Compare Health Insurance Quotes & Prices

Compare Health Insurance Rates

Let's begin with your zip code.

We'll find you a health insurance quote based on your needs.

Comparing health insurance quotes can get you a better deal on coverage.

ValuePenguin's health insurance calculator can give you rate estimates and plan recommendations. Our experts can help you:

Compare health insurance quotes and plans

Compare health insurance quotes by cost

Compare health insurance quotes by state

Learn more about the health insurance plans offered in your state:

Find Cheap Health Insurance Quotes in Your Area

Compare health insurance quotes

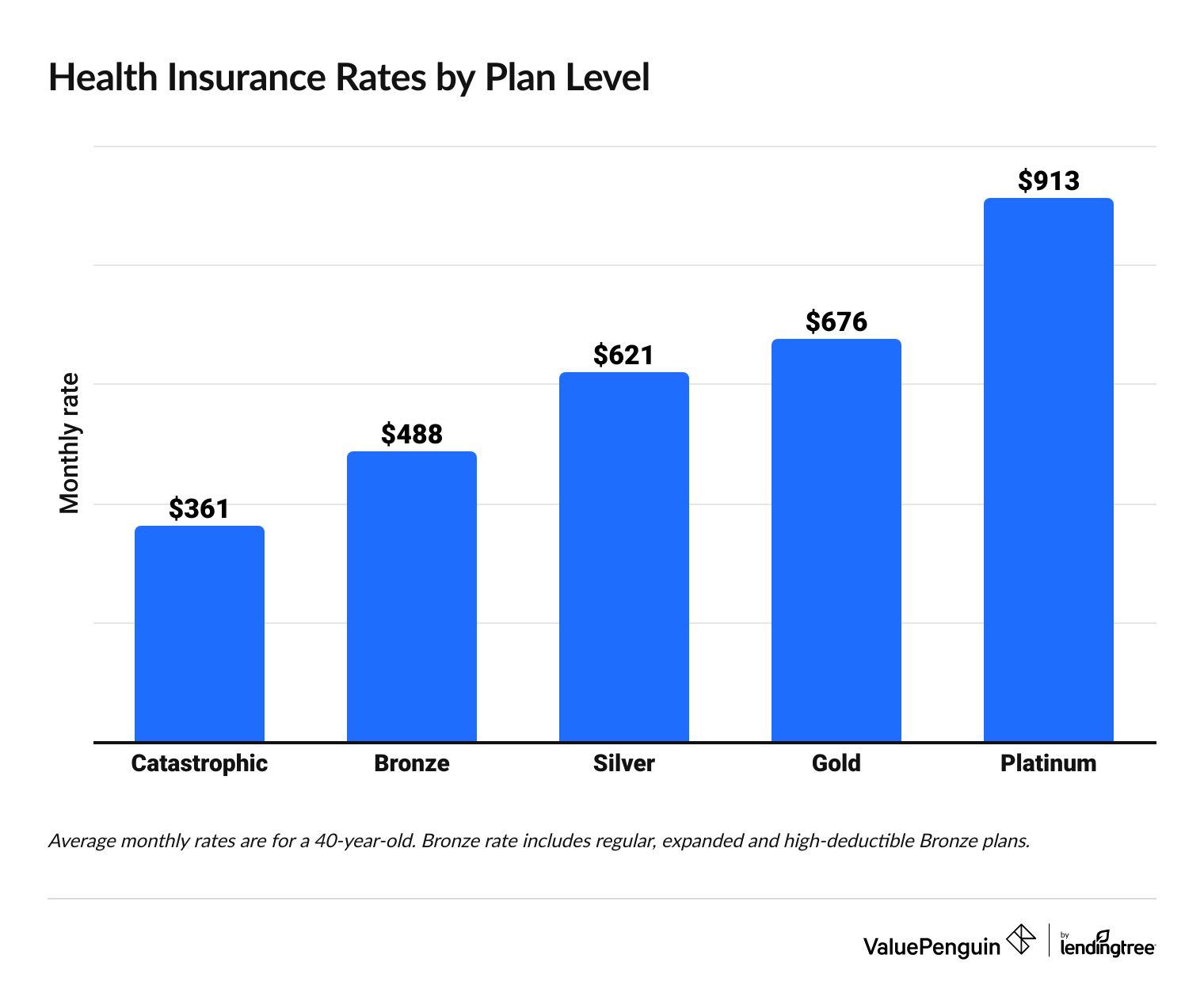

By plan level

By age

By company

By location

Plan tier | Rate |

|---|---|

| Catastrophic | $361 |

| Bronze | $488 |

| Silver | $621 |

| Gold | $676 |

| Platinum | $913 |

Average monthly rates for a 40-year-old.

By plan level

Plan tier | Rate |

|---|---|

| Catastrophic | $361 |

| Bronze | $488 |

| Silver | $621 |

| Gold | $676 |

| Platinum | $913 |

Average monthly rates for a 40-year-old.

