Humana Medicare Supplement Review

Humana has higher-than-average rates and poor customer service for Medicare Supplement coverage.

Compare Medicare Plans in Your Area

Humana offers nearly every Medicare Supplement plan. Its policies come with useful perks, including meal delivery services and discounts on vision care. However, the company typically has higher-than-average rates and low customer service ratings. You can probably find the same coverage for cheaper with another company, unless you specifically want one of Humana's extra benefits.

Pros and cons

Pros

Perks like drug discounts

Sells several Medigap plans

Cons

Higher-than-average rates

Bad customer service

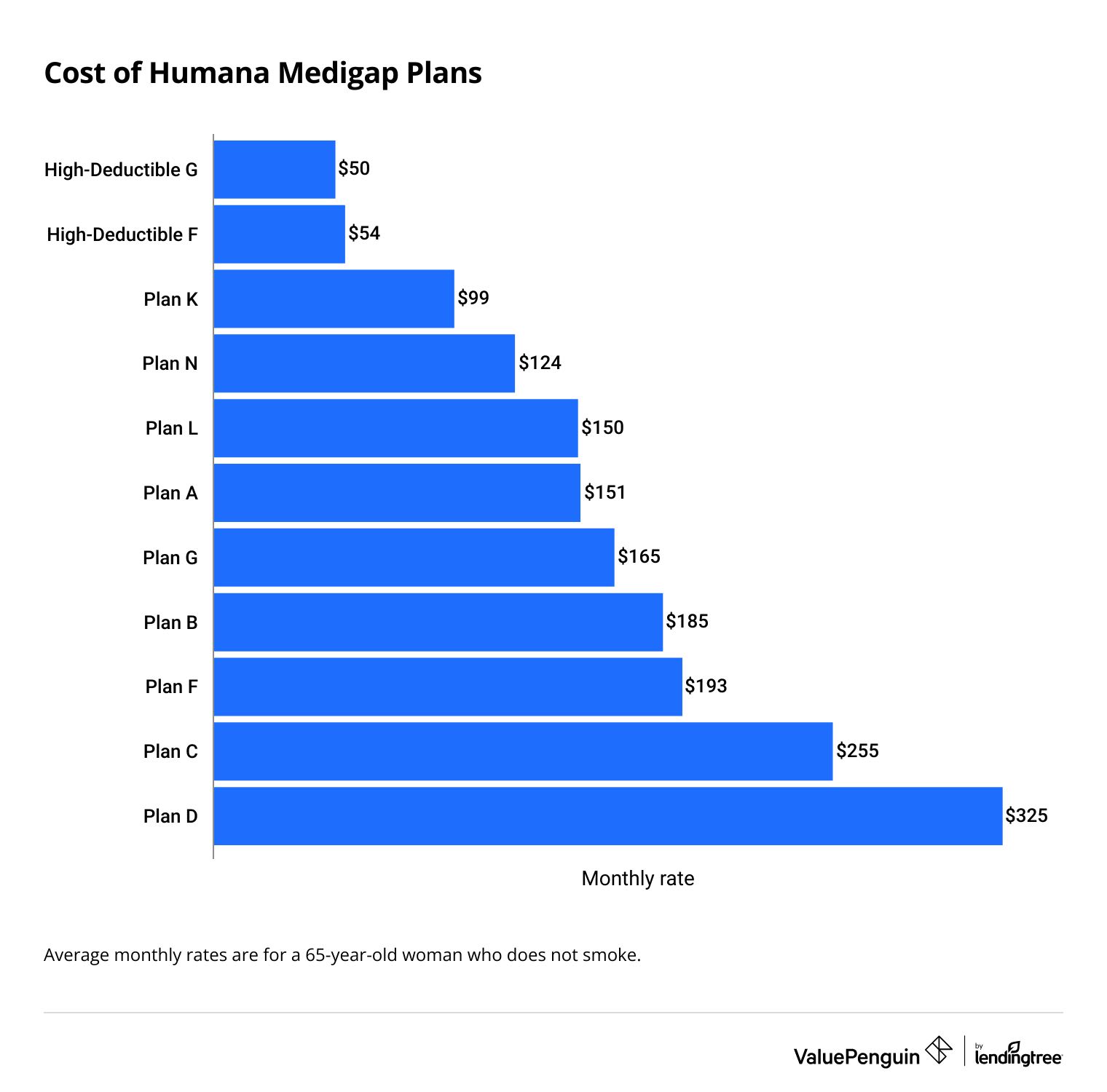

How much do Humana Medigap plans cost?

