Best Health Insurance for Cancer Patients

Blue Cross Blue Shield has the best insurance for most cancer patients. Kaiser Permanente is also good, but you can only get it in eight states.

Find Cheap Health Insurance Quotes in Your Area

UnitedHealthcare is a good option if you have a higher risk for complications because the company has a great support program. Cigna is a good option if you want extra coverage on top of your main health insurance plan.

Best health insurance for cancer patients

Blue Cross Blue Shield is the best insurance company if you have cancer.

Most doctors and hospitals take Blue Cross Blue Shield, which gives you easier access to specialists and makes it easier if you need to travel for care.

Kaiser Permanente is a great option that makes coordinating treatment with insurance easy, but it's only available in eight states and Washington, D.C., and it can limit your flexibility to choose doctors.

Average monthly costs are for a 40-year-old with a Gold plan. Cigna supplement rates are based on a $20,000 fixed benefit plan.

Find Cheap Health Insurance in Your Area

UnitedHealthcare has a unique cancer support program for patients who are at a higher risk for complications or side effects, so it's a good choice if you need extra support.

Cigna offers the best supplemental cancer insurance that can help you cover things that your health insurance doesn't cover. You can have on top of a regular health insurance plan and use the money to pay for things like your regular health plan's deductible, help around the house, childcare, transportation to appointments and more.

The best health insurance companies for cancer patients were chosen by comparing how the plans will help you treat cancer. ValuePenguin's experts reviewed:

- The doctors and hospitals in the company's provider network. Cancer patients often need to see several doctors and specialists. A large provider network makes it easier to get care.

- Coverage for cancer drugs and medical costs. The best plans provide access to affordable cancer treatment.

- Cancer-specific programs. Insurance programs for cancer patients can help you navigate your diagnosis and get the best care.

Blue Cross Blue Shield (BCBS): Best for most cancer patients

-

Editor's rating

- Cost: $681/month

Blue Cross Blue Shield gives you a wide range of options for where to get cancer treatment.

Pros:

-

Most doctors take BCBS

-

Low average deductible

-

Makes it easy to find high-quality cancer treatment

Cons:

-

Rates are higher than average

-

Total medical costs can be high

More than 90% of the doctors and medical offices in the country take Blue Cross Blue Shield health insurance. That means it's likely there are in-network doctors in your area. Being diagnosed with cancer can mean having a lot of doctor's appointments. Having a company that works with most doctors can help you find the medical care you need at lower rates.

Blue Cross Blue Shield (BCBS) gives you access to cancer-specific health offices, called Blue Distinction Centers for Cancer Care.

The Blue Distinction Centers for Cancer Care offer safe, effective and cost-efficient specialty medical care. You can find Blue Distinction Centers for Cancer Care using the search tool on the Blue Cross Blue Shield website.

While the overall average cost of a Gold plan from Blue Cross Blue Shield is $681 per month, you might want to spend a bit more to get a PPO plan. A Gold plan with a PPO network costs $744 per month, on average, from BCBS. A PPO plan lets you see specialists without a referral. This could mean you will have less wait time and can start cancer treatment faster. You can also go to any doctor you want, even if they aren't in your plan's network. You'll pay more when you go outside the network.

