Best Cheap Health Insurance in Utah (2025)

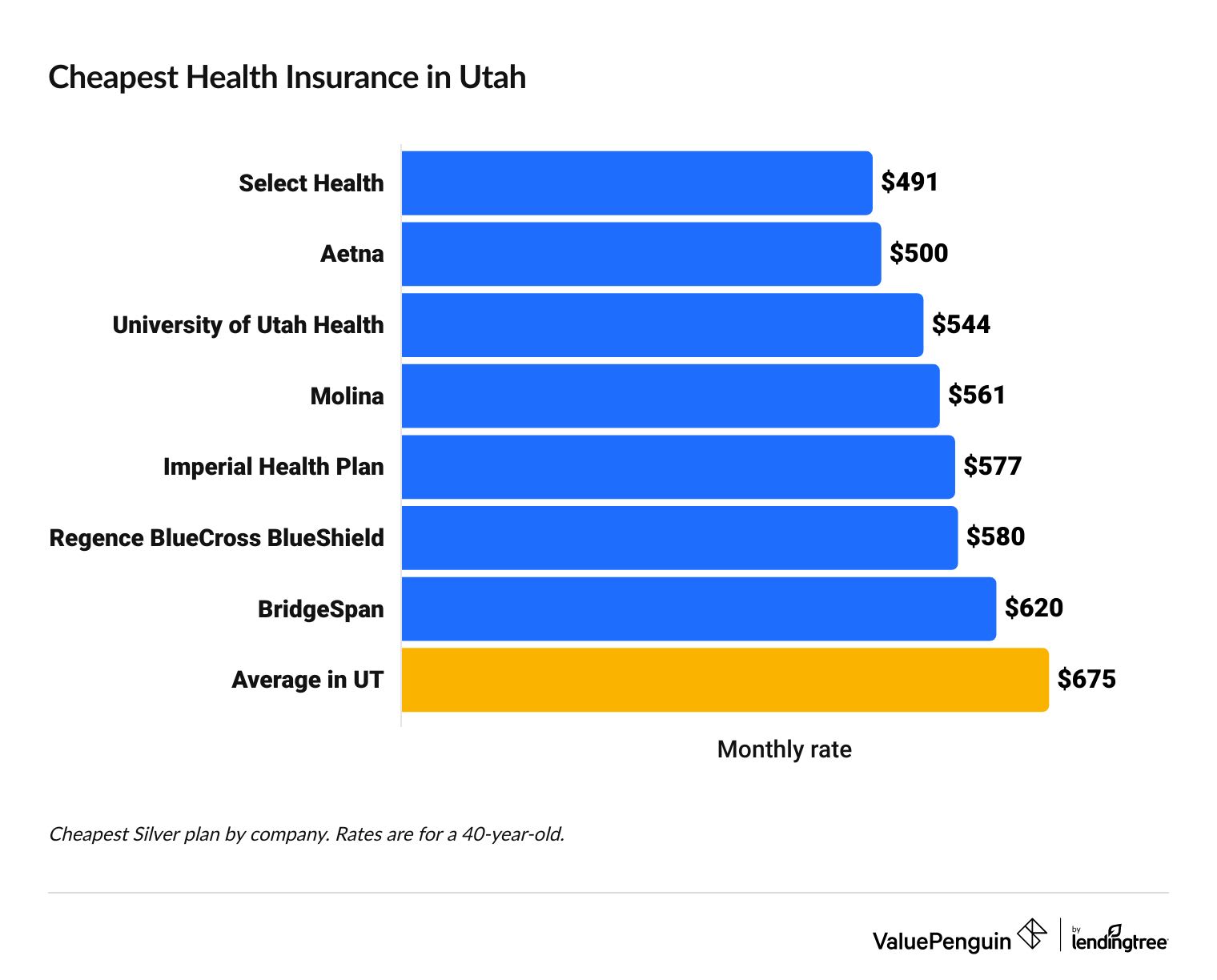

Select Health sells the best cheap health insurance in Utah. Plans start at $491 per month before discounts.

