Best Cheap Health Insurance in Massachusetts for 2026

Blue Cross Blue Shield of Massachusetts has the best health insurance in Massachusetts. Its cheapest Silver plan costs $807 per month before discounts.

Find Cheap Health Insurance Quotes in Massachusetts

Best and cheapest health insurance in Massachusetts

Cheapest health insurance companies in Massachusetts

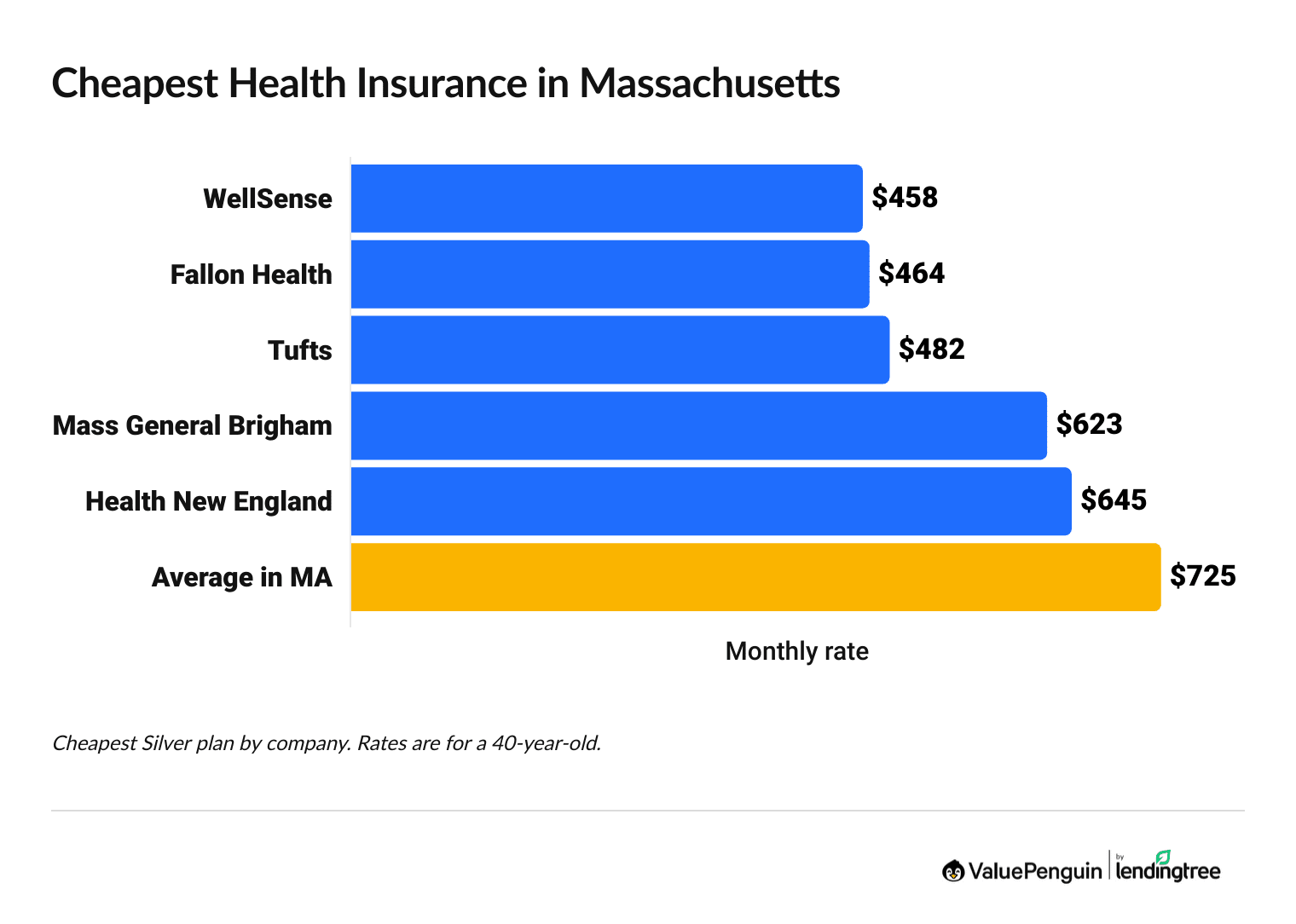

WellSense Health Plan, Fallon Health and Tufts Health Plan sell the cheapest health insurance plans in Massachusetts, with Silver rates starting at $458 per month before discounts.

