What Are the Best Medicare Supplement Plans in California?

State Farm sells the best and cheapest Medicare Supplement plans in California.

Compare Medicare Plans in Your Area

State Farm has good customer service, too. And it's a convenient option if you already have State Farm car and home insurance. If you want extra perks with your Medigap plan, AARP/UnitedHealthcare is the best option.

What's the best Medicare Supplement company in California?

State Farm has the best Medigap plans in California because it has low rates and good customer service.

State Farm has some of the cheapest rates for Plan G and the cheapest rates for Plan N in California. The company also has about one-fourth fewer complaints than an average company its size. That means people tend to have a good experience with State Farm's Medigap customer service.

Top Medicare Supplement companies in California

Company |

Customer satisfaction (out of 5)

| Plan G monthly rate | |

|---|---|---|---|

| State Farm | 4.0 | $144 | |

| AARP/UHC | 4.0 | $165 | |

| Mutual of Omaha | 4.0 | $168 | |

| United American | 3.5 | $201 | |

| USAA | 3.0 | $144 | |

All rates are for a 65-year-old woman who does not smoke.

Plan G is the best plan if you're new to Medicare, because it pays for most of your medical costs. Although Plan F is the most popular Medigap policy in California, it's only an option if you were eligible for Medicare before Jan. 1, 2020.

Mutual of Omaha is a good option if you don't want State Farm or AARP/UnitedHealthcare. Its rates are a bit cheaper than average and it has good customer service.

Best overall: State Farm

-

Editor rating

- Plan A: $108

- Plan N: $110

- Plan D: $143

- Plan G: $144

- Plan C: $198

- Plan F: $200

State Farm's cheap rates and excellent service make it the best Medigap company in California.

Plan G, the best plan if you're new to Medicare, from State Farm costs $144 per month. That's 21% less than the state average of $182 per month. Because the coverage that Plan G gives you is the same no matter what company you buy a plan from, choosing a company with cheap rates is a good idea.

State Farm also has good customer service for its Medigap plans. The company gets about 28% fewer complaints than expected for a company its size. Choosing a company with good service means you'll probably have fewer problems if you have questions about your plan.

If you already have State Farm auto, home or renters insurance, it might make sense to buy a Medigap plan from the company too. That way, all your insurance is with one company and it could make it easier to manage.

State Farm also has the cheapest rates in California for Plan N. Plan N is a great option if you're on a budget but still want good coverage. It has coverage that's almost as good as Plan G but at a much cheaper rate. Statewide, Plan N costs $146 per month, on average. But Plan N from State Farm costs an average of $110 per month. That's a savings of $36 per month or $432 per year.

Best added Medigap perks: AARP/UnitedHealthcare (AARP/UHC)

-

Editor rating

- Plan K: $64

- Plan L: $115

- Plan A: $124

- Plan N: $140

- Plan G: $165

- Plan B: $174

- Plan C: $211

- Plan F: $212

AARP/UnitedHealthcare offers lots of extra perks and benefits when you buy a Medigap plan.

That's because you have to join AARP to get a plan. A membership is $20 per year, though, and the perks usually outweigh the cost. AARP gives you discounts on vision and hearing care, rental cars, hotels, restaurants and more. You'll also have access to financial tools, community support and more.

While it's not the cheapest company overall, AARP/UnitedHealthcare does have lower-than-average rates for its Medigap plans in California. Plan G from AARP/UHC costs $165 per month, on average, which is about 9% cheaper than the overall state average.

Plan N from AARP/UHC costs an average of $140 per month. That's about 4% cheaper than the state average.

AARP/UnitedHealthcare is the most popular Medicare Supplement company in California. About two-thirds of the Medigap plans in California come from AARP/UnitedHealthcare. That could be partly because of the company's excellent service. AARP/UHC has about half the number of complaints expected for a company its size.

How much does a Medigap plan cost in California?