Find Cheap Health Insurance Quotes in Utah

Best and cheapest health insurance in Utah

Cheapest health insurance companies in Utah

Select Health has the cheapest Silver health plans in Utah.

Find Cheap Health Insurance Quotes in Utah

Affordable health insurance in Utah

Company |

Cost

| |

|---|---|---|

| Select Health | $491-$968 | |

| Aetna | $500-$703 | |

| University of Utah Health Plans | $544-$878 | |

| Molina | $561-$703 | |

- Select Health has the most affordable coverage for around eight out of every 10 people in Utah. The company has the cheapest rates in Salt Lake City, Provo and Orem.

- Select Health is also the most popular health insurance company in Utah. The company sells about eight out of 10 health insurance plans in the state.

Lowest deductibles: University of Utah Health Plans

University of Utah Health plans let you pay the least for your medical care.

That's because they have the lowest deductibles and out-of-pocket maximums , on average, of any company in Utah.

The company's Silver plans have an average deductible of $4,036, compared to an average of $5,295 in the state. And you won't pay more than an average of $7,500 each year for medical care, compared to an average of $8,261 for all companies in Utah.

Best health insurance companies in Utah

Select Health has the best health insurance plans in Utah for most people because of its affordable rates and high customer satisfaction.

Select Health has a strong 4 out of 5 star rating from HealthCare.gov. That's the highest star rating of any company on the Utah health insurance marketplace. Plus, Select Health gets far fewer complaints than an average company its size.

University of Utah Health Plans also has a 4-star rating from HealthCare.gov. However, its plans aren't as cheap as Select Health's plans.

Best-rated health insurance companies in Utah

Company |

Editor rating

|

ACA rating

|

|---|---|---|

| Select Health | 4.0 | |

| Regence BlueCross BlueShield | 3.0 | |

| Aetna | N/A | |

| BridgeSpan | N/A | |

| Imperial Health Plan | N/A |

Best if you travel often: Regence BlueCross BlueShield

Regence plans let you see 95% of all doctors and go to 96% of all hospitals in the country.

If you travel often, a plan from Regence could be a good option. If you are injured or get sick when you're away from home, you'll likely still be able to find a doctor near you that takes your insurance.

However, Regence plans are more expensive than plans from most other companies in Utah. The cheapest Silver plan from Regence costs $580 per month. That's $89 per month more than the cheapest plan from Select Health. But if you travel often and value peace of mind, the extra cost could be worth it.

