Car Insurance Costs for 25-Year-Old Drivers

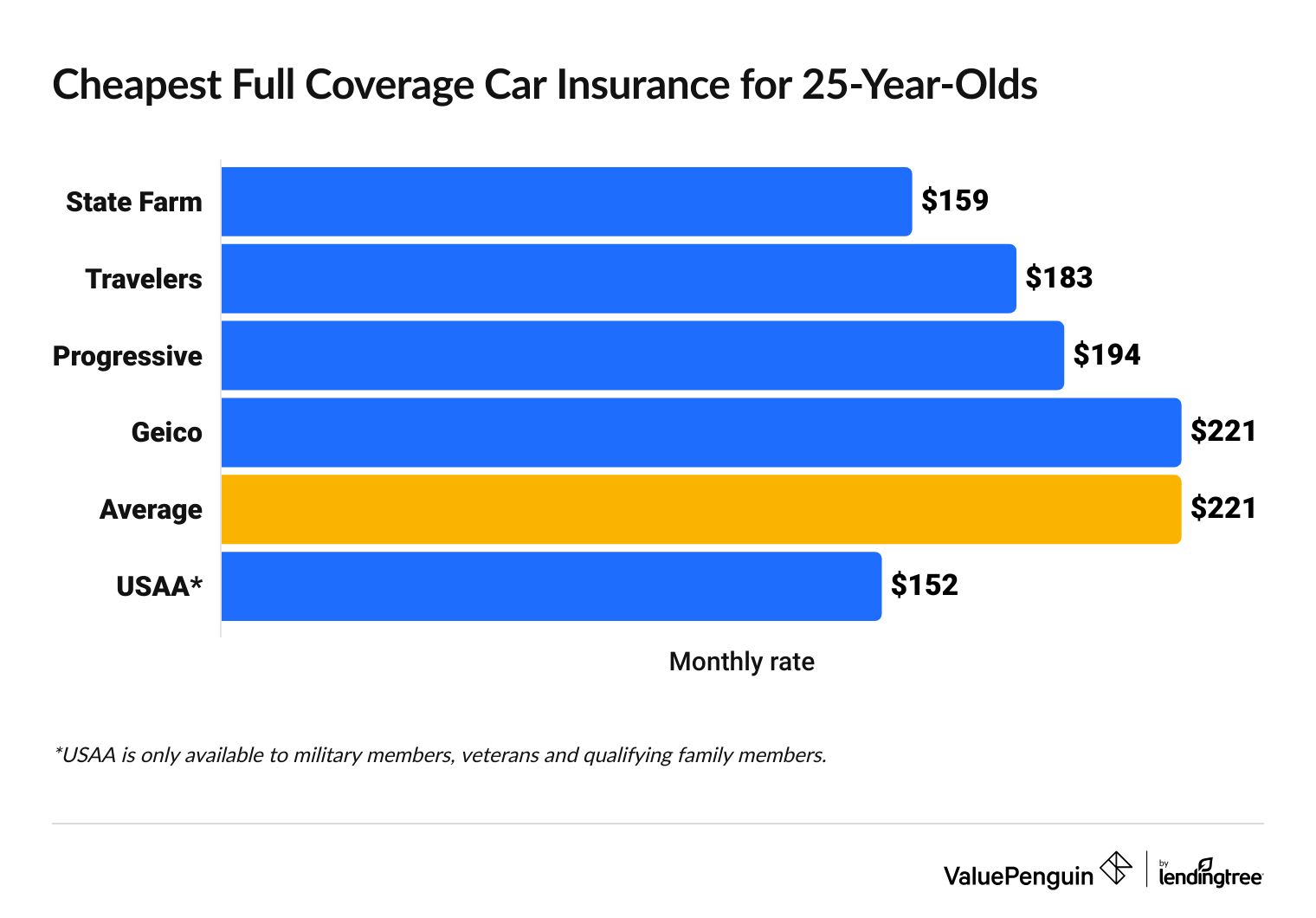

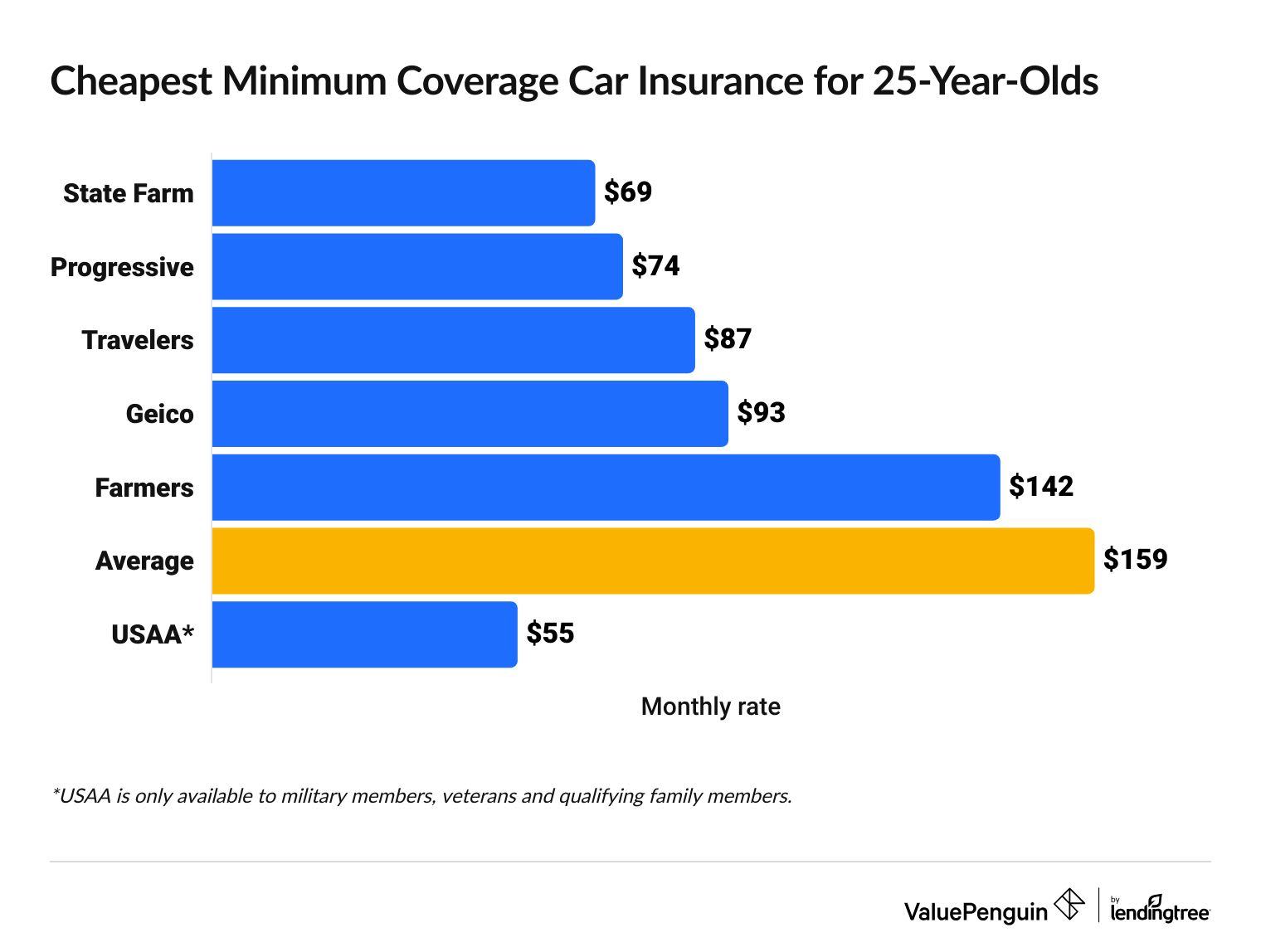

At age 25, drivers pay an average of $221 per month for full coverage or $159 per month for minimum coverage.