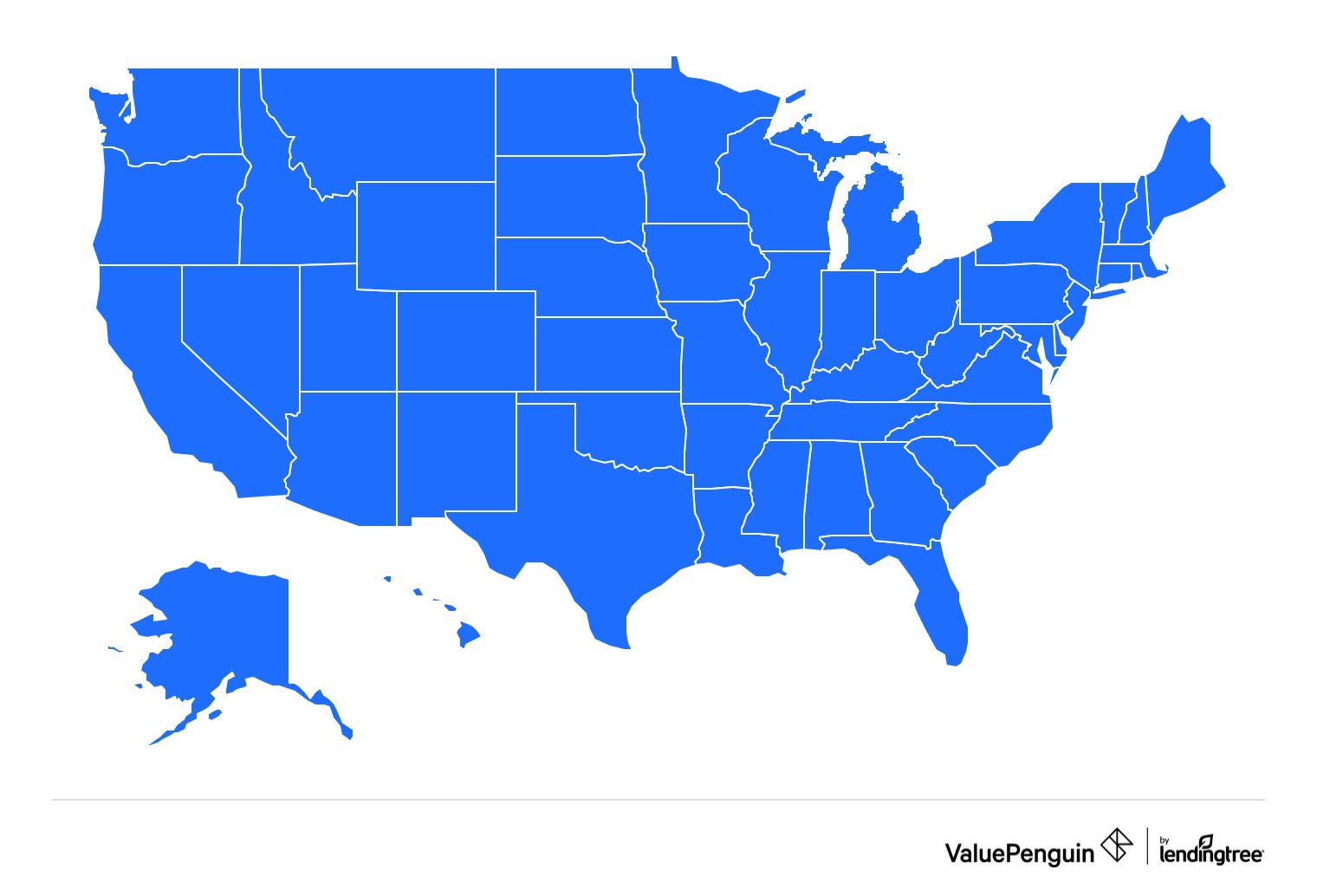

Blue Cross Blue Shield sells health insurance in all 50 states and Washington, D.C.

Kaiser Permanente: Best for customer service

-

Editor's rating

- Cost: $539/month

Kaiser Permanente has great customer service, but you can only get it in eight states.

Pros:

-

Excellent customer service

-

Low average deductible

-

Cheap average rates

Cons:

-

Requires you to use Kaiser offices and doctors

-

Only in eight states and D.C.

Kaiser Permanente has excellent customer service, and it can make the insurance side of cancer treatment easier. That's in part because Kaiser pairs its insurance plans with its doctor offices and hospitals. Having a Kaiser plan can help take some of the stress out of managing your insurance and picking doctors when you're getting cancer treatment.

Before you buy a Kaiser plan, make sure you are happy with the doctors within Kaiser's network.

Kaiser Permanente limits your choices for where to get treatment. When you have a plan from Kaiser, you have to use Kaiser medical offices and hospitals to get treatment, unless you have an emergency. That means if you want to see a doctor that doesn't work for Kaiser, you have to pay the full cost of care yourself. Because cancer treatment is so expensive, paying out of pocket isn't an option for most people.

Kaiser also has low average rates. A Gold plan from Kaiser costs $539 per month, on average, which is much cheaper than the average of $676 per month. The plans also usually have lower deductibles than plans from other companies, which means you have to pay less for your treatment before your coverage kicks in.

