Best Cheap Health Insurance in North Dakota (2026)

Sanford Health Plan is the best and cheapest health insurance company in North Dakota. Bronze plans start at $332 per month before discounts.

Find Cheap Health Insurance Quotes in North Dakota

Cheapest health insurance companies in North Dakota

The cheapest health insurance plans in North Dakota are Sanford Health Plan, Medica and Blue Cross Blue Shield, with Bronze plans starting at $332 per month before discounts.

Find Cheap Health Insurance Quotes in North Dakota

Affordable health insurance plans in North Dakota

Company |

Cost

| |

|---|---|---|

| Sanford Health Plan | $332-$488 | |

| Medica | $358-$613 | |

| Blue Cross Blue Shield of North Dakota | $434-$461 | |

- Sandford Health Plans has the cheapest individual Gold, Silver, Bronze and Catastrophic plans in ND, on average. It has the most affordable rates for roughly half the people in North Dakota, including those in Fargo, Bismarck and Mandan.

- Blue Cross Blue Shield of North Dakota has the cheapest coverage for people in more rural counties. It offers the cheapest Bronze plans for about four in 10 people.

- Medica is the cheapest option for around one in 10 North Dakota residents. North Dakotans in Grand Forks, Ransom, Richland and Sargent can look for the lowest rates with Medica.

Best health insurance companies in North Dakota

Sanford Health Plan is the best health insurance company in North Dakota.

Sanford Health Plan has a good 4-out-of-5 star rating from HealthCare.gov. That's the highest rating among health insurance companies on the North Dakota health exchange website and includes strong marks for member experience.

Find Cheap Health Insurance Quotes in North Dakota

Best-rated health insurance companies in North Dakota

Company |

ACA rating

|

VP rating

|

|---|---|---|

| Sanford Health Plan | ||

| Blue Cross Blue Shield of North Dakota | ||

| Medica | N/A |

Best health insurance plans in ND for access to doctors

Consider Blue Cross Blue Shield of North Dakota plans if you want the freedom to choose from a big selection of doctors and don't mind paying a bit more for coverage.

Blue Cross Blue Shield (BCBS) has the largest network of doctors and hospitals in the nation. That makes it a good choice for people who need a lot of specialty care or who travel frequently.