Find Cheap 25-Year-Old Auto Insurance Quotes

State Farm has the cheapest car insurance for most 25-year-olds.

Progressive and Travelers also have cheap rates for 25-year-olds, while Farmers and Allstate tend to be the most expensive. You'll pay more for full coverage, but you'll also get protection for damage to your own car that you won't get with minimum coverage.

How much is car insurance for a 25-year-old per month?

A 25-year-old pays $221 per month, on average, for full coverage car insurance.

State Farm has the cheapest rates for 25-year-old drivers for both full coverage and minimum coverage. USAA can be cheaper, but you can only get it if you're a military member, veteran or a qualifying family member.

Find Cheap 25-Year-Old Auto Insurance Quotes

While some companies tend to be cheaper overall, don't assume they will have the cheapest policy for you. You should always shop around and get several quotes. Comparing quotes is one of the best ways to save money on car insurance.

Cheapest car insurance companies for 25-year-old drivers

Full coverage

Minimum coverage

Company | Editor's rating | Monthly rate | |

|---|---|---|---|

| State Farm | $159 | ||

| Travelers | $183 | ||

| Progressive | $194 | ||

| Geico | $221 | ||

| Farmers | $337 | ||

*USAA is only available to military members, veterans and their families.

Full coverage

Company | Editor's rating | Monthly rate | |

|---|---|---|---|

| State Farm | $159 | ||

| Travelers | $183 | ||

| Progressive | $194 | ||

| Geico | $221 | ||

| Farmers | $337 | ||

*USAA is only available to military members, veterans and their families.

Minimum coverage

Company | Editor's rating | Monthly rate | |

|---|---|---|---|

| State Farm | $69 | ||

| Progressive | $74 | ||

| Travelers | $87 | ||

| Geico | $93 | ||

| Farmers | $142 | ||

*USAA is only available to military members, veterans and their families.

How much is car insurance for a 25-year-old vs. other ages?

On average, 25-year-olds pay $132 less per month for full coverage compared to 20-year-olds.

Most 25-year-old drivers have nearly a decade of driving experience. Insurance companies view them as less likely to get into accidents than drivers who are younger. This makes car insurance less expensive for 25-year-olds than it is for younger drivers.

Does car insurance go down at 25?

Car insurance is cheaper for 25-year-old drivers than it is for younger drivers. On average, 25-year-old drivers pay about 10% less for full coverage compared to a 24-year-old.

But there's nothing magical about turning 25 that makes your car insurance rates lower. Your rates usually start out higher when you're young and get lower as you gain more experience behind the wheel. In fact, rates generally continue to drop until your mid-60s, when they start to rise again.

How much is insurance for new drivers who are 25?

You'll pay more for car insurance if you got your license at 25. Drivers who get their license and insurance for the first time at age 25 pay 53% more for a full coverage policy compared to 25-year-old drivers who have had their license since age 16.

That's because car insurance companies use your driving experience alongside your age to rate your policy. The longer you have had a license and the more driving experience you have, the lower your rates will be. But regardless of when you get your license, you'll still pay lower rates for car insurance in your 20s compared to in your teens.

Car insurance rates for 25-year-old males vs. females

Men pay an average of 2% more each month for car insurance at age 25 compared to 25-year-old women.

Men are more likely to be risky drivers compared to women. Since that makes them more likely to get into accidents, insurance companies charge them higher rates.

For younger drivers, there is a noticeable difference in the cost of car insurance between men and women, with men paying more. However, that gap begins to narrow at age 25.

