Bodily Injury Car Insurance Coverage: How Does It Work?

If you cause a car crash in which someone else is injured, your bodily injury liability (BI or BIL) insurance pays for expenses related to injuries they sustain in the crash.

It is one of the two forms of liability car insurance coverage that pay for any damage you cause other drivers.

Nearly every state sets a minimum requirement for bodily injury coverage to demonstrate your financial responsibility on the road, such as $25,000 per person. But consumers have the option to buy coverage beyond the legal minimum.

What does bodily injury coverage pay for?

Bodily injury liability insurance pays for injuries you cause to another driver if you are at fault in the accident. It includes medical bills as well as lost wages and even funeral costs if applicable.

Bodily injury does not cover the medical costs of injuries you may get in the accident. It is considered "third-party" insurance since it only pays for damage to other drivers and passengers (you're the "first party").

What is covered under bodily injury coverage

The types of expenses a third party can file against your bodily injury liability policy include:

- Medical bills: For the other party's hospitalization, follow-up care and related medical or health care.

- Lost wages: If the harmed party was seriously injured and unable to work, your bodily injury liability coverage makes up for their lost income. This amount will be based upon the amount of time they are unable to work as a result of the injury, and subject to various limits based on where you live.

- Legal fees: This is the one item where bodily injury pays for your expenses instead of the third party. Your insurer will usually provide legal defense for you if you are sued by the other party, and that's paid for under your own bodily injury coverage.

- Funeral costs: Pays for costs associated with funeral and burial if someone is killed as a result of the crash.

How to understand bodily injury liability limits

Your bodily injury coverage is stated in part of a three-number format such as "25/50/25." In the three-number format, the first two numbers are the bodily injury coverage limits and the third is for property damage, a separate type of coverage.

The first number is the amount of coverage for one person in the accident, while the second number represents the amount covered in the entire accident. So, for example, if you are quoted a 25/50 limit for bodily injury, it means that the insurance policy will cover up to a maximum of $25,000 per person injured in an accident and a total of $50,000 in claims for a single accident.

We'll look at two examples to explain how bodily injury liability works.

- You were deemed at fault for an accident in which two people in the other vehicle were injured. Person A had medical expenses of $30,000, while Person B had medical expenses of $10,000. While the combined medical bills are within the $50,000 limit per accident, your auto insurance policy will only pay Person A $25,000, and Person B $10,000. That's because Person A's expenses exceeded the per-person limit, leaving you on the hook for the $5,000 of the unpaid claim.

- You were at fault for an accident in which two people were injured. Both made medical expense claims of $25,000 each. Because both the individual claims are within the $25,000 and the combined claim is less than or equal to $50,000, the insurance policy will cover these expenses.

Combined single limit (CSL) is another — and less common — type of limit consumers may purchase. Unlike the split limit, CSL has one limit that applies to the whole accident and is not constrained by the number of injured people. The flexibility of CSL makes this type of limit more expensive, and not every car insurance company provides this option.

Minimum bodily injury liability requirements by state

Each state has a minimum amount of coverage you are required to have as part of your auto insurance. The most common minimum BIL limit is $25,000 per person, but your state may have a different minimum. Florida doesn't even require this coverage.

State minimums for bodily injury liability are displayed in the following table:

State | Min. Coverage | State | Min. Coverage |

|---|---|---|---|

| $25,000/$50,000 | Montana | $25,000/$50,000 | |

| $50,000/$100,000 | Nebraska | $25,000/$50,000 | |

| $15,000/$30,000 | Nevada | $25,000/$50,000 | |

| $25,000/$50,000 | New Hampshire | $25,000/$50,000 | |

| $15,000/$30,000 | New Jersey | $25,000/$50,000 | |

| $25,000/$50,000 | New Mexico | $25,000/$50,000 | |

| $25,000/$50,000 | New York | $25,000/$50,000 | |

| $25,000/$50,000 | North Carolina | $30,000/$60,000 | |

|

District of Columbia | $25,000/$50,000 | North Dakota | $25,000/$50,000 |

| None | Ohio | $25,000/$50,000 | |

| $25,000/$50,000 | Oklahoma | $25,000/$50,000 | |

| $20,000/$40,000 | Oregon | $25,000/$50,000 |

How much bodily injury liability coverage should you have?

You should get limits that match the value of assets you have, or the highest limits you can afford. That's because if your car insurance isn't enough to pay for the damage you cause, the other driver may take you to court and sue for the remainder. If the judges rule in their favor, your assets may be liquidated to pay for the court damages.