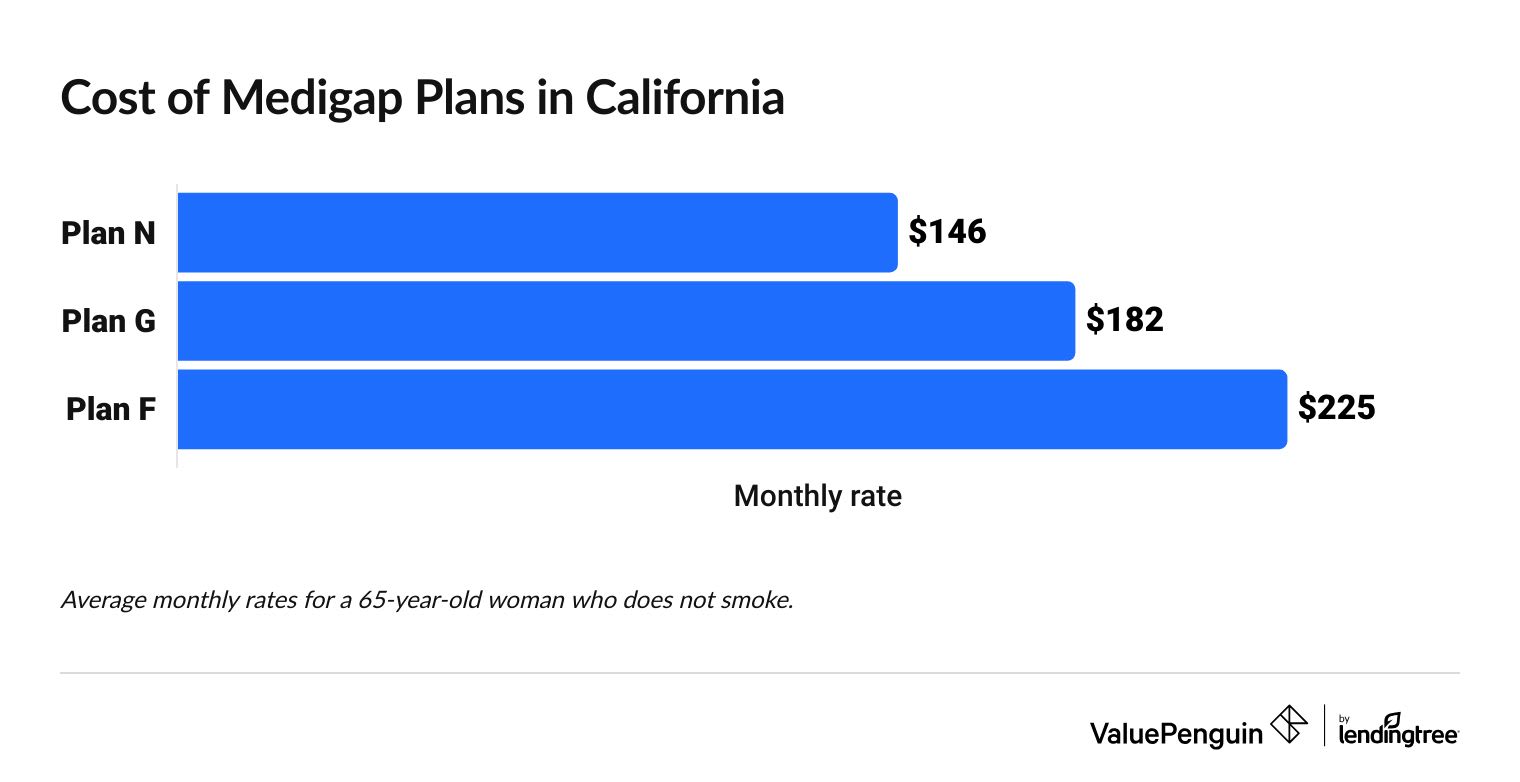

Medicare Supplement plans in California cost between $55 and $225 per month, on average.

