What Is PPO Health Insurance?

PPO health insurance lets you go to any doctor and still pays at least part of your medical bills.

Find Cheap Health Insurance Quotes in Your Area

With a PPO, or preferred provider organization, you can go to any doctor but you'll pay less when you go to the doctors in the plan's network. But unlike other types of health insurance, your plan still pays some of your medical bills when you see a doctor outside the network. PPOs also let you go to specialists without a referral, which can help you get medical care faster.

What is a PPO plan?

A PPO is a type of health insurance plan that gives you the ability to see any doctor and have some coverage.

You'll pay a lower amount if you go to a doctor that is in your PPO's network. But if you go outside of the network, your health insurance will still pay part of the cost for your visit.

If you have a PPO, you don't need a primary care doctor like you do with other types of health insurance plans. You can see a specialist without a referral, too, which is a major perk if you have a chronic illness or develop a disease.

However, even if you don't need a referral from the plan to see a specialist, some specialists still require a referral. And it can still be helpful to have a primary doctor even though you don't have to.

What is a provider network?

A provider network is a list of the doctors and hospitals that a plan contracts with to give medical care to its members. These are called "in-network" doctors. Medical offices that aren't contracted with the plan are considered "out-of-network."

How much does a PPO plan cost?

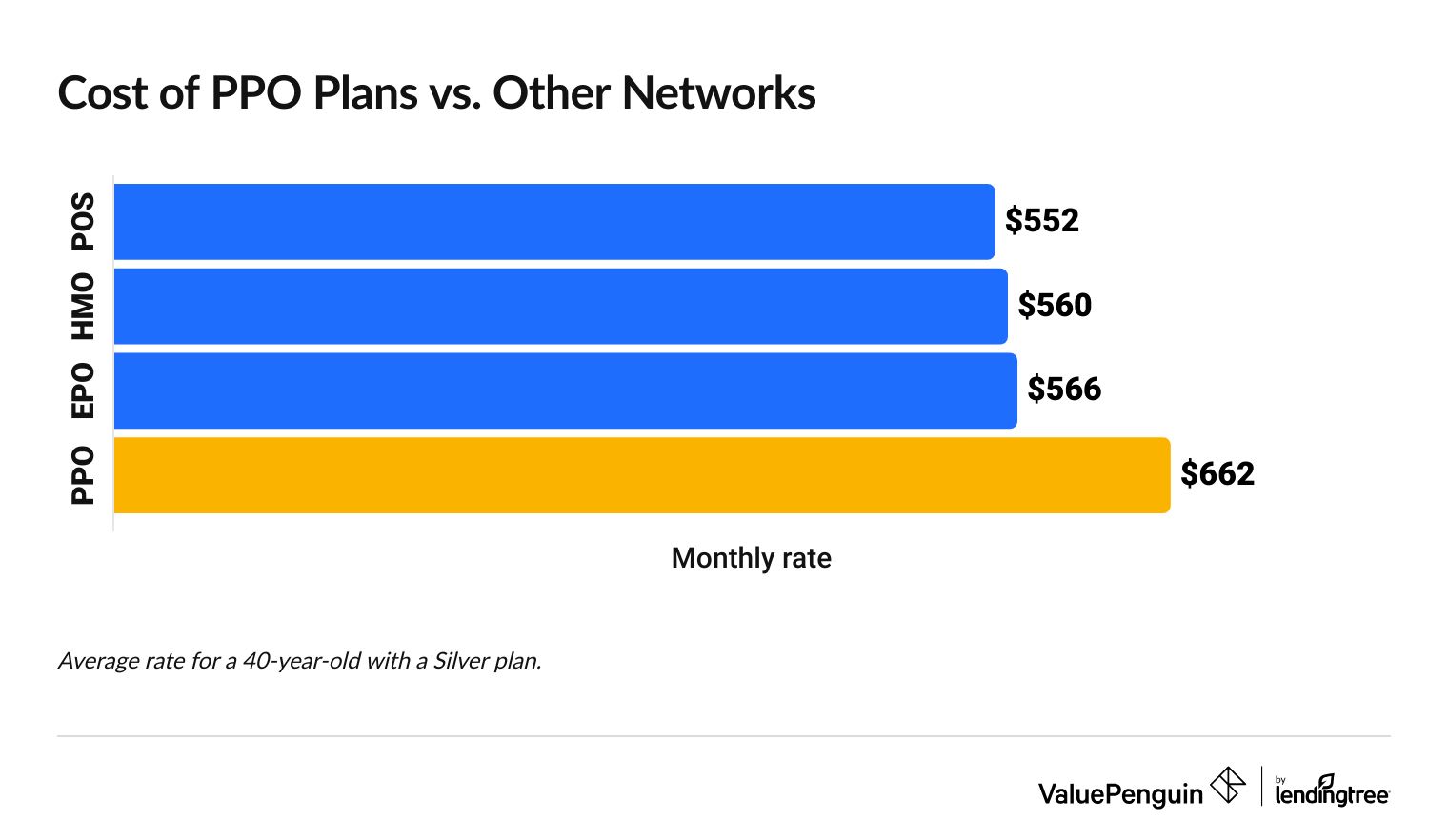

The average cost of a PPO health insurance plan is $662 per month.

Find Cheap Health Insurance Quotes in Your Area

PPO plans are often the most expensive option because they give you the most flexibility.

PPO rates vs. other health insurance plans types

Even though PPOs are more expensive, they can save you money overall if you go to the doctor often and need the flexibility to go to doctors outside the plan's network. If you have an HMO, for example, you have to pay for the entire cost of visits to doctors that aren't in your plan's network. Having a PPO means you'll at least have some coverage for out-of-network doctors.

PPO rates by company

Oscar has the cheapest PPO rates from a major insurance company. But the best PPOs for most people come from Blue Cross Blue Shield.