Medigap Plan G from Humana costs $165 per month, which is more expensive than many other companies.

Plan G is the best option for people who are new to Medigap. When compared to the national average, all of Humana's Medigap plans are more expensive. But rates change based on where you live, and in some areas of the country, Humana is a cheap option.

Overall, the cheapest Medigap plan from Humana is the high-deductible version of Plan G. It costs $50 per month but requires that you pay the first $2,800 of your medical bills each year. Plan D is the most expensive, at $325 per month on average. That's almost twice the national average rate for Plan D.

Compare Medicare Plans in Your Area

Because Medicare Supplement coverage is the same no matter what company you choose, you should always compare Medigap rates from several companies to make sure you get the best value.

Average monthly cost of Humana Medigap plans

Plan | Humana | National average |

|---|---|---|

| High-Deductible G | $50 | $48 |

| High-Deductible F | $54 | $52 |

| K | $99 | $77 |

| N | $124 | $111 |

| L | $150 | $112 |

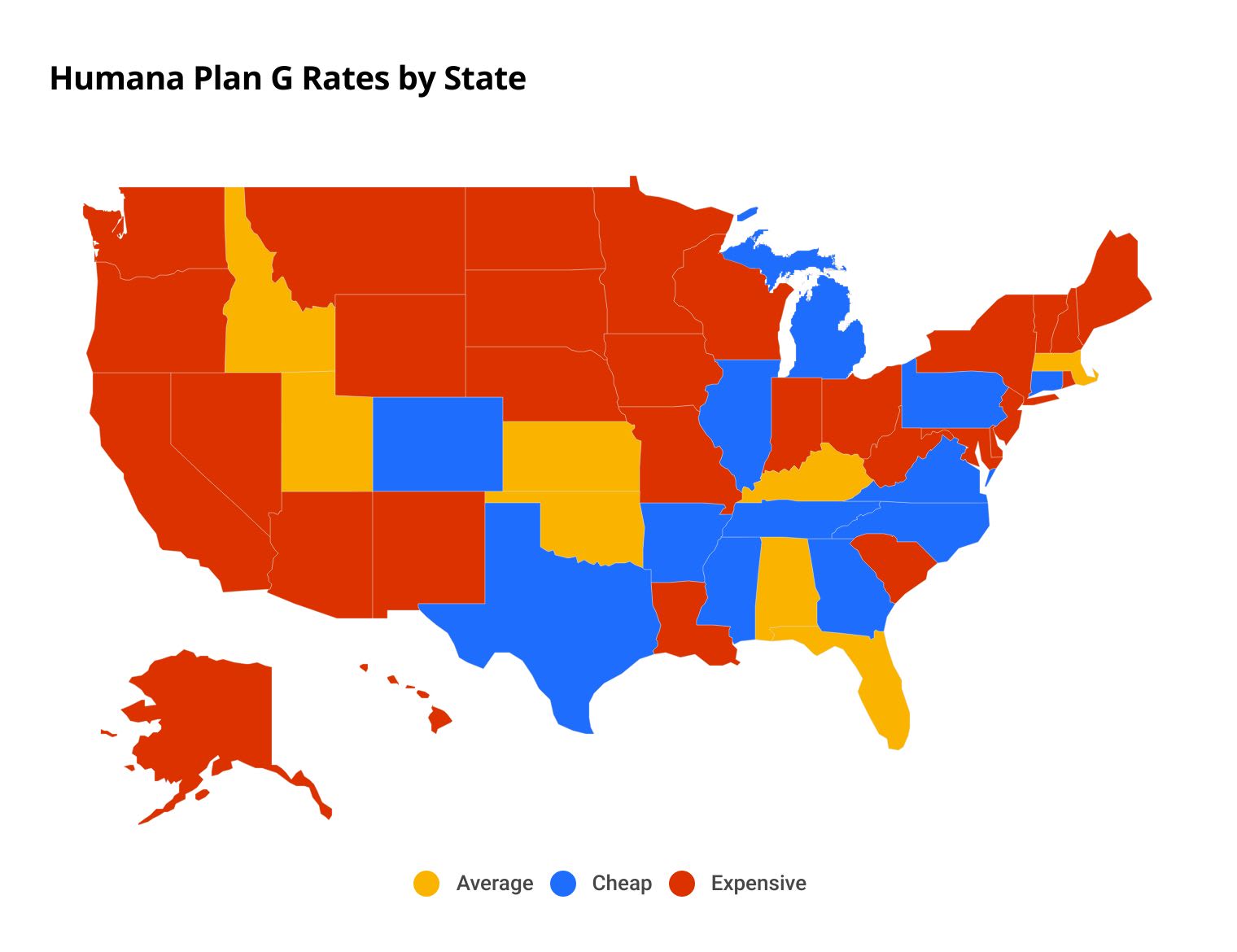

Humana Medigap Plan G rates by state

While Humana is usually more expensive than other companies, its Plan G rate is cheaper than average in 12 states. And in eight states, Humana's Plan G rate is within $5 of the state average.

