When Is Physical Therapy Covered by Medicare, and What's the Cost?

Medicare covers physical therapy when it's recommended by a doctor, and there's no limit to how many physical therapy sessions you can get.

Compare Medicare Plans in Your Area

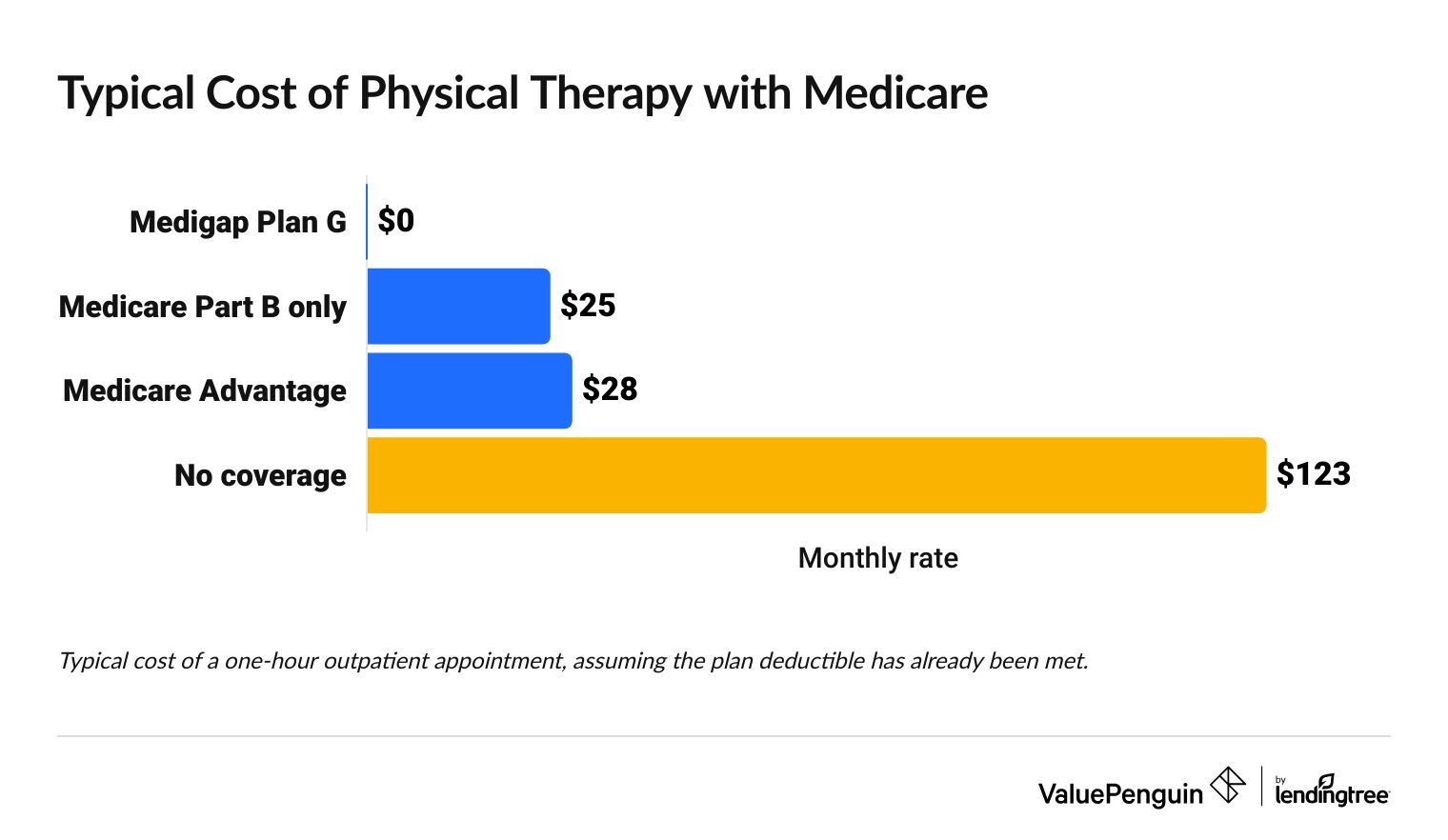

With Medicare, physical therapy typically costs between $0 and $28 per appointment depending on the type of plan you have and where you go for your appointment.

If you have a Medicare Advantage plan, you'll usually need to get your insurance company to approve it before getting physical therapy.

On this page

When does Medicare cover physical therapy?