Age | Male monthly rate | Female monthly rate | Difference |

|---|---|---|---|

| 23 | $264 | $254 | 4% |

| 24 | $250 | $241 | 4% |

| 25 | $223 | $219 | 2% |

Average monthly full coverage rates.

But in some states, insurance companies aren't allowed to use your gender to rate your car insurance.

- California

- Hawaii

- Massachusetts

- Michigan

- Montana

- North Carolina

- Pennsylvania

Your rate will likely still change based on your age, the type of car you drive, your driving history and the amount of coverage you need.

Car insurance rates for 25-year-olds by state

Where you live affects how much you pay for car insurance no matter how old you are.

In Pennsylvania, for example, a 25-year-old pays an average of $193 per month for full coverage. But in Texas, the average rate is $254 per month. That's a difference of $61 per month, or $732 per year.

State | Average rate |

|---|---|

| Illinois | $205 |

| New York | $232 |

| Pennsylvania | $193 |

| Texas | $254 |

Average monthly full coverage rates for a 25-year-old.

Find the Cheapest Insurers for Drivers in Your State

How to find cheap car insurance when you turn 25

Car insurance rates are lower at 25 than they are at younger ages, but you can probably get an even cheaper policy if you follow a few strategies.

Shop around

Comparing car insurance quotes helps you find the coverage you need at the lowest price. Sometimes the same coverage can be hundreds of dollars cheaper each month depending on the company you pick.

It's a good idea to compare customer satisfaction ratings too. Choosing a company that has good service can mean less of a hassle for you when it comes to filing a claim. You can also review the different extra coverage options and discounts.

Review potential discounts

Most car insurance companies offer discounts to help you get a lower rate. Opting for a company that has several discounts you can get might help you get a cheaper policy.

Some common discounts for 25-year-olds include:

- Bundling: If you get your car insurance along with a renters or homeowners insurance policy from the same company, you could save on both.

- Full payment: Many companies give you a lower rate if you can pay your full six-month or annual rate in one installment. This also helps you avoid monthly billing fees.

- Safety features: If your car has anti-lock brakes or anti-theft devices, you may qualify for savings.

- Defensive-driving classes: Companies may reward you for taking a safe- or defensive-driving course.

Drive safely

Although safe driving won't lower your rate immediately, it can help you keep your costs down over time. When you cause accidents or get tickets, your car insurance rate goes up. Practicing safe driving habits helps you avoid these rate increases, which keeps your rates down in the long run.

Frequently asked questions

What is the cheapest car insurance for a 25-year-old?

State Farm has the cheapest average car insurance rates for most 25-year-olds. Full coverage from State Farm costs $159 per month and minimum coverage costs $69 per month, on average. USAA might be cheaper, but you can only get it if you're associated with the military.

Does car insurance actually go down at 25?

Car insurance rates do go down at age 25, but they're also steadily lower every year that you have your license until you're in your 60s. If you're a new driver at age 25, you'll pay more than if you'd had your license since 16.

What does the average 25-year-old spend on car insurance a year?

On average, 25-year-olds spend $221 per month on full coverage car insurance or $159 per month for minimum coverage. Your rate will depend on where you live, the company you choose, the coverage you pick and your driving history.

Methodology

ValuePenguin got quotes from four of the most populated states in the U.S. to find the average cost for full coverage and minimum coverage car insurance for 25-year-olds. The rates shown here are for 25-year-old men and women who own a 2015 Honda Civic EX, have no accidents or tickets, and have good credit scores.

Rates for minimum coverage are for policies with only the state-required coverage and limits. Full coverage rates have higher liability limits, plus comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection (PIP): Minimum, when required by state

- Medical payments: $5,000

- Comprehensive and collision deductible: $500 deductible

ValuePenguin reviewed seven major insurance companies for this analysis. Some of the companies were not available in all four states.

The rates used in this article are averages calculated from Quadrant Information Services data. Rates are sourced from publicly available insurance company filings. Your own rates will differ from what is shown in this article.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.