Find Cheap Health Insurance Quotes in Massachusetts

Affordable health insurance in Massachusetts

Company |

Cost

| |

|---|---|---|

| WellSense | $458-$526 | |

| Fallon Health | $464-$510 | |

| Tufts | $482-$614 | |

| Mass General Brigham | $623-$881 | |

- The cheapest health insurance for you depends on where you live. WellSense has the most affordable medical insurance in Boston, and Fallon Health has the best rates in Worcester.

- However, if you want the freedom to choose your doctors, UnitedHealthcare is the best choice. UnitedHealthcare is the only company in Massachusetts that sells EPO plans, which let you see a specialist without getting a referral. You also don't need to choose a primary care doctor with an EPO.

Best health insurance companies in Massachusetts

Blue Cross Blue Shield of MA is the best health insurance company in Massachusetts.

It has a perfect 5.0 rating from HealthCare.gov. That means health plans from BCBS of Massachusetts have quality coverage and good customer satisfaction.

Harvard Pilgrim, Mass General Brigham and Tufts also have an excellent 5-out-of-5-star rating from HealthCare.gov. But these companies have lower 4-star ratings for plan administration. BCBS of MA is the only company in Massachusetts to have 5-star ratings for every quality rating category.

Find Cheap Health Insurance Quotes in Massachusetts

Best-rated health insurance companies in MA

Company |

ACA rating

|

VP rating

|

|---|---|---|

| Tufts | ||

| BCBS of Massachusetts | ||

| Fallon Health | ||

| Health New England | ||

| WellSense |

Best for flexible coverage: UnitedHealthcare

UnitedHealthcare is the only company in Massachusetts that offers EPO (exclusive provider organization) plans. With an EPO, you don't need to choose a primary care doctor or get a referral to see a specialist. This gives you more flexibility than HMO (health maintenance organization) plans, which are the only other option in Massachusetts.

Keep in mind, EPO plans tend to cost more than HMOs. The cheapest Silver EPO plan in MA costs $918 per month. That's about $460 per month more than the cheapest Silver HMO plan in Massachusetts.

Plus, you may need permission from your insurance company, called prior authorization, before you can get certain types of specialty care.

Consider an EPO plan if you want to get specialty care without a referral and don't need to get the cheapest rate.

How much does health insurance cost in Massachusetts?

