Mutual of Omaha Medicare Supplement Review

Mutual of Omaha is a good option for Medigap plans if customer service is a high priority for you. However, it has average rates for most plan options.

Compare Medicare Plans in Your Area

Mutual of Omaha has average to above-average rates for most of its plans. However, its strong customer satisfaction reputation makes it a good choice if you are willing to pay a little more to avoid a headache down the road.

Mutual of Omaha sells Medicare Supplement (Medigap) plans in every state but Massachusetts. Mutual of Omaha offers all Medigap plan choices except Plans K and L.

Pros and cons

Pros

Strong customer service

Has a discount if you live with a senior

Sells cheap Plan N and High-Deductible Plan G

Available in most states

Cons

Average to expensive rates overall

Expensive Plans B, C, D and M

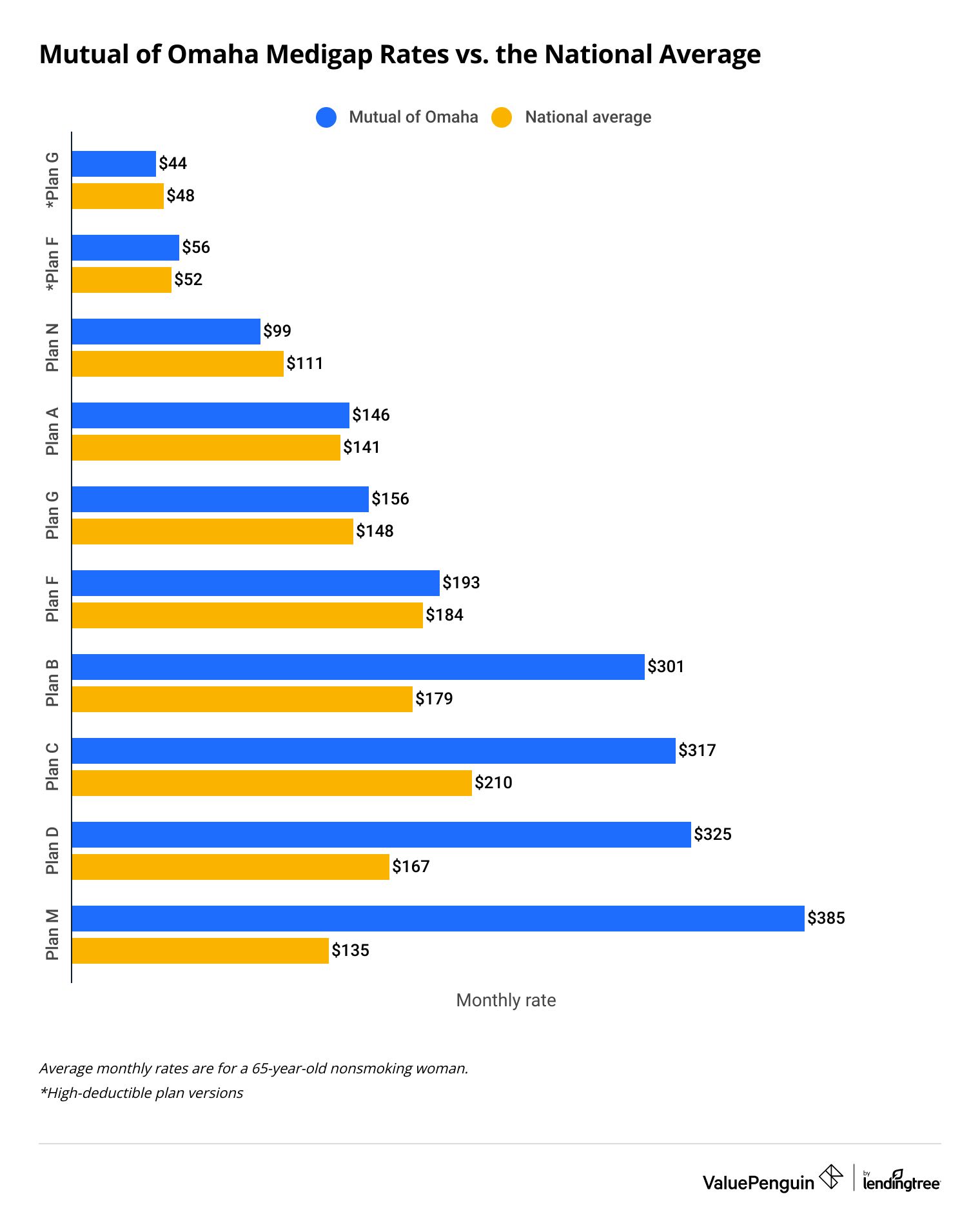

How Much Does a Mutual of Omaha Medigap Cost?

Plan G from Mutual of Omaha costs $156 per month, on average.

That's roughly in line with the national average. Plan G is the best Medicare Supplement plan for those who are newly eligible for Medicare.

Mutual of Omaha offers eight Medicare Supplement plans and two additional high-deductible plan versions. Eight of these are more expensive than the national average. However, the most popular plans cost roughly as much as the national average.

Plans B, C, D and M are expensive. However, these account for only a very small number of Medicare Supplement policies sold.

Compare Medicare Plans in Your Area

Mutual of Omaha's Medigap rates range from average to expensive. But, its Plan N is a good deal. You could save $144 annually by switching to Mutual of Omaha from an average Medigap insurance company.

You can only buy a Plan F or C policy if you became eligible for Medicare before January 1, 2020.

Mutual of Omaha vs. average Medigap rates

Plan | Mutual of Omaha monthly rate | National monthly rate |

|---|---|---|

| Plan G | $44 | $48 |

| Plan F | $56 | $52 |