Company | PPO rate | |

|---|---|---|

| Oscar | $471 | |

| Ambetter | $491 | |

| Blue Cross Blue Shield | $689 | |

| Aetna | $780 | |

Average monthly rates for a 40-year-old with a Silver plan.

Not all companies sell PPO plans on HealthCare.gov or state marketplace websites. For example, UnitedHealthcare is the largest health insurance company in the United States, but you can't get a PPO from UnitedHealthcare unless you have insurance through your job.

Cost of PPO plans by state

Where you live impacts how much you'll pay for a PPO. In some states, you can't even get a PPO plan on HealthCare.gov or your state's health insurance marketplace.

Even if you live in a state where PPO plans aren't available for marketplace insurance, you might still have or be able to get a PPO plan through your job.

Best PPO health insurance

The best PPO companies include Blue Cross Blue Shield and Ambetter. But you may be able to get a great PPO from a smaller, regional company in your area.

Best PPO plans for most people: Blue Cross Blue Shield

-

Editor's rating

- Average monthly cost: $689

Most people can get a plan from Blue Cross Blue Shield, and most doctors take the coverage.

Pros

-

You can see most doctors with BCBS

-

PPOs are available in 20 states and D.C.

Cons

-

High average rates

-

Customer service varies by location

Despite having higher monthly rates, Blue Cross Blue Shield's PPOs can save you money overall because most doctors and hospitals are in the plan's network. That means you'll pay the lower, in-network rates when you get most medical care.

In many states, Blue Cross Blue Shield is the only company that sells PPO plans on HealthCare.gov or a state marketplace. For example, Florida Blue is the only company that sells PPO plans in Florida. And in Arizona, you can only get a PPO from Blue Cross Blue Shield of Arizona.

But Blue Cross Blue Shield's PPOs are a bit more expensive than average. And the customer service quality depends on where you live. Each Blue Cross Blue Shield company operates independently.

Blue Cross Blue Shield sells PPO plans in 20 states and Washington, D.C.

- Alabama

- Alaska

- Arizona

- Arkansas

- Delaware

- Florida

- Hawaii

- Illinois

- Louisiana

- Michigan

- Montana

- Nebraska

- North Carolina

- North Dakota

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- Washington, D.C.