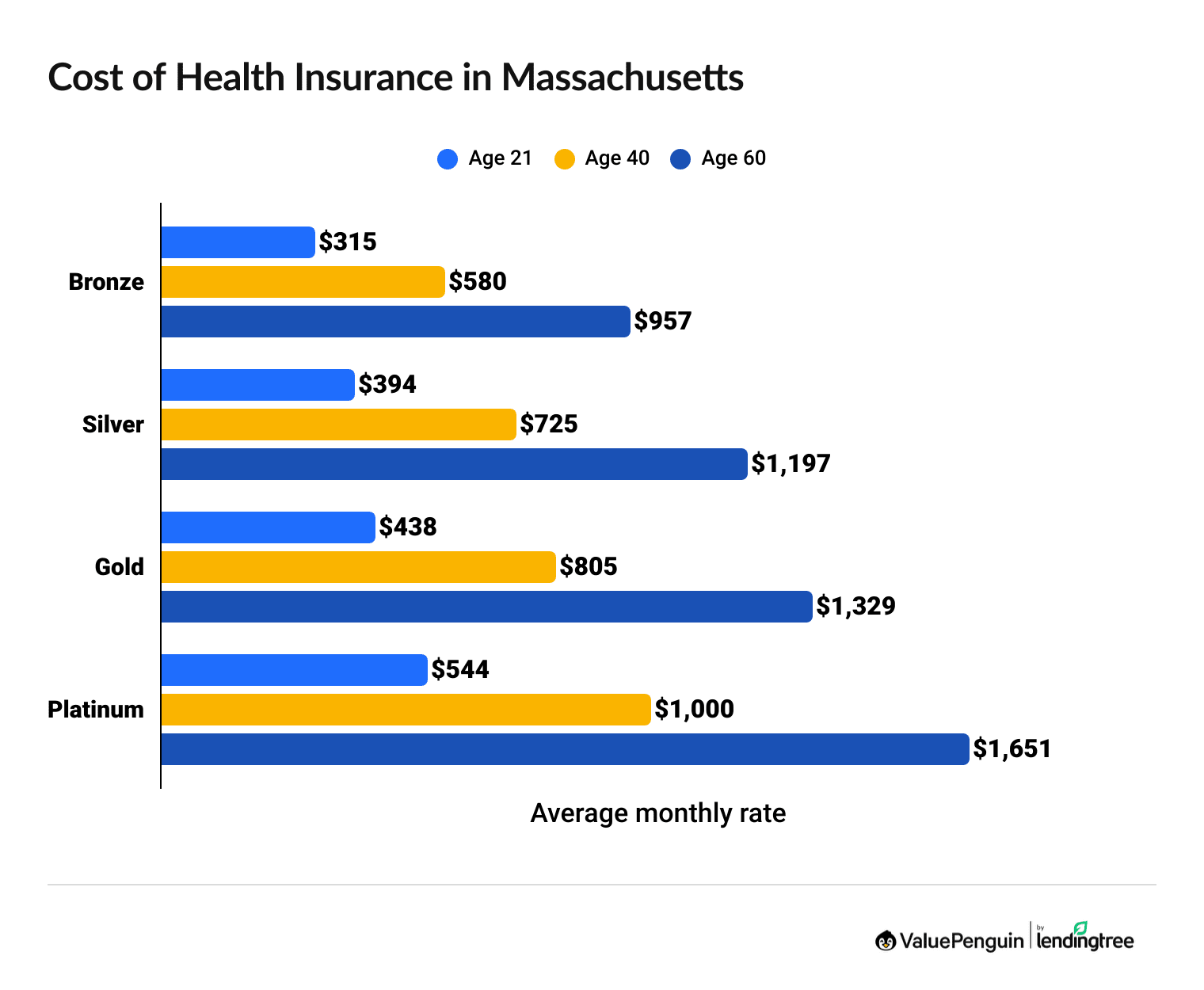

Massachusetts health insurance costs an average of $725 per month, but you could pay as little as $0 per month, depending on your income.

Find Cheap Health Insurance Quotes in Massachusetts

- The plan tier you choose will impact your health insurance costs. Higher plan tiers have more expensive monthly rates than lower plan tiers, such as Silver, Bronze and Catastrophic plans.

- But you'll pay less when you visit the doctor or fill a prescription with a higher plan tier. Lower plan tiers usually have high costs when you get medical care.

- Your age is also a big factor in how much you'll pay. In Massachusetts, the cost of a Silver plan jumps by almost 65% between the ages of 40 and 60.

Health insurance discount changes in Massachusetts for 2026

Health insurance costs $725 in Massachusetts, or as little as $0 per month, if you get discounts based on your income.

Fewer subsidies will likely be available to those who might have otherwise qualified for discounted health coverage in 2026 because of expiring federal subsidies. Keep in mind, Massachusetts has a generous state-level subsidy program. That means if you live in Massachusetts and you earn a low income, you'll see a smaller monthly price increase than if you lived in most other parts of the country.

To cover the shortfall from lower federal subsidies, Massachusetts won't offer financial help to individuals who make more than $62,600 ($128,600 for a family of four).

Health insurance rates in Massachusetts after subsidies (2026)

Income |

Monthly rate

|

OOPM

|

Drug OOPM

|

|---|---|---|---|

| $21,597–$23,475 | $0 | $750 | $500 |

| $23,476–$31,300 | $53 | $750 | $500 |

| $31,301–$39,125 | $103 | $1,500 | $750 |

| $39,126–$46,950 | $152 | $1,500 | $750 |

| $46,951–$62,600 | $235 | $1,500 | $750 |

All income ranges have a $0 deductible for ConnectorCare plans.

- Who can get subsidies? You'll typically be eligible for subsidies if you make between $21,597 and $62,600 as a single person ($39,125 and $128,600 for a family of four).

- How do subsidies work? You can use your subsidy on any Bronze, Silver, Gold or Platinum plan from any company.

- How much do you save? Use ValuePenguin's subsidy calculator to get an idea of how much you'll pay for coverage after discounts.

Cheap Massachusetts health insurance plans by city

WellSense Health Plan is the cheapest company in Boston, with Silver plans starting at $471 per month.