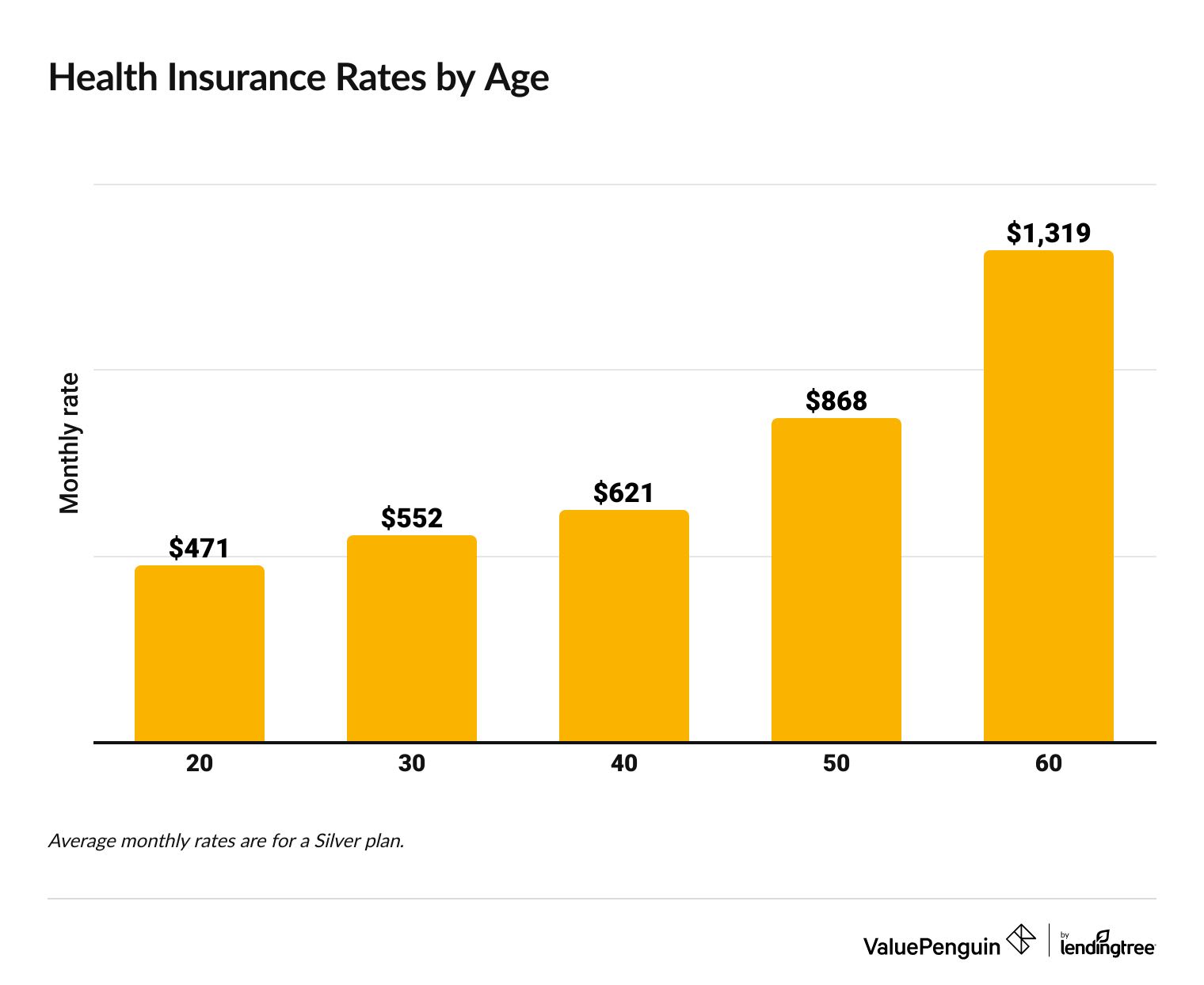

By age

Age | Rate |

|---|---|

| 20 | $471 |

| 30 | $552 |

| 40 | $621 |

| 50 | $868 |

| 60 | $1,319 |

Average monthly rates for a Silver plan.

