Benefits and Costs of Catastrophic Health Insurance

Catastrophic health insurance is a type of cheap plan that will cover you if you get very sick or badly injured.

The downside of Catastrophic plans is you'll have to pay for the first $9,200 of your medical expenses each year yourself. Also called emergency medical insurance, you are eligible for Catastrophic health insurance if you are under 30 years old or have a financial hardship.

Catastrophic plans aren't always the best deal. Many people can get health insurance discounts for a plan that has better coverage, making it cost less than a Catastrophic plan.

Find Cheap Health Insurance in Your Area

On this page

What is Catastrophic health insurance?

Catastrophic health insurance is a bare-bones health insurance plan that covers you if you're badly injured or very sick.

A Catastrophic plan caps your medical and prescription costs at $9,200 for an individual in 2025. This gives you financial protection if you need surgery, have an unexpected illness or have a medical emergency.

You'll only have coverage for a few basic doctor visits before your spending reaches the $9,200 cap. But after you reach the cap, you wouldn't pay anything for treatment, doctor visits, or other medical treatment.

Should you get Catastrophic health insurance?

Get a Catastrophic plan if you:

Don't get a Catastrophic plan if you:

Who qualifies for a Catastrophic plan?

You can buy a Catastrophic health insurance plan if you are:

- Under age 30

-

Qualify for a hardship exemption, such as if you:

- Were evicted

- Filed for bankruptcy

- Have substantial medical debt

- Could not find affordable health insurance

- Had difficulty getting other health plans

- Had home damage from a natural disaster

- Experienced domestic violence

- Had a death in your family

- Received a shutoff notice for your utilities

- Were homeless

In many cases, those who have financial hardship may also be eligible for low-income health insurance. These programs usually have coverage that's free or costs very little.

