Average Cost of Car Insurance (2026)

The average cost of car insurance in the U.S. is $208 per month for a full coverage policy and $76 per month for minimum liability coverage.

Find Cheap Auto Insurance Quotes in Your Area

Key factors for car insurance costs

- The cost of car insurance varies by state, from $164 per month in Nevada to $30 per month in Wyoming for minimum liability coverage.

- American Family is the cheapest widely available car insurance company, with an average rate of $60 per month for liability-only coverage.

- Teen drivers pay the highest rates, with 18-year-olds paying more than twice as much as 30-year-olds.

- Rates increase by an average of 49% if you cause a car accident and by 88% after a DUI.

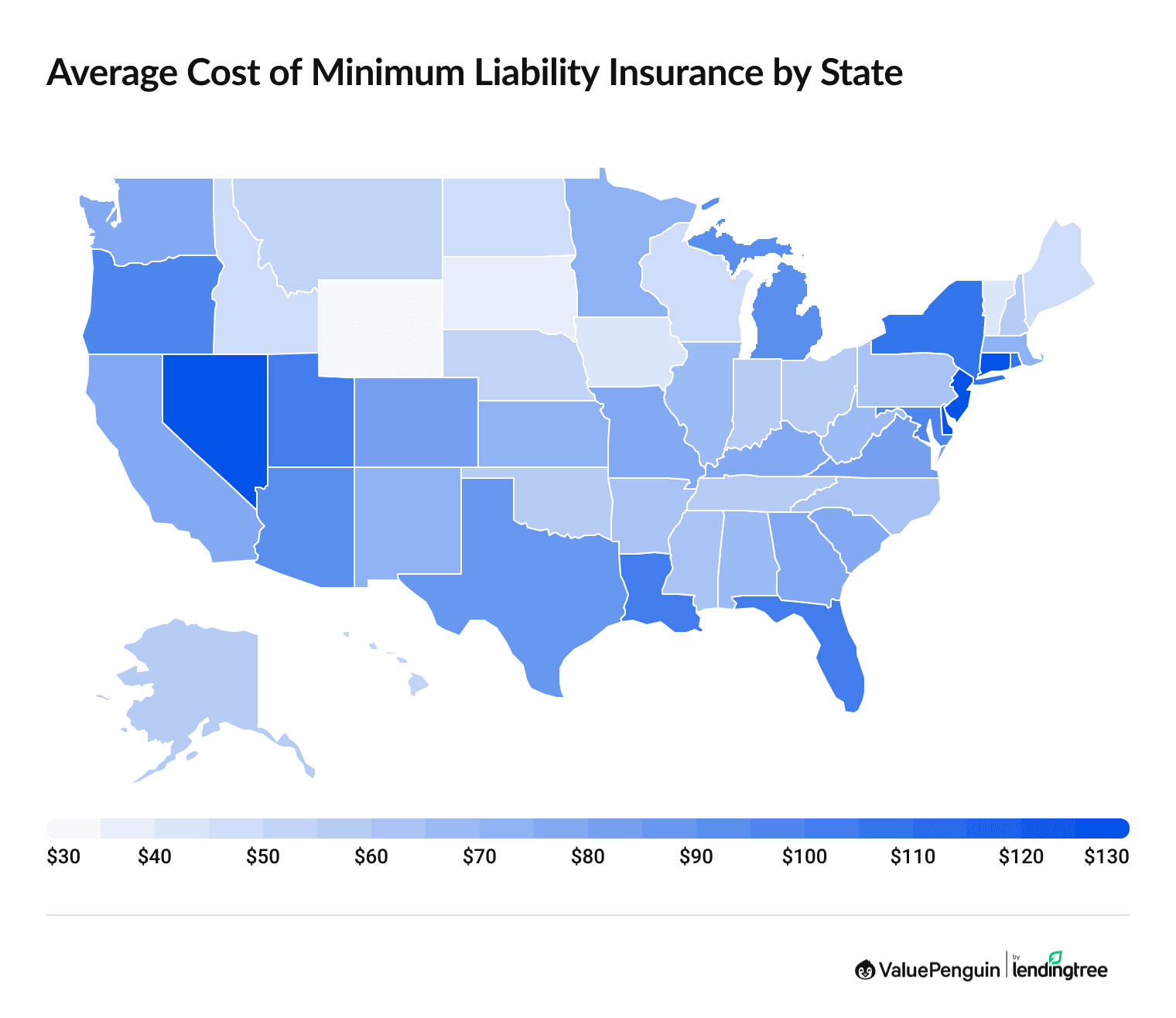

Average car insurance rates by state

Nevada is the most expensive state for auto insurance, at $164 per month for a minimum liability policy and $335 per month for full coverage.