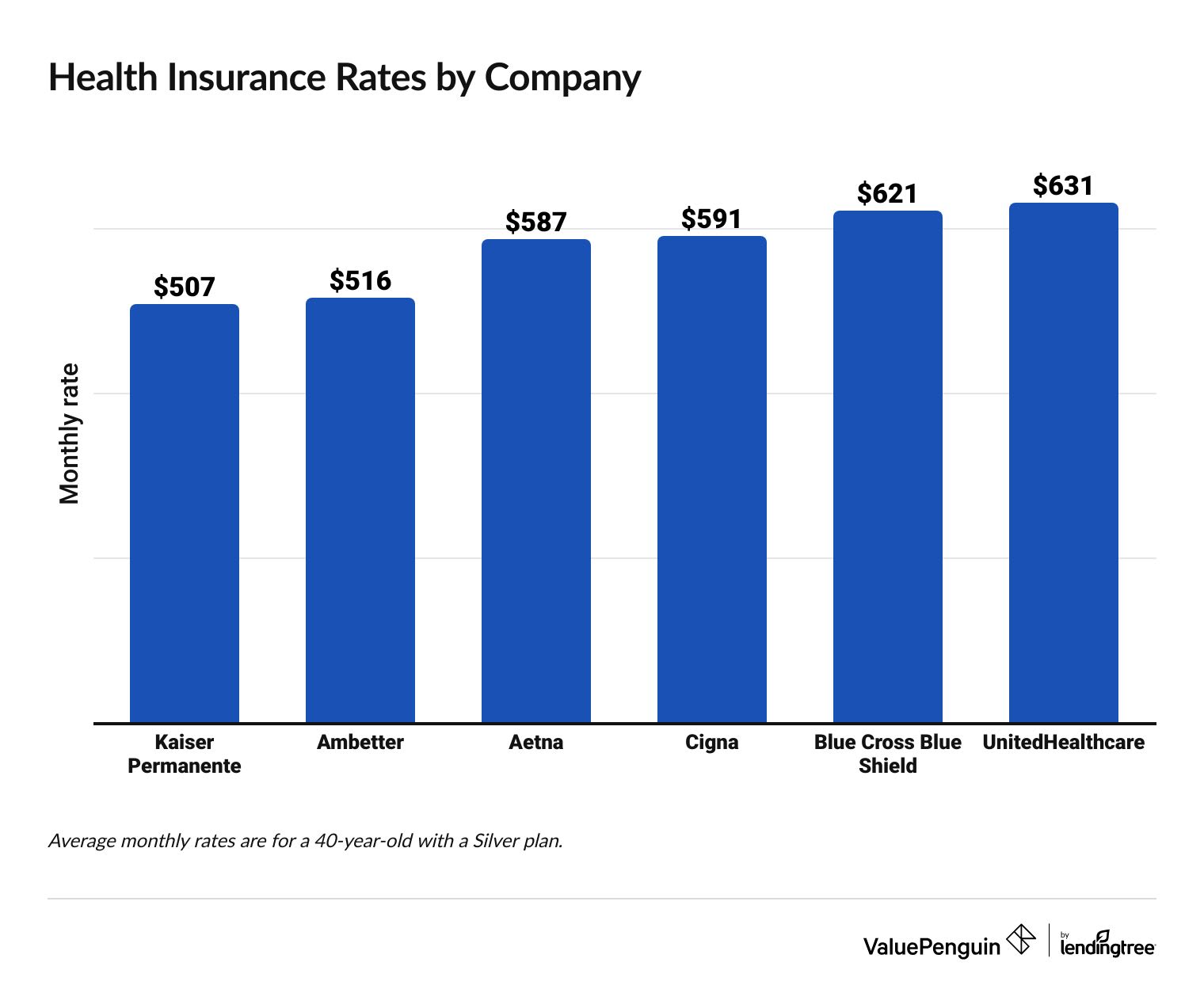

By company

Company | Rate | |

|---|---|---|

| Kaiser Permanente | $507 | |

| Ambetter | $516 | |

| Aetna | $587 | |

| Cigna | $591 | |

| Blue Cross Blue Shield | $621 | |

| UnitedHealthcare | $631 |

Average monthly rates for a 40-year-old with a Silver plan.