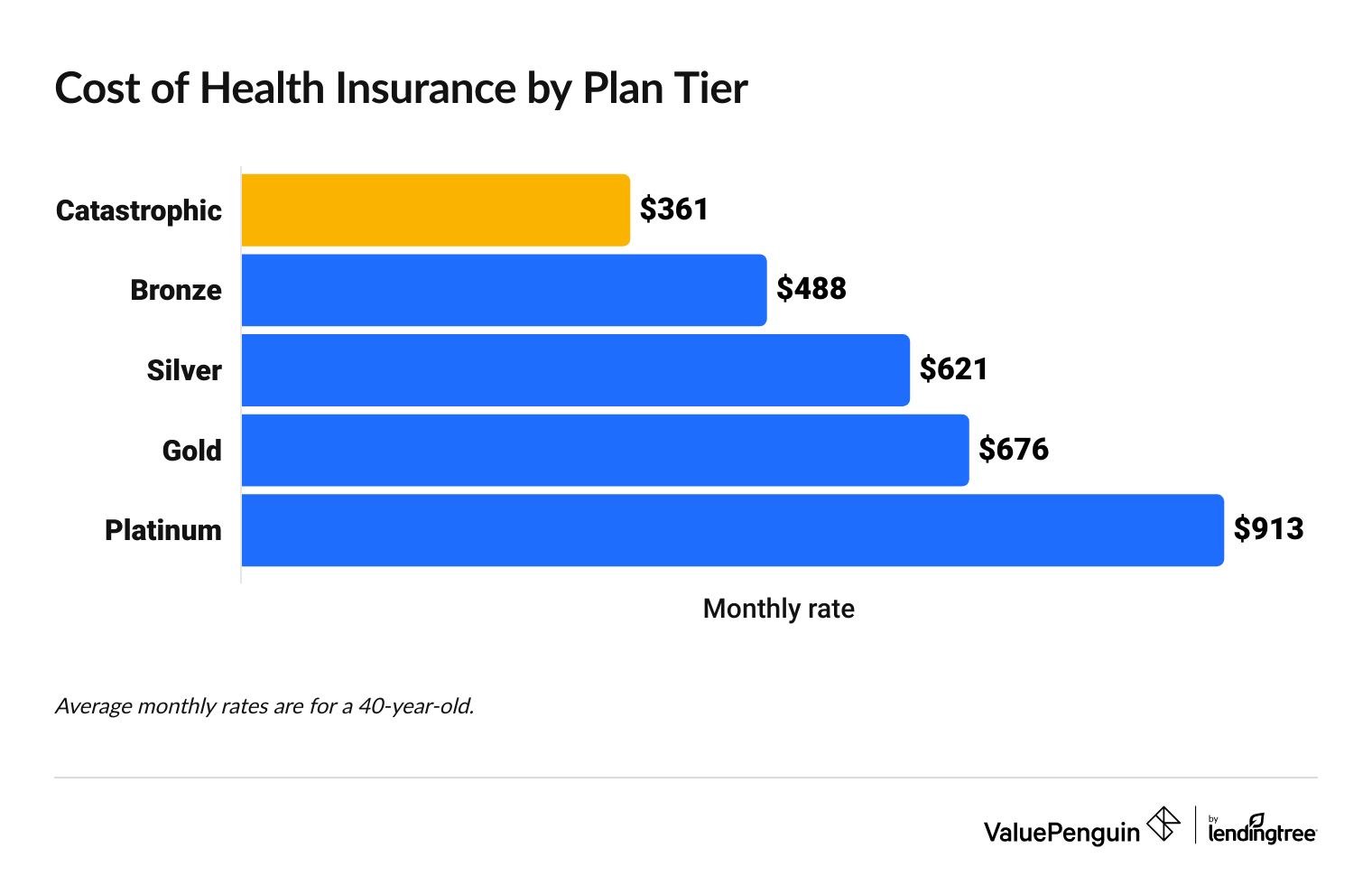

How much does Catastrophic health insurance cost?

Catastrophic health insurance costs an average of $361 per month.

That means the average cost of health insurance for a Catastrophic plan costs a quarter less than a Bronze plan, saving you about $127 per month.