| Plan N | $99 | $111 |

| Plan A | $146 | $141 |

| Plan G | $156 | $148 |

Average monthly cost for a 65-year-old nonsmoking woman.

Your rate changes based on where you live, too. Most states are allowed to increase monthly costs as you get older. Eight states ban cost increases based on age or health condition.

States where companies can't use age in pricing

- Arkansas

- Connecticut

- Maine

- Massachusetts

- Minnesota

- New York

- Vermont

- Washington

Ways to lower your Mutual of Omaha rates

-

Household discount: The company offers a 7% to 12% household discount in most states. You can get this discount if you live with a spouse, domestic partner or other seniors over age 60. You can get these savings even if other household members don't have Mutual of Omaha insurance.

-

High-Deductible Plan G: These low-cost plans are not available from many providers, and they're a great deal at just $44 per month for a 65-year-old woman. Plans have the same great coverage as a standard Part G plan, including covering Medicare Part B excess charges and the Part B deductible. However, your high-deductible plan won't kick in until you pay at least $2,800 for medical care.

You should choose this type of coverage if you want protection from high medical costs if you become very sick, and you have enough money on hand to easily pay the deductible cost.

Mutual of Omaha Medigap costs in states where age affects pricing

In most states, your Medicare rates will go up because you get older. In some states that don't allow companies to take age into account, companies will offer new members discounts which go away over time. These discounts mean that your rate will increase as you age.

Aside from its high-deductible options, Plan N is the cheapest Medigap plan sold by Mutual of Omaha. It offers a similar level of coverage as Plan G, although with Plan N, you're responsible for copays when you visit the doctor. That makes Plan N a good alternative to Plan G, if you're in good health and rarely go to the hospital.