Wyoming is the cheapest state for minimum liability insurance, at $30 per month — five times less than Nevada. The cheapest full coverage quotes can be found in Vermont, where a policy costs an average of $128 per month.

Find Cheap Auto Insurance Quotes in Your Area

How much does car insurance cost in each state?

State | Minimum coverage | Full coverage |

|---|---|---|

| Alabama | $66 | $181 |

| Alaska | $55 | $170 |

| Arizona | $90 | $236 |

| Arkansas | $63 | $225 |

| California | $75 | $221 |

Cheapest states for liability-only car insurance

- Wyoming: $30 per month

- South Dakota: $35 per month

- Vermont: $40 per month

Most expensive states for liability-only car insurance

- Nevada: $164 per month

- Connecticut: $141 per month

- New Jersey: $137 per month

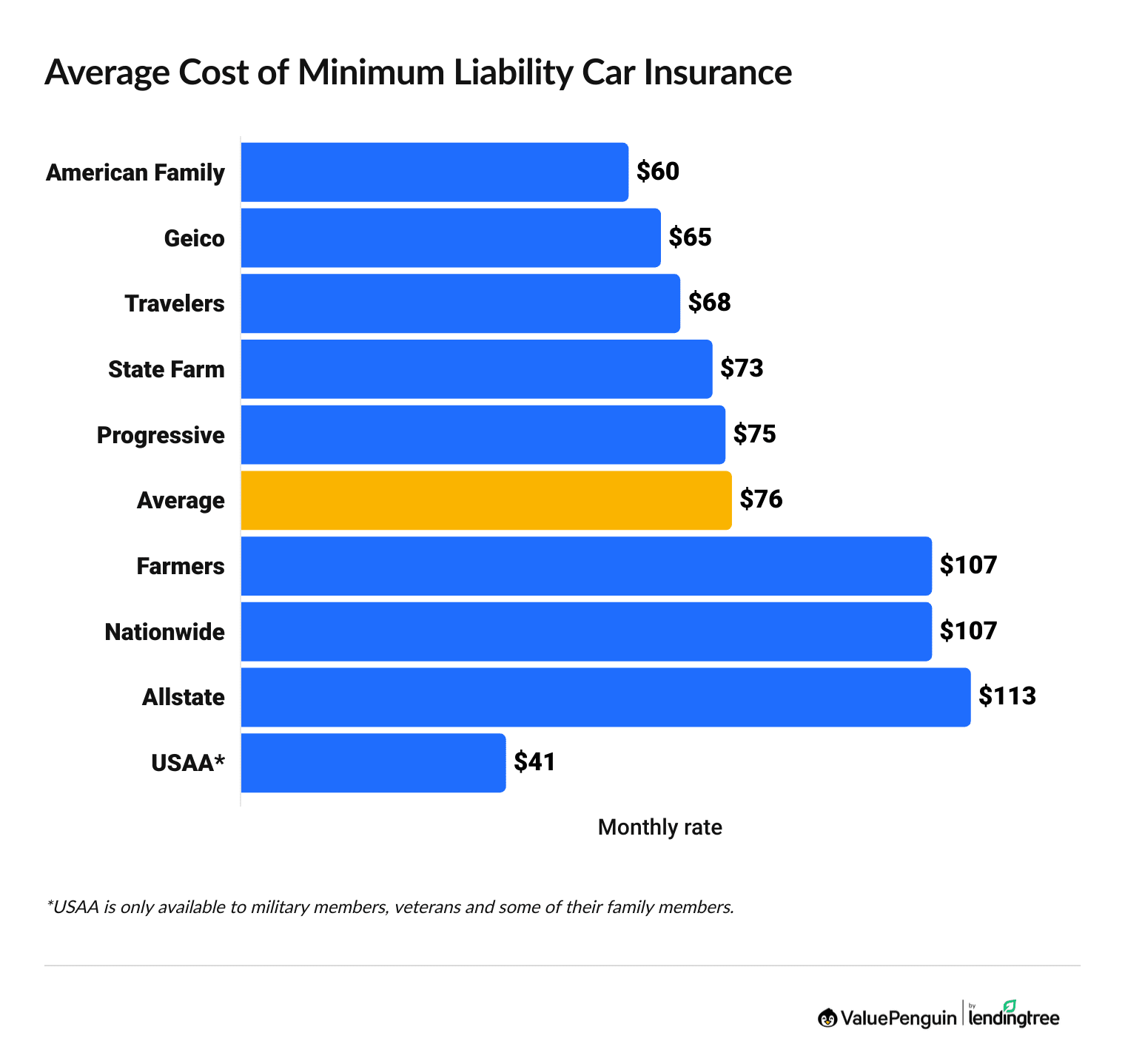

How much does car insurance cost by company?