Find Cheap Health Insurance Quotes in Utah

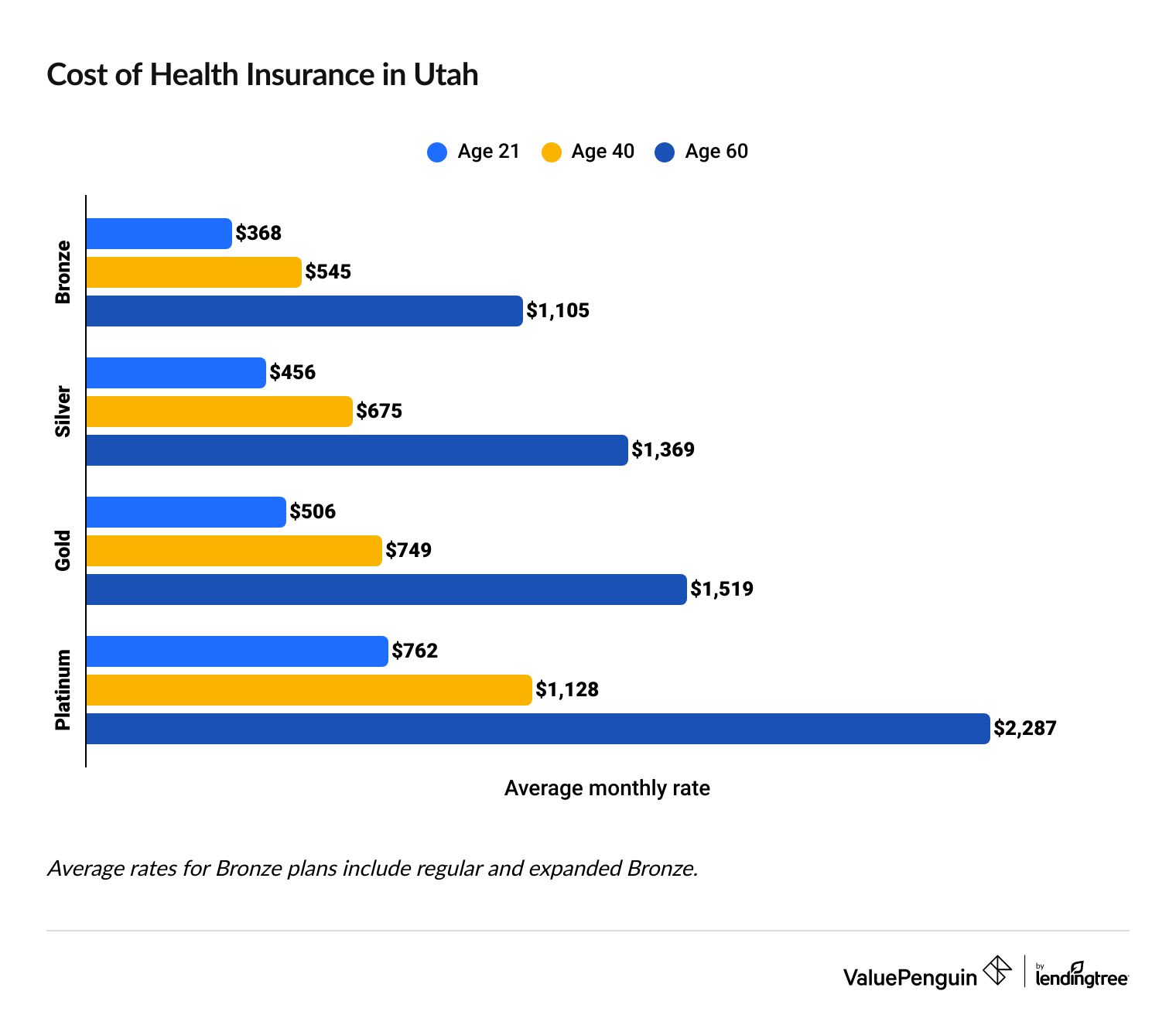

What's the cost of health insurance in Utah?

In Utah, health insurance costs an average of $675 per month, or $48 per month if you qualify for discounts because of your income.

- Your age and the plan tier you choose have the biggest impact on how much you pay for health insurance in Utah.

- Higher plan tiers have expensive rates, but you pay less when you get medical care. In contrast, lower plan tiers have cheap rates, but you pay a large portion of the bill when you go to the hospital.

- Health insurance rates get more expensive as you grow older. Rates are cheap in your 20s and 30s before rising sharply as you enter middle age. A 60-year-old in Utah pays more than twice as much as a 40-year-old for the same level of coverage.

Get affordable health insurance in Utah

Health insurance in Utah costs an average of $48 per month with discounts.

About 95% of Utah residents who have coverage through HealthCare.gov qualify for a discount, called a subsidy or premium tax credit. In addition, roughly half of people who buy a plan on HealthCare.gov in Utah pay under $10 per month after discounts.

To qualify, you have to make between $15,606 and $60,240 per year as a single person or between $31,200 and $124,800 per year as a family of four. But if you qualify for Medicaid, you can't get subsidies.