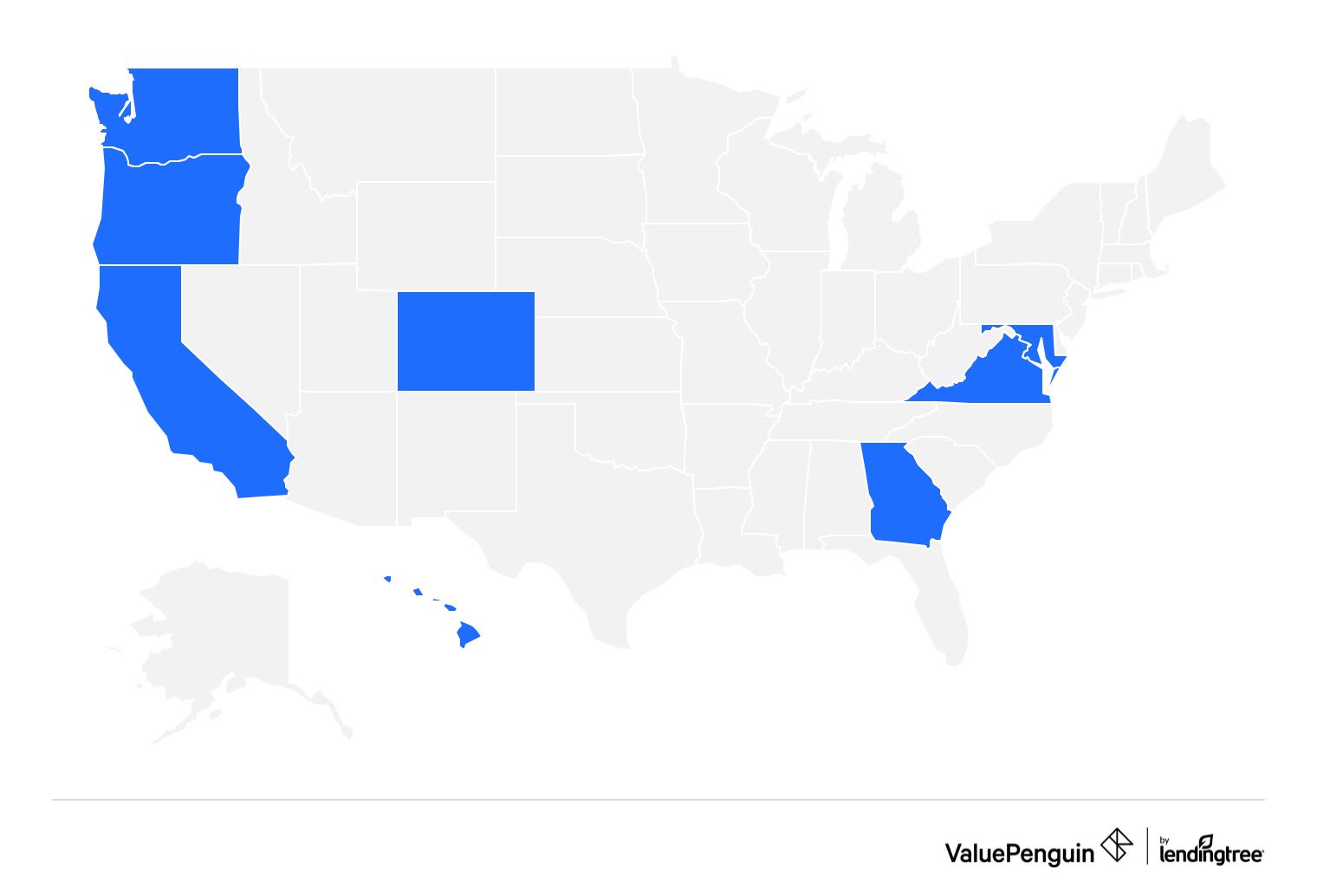

Kaiser Permanente sells plans in eight states and Washington, D.C.

- California

- Colorado

- Georgia

- Hawaii

- Maryland

- Oregon

- Virginia

- Washington

- Washington, D.C.

UnitedHealthcare: Best for patient support

-

Editor's rating

- Cost: $645/month

UnitedHealthcare's cancer support program can help you understand your treatment options and coordinate your care.

