Average Car Insurance Costs for 21-Year Old Drivers

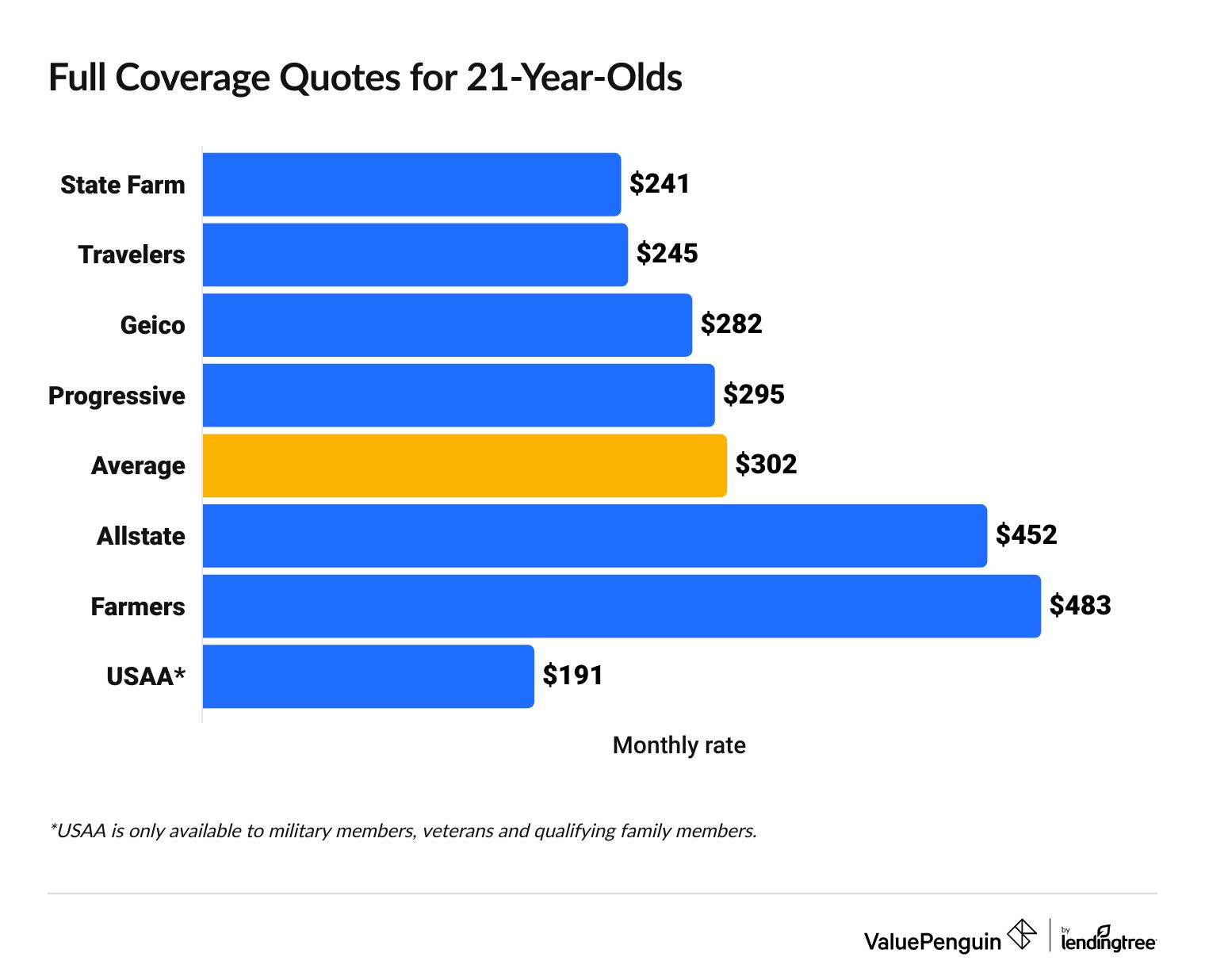

The average cost of car insurance for a 21-year-old is $302 per month for a full coverage policy and $220 per month for minimum liability insurance.

