Best Cheap Car Insurance Quotes in Washington (2025)

State Farm has the best cheap car insurance in Washington, at $98 per month for full coverage.

Find Cheap Auto Insurance Quotes in Washington

Best cheap car insurance in Washington state

How we chose the top companies

Best and cheapest car insurance in Washington

- Cheapest full coverage: State Farm, $98/mo

- Cheapest minimum liability: State Farm, $37/mo

- Cheapest for young drivers: State Farm, $115/mo

- Cheapest after a ticket: State Farm, $107/mo

- Cheapest after an accident: State Farm, $115/mo

- Cheapest for teens after a ticket: State Farm, $64/mo State Farm, $128/mo

- Cheapest after a DUI: American Family, $161/mo

- Cheapest for poor credit: American Family, $128/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

State Farm has the best mix of reliable customer service and cheap quotes in Washington.

Washington drivers should also compare quotes from American Family and Geico. Both companies have affordable rates, but their customer service isn't typically as good as State Farm's.

Cheapest Washington car insurance: State Farm

State Farm has the cheapest full coverage quotes in Washington.

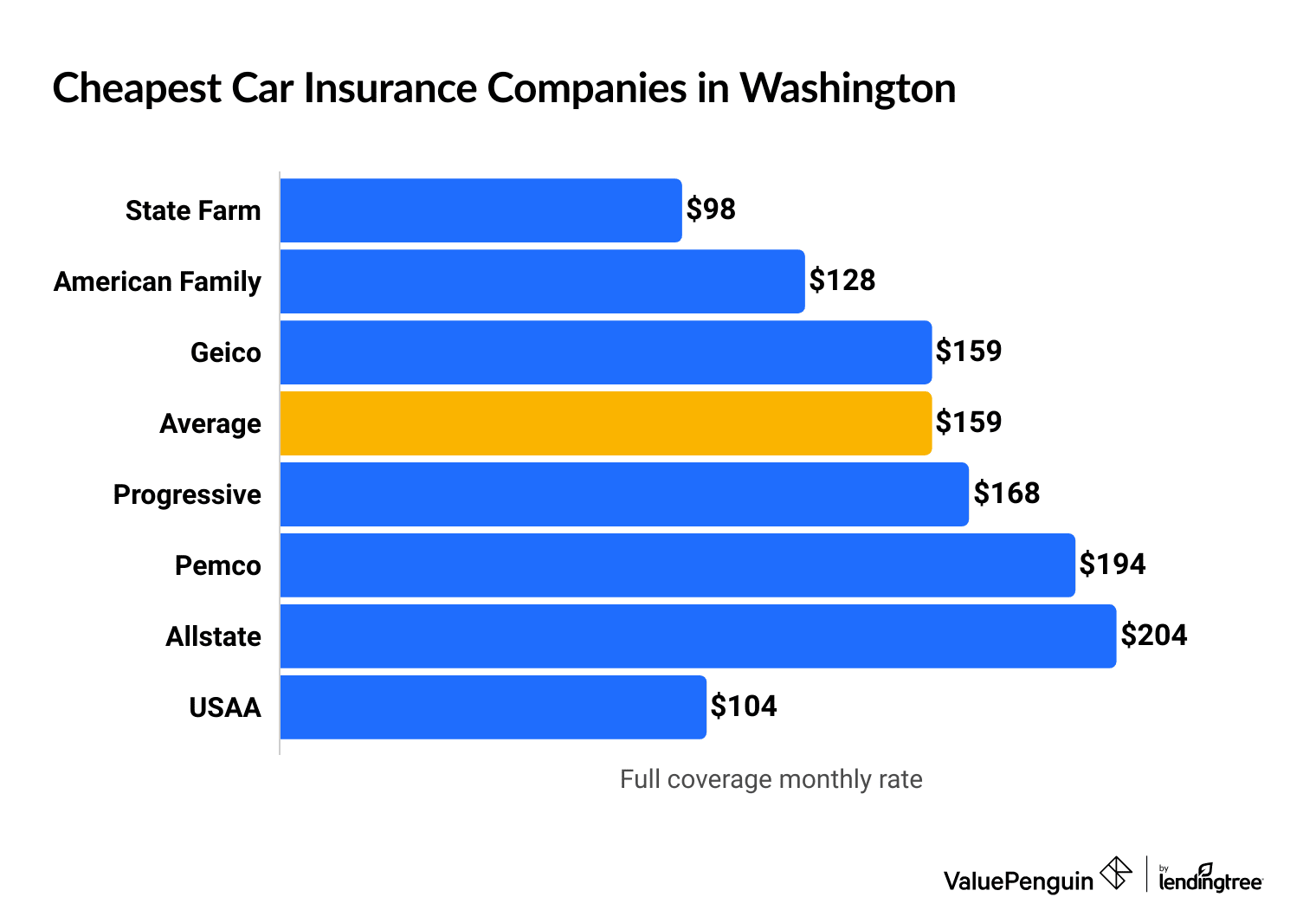

At $98 per month, full coverage from State Farm is $61 per month less than the state average. The average cost of car insurance in Washington state is $159 per month for a full coverage policy.

