Sidecar Health Access Plan Review: Who Is It Good For?

Sidecar Health's Access Plan is a good way to make day-to-day medical care affordable, but it does not provide the same safety net as traditional health insurance.

Find Cheap Health Insurance Quotes in Your Area

Sidecar Health offers plans that pay a set rate for each type of health service such as a doctor's visit, X-ray or surgery. This is called a fixed indemnity plan.

Sidecar stands out for its technology, including its debit card that's linked to its claims department. However, only having this type of plan means you're unprotected from major medical bills because there's no limit on your medical costs, also called the out-of-pocket maximum.

This review is for the Sidecar Health Access Plan, a fixed indemnity plan. It is not reflective of Sidecar Health's major medical plans. For more information on those, please refer to Sidecar Health's website.

Pros and cons

Pros

Good short-term coverage

Lets you go to any doctor

Plans don't have a deductible

Cons

Paying for care can be complex

Only in 18 states

Fewer benefits vs. regular insurance

What is the Sidecar Health Access Plan?

Sidecar Health's Access Plan typically costs between $175 and $295 per month, and it pays a specific amount for each type of health care service or treatment you receive. You're responsible for paying the remaining balance of the medical costs. This is called a fixed indemnity plan.

The plan always pays the same amount for a service, no matter how much the provider charges for your health care. This means you can get the best deal on your health care by doing research and price comparisons when choosing your doctors and medical providers.

For example, Sidecar could pay $100 for a standard X-ray. If the bill from the radiologist is $150, you would pay the other $50. If you went to a radiologist that charged $300, Sidecar would still pay $100, and you would pay $200.

A fixed indemnity plan is not the same as a traditional insurance plan, and these policies do not have to follow most health insurance rules.

- You could be denied a policy or you could have to pay more because of your medical history. And Sidecar isn't available to those over age 65. Instead, the best option is for seniors to get a Medicare plan.

- Plans don't have to provide free preventive care like a regular health insurance plan. Instead, you'll use the same cash pricing discount for regular checkups and screenings.

However, as a tech-focused startup, Sidecar offers innovative tools to help you save money. These aren't typically available from other health insurance companies or fixed indemnity providers.

Find Cheap Health Insurance in Your Area

How Sidecar is using technology to improve the cost of health care

- Cash pricing: Many doctors and health care providers offer a discounted rate to anyone who will pay cash at the appointment. Sidecar members can access these cash discounts with a debit card to pay their doctor's bills at the time of care.

- Pricing transparency: The Sidecar platform estimates the average cash price for each type of service alongside how much a policy will pay, helping you calculate your expected costs. It also shows real-time pricing information about what local doctors and facilities are charging for treatments. This can help you shop around for the best prices when choosing your providers.

How Sidecar compares to a traditional insurance plan

If you're considering the Sidecar Health Access Plan, remember that it's not a traditional insurance policy. It doesn't give you any of the safeguards of typical insurance such as having an out-of-pocket maximum to protect you from a worst-case scenario of extreme medical bills.

Even if you're young and healthy and you don't expect to need much medical care, an unexpected accident could lead to major medical bills. Only having an indemnity plan is risky because you won't have a limit on your medical costs.

There are two key terms to pay attention to when comparing policies:

-

Annual coverage per person (indemnity-style plans): This is the most the insurance company will pay for your medical care. Rather than protecting you, it protects the company. The Sidecar Health Access Plan has a cap on how much it will pay for care in a policy year. Even if you need expensive medical care, the plan would pay its rate for services up to between $10,000 per year and $2 million per year, based on your policy.

You won't have a cap on your medical costs. For example, if you needed $100,000 in medical care, the insurer could cover 75% of the cost, and you could owe $25,000.

-

Out-of-pocket maximum (traditional health insurance): This protects you because if you need major medical care, you'll only have to pay a limited amount. An out-of-pocket max is the most you'll pay for covered services each year.

Regular insurance plans on the marketplace can have an out-of-pocket max of up to $9,450 in 2024. This means that even if your medical bills total $100,000 or millions of dollars, you'll only pay $9,450 if that is your plan's out-of-pocket maximum.

When is Sidecar Access Plan a good choice?

Sidecar Health's Access Plan is a good choice for those who need short-term insurance coverage.

You can sign up for Sidecar's plan at any time and cancel at any time. Like other short-term health insurance plans, it can give you coverage while you're waiting for open enrollment or when your employer's insurance coverage hasn't begun.

It may also be good for young adults who are healthy and comfortable with risk.

You won't have the typical protections of regular health insurance, and a health situation such as needing surgery could leave you with major medical bills. However, the low monthly rates combined with no deductibles can make it an affordable way to manage day-to-day medical costs.

