Cigna Medicare Supplement Review

Most Cigna Medigap plans have good rates. But you might not be happy with the company's poor service.

Compare Medicare Plans in Your Area

Cigna Medigap plans aren't usually the best choice. The biggest problem is the company's low customer satisfaction. The low rates might not make up for the issues you have using your coverage and getting your medical bills paid.

Pros and cons

Pros

Usually has cheap rates

Available in 48 states

Cons

Bad customer service

Fewer perks than competitors

Alternatives to Cigna Medicare Supplement

Cigna is selling its Medicare plans, including its Medigap plans, to Health Care Service Corp. (HCSC), which is a Blue Cross Blue Shield company. The deal should be finalized in 2025. If you have or buy a Medigap plan from Cigna before then, your coverage will transfer to HCSC once the sale is done.

Cigna Medicare Supplement cost

Cigna Medicare Supplement plans are usually cheap or have average prices.

It has average rates for Plan F and Plan G, the two most popular plans. But Plan N from Cigna has cheap rates. Plan N is a good choice if you want a cheaper monthly rate but still want good coverage.

Average monthly cost of Cigna Medigap plans

Medigap plan | Cigna rate | National average |

|---|---|---|

| Plan F | $184 | $184 |

| Plan G | $148 | $148 |

| High-Deductible F | $54 | $52 |

| High-Deductible G | $50 | $48 |

| Plan N | $106 | $111 |

Average monthly rates are for a 65-year-old woman who does not smoke.