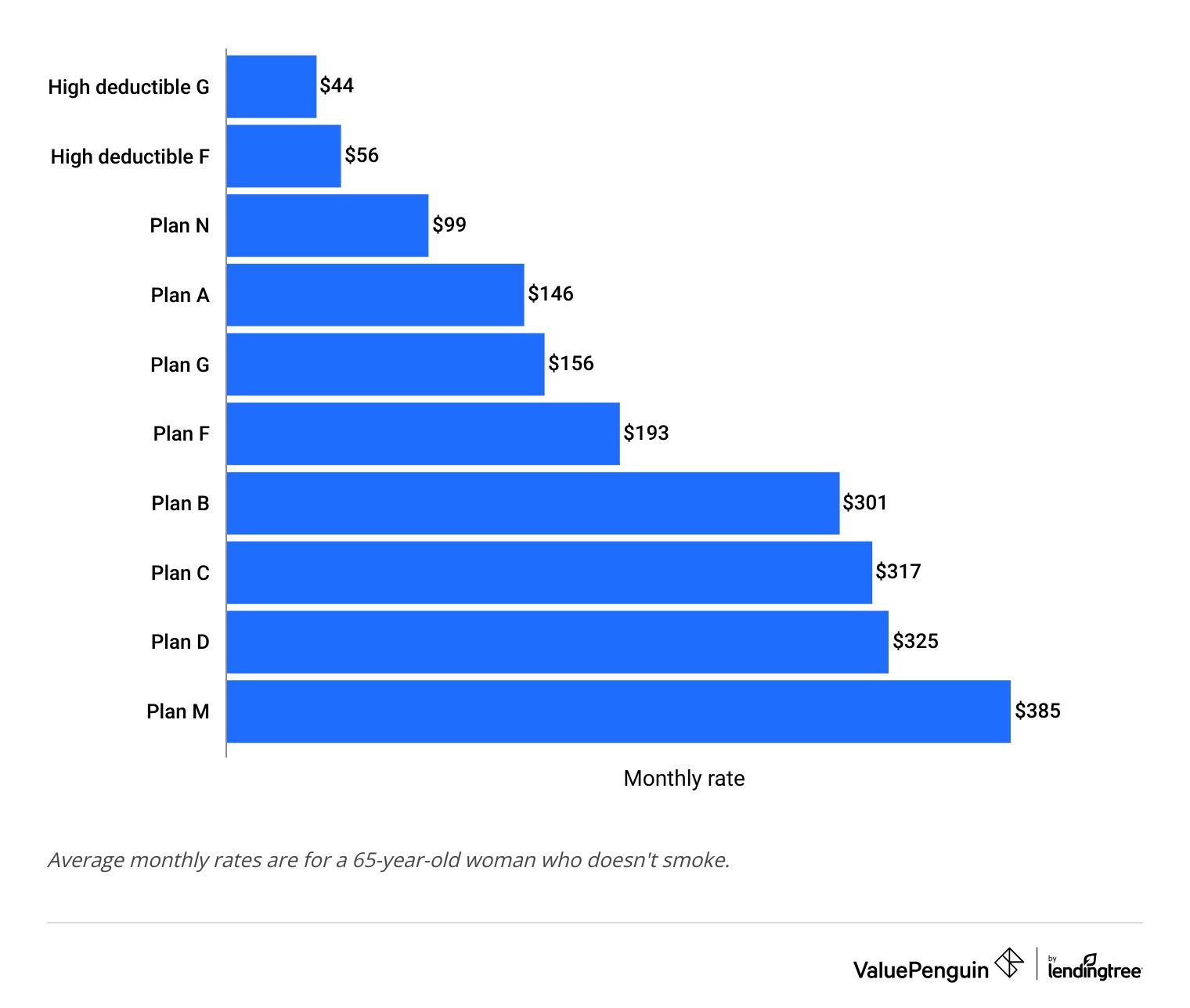

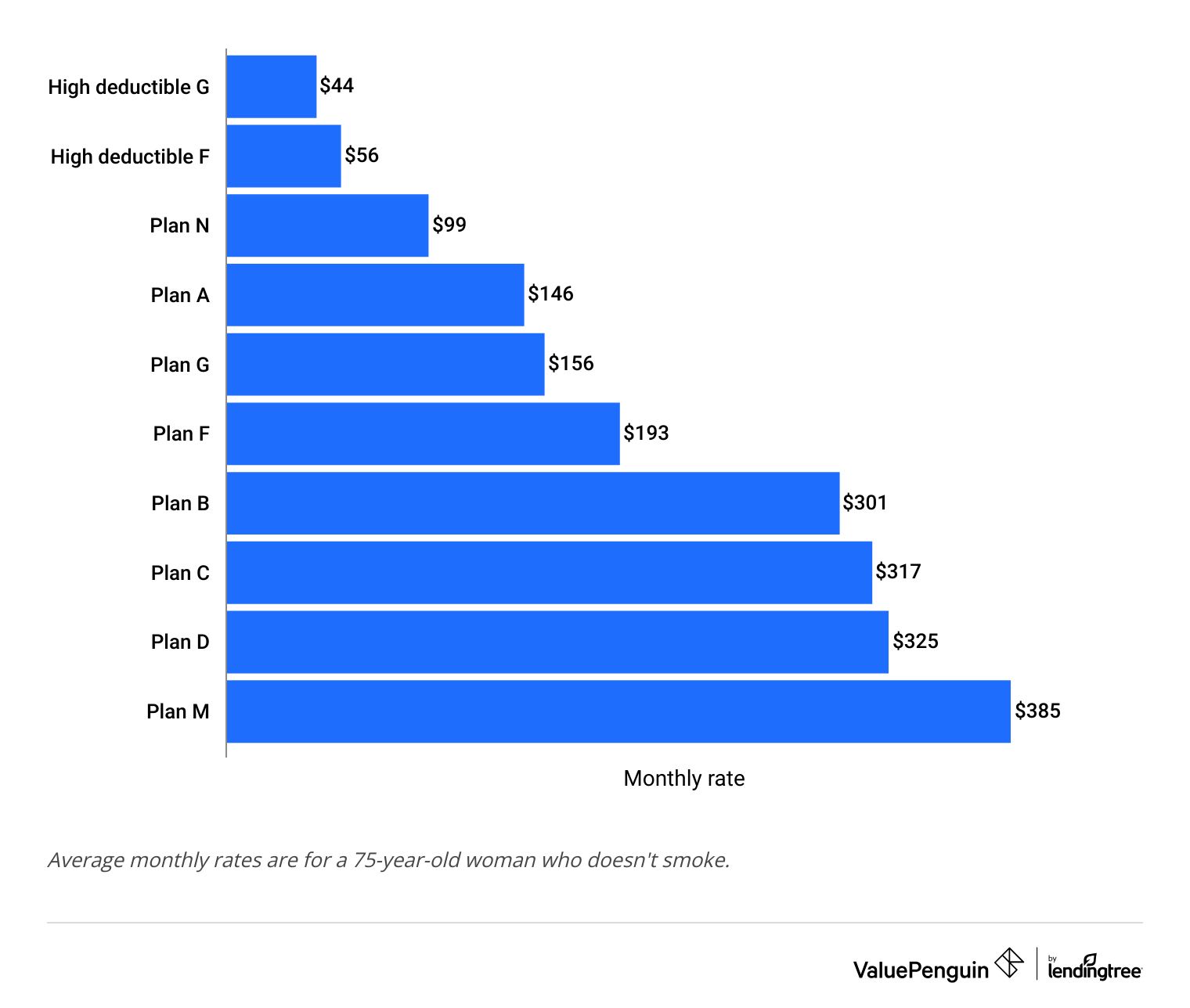

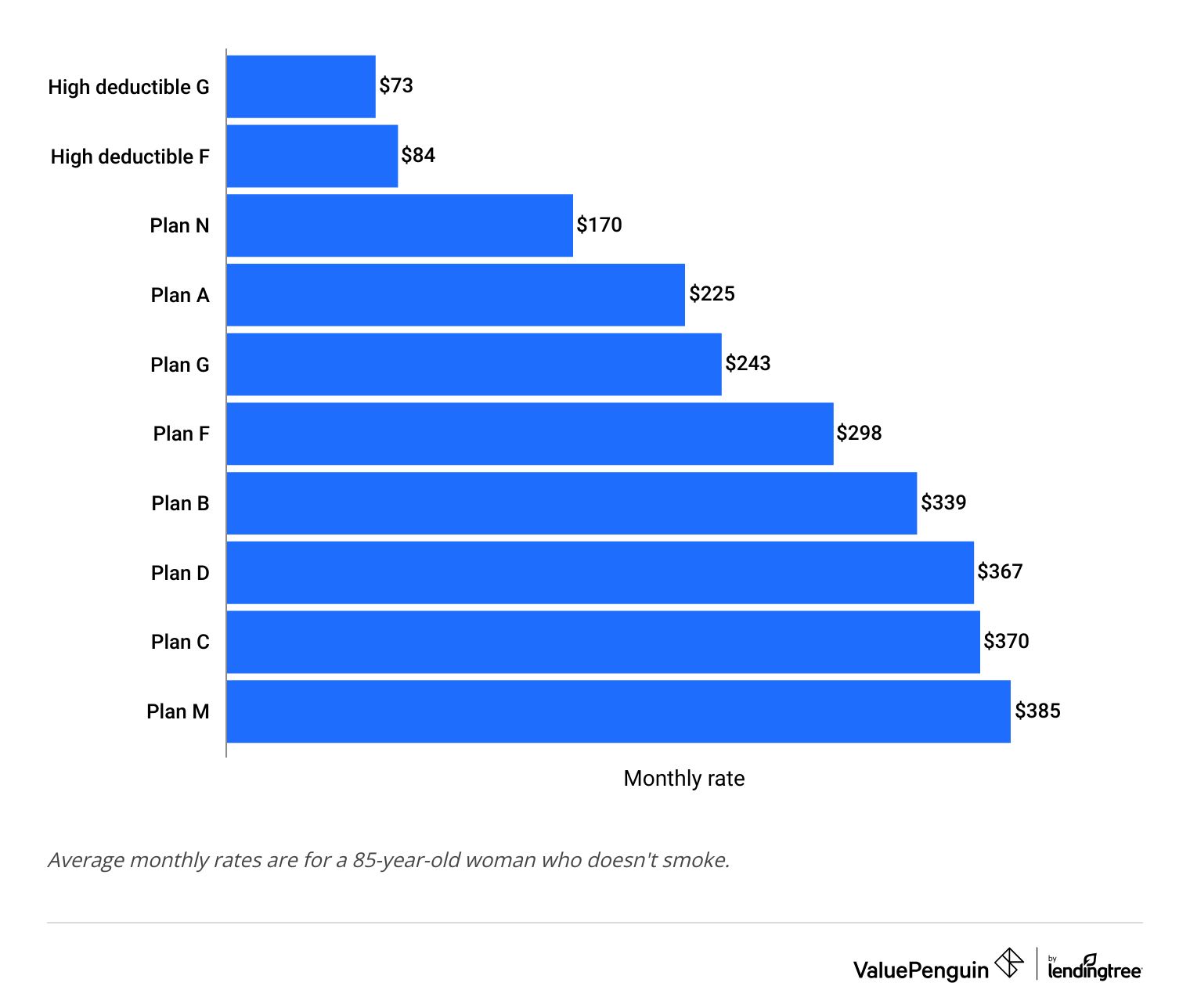

Cost of Mutual of Omaha plans by age

Age 65

Age 75

Age 85

Plan | Mutual of Omaha monthly rate |

|---|---|

| Plan G | $44 |

| Plan F | $56 |

| Plan N | $99 |

| Plan A | $146 |

| Plan G | $156 |

Average rates are for a 65-year-old woman who does not smoke.

Age 65

Plan | Mutual of Omaha monthly rate |

|---|---|

| Plan G | $44 |

| Plan F | $56 |

| Plan N | $99 |

| Plan A | $146 |

| Plan G | $156 |

Average rates are for a 65-year-old woman who does not smoke.

Age 75

Plan | Mutual of Omaha monthly rate |

|---|---|

| Plan G | $55 |

| Plan F | $67 |

| Plan N | $125 |

| Plan A | $174 |

| Plan G | $186 |

Average rates are for a 75-year-old woman who does not smoke.

Age 85

Plan | Mutual of Omaha monthly rate |

|---|---|

| Plan G | $73 |

| Plan F | $84 |

| Plan N | $170 |

| Plan A | $225 |

| Plan G | $243 |

Average rates are for an 85-year-old woman who does not smoke.

Mutual of Omaha Medigap costs in states with alternative plans

Wisconsin and Minnesota don't have standard Medigap plans broken down by letters. Those states have different sets of Medigap plans. Wisconsin lets insurance companies raise Medigap rates by age, but Minnesota doesn't.