Medicare covers physical therapy when your doctor or health care provider says you need it.

Medicare won't cover physical therapy that you choose to do on your own. For example, physical therapy won't be covered if you want to use it to improve as an athlete. But it will cover it if a doctor says you need it for mobility or to recover from an injury.

Physical therapy is covered by Medicare when:

- It's recommended by your doctor, which means they feel it's "medically necessary."

- It's used to improve or maintain your current condition or slow a health decline

- You get treatment from someone who accepts Medicare or works with your Medicare Advantage plan

Physical therapy can't be denied by Medicare because of:

- The number of appointments you've had

- Your potential to improve as a result of physical therapy

- No improvements from prior physical therapy sessions

If you get physical therapy without a doctor's order, Medicare normally won't cover it. This is similar to how regular health insurance covers physical therapy.

If you don't have a referral from your doctor, your physical therapist must give you a written notice saying you'll have to pay the full cost because Medicare isn't paying anything.

How much does physical therapy cost with Medicare?

Physical therapy appointments usually cost between $0 and $28 each with Medicare, after you meet your deductible.

Compare Medicare Plans in Your Area

Typical cost of physical therapy with Medicare

Type of Medicare coverage | Cost of physical therapy |

|---|---|

| Medigap Plan G | $0 |

| Medicare Part B only | $25 |

| Medicare Advantage | $28 |

| No coverage | $123 |

Typical rates for a 1-hour outpatient physical therapy appointment

Where you get physical therapy affects your costs and Medicare coverage

Physical therapy is covered by Medicare no matter where you get it. But it may cost different amounts if you get physical therapy at a clinic, medical office, hospital, rehab center or at home. That's because you could have different copays or deductibles.

You'll also have to use a physical therapist that accepts your Medicare plan, either Original Medicare or Medicare Advantage.

What's the Medicare physical therapy cap for 2025?

Medicare covers as many physical therapy appointments as your doctor says you need.

But if you have Original Medicare, the Medicare physical therapy cap of $2,410 in 2025 means that appointments above the coverage cap will need extra paperwork explaining why you need more physical therapy than usual.

- The $2,410 cap includes both physical therapy and speech-language pathology services.

- There's a separate $2,410 cap for occupational therapy services.

If Medicare starts denying your claims for physical therapy after you've already had a lot of treatment, check that your claims are following the rules of the coverage cap. CMS requires physical therapy claims above the coverage cap are coded using the KX modifier and include documentation that the treatment is medically necessary.

You can check by calling your physical therapy office or reviewing the claims sent to your insurance.

The cap includes all the physical therapy you get during a year and does not reset if you get treatment for a different issue or at a different location. However, the cap only applies to outpatient physical therapy under Medicare Part B, such as treatment in a clinic, doctor's office or medical center. It doesn't apply to any Part A coverage, like what you would get at a skilled nursing facility.

Other Medicare rules for longer physical therapy treatment

Under Original Medicare, your doctor may need to confirm that you still need physical therapy during your treatment. This is called recertification. This can happen if your treatment plan changes or if you get physical therapy for longer than 90 days.

Does Medicare cover physical therapy in a hospital or rehab center?

Yes, Original Medicare covers inpatient physical therapy under Medicare Part A. In most cases, your physical therapy costs will be included in the overall cost of your stay at the hospital, rehab center, or skilled nursing facility. That means you usually won't pay any extra for physical therapy on top of your daily costs.

Medicare Part A will only cover physical therapy that your doctor says you need, That means it's "medically necessary."

With Medicare Part A, you'll pay the full cost of all inpatient care until you hit your deductible, which is $1,676 in 2025.

Then, you'll have very few costs because Medicare will pay for most things during the first 60 days of your stay in a hospital or rehab facility.

How much does an inpatient stay cost with Original Medicare?

Hospital and rehab center

Skilled nursing

Hospice

Days | Your daily cost | |

|---|---|---|

| 1-60 | Free after your $1,676 deductible | |

| 61-90 | $419/day | |

| 91-150 | $838/day | |

| After day 150 | You pay all costs |

If you paid your deductible during a hospital stay and then went to the rehab facility within 60 days, you won't have to pay your deductible again because it's considered a part of the same stay.

Hospital and rehab center

Days | Your daily cost | |

|---|---|---|

| 1-60 | Free after your $1,676 deductible | |

| 61-90 | $419/day | |

| 91-150 | $838/day | |

| After day 150 | You pay all costs |

If you paid your deductible during a hospital stay and then went to the rehab facility within 60 days, you won't have to pay your deductible again because it's considered a part of the same stay.