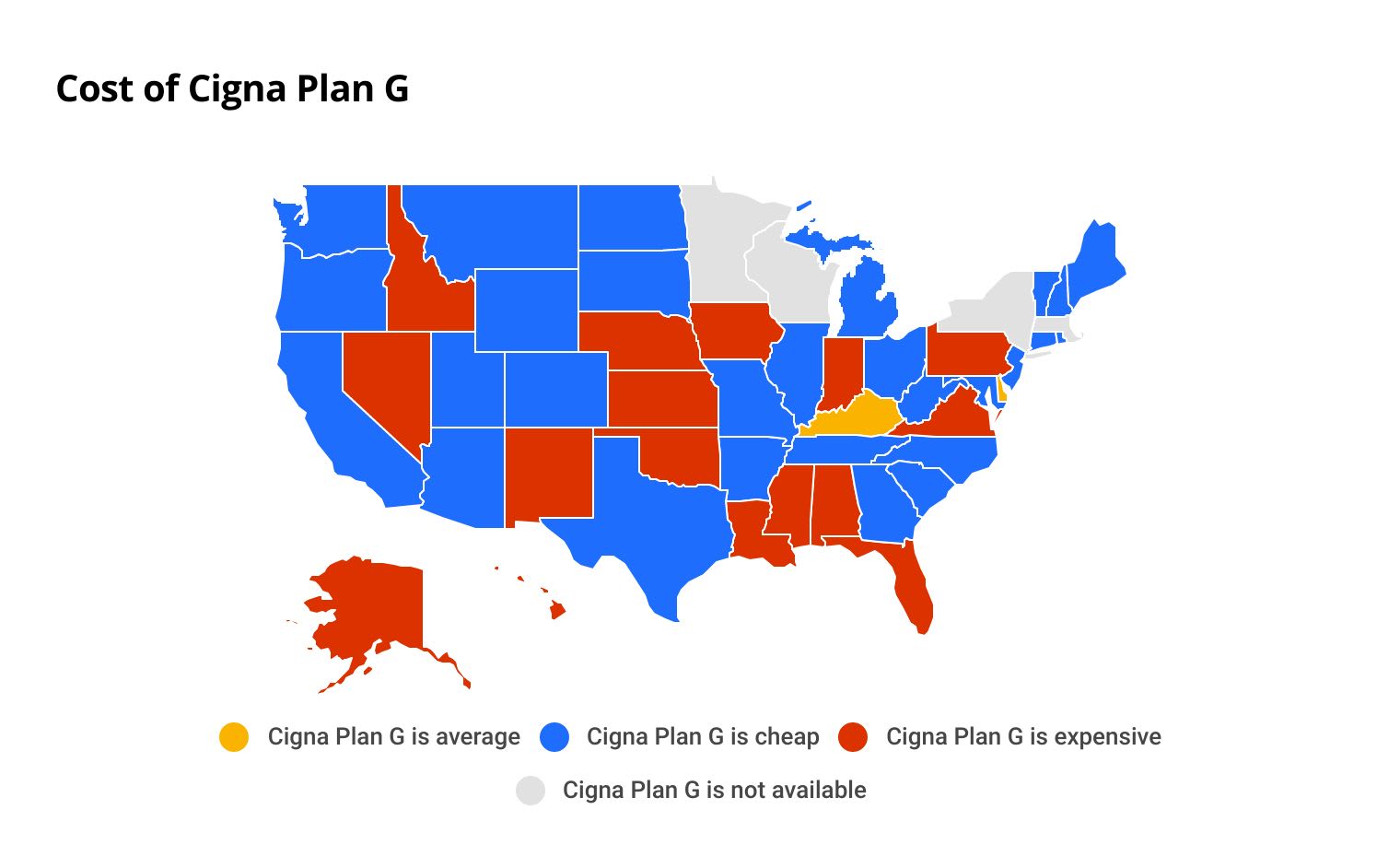

But your rate depends on where you live. In most states where it sells Plan G, Cigna is a cheap choice. If you live in a state where Cigna has a cheap Plan G rate, it might be worth getting a quote. Just keep in mind that the company doesn't have good customer service.

Compare Medicare Plans in Your Area

Plan G isn't available at all in Minnesota and Wisconsin. Cigna does sell plans in these states, but they are different from the rest of the country. Cigna doesn't sell any Medigap plans in New York or Massachusetts.

Average cost of Cigna Plan G by state

State | Cigna rate | National rate |

|---|---|---|

| Alabama | $133 | $132 |

| Alaska | $160 | $140 |

| Arizona | $123 | $139 |

| Arkansas | $145 | $161 |

| California | $152 | $168 |

Average monthly Plan G rates are for a 65-year-old woman who does not smoke.

Cigna Medicare Supplement plan options

Cigna sells most Medigap plan letters.

The only plans you can't buy from Cigna are Plan K and Plan M.

Cigna Medigap plan letters

- Plan A

- Plan B

- Plan C

- Plan D

- Plan F

- Plan G

- Plan N

- High-deductible Plan F

- High-deductible Plan G

Which Cigna plans you can buy depend on where you live. For example, Cigna only sells Plan B in Pennsylvania and Plan D in New Jersey. But Plan G is offered in nearly every state. And in Minnesota and Wisconsin, Cigna offers specialized policies that follow state-specific Medigap requirements.

Medicare Supplement plans have a standard set of benefits. That means your coverage will be the same no matter where you buy your policy. The main difference between Medigap insurance companies is usually the price for each plan and any added benefits the company offers.

Compare Medicare Plans in Your Area

Top picks

Other plans

Plan A | Plan B | Plan C | Plan D | Plan L | Plan M | |

|---|---|---|---|---|---|---|

| Part A coinsurance | ||||||

| Part B coinsurance | 75% | |||||

| Blood (3 pints) | 75% | |||||

| Part A hospice care | 75% | |||||

| Skilled nursing facility | 75% | |||||

| Part A deductible | 75% | 50% | ||||

| Part B deductible | ||||||

| Part B excess charges | ||||||

| Foreign travel emergency | 80% | 80% | 80% | |||

| Out-of-pocket limit | N/A | N/A | N/A | N/A | $3,530 | N/A |

Cigna Medigap availability

You can buy Cigna Medicare Supplement plans in 48 states and Washington, D.C. Cigna doesn't sell Medigap plans in Massachusetts or New York. And if you live in Oregon, you have to call Cigna for a quote rather than getting a quote online.

Plans A, F, G and N are available everywhere except New York, Massachusetts and Wisconsin.

You can get the high-deductible version of Plan F from Cigna in 14 states.

You can buy Cigna's High-Deductible Plan G in 16 states.

Cigna sells Plan B in Pennsylvania. Plans C and D are only available in New Jersey.

Minnesota and Wisconsin have different Medicare Supplement plans than the rest of the country.

In Minnesota, Cigna sells the Basic, Extended Basic and High Deductible plans. You can get more coverage by buying add-ons, like coverage for preventive health care.