Find Cheap Auto Insurance Quotes in Washington

Military members, veterans and some of their family members can also find cheap quotes from USAA, where full coverage costs just $104 per month.

Best cheap full coverage car insurance in Washington state

Company | Monthly rate | |

|---|---|---|

| State Farm | $98 | |

| American Family | $128 | |

| Geico | $159 | |

| Progressive | $168 | |

| Pemco | $194 |

*USAA is only available to current and former military members and their families.

Cheapest liability auto insurance in Washington state: State Farm

State Farm is the cheapest company in Washington state for minimum coverage car insurance.

A State Farm policy costs an average of $37 per month, which is $26 per month less than the overall state average.

USAA has even cheaper rates, at just $28 per month for a minimum liability policy. However, only military members, veterans and some of their family members can get car insurance from USAA.

Cheap minimum auto insurance in Washington state

Company | Monthly rate |

|---|---|

| State Farm | $37 |

| Pemco | $40 |

| Geico | $64 |

| American Family | $67 |

| Progressive | $71 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Washington

Cheapest auto insurance in WA for young drivers: State Farm

State Farm offers the most affordable quotes for young drivers in Washington.

A minimum liability policy from State Farm costs $115 per month for an 18-year-old driver. That's $77 per month cheaper than the Washington state average.

Teen drivers can also find the cheapest full coverage insurance at State Farm. A policy costs $276 per month, which is $171 per month less than the state average.

Cheapest Washington state car insurance for teens

Company | Liability only | Full coverage |

|---|---|---|

| State Farm | $115 | $276 |

| Pemco | $129 | $549 |

| American Family | $157 | $286 |

| Progressive | $190 | $479 |

| Geico | $198 | $460 |

*USAA is only available to current and former military members and their families.

In Washington, 18-year-old drivers pay three times as much for car insurance as 30-year-olds. That's because their lack of experience behind the wheel typically leads to more accidents.

Young drivers can get the best car insurance rates by sharing a policy with their parents, which can save them around 62%.

Many companies also have discounts geared towards young drivers. For example, you can earn a discount with State Farm's Steer Clear program when you take online safety courses and practice driving with a mentor.

Best auto insurance in Washington state after a ticket: State Farm

State Farm had the cheapest quotes for Washington drivers with a speeding ticket on their record. A full coverage policy from State Farm costs $107 per month, which is $93 per month less than the Washington average.

Cheapest WA state auto insurance after a speeding ticket

Company | Monthly rate |

|---|---|

| State Farm | $107 |

| American Family | $161 |

| Allstate | $225 |

| Pemco | $226 |

| Progressive | $237 |

*USAA is only available to current and former military members and their families.

In Washington state, car insurance rates go up by 26% after one speeding ticket. That's an average increase of $41 per month for a full coverage policy.

Cheapest WA state car insurance after an accident: State Farm

State Farm has the cheapest quotes for Washington drivers with an accident on their record. At $115 per month, full coverage auto insurance from State Farm is half the state average, which is $230 per month.

Cheap auto insurance in Washington after an accident

Company | Monthly rate |

|---|---|

| State Farm | $115 |

| American Family | $203 |

| Pemco | $239 |

| Geico | $262 |

| Farmers | $290 |

*USAA is only available to current and former military members and their families.

Washington drivers see an increase of around 45% in the price of car insurance after a single accident.

Don't shop for a new policy right after your accident. Your rates won't go up until your current policy renews. But any quotes you get now will include your accident, so they'll probably be more expensive than what you're currently paying.

Instead, wait until you get your renewal offer in the mail a few weeks to a month before your current policy expires. Then, compare quotes from multiple companies to find the best price for you.

Cheapest WA auto insurance for teens with a ticket or accident: State Farm

State Farm has the most affordable quotes for young drivers in Washington with a speeding ticket or accident.

Teen drivers with a speeding ticket pay around $128 per month for minimum coverage from State Farm. That's $99 per month less than the average price in Washington.

Minimum coverage from State Farm costs $141 per month after an accident, which is $124 per month less than the state average.

Cheap car insurance in WA state for teens with a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| State Farm | $128 | $141 |

| Pemco | $136 | $142 |

| American Family | $186 | $258 |

| Progressive | $220 | $245 |

| Geico | $274 | $308 |

*USAA is only available to current and former military members and their families.

A single speeding ticket can cause rates for teenage drivers to go up by 18% on average. After an accident, car insurance quotes go up by 37% for 18-year-old drivers in Washington.

Affordable Washington state car insurance after a DUI: American Family

American Family has the cheapest car insurance for drivers in Washington with a DUI. A full coverage policy from American Family costs $161 per month, which is $83 per month less than the average cost of DUI insurance in Washington state.