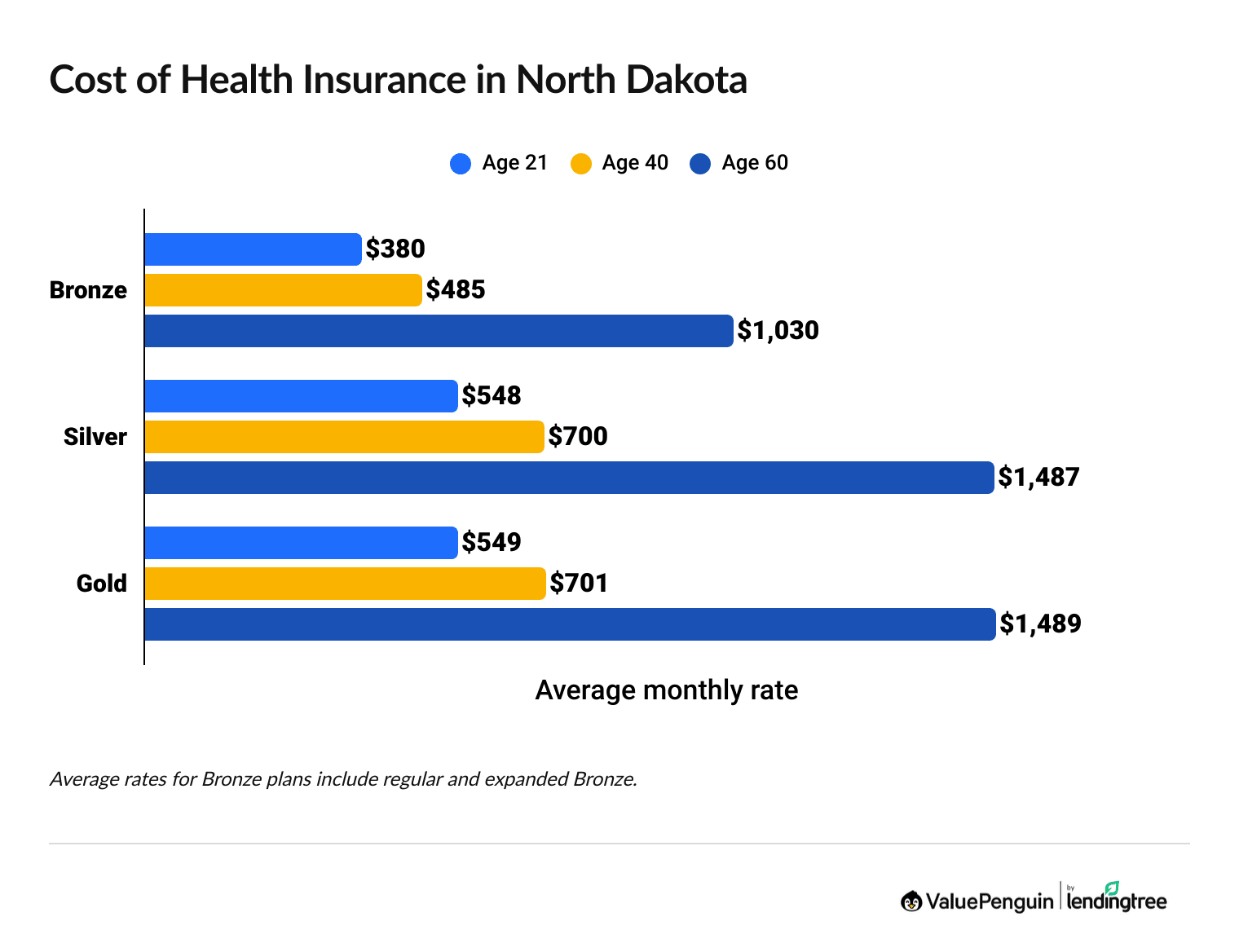

How much does health insurance cost in ND?

For 2026, North Dakota health insurance costs an average of $485 per month at full price and could be about $299 per month if you qualify for because of your income.

Find Cheap Health Insurance Quotes in North Dakota

Your health insurance costs depend on several factors, including the coverage you choose, your age, your income and where you live in North Dakota.

- More expensive plan tiers typically pay more of the bill when you go to the hospital. It's a good idea to choose a higher plan tier if you have an ongoing health issue. However, you'll probably save money with a lower plan tier if you're young and in good health.

- Your monthly rate goes up as you get older. Costs rise slowly when you're younger before increasing sharply as you enter middle age.

- People who earn lower incomes qualify for larger discounts, called premium tax credits or subsidies.

- Where you live in North Dakota influences how much you'll pay for coverage and the number of plans you can choose from.

Health insurance discount changes in ND for 2026

If you qualify for discounts, your ND health insurance could drop from an average of $485 per month to possibly about $299 per month.

The cost of your health insurance plan depends in part on your household income. Discounts are typically larger if you earn less money.

Since 2021, you could find discounts called "expanded subsidies" when shopping for healthcare on a HealthCare.gov or a state marketplace. But these better discounts expire at the end of 2025. While some discounts are still available for 2026, they won't be as good as they were before.

If you make less than $22,000 a year or less as an individual or $44,000 as a family of four, you could qualify for Medicaid or the Children’s Health Insurance Plan, also called CHIP.

Health insurance rates in North Dakota after subsidies (2025 vs. 2026)

Income | 2025 rate | 2026 rate | Difference |

|---|---|---|---|

| $30,000 | $49 | $155 | 216% |

| $40,000 | $154 | $287 | 86% |

| $50,000 | $283 | $415 | 47% |

| $60,000 | $423 | $498 | 18% |

| $70,000 | $496 | $570 | 15% |

Average cost after subsidies for a single 40-year-old with a Bronze plan.

- Who can get subsidies? To qualify for a subsidy based on income, you have to earn between $15,650 and $62,600 as a single person or between $32,150 and $128,600 as a family of four. If you earn less, you qualify for Medicaid instead.

- How do subsidies work? Health insurance subsidies can be used for Bronze, Silver or Gold plans. You can’t use them for Catastrophic plans.

