Best Cheap Health Insurance in South Carolina (2025)

Blue Cross Blue Shield (BCBS) has the best cheap health insurance in South Carolina. Silver plans from BCBS cost as little as $412 per month before discounts.

Find Cheap Health Insurance Quotes in South Carolina

Best and cheapest health insurance in South Carolina

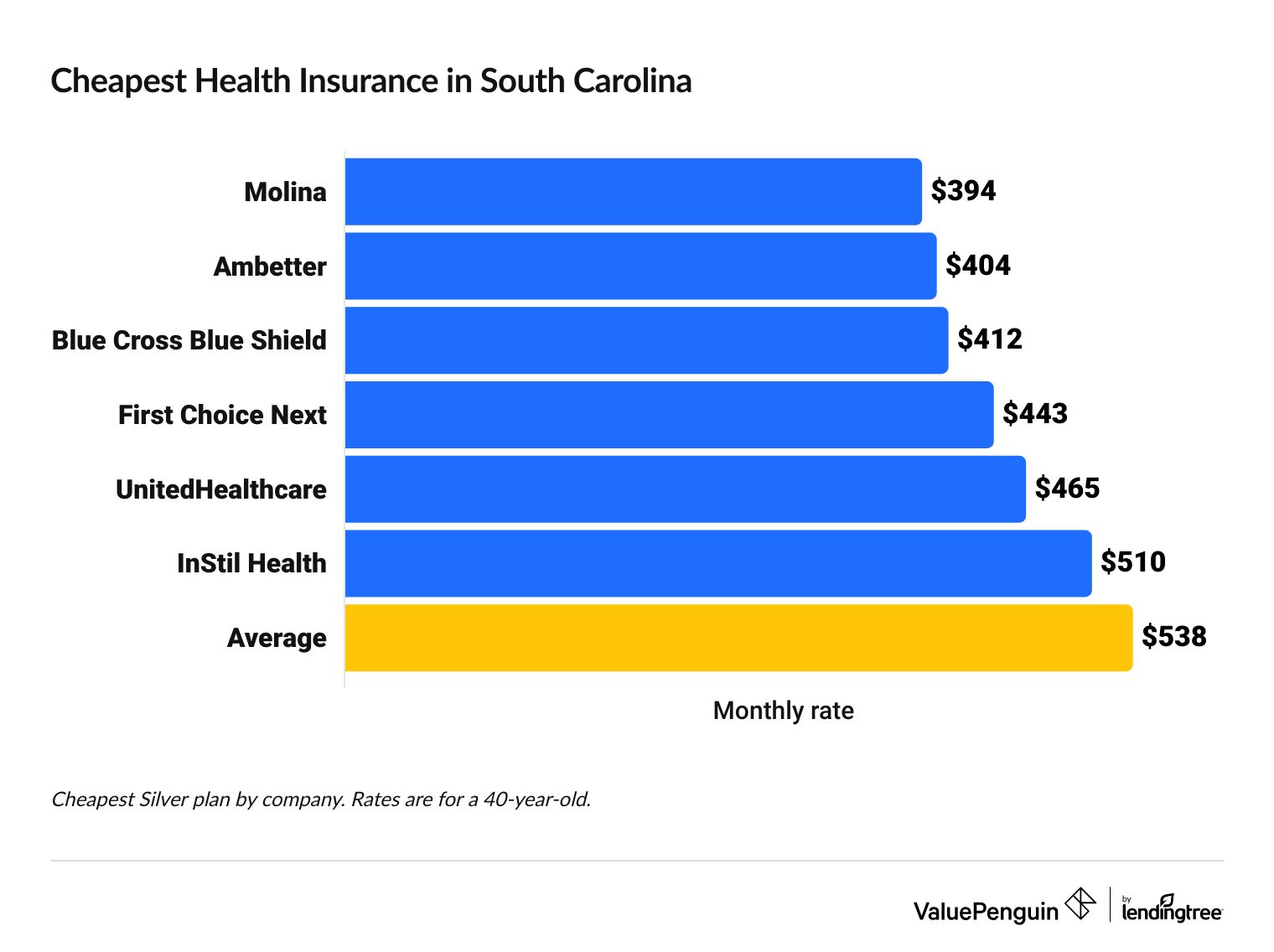

Cheapest health insurance companies in South Carolina

Molina has the most affordable health insurance plans in SC. Coverage starts at $394 per month before discounts.