Fallon Health has the most affordable quotes in Worcester, and Tufts has the best rates in Springfield. In Massachusetts, prices can differ within a county. That means you need to pay attention to both your county and the first three letters of your ZIP code when finding the cheapest plan in your area.

Cheapest health insurance plans by MA county

County |

ZIP code

| Plan name | Monthly rate |

|---|---|---|---|

| Barnstable | 025, 026 | WellSense Standard Silver | $526 |

| Berkshire | 012 | Tufts Standard Silver | $482 |

| Bristol | 020 | Fallon Health Standard Silver | $464 |

| Bristol | 023, 027 | WellSense Standard Silver | $458 |

| Dukes | 025 | Mass General Brigham Standard Silver | $736 |

Cheapest Silver plan with rates for a 40-year-old

Best health insurance by level of coverage

No matter where you live in Massachusetts, you will get the chance to choose from five different plan tiers: Catastrophic, Bronze, Silver, Gold and Platinum.

Lower plan tiers, like Catastrophic and Bronze, pay for less of your health care, while higher plan tiers, like Gold and Platinum, pay for more. When choosing a plan, try to balance your monthly budget and healthcare needs.

Platinum plans: Best if you have a chronic or complex condition

| Platinum plans pay for about 90% of your medical care. |

Platinum plans cost $1,000 per month, on average, in Massachusetts.

Platinum plans are best if you have a chronic or complex condition to manage, or if you take expensive prescriptions or need pricey medical treatments.

These plans have high monthly rates, which are balanced by low out-of-pocket costs. This means you'll pay less when you go to the doctor, because Platinum plans have lower deductibles, copays and coinsurance than higher-tier plans.

Gold plans: Best if you need frequent medical care

| Gold plans pay for about 80% of your medical care. |

In Massachusetts, Gold plans cost an average of $805 per month.

Gold plans are cheaper than Platinum plans, but still pay for a large share of your medical bills. They're a good option if you go to the doctor often or expect to need medical care in the coming year.

For example, if you plan to have a baby or think you'll need surgery, a Gold plan might be a good idea.

Silver plans: Best if you have moderate medical needs

| Silver plans pay for about 70% of your medical care. |

Silver plans cost an average of $725 per month in Massachusetts.

Silver plans are best for most people because they balance good coverage with affordable rates. They might be a good idea if you go to the doctor a handful of times each year or have a moderate health condition to manage.

If you aren't sure how much coverage you need, start by looking at Silver plans and deciding if they're right for you.

Bronze plans: Best if you're healthy and have emergency savings

| Bronze plans pay for about 60% of your medical care. |

Bronze plans in Massachusetts cost $580 per month, on average.

Bronze plans often have the cheapest monthly medical insurance rates. They can be a good option if you're young, healthy and don't expect to need much medical care.

But you should make sure you have savings in the bank to pay for higher medical costs if you're sick or injured, since Bronze plans don't pay as much of your medical bills.

Catastrophic plans: Best as a last resort

Catastrophic health insurance have very cheap monthly rates and high out-of-pocket costs.

Catastrophic plans cost $242 per month, on average, for a 21-year-old in Massachusetts.

Only people under the age of 30 or those who qualify for a special hardship exemption can buy a Catastrophic plan. Catastrophic health insurance plans are rarely a good idea financially, because they offer very little coverage and can leave you with high medical bills.

Plus, you can't get discounts on Catastrophic plans. That means you can usually get a cheaper plan with better coverage if you earn a low income.

Cheap or free health insurance in Massachusetts if you have a low income

If you have a low income and can't afford insurance, or if you're struggling to pay your medical bills even with insurance, there are a few options.

MassHealth: Medicaid in Massachusetts

Medicaid is a type of free health insurance from the government.

In Massachusetts, Medicaid is called MassHealth. You can qualify for Medicaid if you earn roughly $22,000 or less as an individual or around $44,000 or less as a family of four. You should consider applying for Medicaid if your income is within this range, since there's no monthly cost to you.

If you're over the age of 65, you should see if you qualify for both Medicare and Medicaid. This can increase your coverage and lower your medical costs even more.

Use cost-sharing reductions for cheaper medical care

If you buy a Silver plan, you may get discounts that lower the cost of your medical care if you make under $39,125 as a single person or $80,375 as a family of four. These are called cost-sharing reductions (CSRs), and they let you pay less when you go to the doctor by lowering your deductible, copay and coinsurance.

Are health insurance rates going up in MA?