In Wisconsin, Cigna only sells the Base plan. But you can add some coverage to your plan to customize it. If you travel often, you can add coverage in other countries, for example.

Can you get Cigna Medigap if you're under 65?

Cigna offers Medigap to people on Medicare because of disability in 23 states. Insurance companies aren't required to let you buy a Medicare Supplement plan if you're under 65. That is true even if you're on Medicare due to kidney failure, Lou Gehrig's disease or a disability.

- California

- Colorado

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Kansas

- Kentucky

- Louisiana

- Maine

- Minnesota

- Mississippi

- Missouri

- Montana

- New Hampshire

- Oregon

- Pennsylvania

- South Dakota

- Tennessee

- Vermont

- Wisconsin

Can you get Cigna Medigap if you have health issues?

If you have a health issue before you buy your Cigna Medigap plan, you may have limited coverage for a period of time. This is called a "preexisting conditions clause."

Cigna Medicare Supplement plans usually have a preexisting conditions clause.

Typically, the clause is only active for six months. This means that if you have a health problem before you buy your Medigap policy, Cigna won't pay for costs associated with that condition for the first six months of your policy. In Washington and Wisconsin, Cigna's preexisting conditions period is three months. If you live in Oregon, you have to call Cigna for info about its preexisting conditions clause.

If you're buying a plan when you are first eligible, your health status won't affect your rates. You'll also usually get cheaper prices. You can buy a Medigap policy on the first of the month when your Medicare Part B is active. After that, you have six months to buy a plan without having your medical history used in your rates.

Member resources and unique benefits

Cigna Medigap plans have a few perks, but other companies offer more.

- Cigna Healthy Rewards program: With this, you might qualify for discounts on health purchases like hearing exams and aids, weight management programs and chiropractic appointments.

- Health Information Line: If you have questions about your health, Cigna's health line can be reached 24 hours per day, seven days per week. The health line representatives hold a nursing license in at least one state, but are not practicing nurses.

You might also be able to lower your Cigna Medicare Supplement rate with discounts. Applying for a policy online can get you up to a 5% discount, and up to an extra 20% may be discounted from your rate depending on the state you live in.

Reviews and customer complaints

Cigna has poor customer service reviews for its Medicare Supplement policies.

Overall, Cigna has 52% more complaints about its Medigap plans than expected for a company its size, according to the National Association of Insurance Commissioners (NAIC).

But customer satisfaction largely depends on what company your plan comes from within Cigna. Some Cigna Medicare Supplement plans come from the American Retirement Life Company. Those plans get considerably fewer complaints than expected (68% less). But plans from Cigna National get over twice as many complaints as expected.

Cigna members have reported concerns with customer service to the Better Business Bureau too, although these complaints aren't always specific to Medigap plans. Some issues include long hold times and difficulty getting claims approved or paid. While the issues might not be for Medigap plans, they can give you an idea of the company's overall service.

Frequently asked questions

Is Cigna good insurance for Medicare Supplement plans?

Cigna probably isn't the best choice for Medigap plans. Cigna has cheap rates, but its customers report issues with the company's service. Cigna's Medigap policies offer the same coverage as those from other companies because coverage is the same across the industry.

How much is Cigna Medicare supplement insurance?

Cigna Medigap plans cost between $50 and $184 per month, depending on the plan you buy. Plan F costs $184 per month, Plan G costs $148 per month and Plan N costs $106 per month. These are the most popular Medigap plans.

Is Cigna Medigap Plan G good?

You should probably look for Plan G from a company that has better customer satisfaction than Cigna. Plan G from Cigna covers the same things as Plan G from any other company. Cigna's average rates for Plan G are cheap in most states. But Cigna has poor service, and you can find a better experience with another insurance company.

Sources and methodology

2024 Medicare Supplement costs are based on rate data for all private insurance companies. Average rates are for a 65-year-old nonsmoking female and represent costs at open enrollment with preferred or guaranteed-issue status and no medical underwriting.

Cigna's Medicare Supplement products are underwritten by Cigna Health and Life Insurance Company, American Retirement Life Insurance Company, Loyal American Life Insurance Company or Cigna National Health Insurance Company. Sources include the Better Business Bureau, Cigna, Medicare.gov and the National Association of Insurance Commissioners.

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.