Pros:

-

Helpful support program

-

Lower-than-average rates

Cons:

-

Limits the doctors you can see

-

Denies claims more often than some companies

If you have or are at risk for complications and side effects from your cancer treatment, UnitedHealthcare (UHC) could be a good option. UHC has a cancer support program that can help you understand your medications, manage your symptoms and find community support.

Once enrolled, you can speak to a trained cancer nurse to help you manage and navigate your treatment plan. The program isn't available with all plans. If you have cancer, make sure the plan you buy lists the cancer support program as an option.

UnitedHealthcare only sells two types of plans, and both types restrict you to certain medical offices. These plans are called HMOs and EPOs. You have to pay the full cost if you get care from an office or doctor outside the network.

EPOs are the better option for cancer patients because they let you see specialists without a referral, but only specialists that are in your network. The amount you will pay to see a specialist depends on your plan. If you aren't sure how your plan covers specialists, you can call UnitedHealthcare to review your coverage.

UnitedHealthcare also tends to deny claims more often than other companies. Before you buy a plan, it's important to make sure your specific treatment is covered. You may want to call UnitedHealthcare to make sure you understand the coverage on the plan you're looking at, to avoid issues in the future.

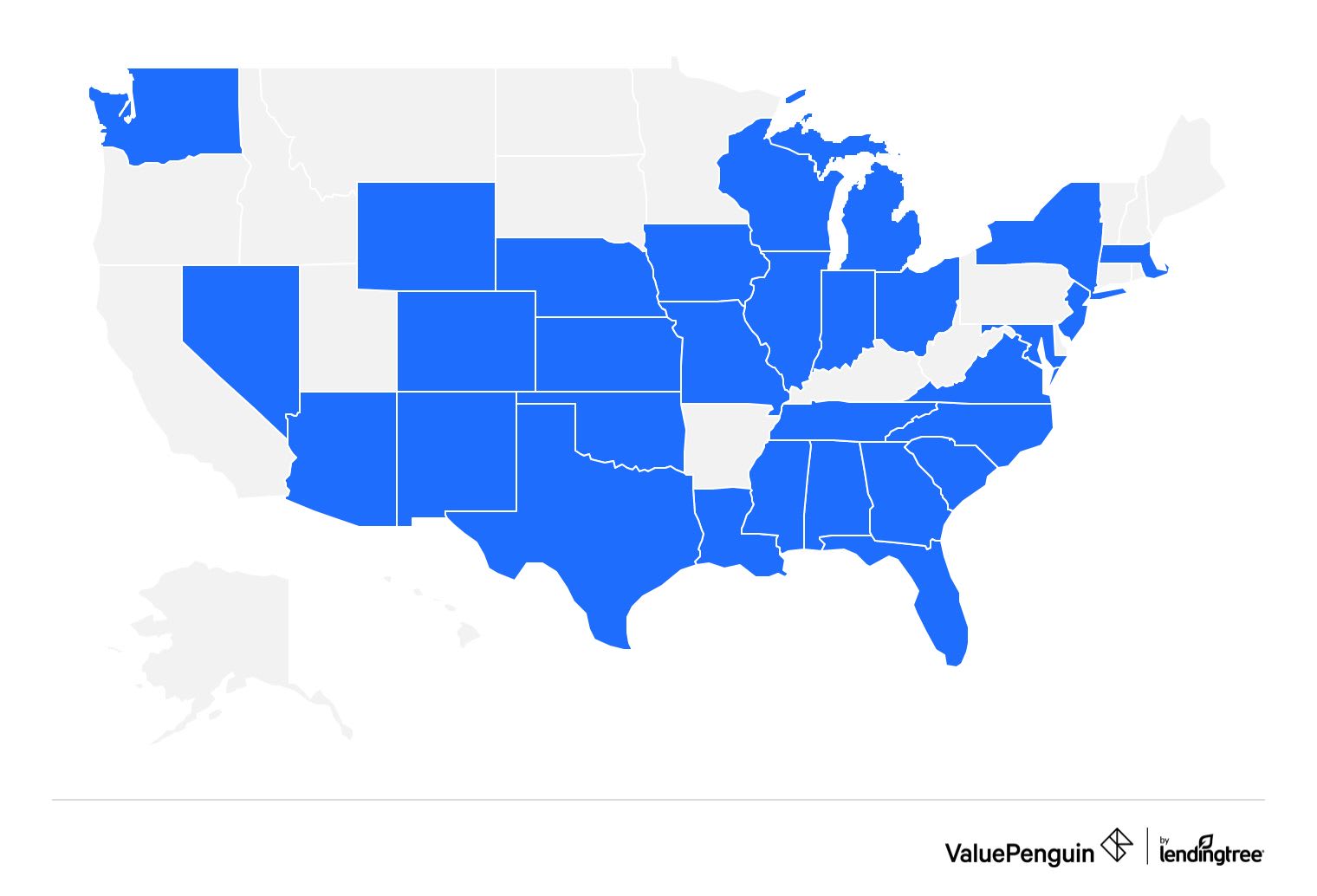

UnitedHealthcare sells Gold health insurance plans in 30 states.

- Alabama

- Arizona

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Maryland

- Mass.

- Michigan

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- South Carolina

- Tennessee

- Texas

- Virginia

- Washington

- Wisconsin

- Wyoming

Cigna: Best for extra coverage

-

Editor's rating

- Cost: $19/month

Cigna's Lump Sum Cancer Insurance and Cancer Treatment Insurance plans can help pay for things your health insurance doesn't cover.

Pros:

-

Helps you cover costs your primary plan doesn't

-

Some plans let you use the money for anything

-

Plans have low monthly rates

Cons:

-

Have to buy plan before cancer diagnosis

Health insurance doesn't cover every cost you'll have during cancer treatment, and Cigna's supplemental insurance can fill the gaps.

You could use the money from Cigna's policies to pay for transportation and hotels if you have to travel for treatment, or for help around the house while you're recovering. You could also use the money for your health insurance deductible or medications that your main policy doesn't cover.

