfaction and unique value. Ratings are out of 100 possible points. ACA ratings show how the company performs in Maryland for medical care, member experience and plan administration. This 2026 plan quality data from CMS is based on data from last year. Ratings are not available for new plans or plans with low enrollment.

More sources

Enrollment trends, including plan selections by tier and enrollment by income, are from CMS data for the 2025 open enrollment period.

Other sources include S&P Global Capital IQ and the National Association of Insurance Commissioners (NAIC).

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.