Find Cheap Health Insurance Quotes in South Carolina

Affordable health insurance in South Carolina

Company |

Cost

| |

|---|---|---|

| Molina Healthcare | $394 - $674 | |

| Ambetter from Absolute Total Care | $404 - $642 | |

| BlueCross BlueShield of South Carolina | $412 - $725 | |

| First Choice Next | $443 - $532 | |

- Molina has the cheapest rates for one-third of South Carolina residents. The company has the most affordable Silver health plans in Charleston and its suburbs as well as Columbia.

- Blue Cross Blue Shield (BCBS) has the cheapest plans for roughly three out of 10 people in South Carolina. The company has the most affordable coverage in several large cities including Greenville, Myrtle Beach and Lexington.

Best health insurance companies in South Carolina

Blue Cross Blue Shield has the best health insurance in South Carolina for most people.

Blue Cross Blue Shield has a high four out of five-star rating from HealthCare.gov. This star rating measures plan quality, customer satisfaction and plan management. In addition, BCBS of South Carolina gets significantly fewer complaints than an average company its size.

BlueCross BlueShield (BCBS) of South Carolina is the only company to offer non-HMO coverage options on the health insurance marketplace. You can buy a PPO (preferred provider organization) plans. These plans let you get care outside your network for a higher cost, and you don't need to choose a primary care doctor or get a referral before you visit a specialist. PPOs typically have higher monthly rates than other plan types.

BCBS also sells EPO (exclusive provider organization) plan that lets you get in-network care from a specialist without a referral. However, you can't go outside your network of doctors with an EPO unless you have a medical emergency.

Best-rated health insurance companies in South Carolina

Company |

Editor rating

|

ACA rating

|

|---|---|---|

| BlueCross BlueShield of South Carolina | 4.0 | |

| Molina Healthcare | 2.0 | |

| Ambetter from Absolute Total Care | 2.0 | |

| UnitedHealthcare | NA | |

| First Choice Next | NA |

Find Cheap Health Insurance Quotes in South Carolina

Best health insurance in South Carolina for low deductibles

UnitedHealthcare has the lowest average deductibles of any company in South Carolina. You'll pay $2,625, on average, before coverage starts for a Silver plan. That's almost half what you'd pay with a Blue Cross Blue Shield plan.

Consider getting a plan with a low deductible if you want to protect yourself from large, out-of-pocket costs in the event you get seriously sick or injured.