Minimum liability car insurance costs $60 per month from American Family, the cheapest broadly available car insurance company.

Allstate has the most expensive car insurance quotes for liability-only car insurance, at $113 per month.

Find Cheap Auto Insurance Quotes in Your Area

Monthly car insurance costs by company

Minimum coverage

Full coverage

Company | Monthly rate | |

|---|---|---|

| American Family | $60 | |

| Geico | $65 | |

| Travelers | $68 | |

| State Farm | $73 | |

| Progressive | $75 | |

*USAA is only available to military members, veterans and some of their family members.

A minimum liability policy is the cheapest car insurance you can buy. It only meets the minimum requirements for an auto insurance policy in your state.

A full coverage auto insurance policy costs two and a half times more than liability-only coverage, on average. But full coverage includes comprehensive and collision coverage, which pay for damage to your car. It can also have higher liability limits than your state requires.

How much car insurance costs by age

An 18-year-old driver pays two and a half times as much for auto insurance as a 30-year-old driver.

Young drivers pay more for car insurance because car insurance companies consider your age and experience behind the wheel when calculating your quotes. Younger, less experienced drivers tend to take more risks and get in more accidents, which is why they have higher auto insurance rates.

However, car insurance rates for teen drivers vary widely depending on where you live. In Hawaii, 18-year-olds pay an average of $54 per month for minimum liability insurance, which is only $4 per month more than 30-year-olds pay. But teens in Rhode Island pay an average of $455 per month for minimum liability coverage — four times more than older drivers.

Average car insurance cost per month by age and state

Liability-only insurance

Full coverage insurance

State | 18-year-old | 30-year-old |

|---|---|---|

| Alabama | $203 | $66 |

| Alaska | $163 | $55 |

| Arizona | $267 | $90 |

| Arkansas | $212 | $63 |

| California | $188 | $75 |

Average car insurance costs by gender

Gender plays a big role in car insurance rates for younger drivers.

For drivers 20 and younger, men pay about 10% more than women. As people get older, the difference in price between men and women disappears.

Monthly full coverage insurance rates by age and gender

Age | Men | Women | Difference |

|---|---|---|---|

| 16 | $738 | $680 | 9% |

| 17 | $636 | $581 | 9% |

| 18 | $557 | $508 | 10% |

| 19 | $407 | $373 | 9% |

| 20 | $367 | $338 | 9% |

Rates are based on statewide averages in Illinois, New York, Pennsylvania and Texas.

Why do men have more expensive car insurance?

Insurance companies often charge young men higher rates than young women because they're more likely to file claims. Young men typically:

- Drive more often

- Get more speeding tickets

- Get in more accidents

- Get more DUIs

A few states prevent insurance companies from using gender when setting auto insurance prices. This means that male, female and nonbinary drivers in these states will pay the same rates for car insurance, if all other factors are equal.

- California

- Hawaii

- Massachusetts

- Michigan

- Montana

- North Carolina

- Pennsylvania

How much is the average cost of car insurance by car make and model?

The Subaru Crosstrek is the cheapest new car to insure among the country's top-selling cars, at $211 per month for a full coverage policy.

However, your car insurance costs can change widely based on your vehicle's make and model. For example, full coverage for a new Tesla Model 3 costs $358 per month. That's $147 per month more than a policy for a Subaru Crosstrek.

Average cost of insurance by model

Car | Cost to insure | MSRP |

|---|---|---|

| Subaru Crosstrek | $211 | $25,695 |

| Honda CR-V | $214 | $30,100 |

| Toyota RAV4 | $214 | $31,310 |

| Subaru Outback | $221 | $28,895 |

| Subaru Forester | $222 | $29,995 |

Average monthly rates for full coverage across seven insurance companies in Pennsylvania for a 30-year-old with a clean driving record.

Cars and trucks with lower prices are usually cheaper to insure. Better safety features and a lower chance of a total loss may also make some big or expensive cars cheaper to insure.

Average cost of car insurance with a bad driving record

Traffic tickets and accidents can have a big impact on your car insurance rates.