If you want supplemental coverage for cancer, you have to buy it before you are diagnosed. Then, if you find out you have cancer, your policy will either pay you a daily amount or a lump sum of money, depending on the type of plan you have.

Cigna sells two supplemental insurance plans to help with cancer treatment costs: the Lump Sum Cancer Insurance plan and the Cancer Treatment Insurance plan.

Cigna's Lump Sum Cancer Insurance plan pays you a cash amount when you're diagnosed with a covered cancer. You can buy a policy that has a payout from $5,000 to $100,000 in most states. You can add extra coverage for cancer recurrence, chemotherapy and radiation, and heart attack and stroke. Plans cost an average of $19 per month, according to Cigna.

Lump-sum plans, also called fixed indemnity plans, pay you a lump sum of cash if you meet certain requirements. You can use the cash for anything, including your health insurance deductible, copayments and coinsurance. You can also use the money for costs that aren't covered by health insurance, like hiring someone to help with household tasks or child care while you're ill.

Cigna's Cancer Treatment Insurance pays you a set amount for covered cancer treatment services. It also covers related costs, like transportation and housing if you have to travel for treatment. You can add extra coverage for intensive care unit stays, hospitalization and heart attacks and strokes.

You can also add coverage for a lump-sum cancer payment, instead of buying a stand-alone Lump Sum Cancer Insurance plan. Plans cost $18 per month, on average, according to Cigna.

Cigna's Lump Sum Cancer Insurance is available in every state except Idaho, New York, Virginia and Wyoming.

Cigna's Cancer Treatment plan is available in every state except Idaho, Massachusetts, Minnesota, New Hampshire, New Jersey, New York, Utah and Wyoming.

Find Cheap Health Insurance in Your Area

Cost for cancer insurance

The high cost of cancer care often means a more expensive health insurance plan is often worth it.

But it's important to consider your total out-of-pocket cost, which includes the cost for your plan and your total medical costs, called the out-of-pocket maximum. Because cancer treatment is so expensive, it's likely that you'll hit this amount each year you need treatment, which means your plan fully pays for any covered medical care during that year.

By looking at the total costs for health insurance and health care, you can pick a plan that lets you pay a lower amount overall.