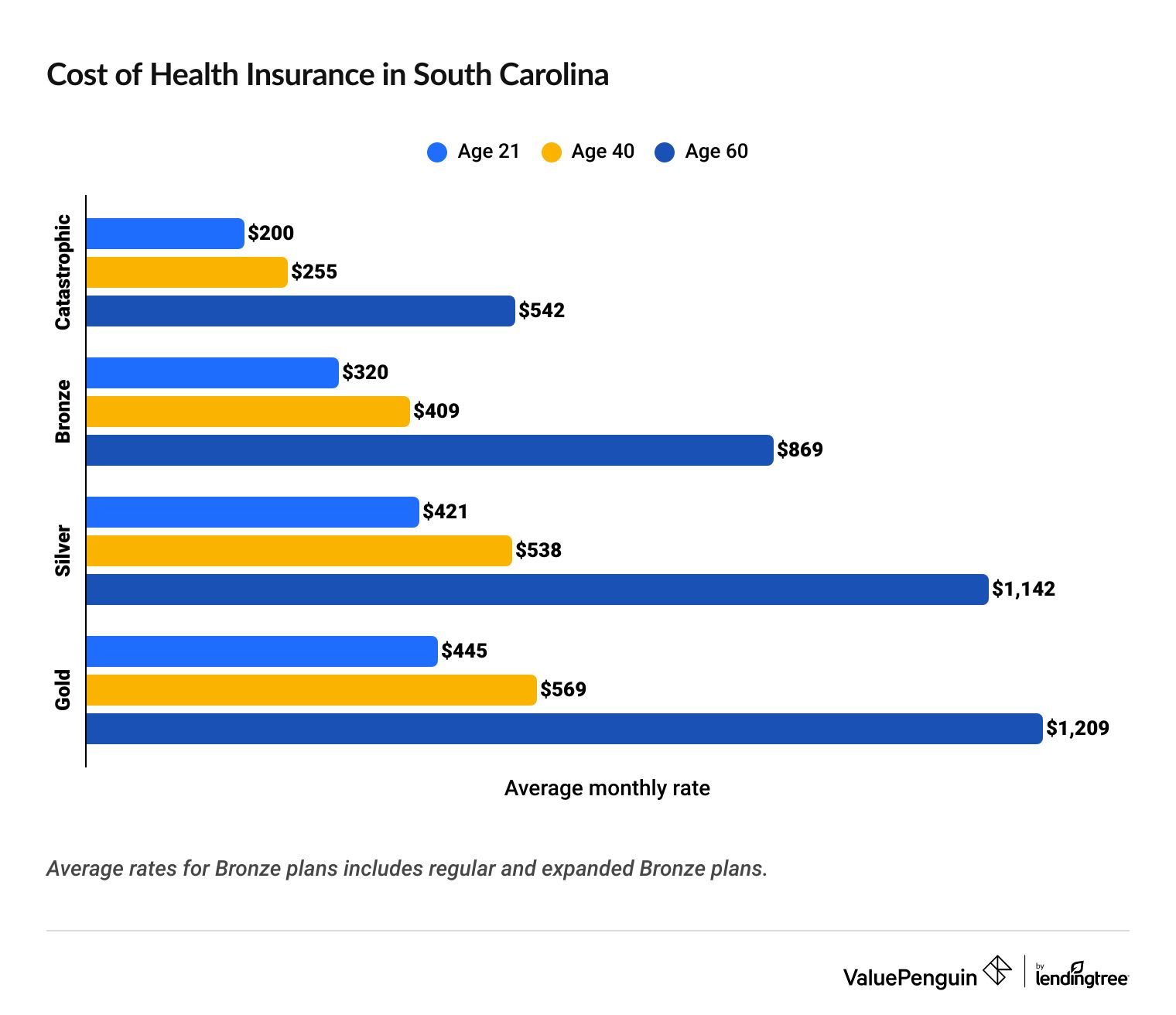

What's the cost of health insurance in South Carolina?

Health insurance in SC costs an average of $538 per month, at full cost, or $50 per month, on average, for those who qualify for discounts based on your income.

Nearly everyone in South Carolina who buys health insurance on HealthCare.gov qualifies for a discount, called a subsidy or premium tax credit. Roughly six in 10 people with exchange health plans pay under $10 per month for a Silver Health plan after discounts.

Silver health plans in South Carolina cost an average of $538 per month if you don't qualify for subsidies.

The plan tier you choose and your age are the two biggest factors influencing your health insurance costs if you live in South Carolina.

Plan tiers with higher monthly rates let you pay less when you visit the doctor. Higher plan tiers make sense if you have an ongoing health condition because you'll save money when you use your insurance. However, lower plan tiers are usually a better choice for healthy individuals.

For example, an average Gold plan in South Carolina costs $31 per month more than a Silver plan, but an average Gold plan has a deductible that's thousands of dollars less than what you'd pay for a Silver plan.

Gold vs. Silver plan total cost for one year with $5,000 in medical bills

Silver | Gold | |

|---|---|---|

| Monthly rate | $538 | $569 |

| Deductible | $5,053 | $1,381 |

| 20% Coinsurance | $0 | $724 |

| Final cost to you | $11,456 | $8,933 |

Assuming you have $5,000 of medical costs in a single year. Rates are for an average 40-year-old in South Carolina.

In addition, Gold plans cap your total annual costs, called an out-of-pocket maximum, at $936 less than Silver plans, on average.

Health insurance gets more expensive as you get older. These rate increases are typically lower in your 20s and 30s. However, they grow much higher as you move into middle age. On average, a 60-year-old in South Carolina pays twice as much as a 40-year-old for the same level of coverage.

Get affordable health insurance in South Carolina

South Carolina residents who qualify for health insurance discounts because of their income pay $50 per month for coverage on average.

Almost 60% of health exchange shoppers in South Carolina pay less than $10 per month for coverage.