Skilled nursing

Days | Your daily cost | |

|---|---|---|

| 1-20 | Free | |

| 21-100 | $209.50/day | |

| After day 100 | You pay all costs |

Medicare will only cover your stay at a skilled nursing facility if you've stayed in the hospital for at least three days and go to the nursing facility within 30 days of leaving the hospital.

Hospice

Days | Your daily cost |

|---|---|

| All | Free |

Most hospice care, including physical therapy, is free if you become eligible for hospice because you are expected to live six months or less, and you agree to hospice care, rather than treating your illness.

To make sure you're not overbilled for physical therapy during your stay in a hospital, always check that the physical therapy appointments are through the main part of the hospital.

Sometimes there are outpatient physical therapy clinics that are attached to a hospital. These locations could bill you as though you went to a different facility, rather than billing you as a part of your hospital stay.

Does Medicare cover in-home physical therapy?

Medicare covers in-home physical therapy when you're homebound .

If you're eligible for home health services, Medicare will pay the full cost of your physical therapy at home. You won't pay anything.

Medicare will cover in-home care when you're unable to leave your home because it's very difficult, you'd need help to leave, or your doctor tells you not to leave home because of a medical condition.

You'll still need to meet Medicare's other coverage rules such as the physical therapy being recommended by a doctor and using a physical therapist that's approved by Medicare.

Best Medicare Advantage company for physical therapy coverage

Aetna and Blue Cross Blue Shield have the best Medicare Advantage plans for physical therapy coverage.

Tips for choosing the best Medicare Advantage plan for physical therapy

All Medicare Advantage plans have pretty good coverage for physical therapy. Generally, you'll have a copay between $25 and $40 for physical therapy if you use a provider that's in the network of your Medicare Advantage plan.

Paying more for a plan doesn't necessarily give you better coverage for physical therapy, based on sample plans. However, paying for a better plan may improve your plan's overall benefits, such as the deductible you must meet before your plan's full benefits begin.

Choose a plan with a low deductible to lower your medical costs overall. For example, if you meet a plan's deductible with a $3,000 knee replacement surgery, then you'll only need to pay the small copay when you get physical therapy appointments after surgery.

Frequently asked questions

Does Medicare cover physical therapy for back pain?

Medicare covers physical therapy for back pain and other health issues as long as a medical doctor orders the services.

Does Medicare cover pay for physical therapy using inpatient rehabilitation coverage?

Yes, Medicare covers inpatient physical therapy during stays at a rehabilitation center, or skilled nursing facility. If you have Original Medicare, this will be under your Part A benefits for inpatient care. Physical therapy costs are usually included in your daily rate. After you meet the deductible, Medicare will pay most of your costs for shorter stays.

Where can I find the full Medicare outpatient physical therapy guidelines?

Original Medicare's outpatient physical therapy guidelines can be found on the website for CMS (Centers for Medicare and Medicaid Services). The guidelines explain the billing process, reporting requirements and coding issues. The guidelines also link to the coverage rules in the full Medicare coverage manual, if you need more details.

Methodology and sources

PT costs with Original Medicare

Physical therapy costs with Original Medicare are based on the 2025 Medicare physician fee schedule, using national payment amount for four popular physical therapy treatment codes.

Rates for 15-minute treatment increments were added together to find the cost of a typical outpatient appointment. Medicare Part B coverage is calculated at 80% of a typical appointment cost after the deductible has been paid.

PT costs with Medicare Advantage

The cost of physical therapy with Medicare Advantage is based on a sample of 2025 plan data. We averaged the physical therapy copays for all Medicare Advantage plans that include prescription drug coverage in Arlington, VA.

Best Medicare Advantage companies for PT

ValuePenguin's picks for the best insurance companies for physical therapy are based on coverage information for a sample of plans across the country. We looked for unique coverage details that can help you improve your access to physical therapy treatment.

Star ratings are based on editor reviews that include cost, coverage, benefits and unique features.

Average cost per company is a national average of 2025 Medicare Advantage plans that include prescription drug coverage. Averages exclude special needs plans, sanctioned plans, PACE plans, prepayment plans (HCPPs), Medicare medical savings account (MSA) plans, Medicare-Medicaid plans and employer-sponsored plans. Averages include company subsidiaries.

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.