Total annual health insurance costs by plan tier

Platinum plans are the best option for people with cancer because they have the lowest total. But the second-best option could be a Bronze plan. Although they require you to pay for a lot of your medical care yourself, their cheap rates mean that you might end up with similar out-of-pocket costs to a Platinum plan.

If you need cancer treatment, it's a good idea to compare all your plan options, including lower-tier plans. Make a list of the plans that fit your needs. Then add the yearly rate for each plan to its out-of-pocket maximum. This will let you see which plans are truly cheaper overall.

The best way to decide what plan is right for you is to think about your budget. If you'd rather pay high but steady monthly rates and less for your medical care, choose a Platinum plan. If you would prefer a lower monthly rate but can afford to pay for more of your care yourself, a Bronze plan might make sense.

When you shop on HealthCare.gov or a state marketplace, always check to see if you qualify for rate discounts called subsidies. You can get discounts on any Bronze, Silver, Gold or Platinum plan if you make between $15,060 and $60,240 per year as a single person.

If you are single and make between $15,060 and $37,650 per year, a Silver plan could be a good idea.

That's because Silver plans come with an extra perk that makes medical care cheaper for people with low incomes. These discounts are called cost-sharing reductions. Cost-sharing reductions lower the amount you have to pay for your deductible, copay, coinsurance and out-of-pocket maximum.

Other health insurance options for cancer patients

There are ways to get coverage for cancer treatment even if you don't have traditional health insurance.

You might be able to get Medicare or Medicaid, or your health care system might offer financial assistance or a payment plan.

You may be able to get help paying for cancer treatment by contacting charities and organizations in your community. Hospitals might also have charity programs for customers who need financial help. The Patient Advocate Foundation could also help. The organization can provide cancer patients with financial counseling, legal advice and debt management tools.

Medicare

If you can get Medicare, you could get coverage for your cancer treatment. Original Medicare will cover some of your hospital and doctor costs through Parts A and B, as well as the costs for chemotherapy.

If your chemotherapy is in a hospital, Medicare Part A covers it. If you get chemotherapy in a doctor's office or clinic, Medicare Part B covers the costs. In both cases, you may have to pay some of the costs.

The best Medicare plan for cancer patients is to combine Original Medicare with a Medicare Supplement Plan G policy and a Medicare Part D drug coverage plan. This combination of coverage is typically going to result in the lowest health care costs for you.

Getting a Medicare Supplement plan is a good idea because cancer treatment can be costly.

If you buy a Medicare Supplement plan when you first become eligible, you'll get the best rates and your current health won't be a factor. There are also other times, depending on your situation and the state you live in, that you can buy a plan without your health impacting your rates. If you've missed those enrollment periods, you could be denied coverage for a Medicare Supplement plan or you might pay higher rates, especially if you have cancer. In that case, you could consider a Medicare Advantage plan.

One of the perks of Medicare Advantage is that it combines Medicare Parts A and B into one plan, and it also usually includes drug coverage. However, unlike Original Medicare, Medicare Advantage plans restrict you to a network of doctors. You should make sure your cancer doctors and specialists are in-network before you buy a plan.

Medicaid

Medicaid is mostly for people with low incomes. If you qualify for Medicaid, your medical care might be free or not cost much. Medicaid coverage can vary by state, so some treatments and services might not be covered.

Payment plans and financial aid

If you don't have any insurance coverage, talk to your doctor, hospital or health care system about a payment plan or financial aid. Many health care systems offer payment plans, financing options and assistance based on income. You could also consider taking out a medical credit card or a medical loan. Just make sure you understand the terms of any payment plan, credit card or loan you sign up for, so you know how it will affect your finances.

Does insurance cover clinical trials?

Health insurance plans may cover some or all of the cost for you to be in a clinical trial.

Part of the cost for your care in a clinical trial may come from the trial's sponsor. But if the sponsor doesn't cover everything, you might be able to get coverage from your health insurance company.

It's a good idea to talk to your health insurance company before the trial starts. Your company may need to know about the trial costs in advance so they can pre-authorize your coverage. You can ask your doctor or someone from the trial to work with you to give your company the info they need to potentially cover the trial costs.

Your plan has to pay for any routine care that you get during your trial. That means any medical care that your plan would normally cover for someone with your type of cancer will still be covered while you're in the trial.