When should you not get Sidecar Access Plan?

-

If you have a low or middle income, it's usually cheaper to sign up for insurance on the health insurance marketplace than through the Sidecar Access Plan.

The Affordable Care Act (ACA) subsidy will discount the cost of your insurance based on your income, and you may find plans for as little as $50 to $100 per month.

- If you want the full protections of a regular health insurance plan, compare the coverage you can get from a cheap health insurance company. Plans may be more expensive than Sidecar's Access Plan. But you can get better benefits.

Want more options? Check out the best health insurance for self-employed freelancers or learn which health insurance companies are cheapest in your state.

How Sidecar Health's Access Plan works

Using the Sidecar Health Access Plan is a little different than you may be used to.

- Request the cash rate for medical care: You'll ask for the discounted cash rate when making your appointment. This can slash your bill before you ever see a doctor. The discount amount varies widely by provider and service, ranging from a 30% discount to as much as 90% off.

- Pay with your Sidecar debit card: All members get a Sidecar Health payment card that's linked directly to Sidecar's claims department. You'll use this card to pay when you go to the doctor or after receiving any type of health care.

- Submit an itemized bill: You'll need to request a detailed receipt from the medical provider with both the procedure codes and diagnosis codes for each service you received. Upload this document to Sidecar so it can process your claim.

- Sidecar pays a fixed rate: The claims department will use your submitted receipt and your policy's list of rates to calculate how much it will pay for each claim.

- You pay Sidecar for the balance: You're responsible for paying the portion of the bill that isn't covered by Sidecar. Typically, the credit card or bank account that you have on file with Sidecar is used to pay your balance.

Downside of using Sidecar Sidecar Health's Access Plan

It can take a little more work to manage your plan and coverage because you'll have to shop around to find the best-priced medical care and file more of the paperwork yourself.

One customer said that getting the right paperwork felt like working in medical billing, and another had conference calls with both Sidecar and their doctor to resolve billing issues.

You may also have to learn more about the codes for procedures and medical diagnoses. For example, Sidecar's online cost estimator could tell you approximately what a visit to urgent care could cost. But if your medical bill from urgent care says it was a follow-up appointment or another type of treatment, then the amount Sidecar pays could be different based on that billing code.

If you are doubling up on policies by getting Sidecar to help pay for routine medical care and Catastrophic health insurance to cover you if you get very sick, you'll probably only be able to use one at a time.

For example, when you use a traditional insurance plan, you won't have access to the discounted cash rate because the provider will be billing your insurance company. On the other hand, any amount you pay when using Sidecar probably won't count toward the deductible of your other policy.

Where are Sidecar Health Access Plans available?