But the amount your rates will go up depends on the severity of your ticket or accident. For example, one speeding ticket will raise your car insurance rates by an average of 24%, while rates go up by 88% after a DUI.

Where you live also plays a big role in determining your rates after a ticket or accident. Drivers in California see a 44% increase in car insurance rates after one speeding ticket, while people in New York see their rates go up by only around 11%.

Monthly full coverage rates for drivers with bad records

Average cost of auto insurance for drivers with good credit

Drivers with good credit pay 50% less for full coverage car insurance than drivers with poor credit.

Drivers with good credit have a lower risk of filing claims, according to insurance companies. As a result, they can get cheaper auto insurance rates.

Monthly cost of full coverage car insurance by credit score

State | Good credit | Poor credit |

|---|---|---|

| Alabama | $181 | $344 |

| Alaska | $170 | $329 |

| Arizona | $236 | $509 |

| Arkansas | $225 | $444 |

| California | $221 | N/A |

California, Hawaii, Massachusetts and Michigan don't allow insurance companies to use credit scores to determine car insurance rates.

What other factors can affect average car insurance costs?

The factors that have the biggest impact on your car insurance rates are:

Other factors that can affect your car insurance costs are, driving experience, your address and ZIP code, how long you've had car insurance, how much you drive and any discounts you qualify for.

Driving experience: Age affects your car insurance cost, but so do the number of years you've been insured and driving. New drivers tend to pay much more for car insurance than more experienced drivers. That's because new drivers have less time behind the wheel, which may make them more likely to cause accidents.

Location within a state: Within a state, insurance companies consider certain locations to be higher risk. If you live in an area that has more traffic, car crashes, weather damage or crime, you may pay more than the same driver living elsewhere.

Insurance history: If you've had continuous auto insurance coverage for three years or more, your insurance company will usually charge a lower rate.

Claims history: A clean driving record means you'll get cheaper rates than someone who has filed auto insurance claims in the past.

Mileage: People who drive less often are less likely to be in crashes. Vehicles with lower annual mileage may qualify for slightly lower rates.

Discounts: Auto insurance companies offer discounts if you take steps to become a safer driver or show responsible behavior. For example, adults can take defensive driving lessons, while teen drivers can qualify for good student discounts.

How much does auto insurance cost for me?

To get an idea of how much your car insurance should cost, start by using a free online car insurance calculator. Then, use those numbers as a baseline when you shop for car insurance quotes to make sure you're paying a fair price.

To find the best car insurance for you, always comparison shop online or talk to an insurance agent or broker.

When you shop for car insurance online, make sure you're comparing policies with the same amount of coverage and the same features to make an apples-to-apples comparison between companies.

You can also talk to an insurance agent or insurance broker who can help you find the best combination of price and fit. Agents and brokers can compare quotes from multiple companies quickly and offer advice on the types of coverage that make the most sense in your area.

Frequently asked questions

How much is car insurance per month?

The national average cost of insurance in the U.S. is $76 per month for minimum coverage or $208 per month for full coverage. Your rate will vary based on where you live, what kind of coverage you have and your driving history.

How much more expensive is full coverage car insurance?

Depending on your car and driving history, full coverage insurance is typically two to three times the cost of liability-only coverage. That's because full coverage includes collision coverage, which pays for damage to your car in a crash, and comprehensive coverage, which covers other forms of damage such as hail.

Is it normal to pay $200 for car insurance?

Paying $200 per month is fairly average for full coverage car insurance. Around half of states have average full coverage rates above $200 per month. But drivers with recent tickets or accidents on their records will likely pay that amount or more.

Does my car insurance cost go down after my car is paid off?

No. Your car insurance rates are not determined by how much you still owe on your car. However, once your car is paid off, you can drop gap coverage, comprehensive and collision coverage. This will lower your rates, but you'll have less coverage if your car is damaged.

Methodology

To find average car insurance prices, ValuePenguin editors collected quotes across all 50 states and Washington, D.C., for 56 top insurance companies, except where noted. Quotes are for a 30-year-old man with good credit who drives a 2018 Honda Civic EX.

Unless otherwise specified, rates are for a full coverage policy, with limits above any one state's minimum requirements.

Full coverage policy

- Bodily injury (BI) liability: $50,000 per person/$100,000 per accident

- Property damage (PD) liability: $50,000 per accident

- Uninsured/underinsured motorist BI: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

- Personal injury protection: Minimum when required by state

Rates for drivers by gender are from every ZIP code in Illinois, New York, Pennsylvania and Texas. Rates by car model are from Pennsylvania.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.