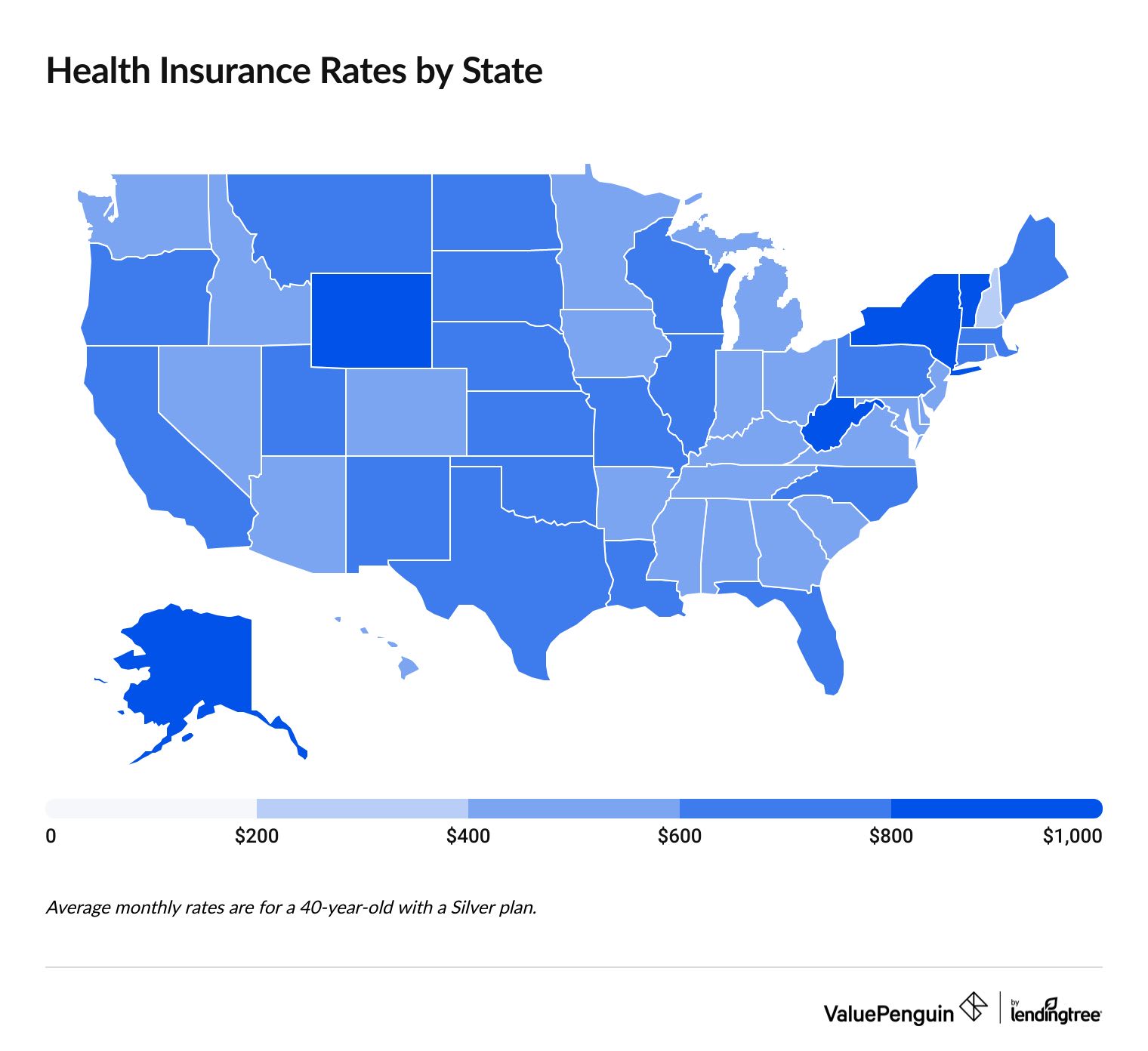

By location

State | Rate |

|---|---|

| Alabama | $564 |

| Alaska | $1,088 |

| Arizona | $529 |

| Arkansas | $494 |

| California | $656 |

Average monthly cost for a 40-year-old with a Silver plan.

Compare health insurance coverage

The first step to picking the best health insurance plan is to compare the coverage.

Start with comparing each plan's deductible and out-of-pocket maximum limits. These amounts show you how much you have to pay for medical care yourself. The deductible is the amount you have to pay before your plan starts to cover your bills, and the out-of-pocket maximum is the most you could pay each year toward your medical bills.

To pick the right amount of coverage, think about what kind of medical care you might need and how much you can afford to pay each month for a plan. If you need a lot of medical care, choose a plan with a lower deductible and out-of-pocket maximum, so your plan pays for more of your bills. If you need a cheap plan, you'll likely have to pay for more of your medical care yourself.

Health insurance terms you should know

- Monthly rate: This is the price you pay each month for your health insurance plan. It's also called the premium.

- Deductibles, copays and coinsurance: You'll have to spend a certain amount of money on healthcare, called a deductible, before your plan starts paying for things. After you meet your deductible, you still have to pay part of your medical bill, either a flat fee called a copay or a percentage of the total bill, called coinsurance.

- Out-of-pocket maximum: The out-of-pocket maximum is the most you will have to spend on medical care in a year. After hitting this limit, the insurance company pays for the full cost of covered health services. Your deductible, copays and coinsurance usually all count toward reaching your out-of-pocket maximum. The monthly rate you pay is not part of the out-of-pocket maximum.

Learn more about the health insurance plans offered in your state:

Find Cheap Health Insurance Quotes in Your Area

Compare plan tiers

Private health insurance plans are divided into five categories: Catastrophic, Bronze, Silver, Gold and Platinum.

Coverage tiers help you know how much coverage you'll get and how much you'll pay each month. Typically, as your monthly rate increases, so does your coverage level.

Silver plans are a good place to start when comparing health insurance quotes. These plans offer middle-of-the-road coverage and rates. If you go to the doctor often or have expensive medical needs, a Gold or Platinum plan is usually the best option. The extra coverage usually makes the higher monthly cost worth it. A Bronze plan makes sense if you're young and mostly healthy. Just make sure that you have the savings to pay for more of your medical bills yourself.