Find Cheap 21-Year-Old Auto Insurance Quotes

State Farm and Progressive are the cheapest major car insurance companies for 21-year-old drivers.

USAA typically offers even cheaper rates, but only drivers with military ties can get insurance from USAA.

How much is car insurance for a 21-year-old?

Full coverage car insurance for a 21-year-old driver costs $302 per month, on average. The average cost of minimum coverage car insurance for 21-year-olds is $220 per month.

Full coverage

Minimum coverage

State Farm has the cheapest full coverage quotes for 21-year-olds, at $241 per month.

Find Cheap 21-Year-Old Auto Insurance Quotes

Some 21-year-olds can get even cheaper rates at USAA. Full coverage from USAA costs $191 per month for a 21-year-old, on average. But you can only get USAA insurance if you are in the military, are a veteran or have a family member who serves or is a veteran.

Cheap full coverage insurance for 21-year-olds

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $241 | ||

| Travelers | $245 | ||

| Geico | $282 | ||

| Progressive | $295 | ||

| Allstate | $452 | ||

USAA is only available to military members, veterans and their families.

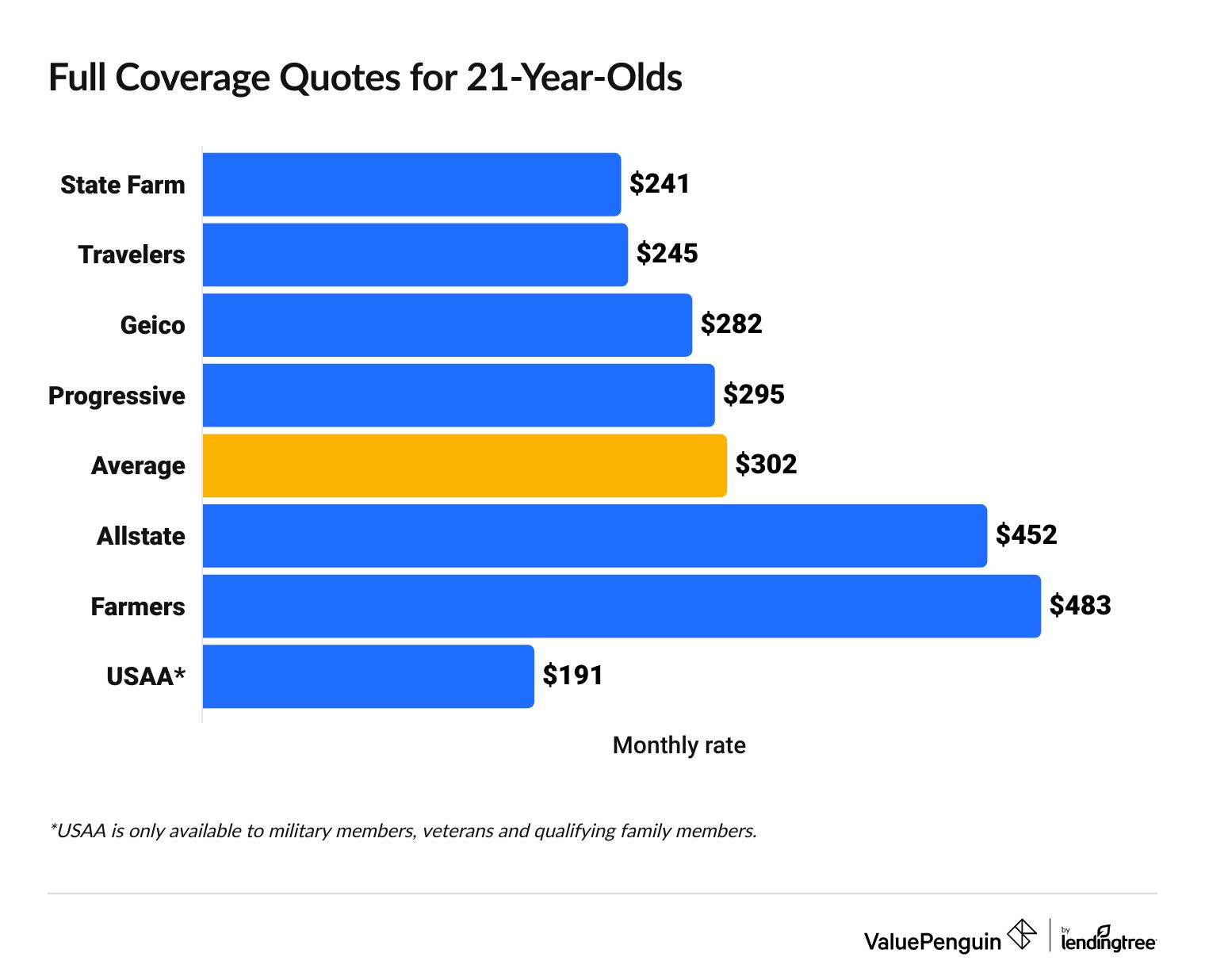

Full coverage

State Farm has the cheapest full coverage quotes for 21-year-olds, at $241 per month.

Find Cheap 21-Year-Old Auto Insurance Quotes

Some 21-year-olds can get even cheaper rates at USAA. Full coverage from USAA costs $191 per month for a 21-year-old, on average. But you can only get USAA insurance if you are in the military, are a veteran or have a family member who serves or is a veteran.

Cheap full coverage insurance for 21-year-olds

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $241 | ||

| Travelers | $245 | ||

| Geico | $282 | ||

| Progressive | $295 | ||

| Allstate | $452 | ||

USAA is only available to military members, veterans and their families.