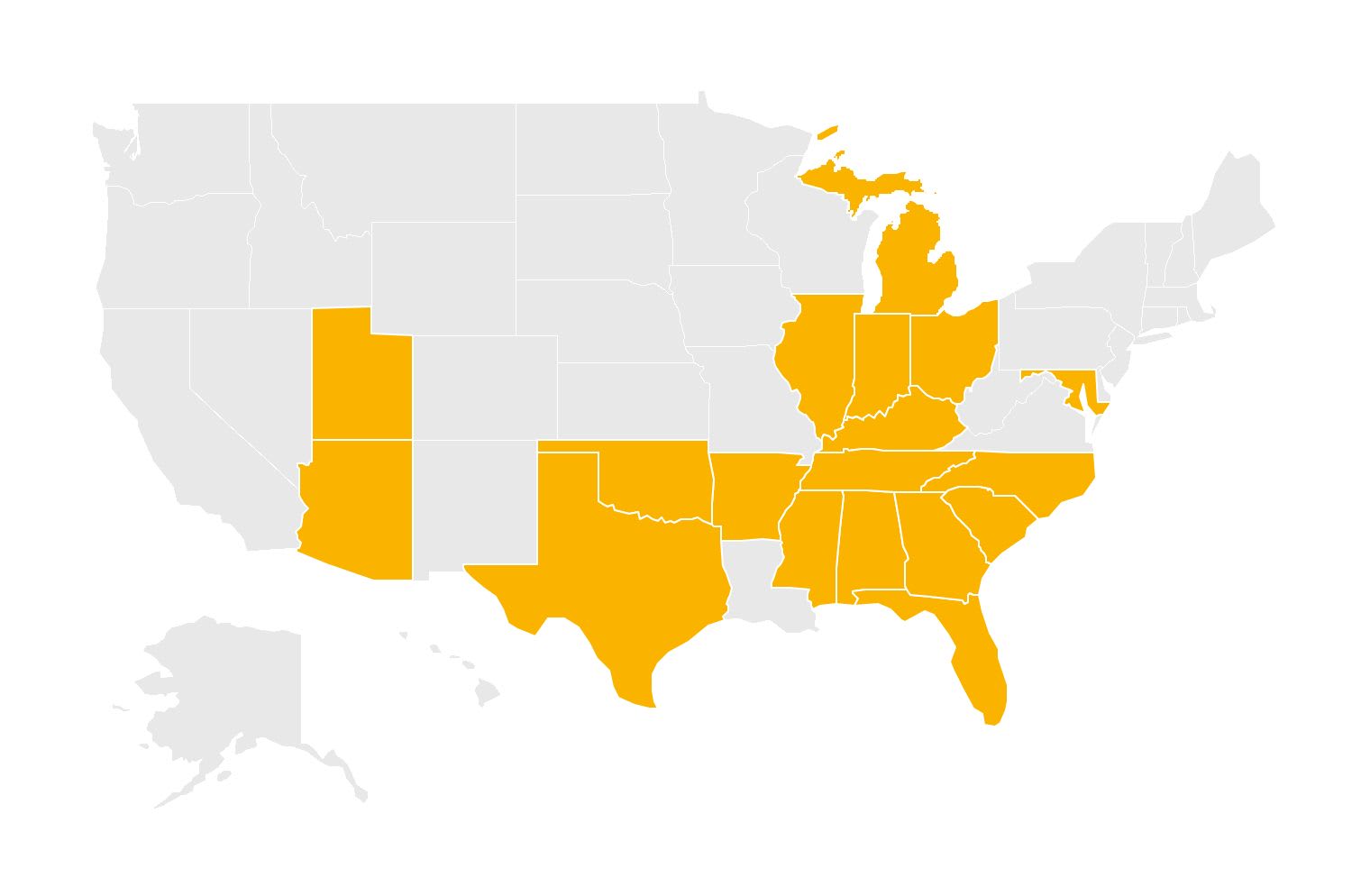

Sidecar has been expanding the number of states where it operates. Sidecar Access Plan is available in 18 states, mostly throughout the South and the Midwest.

Find Cheap Health Insurance in Your Area

States where Sidecar Health Access Plans are available

Plan options, costs and features

The Sidecar Health Access Plan offers coverage for 170,000 medical procedures and services. Each of the covered services is listed in the policy, alongside how much it will pay.

You can go to any doctor or facility that accepts cash-paying customers who don't have traditional insurance. That's because the Sidecar plan has no in-network or out-of-network list of providers.

How much does Sidecar Health Access insurance cost?

Sidecar Health Access Plan typically costs between $175 and $300 per month.

However, how much you pay can change based on your medical history. There are three plans to choose from, and they all have a zero deductible.

Cost of Sidecar Health Access Plan

Base rates

Rates if you use a chiropractor

Rates if you use mental health services

Plan | Monthly cost | Most the plan will pay |

|---|---|---|

| Budget | $175 | $10,000 |

| Standard | $215 | $25,000 |

| Premium | $295 | $2 million |

Base rates

Plan | Monthly cost | Most the plan will pay |

|---|---|---|

| Budget | $175 | $10,000 |

| Standard | $215 | $25,000 |

| Premium | $295 | $2 million |

Rates if you use a chiropractor

Plan | Monthly cost | Most the plan will pay |

|---|---|---|

| Budget | $255 | $10,000 |

| Standard | $295 | $25,000 |

| Premium | $375 | $2 million |

Based on if you've visited a chiropractor five times in the past year

Rates if you use mental health services

Plan | Monthly cost | Most the plan will pay |

|---|---|---|

| Budget | $465 | $10,000 |

| Standard | $505 | $25,000 |

| Premium | $585 | $2 million |

Based on if you've visited a mental health professional five times in the past year

Rates are 37% higher, on average, if you've frequently seen a chiropractor in the past year. And rates can double if you've had five mental health appointments.

Also, you could be denied coverage if you have conditions such as cancer, heart disease, diabetes or a high weight.

Because the plans have zero deductible, it can be a straightforward way to afford routine medical care without large, upfront costs.

You can also customize your plan by selecting the coverage level, adding a deductible and choosing if you want prescription drug coverage.

This plan flexibility can help you get a price quote that works for both your budget and health care needs.

How does the cost of Sidecar compare to regular health insurance?

The Sidecar Access Plan will usually cost more than regular health insurance if you have a low or moderate income.