Compare health insurance networks

A plan's network limits which doctors you can use, the flexibility of your coverage and how easy it is to see a specialist.

PPOs and HMOs are the two most common network types. PPOs typically cost more, but they let you see specialists without a referral. They also give you some coverage for doctors that aren't in the plan's network. HMOs are cheaper, but you only have coverage to see an in-network doctor. With an HMO, you'll also need to go through your primary care doctor to see a specialist, which can slow down your medical care.

Two less-popular plan types are exclusive provider organizations (EPOs) and point of service (POS) plans. These usually aren't the best option, and you might not even have any of these plans in your area.

Health insurance network comparison

Find Cheap Health Insurance Quotes in Your Area

Private health insurance is coverage that you buy from a health insurance company rather than the government.

Supplemental health insurance can help you manage costs that aren't covered by your main health insurance.

Supplemental insurance comes in different forms. For example, hospital indemnity insurance gives you cash payments when you have a hospital stay. You can spend these payments however you like .

Other types of supplemental coverage, such as dental and vision, can help you pay for things that don't fall under your normal health plan. Health insurance plans for adults don't usually cover dental care, so it's important to buy standalone coverage.

Frequently asked questions

How much does individual health insurance cost?

Health insurance costs $621 per month, on average, for an adult in the United States. However, the cost of plans will depend on your age, where you live and the level of coverage you choose.

How to compare two health insurance plans?

When comparing two or more health insurance plans, look at the total cost of each plan including the monthly rate and how much you would have to pay through the deductible, out-of-pocket maximum, copay and coinsurance. You should also compare the coverage, especially if you have an ongoing illness, disability or you're taking prescription drugs.

What are the cheapest health insurance quotes I can get?

You may be able to get cheap or free health insurance from HealthCare.gov or your state's marketplace site if you have a low income. That's because you might get subsidies, which lower the cost of your monthly rate. If you buy a Silver plan, you might also get discounts that make medical care cheaper. If you don't get either of these discounts, a Bronze or Catastrophic plan is often cheapest. And if you have a very low income, you might qualify for Medicaid.

What are the best health insurance companies?

The overall best health insurance companies are Kaiser Permanente and Blue Cross Blue Shield. However, health insurance plans vary in price and quality. Compare plan options based on your location, age, preferred doctors and medical needs.

How much is dental insurance?

Dental insurance typically costs between $15 and $25 per month. You can lower your rate even further by bundling your dental and health insurance policies together through the same company.

Health insurance research and advice

Dental Health Report 2024: Costs, Visits and Access Across the US

With out-of-pocket costs accounting for 40.3% of dental spending, one-third of American adults don’t visit the dentist... Read More

State of Prescriptions in 2024: Shortages and Rising Prices

26% of Americans with a prescription say they’ve had difficulty filling one in the past year, leading 24% to skip doses in the same... Read More

What is Fixed Indemnity Insurance?

Fixed indemnity plans pay you a set amount of money for specific medical situations, like a broken limb or hospital stay. The plans can... Read More

Are Nutritionists Covered by Insurance?

Many insurance plans pay for nutritionists or dietitians if you're at risk for certain diseases, such as obesity or heart disease. You may... Read More

More Than 1 in 4 Insured Americans Considering Dropping Health Coverage

Of the 47% of insured Americans not fully satisfied with their current insurance, 34% blame high... Read More

Expat Health Insurance: What You Need to Know

Most expats should consider buying a global health insurance plan until they qualify for coverage in their new country. After that, travel... Read More

PacificSource Health Plans Review

PacificSource has strong customer service but expensive costs for normal health insurance. The company also sells cheap Medicare Advantage... Read More

2024 Children's Mental Health Report

15.9% of American households with children have a kid who needs mental health treatment. Here’s a look at where those rates are highest.... Read More

Sources and methodology

The average cost of health insurance uses 2025 quotes for a 40-year-old person sourced from public use files (PUFs) on the Centers for Medicare & Medicaid Services (CMS) government website and state marketplaces.