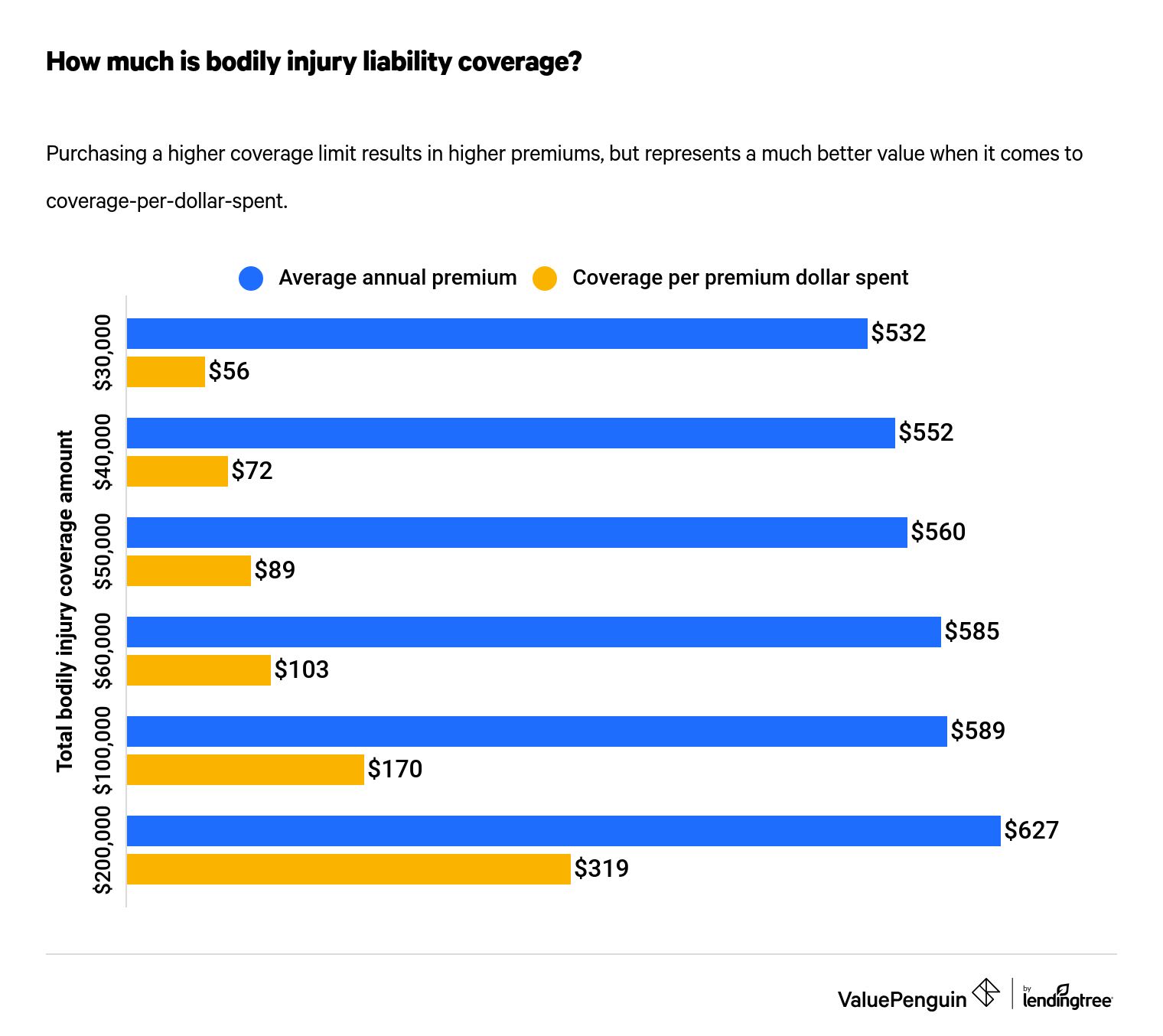

Higher liability limits provide much more protection, without significant cost.

We found that doubling your bodily injury liability coverage from 25/50 to 50/100 results in a rate increase of only 18%. For each additional dollar you spend, you get an extra $419 in protection.

- If you have limited assets — meaning you don't have a lot of money stored in bank accounts, retirement accounts or other funds — it's likely that the other party will be willing to settle a claim for what the insurance company pays out. You don't have as much risk in a lawsuit when there are fewer assets to spare.