- How much do you save? You can find out how much a subsidy could lower your insurance rate with ValuePenguin's subsidy calculator.

Cheap North Dakota health insurance plans by city

Sanford has the cheapest health insurance quotes in Fargo, where Bronze plans cost $338 per month, on average.

Sanford also has the most affordable coverage in North Dakota's other large cities, such as Bismarck, West Fargo and Mandan. In Grand Forks, Medica offers the cheapest Bronze plan, while in Minot, Blue Cross Blue Shield is the most affordable.

Cheapest health insurance plans by ND county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Adams | BCBS BlueCare Bronze | $434 |

| Barnes | BCBS BlueCare Bronze | $434 |

| Benson | BCBS BlueCare Bronze | $434 |

| Billings | BCBS BlueCare Bronze | $434 |

| Bottineau | BCBS BlueCare Bronze | $434 |

Cheapest Bronze plan with rates for a 40-year-old

Best health insurance by level of coverage

The best health insurance for you depends on your medical needs, income and savings.Silver plans balance average rates with middle-of-the-road costs when you go to the hospital. Silver plans also qualify for both premium subsidies and cost-sharing reductions. That means, depending on your income, a Silver plan may be the cheapest overall.

Gold plans: Best if you need expensive medical care

| Gold plans pay for about 80% of your medical care. |

Gold plans cost an average of $701 per month in North Dakota.

Consider a Gold plan if you think you'll need a lot of medical care in the near future. These plans can have expensive monthly rates, but they pay for most of your bill when you go to the hospital.

Silver plans: Best if you qualify for subsidies

| Silver plans pay for about 70% of your medical care. |

On average, Silver plans cost $700 per month, before discounts, in North Dakota.

You may be eligible for extra savings, called cost-sharing reductions, if you earn less than about $39,000 per year as an individual ($80,000 per year for a family of four). Cost-sharing reductions help cover the part of your medical bill you're responsible for paying, such as your deductible, coinsurance and copays.

Bronze: Best for most North Dakotans

| Bronze plans pay for about 60% of your medical care. |

Bronze plans cost $485 per month, on average, in North Dakota.

Bronze plans are a good choice if you don’t qualify for subsidies and are in generally good health. These plans have relatively cheap monthly rates, even if you can’t get subsidies, but you'll pay more when you go to the hospital. If you have a Bronze plan, it's important to have enough money in your savings account to easily cover your deductible. Otherwise, you may have a difficult time if you get sick or injured.

Catastrophic plans: Best for protection against high medical bills

Catastrophic health plans cost $389 per month, on average, in North Dakota.

Catastrophic plans offer bare-bones coverage at a low price. These plans are usually not a good choice because you have to pay a $10,600 deductible before most coverage starts. Plus, Catastrophic plans are not eligible for discounts.

You can buy a Catastrophic plan only if you're under the age of 30 or you qualify for a hardship exemption.

Medicaid: Free health insurance plans if you have a low income

Free government health insurance, called Medicaid, is available to North Dakotans who earn a low income.

You may qualify for Medicaid in North Dakota if you earn about $22,000 per year or less (roughly $44,000 per year or less for a family of four). Pregnant women, families with children and people who have specific disabilities can make more than those limits and still possibly qualify.

Are health insurance rates going up in ND in 2026?

Health insurance rates in North Dakota went up by an average of 24% between 2025 and 2026.

Catastrophic plans had the largest increase, at 57%, on average. Gold plans rose by an average of 14%, Bronze by 13% and Silver plans got 12% more expensive, on average. Since 2022, the cost of a Gold plan has increased by 43%.

Catastrophic

Bronze

Silver

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $214 | – |

| 2023 | $221 | 3% |

| 2024 | $239 | 8% |

| 2025 | $247 | 3% |

| 2026 | $389 | 57% |

Monthly costs are for a 40-year-old.

Catastrophic

Year | Cost | Change |

|---|---|---|

| 2022 | $214 | – |

| 2023 | $221 | 3% |

| 2024 | $239 | 8% |

| 2025 | $247 | 3% |

| 2026 | $389 | 57% |

Monthly costs are for a 40-year-old.