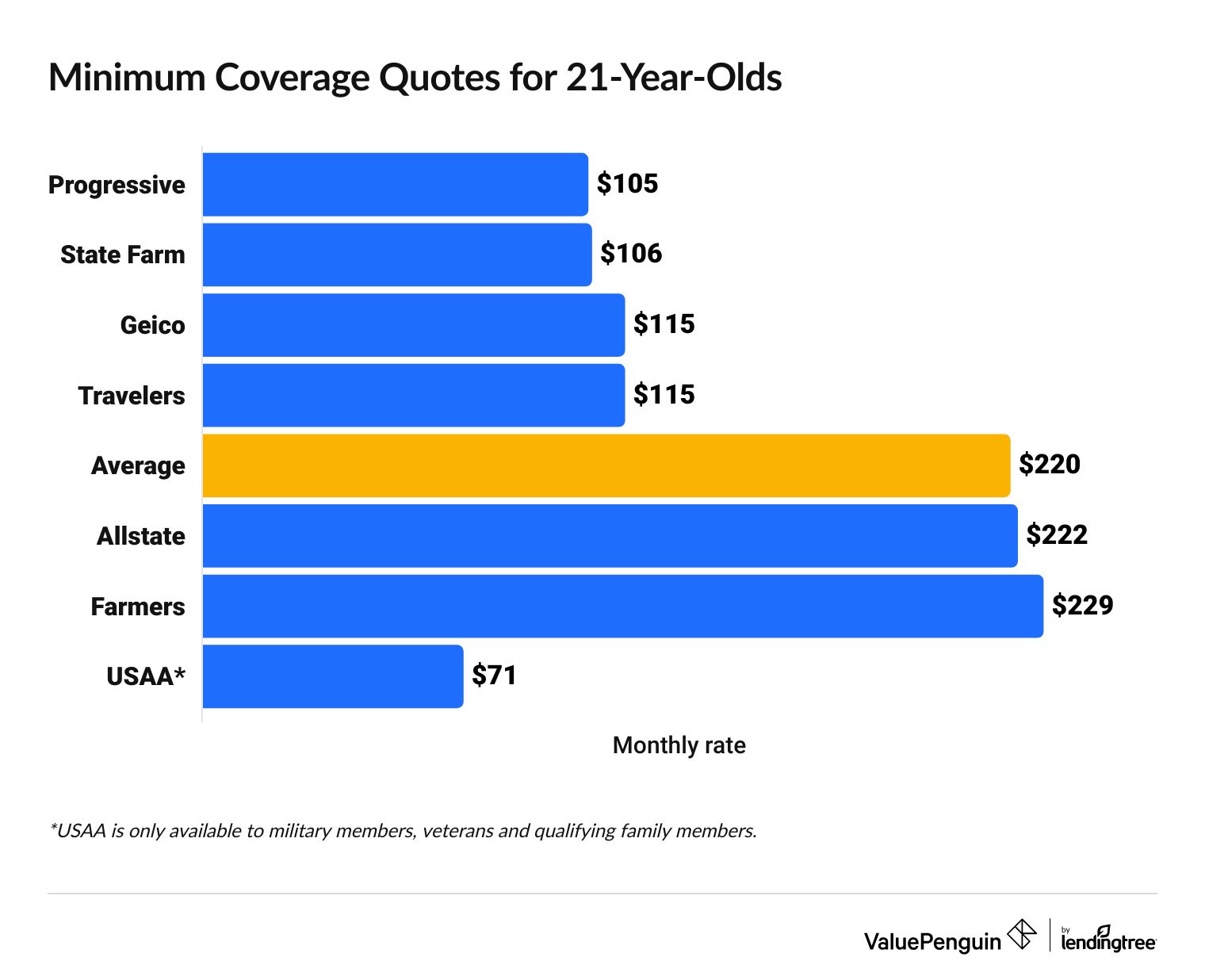

Minimum coverage

Progressive has the most affordable minimum liability insurance, at $105 per month.

However, Progressive doesn't have great customer service reviews.

A policy from State Farm only costs an average of $1 per month more, and it has much better customer service. It may be worth spending a little extra for the peace of mind that your car will be fixed quickly after a crash.

Find Cheap 21-Year-Old Auto Insurance Quotes

USAA offers the absolute cheapest minimum liability quotes for 21-year-olds, at just $71 per month. But only military members, veterans and some of their family members can buy insurance from USAA.

Cheapest minimum liability insurance for 21-year-olds

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $106 | ||

| Travelers | $115 | ||

| Geico | $115 | ||

| Progressive | $105 | ||

| Allstate | $222 | ||

USAA is only available to military members, veterans and their families.

Does car insurance go down at 21?

When you turn 21, you can expect your car insurance rates to go down by around 14%, as long as you have a clean driving record.

Car insurance rates usually go down as you get older, and just a few years can result in big savings for young drivers. By the time you're 25 years old, you'll pay an average of 27% less for a full coverage policy than you did as a 21-year-old.

Young drivers typically pay more for car insurance than older drivers because companies consider them higher risk. That's because younger drivers have less experience behind the wheel, so they tend to get into more accidents and file more claims.

Car insurance for 21-year-old men vs. women

On average, 21-year-old men pay $20 more per month for full coverage insurance than women.

A full coverage policy costs $312 per month for a 21-year-old man. In comparison, a 21-year-old woman pays $292 per month for the same coverage. That's because young men tend to get in more accidents than young women, which makes them riskier to insure.

The cheapest company is also different for 21-year-old men and women. Travelers has the cheapest rates for most 21-year-old men, at $255 per month for full coverage. Women can find the cheapest rate at State Farm, where a full coverage policy costs around $225 per month.

Monthly full coverage car insurance quotes

Company | Male | Female | |

|---|---|---|---|

| Travelers | $255 | $234 | |

| State Farm | $257 | $225 | |

| Geico | $297 | $267 | |

| Progressive | $306 | $285 | |

| Allstate | $458 | $446 | |

In some states, insurance companies aren't allowed to use gender to determine car insurance rates. Men and women should pay the same price for auto insurance coverage in these states, all else being equal.