You're eligible for discounts if you earn between $15,606 and $60,240 per year as a single person or around $31,200 and $124,800 for a family of four. Subsidies can be used with Bronze, Silver and Gold health plans bought through HealthCare.gov.

If you earn less than the minimum qualifying income, you may be in what's called the Medicaid "coverage gap", which exists because South Carolina has not expanded Medicaid coverage to everyone who earns a low income.

There are 76,000 adults who don't have access to Medicaid or health insurance discounts in South Carolina.

In other words, a single person who earns below about $15,000 per year and who doesn't qualify for Medicaid has few affordable health coverage options in South Carolina.

Cheap South Carolina health insurance plans by city

Molina has the cheapest Silver health plans in Charleston, at $395 per month on average.

Molina also has the most affordable rates in Columbia. Blue Cross Blue Shield also has the cheapest rates in other large South Carolina cities like Greenville and Myrtle Beach.

Cheapest health insurance by SC county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Abbeville | Ambetter Clear Silver | $406 |

| Aiken | Ambetter Clear Silver | $443 |

| Allendale | Molina Healthcare Silver 12 | $436 |

| Anderson | First Choice Next Silver Signature | $518 |

| Bamberg | Molina Healthcare Silver 12 | $442 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in South Carolina

Best health insurance by level of coverage

The best health insurance for you will depend on the level of medical care you think you'll need in the coming year. It's also important to look at what discounts you'll qualify for because of your income and what plan types are available where you live.

Gold plans: Best if you visit the doctor frequently

| Gold plans pay for about 80% of your medical care. |

Consider a Gold plan if you have an ongoing illness or a medical problem that requires expensive treatment. Gold plans have high monthly rates, but you pay very little when you go to the doctor.

Gold plans in South Carolina cost $569 per month and have a $1,381 yearly deductible on average.

Silver plans: Best for average medical needs

| Silver plans pay for about 70% of your medical care. |

Silver health plans have average monthly rates and middle-of-the-road costs when you go to the hospital or get a prescription filled. That makes Silver plans a good choice for most people. In addition, you may qualify for extra discounts with a Silver plan if you earn a low income, called cost-sharing reductions.

On average, Silver plans in South Carolina cost $538 per month and have a $5,053 deductible on average.

Bronze plans: Best if you're young and healthy

| Bronze plans pay for about 60% of your medical care. |

Bronze plans may be a good choice if you're in good health and don't expect that you'll need much medical care in the coming year. These plans have cheap monthly rates, but expensive costs when you visit the doctor. You should only buy a Bronze plan if you have enough money in your savings account to cover your share of the medical bill if you get into an accident or fall sick.

In South Carolina, Bronze plans cost $409 per month and have a $5,753 health insurance deductible on average.

Catastrophic plans: Best to prevent financial disaster

Catastrophic plans are usually a bad idea because of their limited coverage.

Catastrophic plans offer bare-bones coverage that only pays for care after you've paid thousands of dollars out of pocket. However, these plans have cheap rates which may make them a good idea in limited circumstances. For example, if you don't qualify for health insurance discounts and you have enough money in your savings account to comfortably pay for large medical bills, a catastrophic plan could make sense.

Catastrophic plans are only available to people under the age of 30 and those who qualify for a special hardship exemption.

In South Carolina, catastrophic plans cost $255 per month and have a $9,200 deductible on average.

Free and affordable health coverage in South Carolina for people who earn low incomes

South Carolina residents who earn a low income may qualify for free or reduced-price health insurance.

Silver plans with cost-sharing reductions: Best if you earn a low income but can't get Medicaid

| Silver plans will pay 73% to 94% of your medical costs if you have a low income. |

Silver health plans are eligible for extra discounts, called cost-sharing reductions, that help pay for the costs you're responsible for when you visit the doctor. This includes your deductible, copays and coinsurance.

Catastrophic, Bronze and Gold plans aren't eligible for cost-sharing reductions.

To qualify for cost-sharing reductions, you need to earn less than $38,000 per year as an individual or under $78,000 per year for a family of four.