Cost of health insurance by tier if you pay full price

Tier | Average monthly rate |

|---|---|

| Catastrophic | $361 |

| Bronze | $488 |

| Silver | $621 |

| Gold | $676 |

| Platinum | $913 |

Find Cheap Health Insurance in Your Area

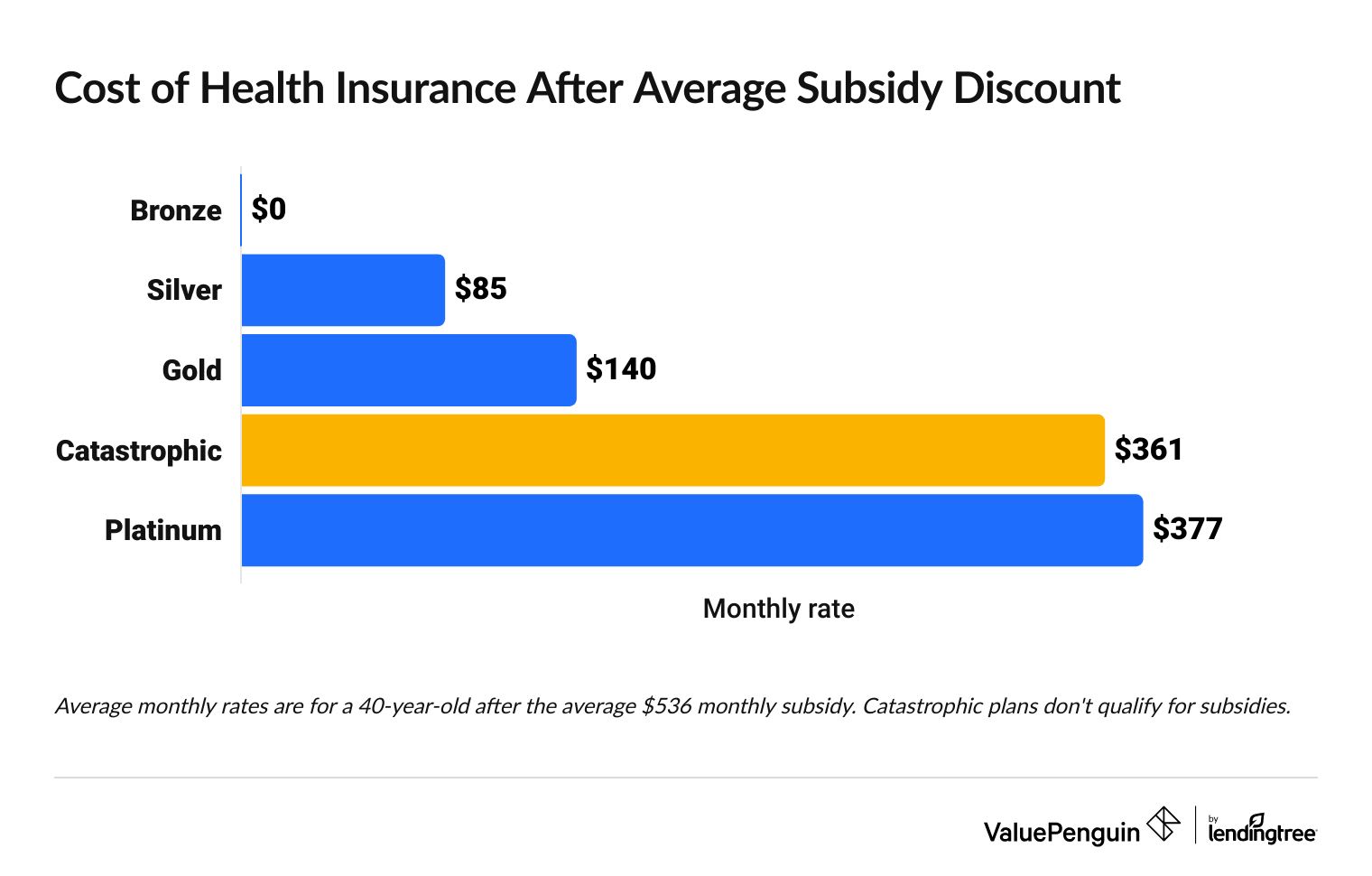

When is a Catastrophic plan not the cheapest option?

A Catastrophic plan won't be the cheapest option if you're one of the many people who qualify for health insurance subsidies.

Subsidies lower the cost of insurance if you meet the income threshold.

But these subsidies cannot be used for Catastrophic health insurance plans — only Bronze, Silver, Gold and Platinum plans.

Shoppers who qualify for subsidies get an average discount of $536 per month on health insurance. This could make a Bronze plan free and a Silver plan cost just $85 per month.

A subsidy calculator can help you find out how much you'll pay for insurance based on how much you earn. Households with lower incomes will save more on insurance than those who earn more.

Average cost of health insurance after subsidies

Tier | Average monthly rate after discounts |

|---|---|

| Bronze | $0 |

| Silver | $85 |

| Gold | $140 |

| Catastrophic | $361 |

| Platinum | $377 |

Average rate after the typical $536 monthly subsidy is applied. Catastrophic plans don't qualify for subsidies.

What does Catastrophic insurance cover?

Catastrophic plans must cover free preventative care and at least three doctor visits per year.

As soon as you enroll, you'll get free check-ups or screenings. You'll also have coverage for three doctor visits when you're sick or injured, but you'll still have to pay a copay. For example, you might have to pay $20 when you go to your doctor for an illness.

However, you usually won't have much other coverage until you meet the $9,200 deductible. For example, you'd pay the full price if you need to see a specialist or if your doctor orders blood work at your appointment.

After you spend $9,200, the Catastrophic plan will cover the same essential medical benefits as other health plans under the Affordable Care Act (ACA). That includes:

- Emergency care

- Hospitalization

- Pregnancy

- Prescriptions

- Mental health

- Pediatric care

What does a Catastrophic plan not cover?

With a Catastrophic health insurance plan, you won't have coverage for emergencies or most medical care until you meet the plan's high deductible of $9,200.

So with a Catastrophic plan, you could have to pay very high medical costs before the plan starts covering your medical bills. You could also have a situation where you're paying for health insurance coverage without ever getting the benefits of the plan because you didn't meet the deductible.

Can I buy short-term catastrophic health insurance?

Yes, most short-term health insurance plans provide catastrophic-style coverage.