But the most popular plans — F, G and N — cost between an average of $146 and $225 per month.

Compare Medicare Plans in Your Area

California Medigap plan rates

Medigap plan | Monthly cost | Popularity in California (enrollment) |

|---|---|---|

| Plan F | $225 | 55% |

| Plan G | $182 | 24% |

| Plan N | $146 | 11% |

| Plan J | N/A | 6% |

Rates are for a 65-year-old female nonsmoker in California. An * indicates a high-deductible plan.

Medicare Supplement Plan G costs $182 per month, on average, in California. That's about 20% cheaper than Plan F, which costs an average of $225 per month. Because the only difference between Plan F and Plan G is that Plan F covers the $257 Medicare Part B annual deductible, Plan G is usually a better deal. Plus, you can't get Plan F unless you were eligible for Medicare before 2020.

Despite being more expensive, Plan F is the most popular Medigap plan in California. More than half of Medigap plans in California are Plan F. Plan G is the second-most popular option, with about one-fourth of the plans in the state. However, because Plan F isn't an option for people who are new to Medicare, it's likely Plan G will increase in popularity each year.

Plan N is the third most popular Medigap plan in California, making up about 1 in 10 of the Medicare Supplement plans in the state. Plan N gives you similar levels of coverage to Plan G, but you have to pay up to $20 for visits to the doctor and up to $50 for visits to the emergency room. You also have to pay for what are called excess charges when you see a doctor, although these are rare. If you're relatively healthy and don't have chronic medical conditions, Plan N can be a good option. You'll save money each month and still have good coverage.

How does age impact Medigap prices in California?

Most Medicare Supplement policies in California get more expensive as you age. Typically, your Medigap policy will be cheaper when you're 65, and you can expect the price to rise after each annual renewal.

Some companies only take your age into account when you buy the policy. Although you may see annual price increases to keep up with inflation, your policy won't jump in price just because you're getting older.

Less commonly, some companies in California require all policyholders to pay the same price per plan regardless of their age.

Frequently asked questions

What's the best Medicare Supplement plan in California?

Plan G is the best Medicare Supplement plan in California because it gives you the most coverage if you're new to Medicare. If you're in relatively good health, you should also consider Plan N, which offers slightly less coverage at an even more affordable price.

How are California Medigap plans priced?

Most California Medigap companies use your age, gender and tobacco use when calculating rates. Plans are typically the cheapest right when you sign up, and they get more expensive as you age.

How much is Medigap in California?

Medicare Supplement plans cost between $55 and $225 per month, on average, in California. Your rates will depend on the plan you pick, the company you choose, your age, and whether or not you smoke.

Sources and methodology

ValuePenguin used actuarial data from California Medigap companies to get average rates for 2025. All rates are for a 65-year-old woman who doesn't smoke. Only companies with a market share above 1.2% for the state of California were included in the analysis. Loyal American was excluded from this study because rates are not available.

Total enrollment numbers by Medicare Supplement plan for California are from America's Health Insurance Plans (AHIP). Customer complaint numbers are from the National Association of Insurance Commissioners (NAIC).

ValuePenguin used NAIC complaint data to score Medigap providers on a five-point scale with a score of one signaling a high number of complaints.

Satisfaction score | Customer complaints adjusted for company size |

|---|---|

| 5.0 (top rating) | Over 75% fewer complaints than typical |

| 4.5 | 50% to 75% fewer complaints than typical |

| 4.0 | 25% to 50% fewer complaints than typical |

| 3.5 | 0% to 25% fewer complaints than typical |

| 3.0 | An average rate of complaints |

| 2.5 | 0% to 50% more complaints than typical |

| 2.0 | 50% to 100% more complaints than typical |

| 1.5 | 100% to 250% more complaints than typical |

| 1.0 | Over 250% more complaints than typical |

Insurance Writer

Cate Deventer is a ValuePenguin writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.