- Minnesota: $252-$299

- Wisconsin: $113

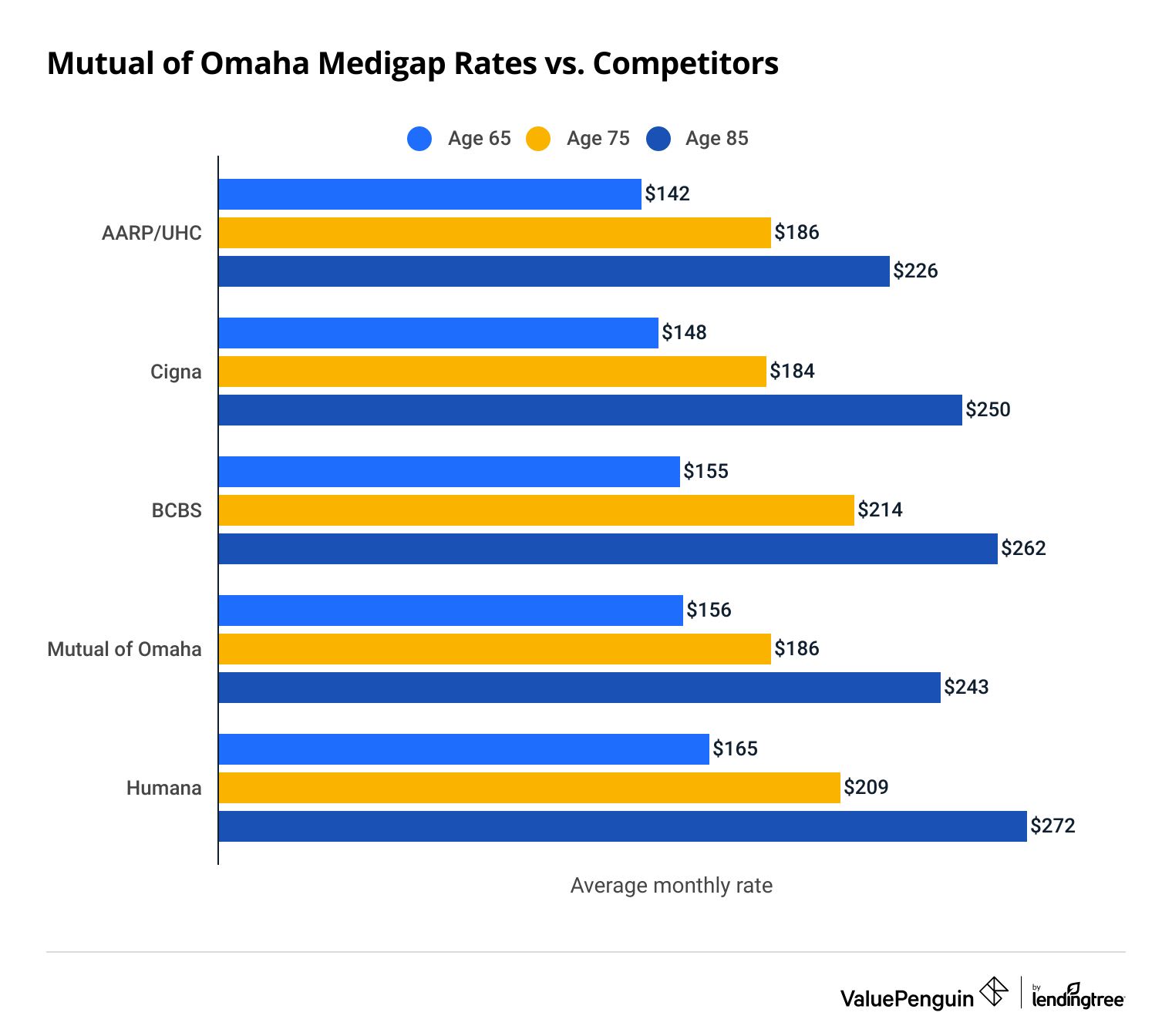

Mutual of Omaha Medigap rates vs. competitors

Mutual of Omaha is more expensive than most of the other large, national Medigap companies. However, it's cheaper than Humana, and as you get older, it becomes cheaper than Blue Cross Blue Shield (BCBS).