- On the other hand, if you are wealthy or have savings or investments, your financial risk and exposure in an accident increases. If you pick low limits, more of your assets are exposed when an accident results in hundreds of thousands of dollars in damages.

How much does bodily injury liability car insurance cost?

Bodily injury liability insurance gets cheaper the more coverage you buy. A state minimum coverage policy in Pennsylvania with $15,000 per person/$30,000 per accident of bodily injury coverage costs $532 on average. However, buying bodily injury coverage that's more than six times more generous ($100,000/$200,000) increased our sample driver's rates by only 18%, to $627 per year.

Find Cheap Auto Insurance Quotes in Your Area

Bodily injury liability car insurance costs

BI coverage limit | Annual cost | Coverage per premium dollar spent |

|---|---|---|

| $15,000/$30,000 (state minimum) | $532 | $56 |

| $20,000/$40,000 | $552 | $72 |

| $25,000/$50,000 | $560 | $89 |

| $30,000/$60,000 | $585 | $103 |

| $50,000/$100,000 | $589 | $170 |

| $100,000/$200,000 | $627 | $319 |

All quotes are for liability-only policies in Pennsylvania with $5,000 of property damage liability coverage.

How to file a bodily injury liability claim

BI claims are considered "third-party claims," which means you are filing a claim against the at-fault driver’s insurance company.

In order to make sure a reasonable amount of your expenses are paid for, you will be required to document and keep a record of the accident. Before making a claim, you should be prepared to provide:

- A detailed description of what happened

- Photos of the scene and any injuries you sustained

- Records of medical examinations and any bills from doctors and health care providers

- Receipts of all related expenses

- Proof of lost wages: If the injuries you sustained caused you to miss work and potential income, documentation of this from your employer is necessary

After making a claim:

- You should hear back within a set time frame, as determined by your state and policy, or get an explanation for any delay.

- Be prepared to discuss the incident. A liability claim examiner or adjuster may want clarification to assess the sustained injuries as well as the cost of the claim.

- Your right to collect compensation for your claim may have a time limit as well: You may be required to accept a settlement within the required time frame as regulated by state law. You can either accept the offer or file a lawsuit if you do not agree with the settlement.

- Sign the release form only if you are ready: As part of the process, the insurance company will ask you to waive all future rights to pursue the person and company for further payments after settlement. You should take into account future medical bills and any expenses that might arise. Ask an attorney to review the settlement and release.

How much is the average bodily liability claim worth?

Compared with property damage liability claims, which have averaged around $3,600 per claim over the last 10 years, bodily injury claims tend to be significantly higher.

In 2019, the average bodily injury claim was $18,417 as reported by Insurance Services Office Inc. (ISO). Bodily injury claims tend to be relatively infrequent, however, with only 1.1% of policies experiencing a claim that year. Based on this data, most bodily injury claims fall within reach of the minimum coverage limits required by the states, with a few exceptions, such as Florida.

This should not be used as the sole piece of information in determining your limit, however. These numbers do not indicate a wide range of claim amounts, ranging from the fortunately low to catastrophically high claims.

Year | Average bodily injury claim amount |

|---|---|

| 2010 | $14,406 |

| 2011 | $14,848 |

| 2012 | $14,690 |

| 2013 | $15,441 |

| 2014 | $15,384 |

| 2015 | $16,046 |

| 2016 | $16,149 |

| 2017 | $16,075 |

| 2018 | $17,164 |

| 2019 | $18,417 |

Frequently asked questions

What is bodily injury liability coverage?

Bodily injury coverage pays for financial damage to others that occurs as a result of a car crash that you're responsible for. This could include medical bills, lost wages and legal fees.

Do I need bodily injury liability coverage?

In most cases, yes. Every state except Florida requires BI liability coverage in order to register a car.

How much bodily injury coverage should I buy?

You will definitely need to buy at least enough to meet the minimum required amount in your state, but we recommend drivers buy more based on their net worth and how often they drive, as a few extra dollars per year could save you tens of thousands if you're ever in an at-fault crash.

Is bodily injury coverage expensive?

The cost of BI liability coverage depends on how much you buy, as well as other factors like your driving history. The more coverage you buy, the better the deal. For example, while the average cost of a legal minimum insurance policy is $532 per year in Pennsylvania, doubling your BI coverage only increases your premium by about 10%.

Sources

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only, as your quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.