In 2026, the average cost of health insurance in Massachusetts is rising by 10%.

Bronze plans had the largest average increase, at 13%. Silver plans rose an average of 10% and Gold plans got 9% more expensive, on average. Platinum plans increased by an average of 8% year on year. The cost of Silver health insurance rose by 36% between 2022 and 2026 in Massachusetts.

Bronze

Silver

Gold

Platinum

Year | Cost | Change |

|---|---|---|

| 2022 | $413 | – |

| 2023 | $464 | 12% |

| 2024 | $476 | 3% |

| 2025 | $515 | 8% |

| 2026 | $580 | 13% |

Monthly costs are for a 40-year-old. Expanded Bronze plans are included in 2024, 2025 and 2026 averages, when they're offered.

Bronze

Year | Cost | Change |

|---|---|---|

| 2022 | $413 | – |

| 2023 | $464 | 12% |

| 2024 | $476 | 3% |

| 2025 | $515 | 8% |

| 2026 | $580 | 13% |

Monthly costs are for a 40-year-old. Expanded Bronze plans are included in 2024, 2025 and 2026 averages, when they're offered.

Silver

Year | Cost | Change |

|---|---|---|

| 2022 | $535 | – |

| 2023 | $553 | 3% |

| 2024 | $639 | 16% |

| 2025 | $661 | 3% |

| 2026 | $725 | 10% |

Monthly costs are for a 40-year-old.

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $659 | – |

| 2023 | $706 | 7% |

| 2024 | $706 | 0% |

| 2025 | $741 | 5% |

| 2026 | $805 | 9% |

Monthly costs are for a 40-year-old.

Platinum

Year | Cost | Change |

|---|---|---|

| 2022 | $886 | – |

| 2023 | $951 | 7% |

| 2024 | $898 | -6% |

| 2025 | $928 | 3% |

| 2026 | $1,000 | 8% |

Monthly costs are for a 40-year-old.

Why is health insurance expensive in MA in 2026?

Higher health care costs are pushing up medical insurance rates in 2026.

As healthcare gets more expensive, medical insurance companies pay out more when people go to the doctor or get medications. The high cost and widespread use of GLP-1 drugs, like Ozempic and Wegovy, have also factored into the higher rates. To make up for more expensive care, rates go up for everyone.

Health insurance discounts could also change in 2026, which could raise rates even more. Right now, people with low incomes get bigger discounts, called "enhanced subsidies." But these extra discounts are going to expire at the end of 2025 unless Congress votes to extend them. That means you'll pay a higher rate for health insurance in 2026, even if you still get discounts.

How to prepare for 2026 rate increases

- Shop around and compare quotes. Each insurance company charges different rates. If your plan goes up in 2026, get quotes from other companies and see if there's a cheaper option that still works well for you.

- Consider a Bronze plan. If you don't go to the doctor often, think about going to a lower-tier plan like Bronze. Just keep in mind that you have to pay for more of your medical bills yourself with Bronze plans. Consider opening an HSA to help you save for health care costs.

- Check for discounts. Discounts might not be as good in 2026, but they could still help you save money if you have a low income. Always check to see if you can get monthly rate discounts.

- See if you can get MassHealth. Massachusetts Medicaid, or MassHealth, can give you free or cheap health insurance if you have a low income. To qualify, you have to make less than about $22,000 per year as a single person or $44,000 per year as a family of four.

Plan tiers don't have anything to do with the quality of care you get or the types of medical care is covered by your plan. All plans from Massachusetts Health Connector, the state's health insurance marketplace, cover at least 10 health circumstances.

- Doctor visits

- Preventive and wellness care

- Emergency care

- Hospital stays

- Prescription medications

- Lab services

- Pregnancy, maternity and newborn care

- Pediatric care

- Mental health and substance use care

- Rehab services

The difference between the plan tiers is how much you pay each month and how much you pay when you go to the doctor.

COBRA health insurance in Massachusetts

COBRA health insurance in MA costs $781 per month if you're single and $2,417 per month if you're a family.

COBRA is a program that lets you keep the health insurance you had with your employer if you quit, lose or retire from your job. The coverage usually lasts up to a year and a half from the time you lose your job. The catch is that you have to pay full price for the plan; your employer no longer chips in.

Unless you need a specific type of coverage that your employer plan had, a plan from the Massachusetts health insurance marketplace can be a better option and will almost certainly be much cheaper.