You can choose to have your monthly rate discounted, or you can get the full subsidy as a refund on your federal income taxes. You can use subsidies with any Bronze, Silver, Gold or Platinum plan bought through the Utah health insurance marketplace.

Cheap Utah health insurance plans by city

Select Health has the cheapest health insurance in most large Utah cities including Salt Lake, Provo and Orem.

Molina has the most affordable rates in St. George, the only big city in Utah where Select Health isn't the cheapest choice.

Cheapest health insurance by UT county

County | Cheapest Silver plan | Monthly rate |

|---|---|---|

| Beaver | Select Health Benchmark Silver 6000 | $703 |

| Box Elder | Aetna Silver 6 Advanced | $523 |

| Cache | Aetna Silver 6 Advanced | $641 |

| Carbon | Select Health Benchmark Silver 6000 | $703 |

| Daggett | Select Health Benchmark Silver 6000 | $703 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Utah

Best health insurance by coverage level

The best health insurance plan level for you depends on your finances and the amount of medical care you expect to use in the coming year. Higher plan tiers have expensive monthly costs, but you'll save money if you need a lot of care. Lower plan tiers have cheap rates, but you'll pay a larger portion of the bill when you visit the doctor.

Platinum plans: Best for expensive medical needs

| Platinum plans pay for about 90% of your medical care. |

Platinum health insurance plans have the highest average costs of any plan tier. However, you can get coverage straight away with a Platinum health plan. In Utah, all Platinum health plans have a $0 deductible.

In addition, Platinum plans limit the amount you pay when you visit the doctor with cheaper copays and coinsurance and low caps on how much you'll pay out of pocket in a single year, called an out-of-pocket maximum.

Platinum plans cost $1,128 per month in Utah, on average, and they don't have a deductible.

Gold plans: Best for frequent medical care

| Gold plans pay for about 80% of your medical care. |

Gold plans are a good choice if you have a chronic illness or you visit the doctor often. These plans have high monthly rates but low deductibles, which means coverage starts quickly.

Gold plans also have a low cap on what you'll pay for medical care in a single year, called an out-of-pocket maximum.

Gold plans in Utah cost $749 per month and have a $1,453 deductible, on average.

Silver plans: Best for average medical needs

| Silver plans pay for about 70% of your medical care. |

Silver health plans balance average rates with middle-of-the-road costs you pay when you visit the doctor. That makes Silver plans a good choice if you have fairly average health care needs. It's also important to note that Silver health plans are eligible for extra discounts, called cost-sharing reductions, if you earn a low income.

In Utah, Silver plans cost $675 per month and have a $5,295 deductible on average.

Bronze plans: Best if you're young and healthy

| Bronze plans pay for about 60% of your medical care. |

Consider a Bronze plan if you're in good health and want to save money on your monthly rate. These plans have affordable rates, but you'll pay a large portion of the bill when you go to the hospital.

Don't buy a Bronze plan unless you can comfortably pay the deductible from your savings. If you can't afford to pay for a large portion of your medical costs, it might make sense to pay more each month for a plan with more coverage.

Bronze plans cost $545 per month in Utah before discounts on average. These plans also have an average deductible of $5,981.

Extra discounts and free health insurance in Utah

Utah residents who earn a low income may qualify for free health insurance or extra discounts.

Silver plans with cost-sharing reductions: Best if you earn a low income but can't get Medicaid

| Silver plans will pay 73% to 94% of your medical costs if you make a low income. |

If you have a low income, you may qualify for discounts, called cost-sharing reductions, that help pay for the costs you're responsible for when you visit the doctor. Cost-sharing reductions help cover your deductible, copays and coinsurance.

Cost-sharing reductions can lower your out-of-pocket costs by helping to cover up to 94% of your costs.

You need to earn between $15,060 and $37,650 per year or less (the range is $31,200 to $78,000 per year for a family of four) to qualify for cost-sharing reductions.

Medicaid: Free health insurance for Utah residents who earn a low income

You may be eligible for free government health insurance, called Medicaid, if you make about $21,000 per year or less as a single person ($44,000 per year or less for a family of four).