Cheapest car insurance in Washington state after a DUI

Company | Monthly rate |

|---|---|

| American Family | $161 |

| Progressive | $209 |

| State Farm | $224 |

| Geico | $247 |

| Pemco | $271 |

*USAA is only available to current and former military members and their families.

Washington drivers can expect their rates to increase by an average of 53% after a DUI.

Most drivers must also get SR-22 insurance after a DUI. Insurance companies typically charge between $15 and $50 to file an SR-22 form on your behalf. That fee is in addition to any increase in your care insurance rates.

Cheapest car insurance in WA for drivers with poor credit: American Family

American Family has the cheapest car insurance in Washington state for drivers with a poor credit score. Full coverage from American Family costs around $128 per month, which is $79 per month less than the Washington average.

Best Washington state auto insurance quotes for poor credit

Company | Monthly rate |

|---|---|

| American Family | $128 |

| Geico | $159 |

| Progressive | $168 |

| State Farm | $201 |

| Farmers | $217 |

*USAA is only available to current and former military members and their families.

In Washington, drivers with poor credit pay 30% more for car insurance than those with a good credit score. That's because car insurance companies factor in data that indicates that drivers with poor credit scores are more likely to file a claim in the future.

Best car insurance in Washington state

USAA has the best auto insurance in Washington state because it offers a great combination of reliable customer service and cheap quotes.

However, USAA is only available to current and former military members and their spouses and children, so most people can't buy a policy.

State Farm is the best choice if you can't get USAA. State Farm has good customer service and some of the lowest rates in Washington state.

Top auto insurance companies in Washington state

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 739 | A++ | |

| State Farm | 657 | A++ | |

| Geico | 637 | A++ | |

| Pemco | 666 | B++ | |

| American Family | 660 | A |

Average cost of car insurance in Washington by city

Boulevard Park, a Seattle suburb, has the most expensive car insurance in Washington state.

Drivers living in Boulevard Park pay an average of $202 per month for a full coverage policy.

Hay, a small community near the Snake River, has the most affordable car insurance rates in Washington, at $127 per month.

Average car insurance quotes in Washington by city

City | Monthly Rate | % from average |

|---|---|---|

| Aberdeen | $140 | -7% |

| Acme | $143 | -5% |

| Addy | $147 | -2% |

| Adna | $146 | -3% |

| Ahtanum | $139 | -7% |

What insurance is required in WA state?

Drivers in Washington state must have a minimum amount of liability insurance to drive legally, which is sometimes written as 25/50/10.

- Bodily injury (BI) liability: $25,000 per person and $50,000 per accident

- Property damage (PD) liability: $10,000 per accident

The state of Washington requires all insurance companies to automatically include personal injury protection (PIP) coverage on every insurance policy, but you can reject it in writing. If you decide to keep it, you can choose between $10,000 or $35,000 per accident.

What's the best car insurance to get in Washington?

Most drivers should choose full coverage auto insurance over minimum coverage.

That's because a full coverage policy protects your car with comprehensive and collision coverage.

- Collision coverage pays for damage to your car after a crash, whether it's with another car, a building, or a stationary object like a pole.

- Comprehensive coverage pays for damage outside of your control, like damage from hail or a tree branch falling on your car.

For that reason, most lenders require you to have collision and comprehensive coverage if you have a car loan or lease. It's also a good idea if your car is less than eight years old or worth more than $5,000.

In addition, you may want to choose higher liability limits than the state requirement. This is important because the minimum limits may not be high enough to cover the cost of a serious accident.

For example, if you crash into a brand new Tesla and total it, $10,000 of property damage liability insurance won't be enough to replace it. So if you have minimum coverage insurance, you'll have to pay the difference.

Alternatives to car insurance

An auto insurance policy is typically the easiest way to satisfy Washington State's mandatory motor vehicle insurance law. However, there are three other ways residents can satisfy the requirements without buying a policy:

We don't recommend these options for most drivers because should you get into an accident, you could easily end up owing more for any damage you cause.

Frequently asked questions

How much is car insurance per month in Washington?

Full coverage car insurance in Washington costs $159 per month, on average. A minimum liability policy costs an average of $62 per month.

What's the best auto insurance in Washington state?

USAA has the best car insurance in Washington state. It has affordable rates, dependable customer service and useful coverage options. However, USAA is only available to current military members, veterans and their spouses or children. Otherwise, State Farm has the best widely available insurance in Washington.

How much is car insurance in Seattle?

Full coverage car insurance in Seattle costs an average of $187 per month. That's $28 per month more expensive than the average in Washington state.

What car insurance do I need in WA?

Washington requires drivers to have minimum bodily injury limits of $25,000 per person and $50,000 per accident, along with $10,000 in property damage liability insurance, to drive legally.

Methodology

To find the cheapest auto insurance in Washington state, ValuePenguin collected thousands of rates from ZIP codes across WA for the state's largest insurance companies. Rates are for a 30-year-old man who owns a 2015 Honda Civic EX with good credit.

Quotes are for a full coverage policy with more liability coverage than the state minimum.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection (PIP): $10,000

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.