Short-term health insurance in Massachusetts

In 2025, no health insurance companies sold short-term health insurance in Massachusetts.

If you're in need of health insurance due to a sudden loss of coverage, you should see if you have an IRS qualifying event. This lets you sign up for health insurance outside the open enrollment period.

Health insurance enrollment by income level in Massachusetts

Roughly eight in 10 people in Massachusetts with marketplace coverage make less than $60,240 per year.

Most people who get ACA health insurance in Massachusetts earn a below average income. That means lower subsidies in 2026 will disproportionately impact those who belong to this group.

Enrollment by income

Income | % of total enrollment |

|---|---|

| Less than $15,060 | 8% |

| $15,060 to $20,783 | 6% |

| $20,784 to $22,590 | 5% |

| $22,591 to $30,120 | 20% |

| $30,121 to $37,650 | 17% |

Enrollment in 2025 marketplace plans made during the 2024-2025 Open Enrollment period. Total may not be 100% due to rounding

Frequently asked questions

Does Massachusetts have free health insurance?

In Massachusetts, you can sign up for MassHealth, which is the state-specific name for Massachusetts's Medicaid program, if you earn a low income. The program gives you free health insurance if you make around $22,000 for a single person or roughly $44,000 for a family of four in 2025.

Why are insurance rates going up in Massachusetts?

Insurance rates in Massachusetts are going up in part because expanded pandemic-era subsidies are set to expire at the end of 2025. That means the amount of subsidies offered in 2026 will be smaller than in years past.

How much does health insurance cost per month in Massachusetts?

Health insurance costs $725 per month, on average, in Massachusetts for a 40-year-old with a Silver health plan. Your age, plan level, the amount of money you make and where you live all influence your health insurance quotes.

What is the most popular health insurance in Massachusetts?

Blue Cross Blue Shield (BCBS) of MA is the most popular health insurance company in Massachusetts, selling roughly half of the state's health insurance plans. It is well rated for plan quality and is available throughout the state.

However, BCBS is one of the most expensive health insurance companies in MA. Tufts is a good alternative since it offers similar levels of quality at a lower price.

Is $200 a month expensive for health insurance in MA?

No, $200 per month is cheap for health insurance in Massachusetts. The average rate for a 40-year-old with a Silver plan is $725 per month, and a 21-year-old pays an average of $394 per month for the same coverage. You might be able to get health insurance for $200 or less per month if you have a low income and can get monthly discounts.

Methodology

Massachusetts health insurance rate data for 2026 is from Massachusetts Health Connector. ValuePenguin used the state marketplace data to find average rates for different plan tiers, geographic locations and family sizes.

Rates

Rates are based on a 40-year-old with a Silver plan, unless otherwise noted. Rates for Bronze plans include regular and Expanded Bronze plans for 2024, 2025 and 2026, when the plans are available. Plan availability and rates by location are based on a combination of county, the first three zip code digits and rating areas. A sample zip code was used for each county and rating area combination. Your costs and plan options will vary; plans aren't always available in all parts of a state or county.

Subsidies

Rates after subsidies are estimates for a 40-year-old with a Benchmark Silver plan and are based on how subsidies were structured before 2021. Prices are calculated using KFF's rates for full-price Benchmark plans, federal poverty levels (FPLs), IRS rules about premium tax credits and Congressional reports about expanded tax credits. The total cost in the state uses rates calculated by income, which are weighted using CMS data on the incomes of those who purchased plans during last year's open enrollment. The median was used for each income range. Unknown incomes were excluded from the calculations. Incomes of 100% of the federal poverty line and 500% of the federal poverty line were assumed for enrollees who earn less than 100% FPL and more than 500% FPL, respectively. Information about state subsidies, when available, was sourced from state marketplaces.

Ratings

ValuePenguin's experts rank companies based on cost, coverage options, customer satisfaction and unique value. Ratings are out of 100 possible points. ACA ratings show how the company performs in Massachusetts for medical care, member experience and plan administration. This 2026 plan quality data from CMS is based on data from last year. Ratings are not available for new plans or plans with low enrollment.

More sources

Enrollment trends, including plan selections by tier and enrollment by income, are from CMS data for the 2025 open enrollment period.

Other sources include S&P Global Capital IQ and the National Association of Insurance Commissioners (NAIC).

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.