Plan G is one of the most popular Medigap plans and the best option for people new to Medigap. It gives you the most coverage, so you will pay less for medical care.

Compare Medicare Plans in Your Area

Humana Plan G rates compared to state average

State | Humana rate | State average |

|---|---|---|

| Alabama | $127 | $132 |

| Alaska | $152 | $140 |

| Arizona | $172 | $139 |

| Arkansas | $146 | $161 |

| California | $196 | $168 |

Average monthly Plan G rate for a 65-year-old woman who does not smoke.

When choosing a plan, it can be helpful to look at both the costs when you sign up and how those costs rise as you age. By requesting multiple quotes, you can determine which company has the best pricing overall. This might help you avoid rate surprises as you age.

Humana doesn't use age as a rating factor in eight states. This means age won't affect rates, and it's called "community-rating." In five states, Humana rates your plan based on your age when you first bought a policy, called "issue-age" rating. But in 37 states and Washington, D.C., Humana increases your rate as you get older. This is called "attained-age" rating.

Keep in mind that costs will be different depending on the company, and requesting a quote is the best way to know how much you would pay. Costs are influenced by a range of factors.

- Plan type: Supplement plans have different levels of coverage and rates. Humana's Plan C costs more than twice as much as its Plan K, and the company's high deductible plans are the cheapest options.

- Location: State regulations and economics can affect how much plans cost.

- Gender: Women usually pay less than men for Medicare Supplement plans.

- Age: In many states, your cost for a supplemental policy can increase as you age. Humana Plan G increases an average of 2% to 3% each year, for example.

- Medical issues: In many states, plans can be rated based on medical conditions or other risk factors. Healthier people usually get a discounted rate.

Humana also offers a few discounts, which might help offset the company's high rates.

- Get 6% off for getting a quote online in most states

- Save $2 per month for automatic payments

- Earn a household discount for multiple policyholders

Humana Medigap plan coverage and features

Humana sells every Medigap plan except Plan M.

Humana sells plans in all 50 states and Washington, D.C., but it doesn't sell every plan in every state. Your plan choices will vary based on where you live. For example, Humana sells Plan G in every state where it's an option, but the company only sells Plan D in Michigan and New Jersey.

Medicare Supplement plans help pay for health care costs that Original Medicare doesn't fully cover. If you go to the doctor often or are worried that you could develop health issues as you age, buying a Medigap plan when you are first eligible is a good idea. In most states, your rate will generally be lower if you buy a plan at age 65.

Medicare Supplement plans have the same coverage no matter what company you buy from. Shopping around can help you find the cheapest plan. It can also help you find a plan with extra perks that set it apart from other companies.

The best Medigap plan for you is one that matches your health care needs and budget. Plan G and Plan N are two popular options and might be a good place to start. Plan F is a good choice, but not everyone is eligible.

Medigap Plan G has the best coverage if you're newly eligible for Medicare. Plan G costs $165 per month from Humana, but you can probably find a cheaper plan with another company. The national average cost is $148 per month. Humana's Plan G is available in every state except Massachusetts, Minnesota and Wisconsin, which structure their Medigap plans differently.

Plan N is a good option if you're on a budget but still want good coverage. It covers almost as many medical situations as Plan G but at a lower monthly cost. The biggest difference is that you won't have coverage for your Medicare Part B deductible with Plan N. Plan N from Humana costs $124 per month, compared to an average monthly rate of $111 nationally. Plan N from Humana isn't available in Alaska, Hawaii, Massachusetts, Minnesota or Wisconsin.

Plan F is also a good option, but you can only buy it if you were eligible for Medicare before 2020. Plan F offers the most coverage of any Medigap plan. Plan F is only slightly more expensive from Humana, at $193 per month compared to the national average of $184. Humana sells Plan F in every state except Massachusetts, Minnesota and Wisconsin.