How to get the best cancer insurance policy

The best way to find a policy that works for your cancer treatment is to fully understand what kind of care you need and how much it costs. Then you can compare plans and consider extra perks, like a cancer support program, to find the plan that best aligns with your needs.

Review your medical needs. Cancer patients need more expensive health care than most people. If you have cancer, it's a good idea to review your treatment plan and make a list of the medications and treatments you need. It will be important to make sure any plan you choose covers your treatments, so you don't have to pay extremely high costs yourself.

Compare plans. If you shop on HealthCare.gov or your state's marketplace site, you'll be able to compare plans from different companies. This can help you find the best combination of coverage and cost.

Remember to compare all the plan tiers, not just high-tier plans like Gold and Platinum. If you're sure you'll reach the out-of-pocket maximum, a lower-tier plan can still be a good deal. You just have to make sure you have the money to pay for more of your medical bills upfront.

Look at extra perks. Many companies have extra perks, like cancer-specific support programs or nurse lines, that might be helpful to you as you navigate cancer treatment. It's not a good idea to buy a plan just for the extra perks, but if you're stuck between two companies, those benefits might help you decide.

Tips to lower your health insurance costs

You might be able to lower your rate and cheaper health insurance by comparing plans and using discounts. But getting good coverage is the most important thing you can do to make sure you can afford treatment.

Shop around: Comparing multiple health insurance companies and plans at once can help you find the coverage you need at the best price. You can also compare how many of your medications are covered and review each plan's deductible and out-of-pocket maximum to make sure you can afford them.

Take advantage of subsidies: Subsidies, also called premium tax credits, lower your monthly rate for health insurance. They're available on Bronze, Silver, Gold and Platinum plans. You qualify based on how much you make each year.

Think about cost and coverage: As a cancer patient, you probably have higher medical bills than most. Finding affordable cancer insurance might be important, but the coverage you get is even more important. Focus on making sure your plan fits your needs rather than finding the cheapest cost. It will save you money overall to make sure your treatments and medications are covered, so you don't have to pay for them yourself.

Frequently asked questions

What is the best health insurance for cancer patients?

sells the best health insurance for cancer patients. Kaiser Permanente and UnitedHealthcare are also good options, and Cigna sells helpful supplemental plans. PPO networks are a good idea for cancer patients because they let you see specialists without a referral. If you take medications, it's also smart to check to make sure a plan covers them before buying the plan.

Can I get cancer insurance after diagnosis?

You can buy health insurance after you've been diagnosed with cancer. The Affordable Care Act prevents most health insurance plans from considering pre-existing conditions when you buy coverage. Not all plans have to follow those rules, though. Short-term health insurance plans and supplemental insurance plans, like Cigna's cancer insurance, can refuse to sell you a policy if you have already been diagnosed with cancer. These plans can also refuse to pay for medical bills related to your cancer if you've already been diagnosed.

Can insurance deny cancer treatment?

Health insurance companies can refuse to pay if your treatment isn't considered medically necessary or if it's experimental. They may also deny coverage for a drug that isn't included in their list of covered medications. You can file an appeal if your treatment has been denied. Secondary health insurance, like a cancer insurance policy, can be used to pay for things that your health insurance won't cover. Health insurance companies can't stop you from getting treatment, but they can deny coverage, which means you would have to pay out of pocket.

Methodology and sources

ValuePenguin used public use files (PUFs) from the Centers for Medicare & Medicaid Services (CMS) to determine average health insurance rates by company, plan level and network type. Average rates are for a 40-year-old with a Gold plan, unless otherwise noted.

Our experts also checked each company's drug formulary for the ten medications most commonly prescribed by cancer doctors, according to Definitive Healthcare: Anastrozole, letrozole, apixaban, tamoxifen citrate, dexamethasone, prochlorperazine maleate, prednisone, gabapentin, ondansetron and rivaroxaban.

Average rates for Cigna's supplemental policies come from Cigna. The rate for a Lump Sum Cancer Insurance policy is based on a 40-year-old in Alabama with $20,000 in coverage. The rate for a Cancer Treatment Insurance policy is based on a person between the ages of 40-44 in Alabama with a $500 per day hospitalization benefit.

Other sources for this article include Cancer.gov and HealthCare.gov.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.