If you make less than $58,320 per year as an individual, you'll qualify for discounted health insurance when you shop through HealthCare.gov or your state marketplace. This makes it more affordable to get a traditional health insurance plan. And depending on your income and where you live, a full benefit plan could be cheaper than Sidecar.

Regular health insurance | Sidecar Standard Access Plan | |

|---|---|---|

| Person earning $30,000 | $56 | $215 |

| Person earning $45,000 | $233 | $215 |

| Person earning $55,000 | $363 | $215 |

| If you pay full price | $418 | $215 |

Rates are the average monthly cost for a 30-year-old male in Charlotte, N.C. Regular health insurance rates are based on a Silver plan sold on HealthCare.gov.

The biggest downside of a regular health insurance plan is that you can only sign up each fall during open enrollment or midyear if you have a qualifying event like losing Medicaid, leaving a job or a change in family size.

Sidecar has no open enrollment or contracts. You can sign up and cancel whenever you want, which is an important feature if you're a freelancer or self-employed and may need scheduling flexibility.

Customer reviews and complaints

Sidecar Health receives mixed reviews from customers, with moderate to good star ratings overall.

Site | Rating | |

|---|---|---|

| Trustpilot | 4.0 stars (333 reviews) | |

| 4.0 stars (42 reviews) | ||

| BBB | 2.3 stars (3 reviews) | |

Members often like the customer service agents who answer the phones. On Trustpilot, agents are described as friendly, helpful and caring. That's a great benefit, considering that it's often frustrating to call a health insurance company.

Complaints about Sidecar Health are often about a difficult claims process or having to pay more than expected. Some Sidecar members say it's more stressful and takes more effort than having a regular health insurance plan.

Sidecar works with top-ranked partner insurance companies that underwrite policies.

-

SiriusPoint America Insurance Co. receives 74% fewer complaints than a typical insurance company its size and is financially strong, with an A- ranking from AM Best.

This company handles Access Plans in Michigan, Mississippi, Ohio and Utah.

-

United States Fire Insurance Co. also has a strong financial ability to pay claims, with an AM Best ranking of A. And it also has high customer satisfaction, with 63% fewer complaints than average.

This company manages Access Plans in Alabama, Arizona, Arkansas, Florida, Georgia, Illinois, Indiana, Kentucky, Maryland, North Carolina, Oklahoma, South Carolina, Tennessee and Texas.

Frequently asked questions

Is the Sidecar Health Access Plan good?

The indemnity insurance policies from Sidecar Health are a good way to make routine medical costs more affordable because they act like a discount coupon off of the full price for health care. However, a traditional health insurance plan provides benefits such as free preventive care and an out-of-pocket max to protect you from major medical costs.

How much does the Sidecar Health Access Plan cost?

Sidecar insurance policies typically cost between $175 and $300 per month for no-deductible plans. Flexible options let you customize your policy's health coverage to meet your budget.

Is Sidecar Health legit?

Yes, Sidecar Health is backed by underwriters with top-ranked financial stability. However, the indemnity-style plans do not have the same financial protection as a traditional health insurance plan.

Is Sidecar or Oscar better for health insurance?

Sidecar's Access Plan is better if you need quick coverage for a short period of time. You can sign up or cancel at any time, but the benefits are not as strong if you get very sick. Oscar is an average-rated company selling traditional health insurance plans that follow ACA regulations. That means that you'll have protection from high bills if you get very sick, and preventive coverage is free. But you can only sign up during open enrollment or if you have a special circumstance.

Methodology and sources

Sample rates are for a 30-year-old man living in Charlotte, N.C. The cost of the Sidecar Health Access Plan is based on quotes from the company website. The comparison to HealthCare.gov plans uses a Silver tier of coverage, which is a popular level of plan that's good for most people, and rates use premium tax credit calculations for different levels of income.

Sources include Sidecar Health, the Better Business Bureau (BBB), Trustpilot, Google reviews, AM Best, KFF and the National Association of Insurance Commissioners (NAIC).

Plans referred to above are excepted benefit fixed indemnity insurance products marketed and administered by Sidecar Health Insurance Solutions, LLC and underwritten by Sirius America Insurance Company or United States Fire Insurance Company, depending on the state. As an excepted benefit plan, it does not provide comprehensive/major medical expenses coverage, minimum essential coverage, or essential health benefits. You cannot receive a subsidy (premium tax credit and/or cost-sharing reduction) under the ACA in connection with your purchase of such an excepted benefit fixed indemnity insurance plan. Also, the termination or loss of this policy does not entitle you to a special enrollment period to purchase a health benefit plan that qualifies as minimum essential coverage outside of an open enrollment period. Coverage and plan options may vary or may not be available in all states.