Humana Medicare Supplement perks and benefits

Humana Medicare Supplement plans have impressive add-on benefits, including discounts on vision, hearing and Lifeline medical alert systems. For some, these extra perks might be worth the high cost of the plans. But you shouldn't choose a Medigap plan just for the perks. Make sure the plan and company are right for you first.

- 24/7 nurse line

- Vision discount through EyeMed

- Discounts on hearing aids and services

- Drug discount program

- Discounts on fall-detection tech and on-demand help

- MyHumana app to review claims or find health information

- Meal delivery program after an overnight stay at a hospital or nursing facility

Not every plan has these perks, so be sure to check your plan documents. Humana Medigap doesn't include any dental benefits, but you could enroll in a Humana dental insurance policy for that coverage.

Humana Medigap customer reviews and complaints

Humana has poor customer service for its Medicare Supplement plans.

One of the largest companies within Humana has nearly five times as many complaints about its Medicare Supplement plans compared to an average company its size, according to the National Association of Insurance Commissioners (NAIC). Ratings vary for each company under Humana, but generally Humana's Medicare Supplement plans have more complaints than average.

The National Committee for Quality Assurance (NCQA) rates Humana's customer satisfaction as average, giving the company a score of 3.7 out of 5.

The Better Business Bureau (BBB) also shows customers are often frustrated with Humana's service. Even though Humana has an A+ rating, showing it actively tries to resolve issues, customers gave the company an average of 1.2 stars out of 5. Humana's most common complaints include denial of claims, bad claims experiences, delays and poor overall service.

The MyHumana app also receives low scores and may not be the most helpful when managing your coverage. The app has a score of 2.9 out of 5 for iOS. Users complain it does not track their coverage accurately, doesn't load well and won't function properly. The Android version has a score of 3.6 out of 5. Recent reviews have low ratings and mention the same issues that iOS users face.

However, when it comes to Humana's historical ability to pay claims, it has an excellent financial rating, receiving an A (Excellent) financial strength rating from AM Best with a stable outlook.

Alternatives to Humana Medigap

If Humana Medicare Supplement plans don't fit what you're looking for, you might want to check out AARP UnitedHealthcare for cheap rates and additional benefits.

- Cheapest rates: AARP UnitedHealthcare

- Better service: AARP UnitedHealthcare

- Useful perks: Tie

Humana and AARP/UHC both offer extra perks, but the specifics are different. Humana plans include vision care discounts, savings on fall-detection devices and drug discounts. AARP UnitedHealthcare plans include benefits for dental, mental sharpness and driver safety.

Another option is to forego Medigap altogether and choose a Medicare Advantage plan that brings together multiple types of coverage into a single insurance policy. Medicare Advantage and Medigap have key differences in coverage, deductibles and health care provider networks. Humana has the best Medicare Advantage plans on the market. But Medicare Advantage plans might mean you have to pay more of your health care costs yourself if you go to the doctor often or have a chronic or complex illness.

- The high rate of complaints is a company-wide problem.

- Humana Medicare Advantage has better-than-average customer satisfaction according to J.D. Power.

- Humana is the second-largest Medicare Advantage company in the country and has nearly 5.5 million members.

Frequently asked questions

How much is Humana Medigap insurance per month?

Plan G from Humana costs an average of $165 per month. That's higher than the national average rate of $148 per month. The cheapest Medigap plan Humana sells is the high-deductible version of Plan G, which costs $50 per month. Plan D is Humana's most expensive plan, at $325 per month.

Is Humana good insurance for Medicare Supplement?

Humana isn't the best choice for Medicare Supplement plans. The company's rates are higher than most other companies and its customer satisfaction is low. The company offers good perks, though, which might make up for the high prices for some people.

Where can you get Humana Medicare Supplement plans?

Humana sells Medigap plans in all 50 states and Washington, D.C. The exact plans you'll be able to buy depend on your state. In 47 states and Washington, D.C., plans are standardized and named after letters. But Massachusetts, Minnesota and Wisconsin have their own Medigap plan system, with different names and coverage options.

Sources and methodology

Average Medicare Supplement rates are from actuarial data for private insurance companies. Average rates are for a 65-year-old nonsmoking woman buying a plan at open enrollment, when she was first eligible and with preferred or guaranteed-issue status. Medical underwriting was not factored into this analysis.

National Committee for Quality Assurance (NCQA) ratings are based on an average of all the rated Humana companies.

Additional sources include the Better Business Bureau (BBB), the National Association of Insurance Commissioners (NAIC), AM Best financial strength rating services, Google Play, the Apple App Store, Kaiser Family Foundation and J.D. Power.

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.