Compare Medicare Plans in Your Area

For the most popular plan options, Mutual of Omaha has average rates. However, Medigap prices differ quite a bit depending on where you live. That means Mutual of Omaha may be your most affordable option or the priciest choice in some areas.

Remember, companies raise prices at different rates. So you might start off with a low initial price but may pay more over the long haul. At 65, you'll pay more for Mutual of Omaha than you would for Cigna or Blue Cross Blue Shield. However, by the time you get to 85, Mutual of Omaha will become the more affordable option.

Mutual of Omaha Medicare Supplement Plan G rates vs. competitors

Company | Age 65 rate | Age 75 rate | Age 85 rate |

|---|---|---|---|

| AARP/UHC | $142 | $186 | $226 |

| Cigna | $148 | $184 | $250 |

| Blue Cross Blue Shield | $155 | $214 | $262 |

| Mutual of Omaha | $156 | $186 | $243 |

| Humana | $165 | $209 | $272 |

Average rates are monthly and for a woman who does not smoke.

AARP/UnitedHealthcare is a good alternative to Mutual of Omaha if cost is a top priority for you. It offers low-cost plans and strong customer service.

Plans and coverage

Medicare Supplement policies help you pay for the costs that you're responsible for with Original Medicare (Parts A and B). Medigap plans commonly cover some or all of your deductibles , coinsurance and other costs. Coverage levels vary by plan level with Plans K and L offering the worst coverage and Plans F and G offering the best coverage.

Even though there are 10 Medigap plan options to choose from, plans F, G and N make up roughly 83% of all plans sold. These plans are popular because they offer more coverage.

All Medigap plans cover your Part A (hospital) and Part B (doctor) coinsurance , although Plans K, L and N only pay for part of your Part B coinsurance. In addition, most plans cover your Part A deductible of $1,632 and Plans C and F will pay for your $240 Part B deductible.

Medigap plans won't pay for your prescription drug coverage. You need Medicare Part D for that. It's also worth keeping in mind that you can't buy a Medigap plan if you have a private Medicare plan called Medicare Advantage.

Reviews and customer satisfaction

Mutual of Omaha gets 35% fewer complaints compared to an average company of a similar size.

It's a good idea to get a Medigap policy from a company that has a strong customer service reputation. A high amount of complaints may reflect a lengthy and frustrating claims process.

Mutual of Omaha has an A+ rating from the Better Business Bureau (BBB). That means Mutual of Omaha makes an effort to resolve customer complaints.

Most of the complaints on the BBB deal with the company's other insurance offerings, such as life insurance and health insurance.

Frequently asked questions

Is Mutual of Omaha a good Medicare Supplement company?

Mutual of Omaha is a good Medigap company if you value customer service over getting the lowest price. It gets notably fewer complaints than average. However, its rates are just average for the most popular Medicare Supplement plans.

How much is Mutual of Omaha Plan G in 2024?

A Mutual of Omaha Plan G policy costs $156 per month in 2024. That's $8 per month more than the national average. However, a Mutual of Omaha high-deductible Plan G costs $44 per month which is cheaper than the $48 per month national average.

Does Mutual of Omaha have a household discount for Medicare supplement plans?

Yes, Mutual of Omaha offers a 7% to 12% household discount if you live in a home with someone else aged 60 or older. The other household member doesn't have to be your spouse. Domestic partners, siblings, parents and roommates are also eligible for the discount.

Sources and methodology

2024 Medicare Supplement rates are for a 65-year-old nonsmoking woman unless a different age or gender is specifically mentioned. The rates on this page are for when a person first qualifies for Medicare. Average rates don't factor health conditions into monthly costs.

Other sources include Better Business Bureau (BBB), KFF, Medicare.gov, the National Association of Insurance Commissioners (NAIC) and UnitedHealthcare.

Note that Mutual of Omaha Medigap plans may not be available in all locations. Plan details may differ depending on where you live.

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.