- California

- Hawaii

- Massachusetts

- Michigan

- Montana

- North Carolina

- Pennsylvania

How much is car insurance for 21-year-olds by state?

Car insurance quotes for 21-year-old drivers will usually be different depending on where you live.

For example, 21-year-olds in Texas pay an average of $330 per month for a full coverage policy, while those in Pennsylvania pay $269 per month for the same coverage. That's a difference of $60 per month.

State | Monthly rate |

|---|---|

| Pennsylvania | $269 |

| Illinois | $296 |

| New York | $314 |

| Texas | $330 |

Find the cheapest insurers for young drivers in your state

How to get cheap car insurance as a 21-year-old

There are four main ways to save money on car insurance as a 21-year-old driver.

Share a policy with your parents

The best way to pay less for car insurance as a 21-year-old driver is to stay on a car insurance policy with your parents. A shared family policy is typically much cheaper than paying for two individual policies.

Shop around for multiple quotes

Comparing quotes from multiple companies can save you a lot of money. The most expensive company for 21-year-olds, Farmers, charges twice as much for full coverage insurance as the cheapest company, State Farm. That could add up to a savings of over $2,900 per year.

Companies determine your rate based on lots of factors, like where you live, the car you drive and your driving history. That's why the company that offers you the best rate may be different from your friends or family members.

Check for discounts

It's important for 21-year-old drivers to take advantage of all available discounts. That could mean taking a driver training class to earn extra savings or keeping your grades up in school.

Young drivers who practice good habits on the road, like staying off their phone in the car and avoiding late-night driving, can save money with usage-based programs. These programs use a mobile app or a device that plugs into your car to share your driving habits with your insurance company. Then, the company uses that info to calculate your discount. Just be careful about which company you choose, as some — including Allstate, Geico and Progressive — will raise your rates if you have bad driving habits.

Consider less coverage

It's important to have enough car insurance coverage to protect you if you're in a major accident. But you may be paying for coverage you don't need.

For example, if your car is worth less than $5,000 or is more than eight years old, you should consider canceling your comprehensive and collision coverage. That's because the amount you spend to have your insurance company pay for repairs could be more than your car is worth.

If you have a car loan or lease and are required to have comprehensive and collision, you can save money by raising your deductible. A higher deductible means you'll pay more if you're in an accident, which is why your insurance policy will cost less.

But it's important to choose a deductible you can afford to pay after a crash.

Frequently asked questions

How much is car insurance for a 21-year-old monthly?

Full coverage car insurance costs an average of $302 per month for 21-year-old drivers. A minimum liability policy costs $220 per month, on average.

Who has the cheapest car insurance for 21-year-olds?

State Farm has the cheapest full coverage car insurance for 21-year-olds, at $241 per month. Progressive has the most affordable minimum liability coverage, at $105 per month.

Will my car insurance get cheaper when I turn 21?

Yes, car insurance rates generally go down by an average of 14% after you turn 21. However, you may see a smaller decrease if you have speeding tickets or accidents on your record.

Methodology

To find the cost of car insurance for 21-year-olds, ValuePenguin collected quotes from thousands of ZIP codes across four of the most populous states in the U.S. Rates are for 21-year-old men and women with clean driving records and good credit scores who own a 2015 Honda Civic EX.

Full coverage quotes include higher liability limits than the state requirements, along with collision and comprehensive coverage.

- Bodily injury liability: $50,000 per person; $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person; $100,000 per accident

- Personal injury protection (PIP): Minimum, when required by state

- Comprehensive and collision deductible: $500 deductible

ValuePenguin's analysis collected insurance rate data from Quadrant Information Services. The rates used to calculate the averages were sourced publicly from insurance company filings. These averages should only be used for comparative purposes. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.