Are health insurance rates going up in Utah?

Health insurance got 15% more expensive, on average, between 2024 and 2025.

Platinum plans increased the most, rising 26% over the previous year. Silver plans rose by 13%, and Bronze plans got 10% more expensive. Gold plan rates went up the least, but they still cost 6% more for 2025 compared to 2024.

Tier | 2024 | 2025 | Change |

|---|---|---|---|

| Bronze | $493 | $545 | 10% |

| Silver | $599 | $675 | 13% |

| Gold | $706 | $749 | 6% |

| Platinum | $895 | $1,128 | 26% |

Monthly costs are for a 40-year-old.

All Utah health insurance marketplace plans have to cover certain essential benefits. These include services like care for pregnant women, new mothers and infants.

All Obamacare plans also have to limit the amount you'll pay for care in a single year, called an out-of-pocket maximum. Marketplace plans can't deny coverage or charge you a higher rate based on your health history.

These rules apply to all Bronze, Silver, Gold and Platinum plans available on HealthCare.gov.

Cost of Utah health insurance by family size

It costs $362 per month, on average, to add a child to your plan in Utah.

Adult coverage costs an average of $675 per month in Utah. That means a single parent with one child pays an average of about $1,036 per month for coverage and a family of four pays $2,073 per month on average before discounts.

Family size | Average monthly cost |

|---|---|

| Individual | $675 |

| Individual and child | $1,036 |

| Couple, age 40 | $1,349 |

| Family of three | $1,711 |

| Family of four | $2,073 |

Averages are based on a Silver plan for 40-year-old adults and children who are under age 15.

Short-term health insurance in Utah

The Trump administration reversed a rule in January 2025 that would cap the length of a short-term health policy to three months. Although there isn't a publicly available timeline for when this change will happen, short-term health insurance could be available in Utah for up to 364 days sometime in the coming year.

Short-term health insurance can help you manage temporary coverage gaps, and coverage is typically cheap. But, it's important to remember short-term plans usually have worse coverage than regular marketplace coverage.

Pros of short-term health insurance in UT

Cons of short-term health insurance in UT

Frequently asked questions

Who has the best cheap health insurance in Utah?

Select Health has the best cheap health insurance in Utah. The company has the cheapest average rates for Silver health plans, at $491 per month before discounts. In addition, Select Health has a high rating of 4 out of 5 stars from HealthCare.gov, and it gets fewer complaints than an average company its size according to the National Association of Insurance Commissioners (NAIC), an industry group.

How much is health insurance in Utah per month?

Silver health plans in Utah cost $675 per month on average. However, it's important to remember that nearly everyone who buys marketplace coverage in Utah qualifies for discounts, which lower the average cost to $48 per month.

What is the most popular health insurance in Utah?

Intermountain Health, which owns Select Health, is the most popular health insurance company in Utah, selling 82% of all policies in the state. It has affordable rates and significantly fewer customer complaints compared to an average health insurance company of a similar size.

Methodology

Utah health insurance rate data for 2025 is from the Centers for Medicare & Medicaid Services (CMS) website. ValuePenguin used the CMS public use files (PUFs) in calculations to average rates across a variety of factors such as plan tier, county and family size. Plans and insurance companies for which county-level data was included in the CMS Crosswalk file were used in our reporting. Those excluded from these files were not included in our analysis.

Rates for subsidized plans are for all shoppers who qualified for advance premium tax credits (APTCs) on their monthly bills during 2024 open enrollment.

To choose the best health insurance companies in Utah, ValuePenguin's experts reviewed average rates, coverage quality, customer service and unique features.

Rates are for a 40-year-old with a Silver plan, unless otherwise noted. Other sources include S&P Global Capital IQ, the National Association of Insurance Commissioners (NAIC) and the Utah Department of Health and Human Services.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.