- West Virginia

- Wyoming

Best cheap PPO plans: Ambetter

-

Editor's rating

- Average monthly cost: $491

Ambetter has cheap rates for its PPO plans.

Pros

-

Cheap PPO rates

-

Good extra perks

Cons

-

PPOs only available in two states

-

Can be hard to find in-network doctors

Ambetter has cheap rates for PPOs, which makes it a good option if you're on a budget but still want a flexible health insurance plan. Its rates aren't as cheap as Oscar's, but it has better customer service. You can only get Ambetter in Arkansas and Oklahoma.

Ambetter's customer service still isn't good, although it's better than Oscar's. If you live in Arkansas or Oklahoma, where Ambetter sells PPOs, Blue Cross Blue Shield is usually a better option. It's more expensive, but customers are usually more satisfied.

Ambetter has also had issues with helping members find in-network doctors. Even though a PPO will still pay for some of your medical bills if you go out of the network, it's cheaper to stay with an in-network doctor. If you have trouble finding doctors that are in the network, you'll pay more overall for medical care.

Ambetter only sells PPO plans in Arkansas and Oklahoma.

What are the differences between PPOs and other networks?

Compared to PPOs, other networks are usually cheaper. But other health insurance networks don't usually have as many perks as PPOs.

The two main types of health insurance networks are PPOs and HMOs, or health maintenance organizations.

HMO | PPO | |

|---|---|---|

| Cost | Cheaper rates | Higher rates |

| Primary care doctor required? | Yes | No |

| Referral needed to see a specialist? | Yes | No |

| Out-of-network care available? | No | Yes |

With an HMO, you need a primary care doctor and need to go through them to see a specialist. You also have to go to in-network doctors for your plan to cover anything. If you go outside the network, you have to pay the full cost for your visit.

Because HMOs restrict you to a network of doctors and give you less flexibility, they have a cheaper monthly rate compared to PPOs.

EPOs, or exclusive provider organizations, don't cover any medical care if you go outside the plan's network.

EPO | PPO | |

|---|---|---|

| Cost | Cheaper rates | Higher rates |

| Primary care doctor required? | No | No |

| Referral needed to see a specialist? | No, but the specialist must be in-network | No |

| Out-of-network care available? | No | Yes |

However, they offer the flexibility to see a specialist without a referral if the specialist is within the network. EPOs are usually cheaper than PPOs, but they're not very common.

Point of service (POS) policies are similar to PPOs because they let you get care outside the plan's network and still have some coverage.

POS | PPO | |

|---|---|---|

| Cost | Cheaper rates | Higher rates |

| Primary care doctor required? | Yes | No |

| Referral needed to see a specialist? | Yes | No |

| Out-of-network care available? | Yes | Yes |

However, as with an HMO, you need a primary care doctor with a POS plan. You will also have to get a referral to see a specialist.

Frequently asked questions

What does PPO mean in health insurance?

PPO stands for "preferred provider organization." A PPO is a type of health insurance plan that lets you go to any doctor and still have some coverage. If a doctor isn't in the plan's network, you'll pay more for your visit, but your plan will still pay something toward your medical bills. You can also see a specialist without a referral if you have a PPO, and you don't need to have a primary care doctor.

What is the downside to a PPO plan?

PPOs tend to be more expensive than other plan networks because they give you the flexibility to go to both in- and out-of-network doctors and still have some coverage. If you go to a doctor that isn't in the network, your plan will still pay for some of your medical bills, but you'll pay more than if you go to an in-network doctor.

Which is better, an HMO or PPO?

An HMO is a better option if you're looking for a cheap plan, but remember that you have to use in-network doctors to have coverage. A PPO is probably better for most people because it gives you the freedom to go to any doctor and still have some coverage. But PPOs cost more than HMOs, so they aren't the best if you're on a budget.

Methodology

ValuePenguin sourced its 2025 health insurance rates from the Centers for Medicare & Medicaid Services (CMS) government website public use files (PUFs). Rates are averages for a 40-year-old with a Silver plan and with each type of health insurance network mentioned.

Insurance Writer

Cate Deventer is a ValuePenguin writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.