Bronze

Year | Cost | Change |

|---|---|---|

| 2022 | $413 | – |

| 2023 | $357 | -14% |

| 2024 | $387 | 8% |

| 2025 | $428 | 13% |

| 2026 | $485 | 13% |

Monthly costs are for a 40-year-old. Expanded Bronze plans are included in 2024, 2025 and 2026 averages, when they're offered.

Silver

Year | Cost | Change |

|---|---|---|

| 2022 | $524 | – |

| 2023 | $538 | 3% |

| 2024 | $548 | 2% |

| 2025 | $627 | 14% |

| 2026 | $700 | 12% |

Monthly costs are for a 40-year-old.

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $490 | – |

| 2023 | $522 | 7% |

| 2024 | $528 | 1% |

| 2025 | $614 | 16% |

| 2026 | $701 | 14% |

Monthly costs are for a 40-year-old.

Why is health insurance expensive in ND in 2026?

The rising cost of healthcare is one of the main reasons health insurance prices are going up.Companies pay for treatment for their members, so when that gets more expensive, the companies raise prices so they don't lose money. Potential rising prices can be driven even more by factors such as the rising use of GLP-1 weight loss drugs, which are expensive and becoming more and more common.

Rates are also rising because the government is allowing some federal tax credits it offers for ACA plans to expire.

There are a few good ways to help keep your costs down:

- Get subsidies with a Silver plan: If you don't have a high income, subsidies can make marketplace plans extremely affordable.

- Get a lower level plan: If you're in good health and you have an emergency fund for a sudden illness or accident, a Bronze plan can save you money each month.

- Use an Health Savings Account: You can set aside money for medical treatment and bills, and you won't have to pay taxes on it.

Obamacare health insurance plans in North Dakota

All plan tiers offered on the North Dakota health exchange – Catastrophic, Bronze, Silver and Gold – have to cover 10 essential services.

- Hospital care

- Doctor visits

- Prescription medications

- Rehabilitation care and devices

- Pregnancy, maternity and newborn care

- Emergency care

- Preventive care

- Pediatric services

- Laboratory services

- Mental health and substance use services

In addition to covering these services, all plans bought through HealthCare.gov offer several other important protections. For example, all Obamacare plans limit the amount you pay for medical care in a single year, called an out-of-pocket maximum. Plus, companies can't charge you higher rates or deny coverage based on your health history when you buy a plan through the North Dakota health exchange.

All plans also automatically include dental and eye care for children under 18 years old. Adults who want those coverages need to double-check that their health plan specifically includes them. Otherwise, you can shop around for separate dental and eye care policies.

Average cost of health insurance by family size

Health insurance for a family of four costs $1,551 per month, on average, in North Dakota.

The amount you pay for coverage depends on the size of your family. A single adult in North Dakota pays an average of $485 per month for health insurance. Coverage costs $290 per month, on average, for a child below the age of 15.

Family size | Average monthly cost |

|---|---|

| Individual | $485 |

| Individual and child | $775 |

| Couple | $970 |

| Family of three | $1,260 |

| Family of four | $1,551 |

Averages based on a Bronze plan for 40-year-old adults and children who are under age 15.

Average cost of health insurance in North Dakota by plan type

In North Dakota, you can choose between HMOs and PPOs when shopping for health insurance on HealthCare.gov.

Type | Cost |

|---|---|

| PPO | $460 |

| HMO | $528 |

Monthly costs are for a 40-year-old with a Bronze plan.

- HMOs tend to have affordable monthly rates, but you can't go outside your plan's network of doctors unless you need emergency care. You also need to pick a primary care doctor and get a referral before you can go to a specialist.

- PPOs typically have more expensive rates, but you can see doctors outside of your network for a higher cost. Also, you can go to a specialist without a referral, and you don't need a primary care doctor.

Short-term health insurance in North Dakota

In North Dakota, you can buy short-term health insurance for up to one year .

In January 2025, the current administration rolled back a Biden-era rule that would've limited short-term health plans to no more than three months.

You can get short-term health coverage at any time during the year. That means you don't need to wait for open enrollment to buy short-term coverage.

However, Short-term plans are almost always a bad choice because they have worse coverage and fewer protections than regular health insurance. It's a good idea to see if you qualify for a special enrollment period before shopping for a short-term plan.