Short-term plans are a different type of plan that typically has high deductibles. This means the benefits won't kick in unless you have a major illness or injury. And a short-term catastrophic plan can be a good way to get quick, temporary coverage if you're between jobs or are waiting for another health insurance policy to begin. However, short-term plans don't have to follow the rules of the ACA.

Short-term plans are different from regular Catastrophic plans:

- Short-term plans usually won't give you free preventive care or affordable check-ups before you meet the deductible.

- Plan benefits can vary widely, making it important to check your coverage carefully. For example, some plans may not cover prescriptions, mental health or preexisting conditions, even after you meet the plan's deductible.

- Short term plans may not be available in 14 states and Washington D.C. because of state regulations or companies not offering plans.

If you need temporary catastrophic insurance, you may also be able to use a regular health insurance plan and keep it for a short period of time.

- Enrolling: You can sign up for a regular health insurance plan any time of the year if you're eligible for special enrollment. This includes situations like losing other health insurance coverage or a change in your family size.

- Canceling: You can keep the insurance plan for as long as you need it and cancel without a penalty.

- Coverage: Plans are available in any tier of coverage, including Catastrophic. You can also use subsidies for other levels of coverage.

- Timing: Benefits usually start on the first of the month after you enroll and end on the last of the month after you cancel. That's different from a short-term policy, which can start the day after you sign up.

Can I buy Medicare catastrophic coverage?

Medicare catastrophic coverage is a kind of extra coverage you get with a Medicare prescription drug policy.

Catastrophic coverage is automatically included in each Medicare prescription plan as a way to protect you from very high costs if you need expensive or brand-name drugs. After you spend $2,000 on prescriptions in 2025, you won't have to pay anything for your prescriptions for the rest of the year.

How to buy Catastrophic health insurance

You can buy Catastrophic health insurance directly from an insurance company or through the government's health insurance exchange, which could be HealthCare.gov or a state marketplace, depending where you live.

A plan you buy on the exchange will automatically follow ACA guidelines so you know you'll have free preventive care and the standard Catastrophic cap for the year. Plans you buy directly from an insurance company aren't any cheaper, and you'll have to check what benefits are included.

- If you're under 30, you can enroll in a Catastrophic health insurance plan using your age to show you're eligible.

- If you're over 30, you'll have to complete an exemption form before signing up. This will give you an Exemption Certificate Number (ECN) that you'll use with your health insurance application.

Best Catastrophic health insurance companies

Blue Cross Blue Shield has the best Catastrophic health insurance plans because of its high ratings, broad availability, variety of plans and flexibility about which doctors you can use.

Blue Cross Blue Shield: Best Catastrophic health insurance

Kaiser Permanente: Best customer satisfaction

Medica: Good company that's expanding

Oscar: Cheap Catastrophic insurance

In some cases, you could have just one or two insurance companies offering Catastrophic health insurance in your state. These could be local insurance companies that don't operate broadly across the country.

Learn more about the best health insurance in your state:

Frequently asked questions

What are the downsides of Catastrophic health insurance?

Catastrophic health insurance will not help you make basic medical care more affordable. Plans are intended mainly to protect you from bankruptcy if you get very sick. This means you could have to pay up to $9,200 per year for medical care before the plan's full benefits kick in.

Is Catastrophic health insurance the same as hospital insurance?

No. A Catastrophic health insurance plan is a bare-bones policy that caps all types of medical costs at $9,200 per year, but offers little coverage before then. A hospital indemnity insurance plan is supplemental insurance that helps pay for specific types of care only, like a stay in the hospital. It won't cover other expensive medical treatments you might need.

What is the Catastrophic cap?

The Catastrophic cap is the most you could spend on medical care or prescriptions if you have a Catastrophic health insurance plan. In 2025, the Catastrophic cap is $9,200 if you have an individual policy and $18,400 if there are two or more people on the policy.

Sources and methodology

2025 health insurance rates are based on public use files (PUFs) on the Centers for Medicare & Medicaid Services (CMS) government website and state-run marketplaces. Average costs are based on a 40-year-old.

Additional sources include HealthCare.gov and Kaiser Family Foundation (KFF).

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.