Medicaid: Free health insurance for qualifying South Carolinians

You may qualify for free government health insurance, called Medicaid, if you earn a low income and you are:

- Blind

- Disabled

- Pregnant

- 18 or younger

- Over the age of 65

- A parent or caretaker to a child 18 or younger

- Diagnosed with breast or cervical cancer

The amount you need to earn to qualify for Medicaid in South Carolina depends on your individual circumstances. For example, pregnant women can earn up to about $30,000. Families with children 18 and under and emancipated minors can qualify with incomes up to about $32,000. However, seniors and people with disabilities have an income limit of $15,060.

Medicaid coverage rules differ by state. South Carolina is one of a handful of states that hasn't adopted expanded Medicaid. That means it has tighter eligibility requirements than most places in the U.S.

Are health insurance rates going up in South Carolina?

Health insurance rates fell by 1% in South Carolina between 2024 and 2025 on average. Catastrophic, Bronze and Silver plans all got 1% cheaper, on average. Rates for Gold plans stayed flat.

Are health insurance rates going up in SC?

Tier | 2024 | 2025 | Change |

|---|---|---|---|

| Catastrophic | $258 | $255 | -1% |

| Bronze | $414 | $409 | -1% |

| Silver | $541 | $538 | -1% |

| Gold | $568 | $569 | 0% |

Monthly costs are for a 40-year-old.

All marketplace health insurance plans in SC have to cover what are called 10 essential benefits.

- Outpatient care

- Emergency care

- Hospital care

- Care for pregnant women and newborns

- Services for mental health and substance use disorders

- Prescription drugs

- Laboratory services

- Coverage for babies

- Rehabilitation services and devices

- Preventive, wellness and ongoing disease services

Catastrophic, Bronze, Silver and Gold plans all have to cover these services. However, short-term health insurance plans don't have these coverage requirements.

Cost of South Carolina health insurance by family size

You'll pay $322 per child that you add to your health plan on average in South Carolina.

That means a single parent with one child pays $859 per month before discounts for Silver health coverage. A family of four with two children under the age of 15 pays $1,719 per month before discounts on average.

Family size | Average monthly cost |

|---|---|

| Individual | $538 |

| Individual + Child | $859 |

| Couple, age 40 | $1,075 |

| Family of three | $1,397 |

| Family of four | $1,719 |

Averages based on a Silver plan for 40-year-old adults and children who are under age 15.

Short-term health insurance in South Carolina

In January, the Trump administration canceled a new rule that would restrict short-term health plans to three months. No timeline is available for when this change will happen. However, short-term health coverage that lasts for up to 11 months may be sold in South Carolina sometime in 2025.

Short-term coverage lets you get coverage if you miss open enrollment and you're not eligible for what's called a special enrollment period.

These plans tend to cost less than regular health insurance. However, they typically offer less coverage and have more restrictions compared to a marketplace health plan.

Pros of short-term health insurance in SC

Cons of short-term health insurance in SC

Frequently asked questions

Who has the best health insurance in South Carolina?

BlueCross BlueShield (BCBS) of South Carolina has the best cheap health insurance in South Carolina. Blue Cross Blue Shield plans have a strong four out of five-star rating from HealthCare.gov, and BCBS gets significantly fewer complaints than an average company its size according to the NAIC.

How much is health insurance per month in South Carolina?

Health insurance in South Carolina costs $538 per month for an average Silver plan before discounts.

However, nearly everyone in SC who buys coverage on HealthCare.gov qualifies for discounts, called subsidies. Discounted plans cost $50 per month, on average, and about six in 10 South Carolina residents pay under $10 per month for health insurance.

What is the most popular health insurance in South Carolina?

Blue Cross Blue Shield has the most popular health insurance in South Carolina. The company sells 73% of health plans in the state.

Methodology

South Carolina health insurance rate data for 2025 is from the Centers for Medicare & Medicaid Services (CMS) website. ValuePenguin used the CMS public use files (PUFs) in calculations to average rates across a variety of factors such as plan tier, county and family size. Plans and insurance companies for which county-level data was included in the CMS Crosswalk file were used in our reporting. Those excluded from these files were not included in our analysis.

Rates are based on a 40-year-old with a Silver plan, unless otherwise noted. Other sources include S&P Global Capital IQ, NAIC (National Association of Insurance Commissioners) and the South Carolina Department of Health and Human Services.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.