Pros of short-term health insurance plans in ND

Cons of short-term health insurance plans in ND

Health insurance enrollment by income level in North Dakota

The 2026 changes to health insurance discounts affect people with low incomes the most.

People with lower incomes tended to buy health insurance through a government marketplace because they received higher discounts. For example, in North Dakota in 2025, half of people with a marketplace plan made less than $30,121.

Enrollment by income

Income | % of total enrollment |

|---|---|

| Less than $15,060 | 1% |

| $15,060 to $20,783 | 4% |

| $20,784 to $22,590 | 8% |

| $22,591 to $30,120 | 18% |

| $30,121 to $37,650 | 20% |

Enrollment in 2025 marketplace plans made during the 2024-2025 Open Enrollment period. Total may not be 100% due to rounding

Frequently asked questions

What's the best health insurance in North Dakota?

Sanford Health Plan has the best health insurance in North Dakota. The company has a strong reputation for customer satisfaction, affordable rates and good coverage.

Who has the cheapest health insurance in North Dakota?

Sanford Health Plan has the most affordable health insurance in North Dakota for roughly half the state's population. Bronze plans start at $332 per year.

Is $200 a month expensive for health insurance in North Dakota?

Plans that cost $200 per month are quite cheap in North Dakota. The average rate in the state is $485 per month at full price for a Bronze plan, although subsidies could lower the cost.

What health insurance companies are in North Dakota?

Sanford Health Plan, Medica and Blue Cross Blue Shield sell health insurance in North Dakota. You can compare quotes from these three companies on HealthCare.gov during open enrollment, which runs from Nov. 1 to Jan. 15 in North Dakota.

Methodology

North Dakota health insurance rate data for 2026 is from the Centers for Medicare & Medicaid Services website. ValuePenguin used the CMS public use files to find average rates for different plan tiers, geographic locations and family sizes.

Rates

Rates are based on a 40-year-old with a Bronze plan, unless otherwise noted. Rates for Bronze plans include regular and Expanded Bronze plans for 2024, 2025 and 2026, when the plans are available. Your costs and plan options will vary; plans aren't always available in all parts of a state or county.

Subsidies

Rates after subsidies are estimates for a 40-year-old with a Bronze plan and are based on how subsidies were structured before 2021. Prices are calculated using KFF's rates for full-price Benchmark plans, federal poverty levels, IRS rules about premium tax credits and Congressional reports about expanded tax credits. The total cost in the state uses rates calculated by income, which are weighted using CMS data on the incomes of those who purchased plans during last year's open enrollment. The median was used for each income range. Unknown incomes were excluded from the calculations. Incomes of 100% of the federal poverty line and 500% of the federal poverty line were assumed for enrollees who earn less than 100% FPL and more than 500% FPL, respectively. Information about state subsidies, when available, was sourced from state marketplaces.

Ratings

ValuePenguin's experts rank companies based on cost, coverage options, customer satisfaction and unique value. Ratings are out of 100 possible points. ACA ratings show how the company performs in North Dakota for medical care, member experience and plan administration. This 2026 plan quality data from CMS is based on data from last year. Ratings are not available for new plans or plans with low enrollment.

More sources

Enrollment trends, including plan selections by tier and enrollment by income, are from CMS data for the 2025 open enrollment period.

Other sources include S&P Global Capital IQ and the National Association of Insurance Commissioners (NAIC) and KFF-Peterson.

Senior Writer

Jenn Jones is a Senior Writer at LendingTree where she covers auto, home, renters and motorcycle insurance topics.

Previously an editor for USA TODAY Blueprint and a finance manager at World Car dealerships, she has more than a decade of experience in the world of personal finance and a deep interest in sharing knowledge that empowers others. She’s also served as a freelance translator, copy editor, writer and researcher. She graduated from the University of Virginia with a B.S. in commerce and a B.A. in Chinese language and literature.

How insurance helped Jenn

Jenn first came to appreciate pet insurance when annual checkups for her cat and dog totaled more than $700.

Expertise

- Auto insurance

- Renters insurance

- Condo insurance

- Home insurance

Referenced by

- USA TODAY

- MSN

- F&I Magazine

- Automotive News

Education

- BS, Commerce, University of Virginia

- BA, Chinese Language and Literature, University of Virginia

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.