Who Has the Cheapest Auto Insurance Quotes in Seattle, WA?

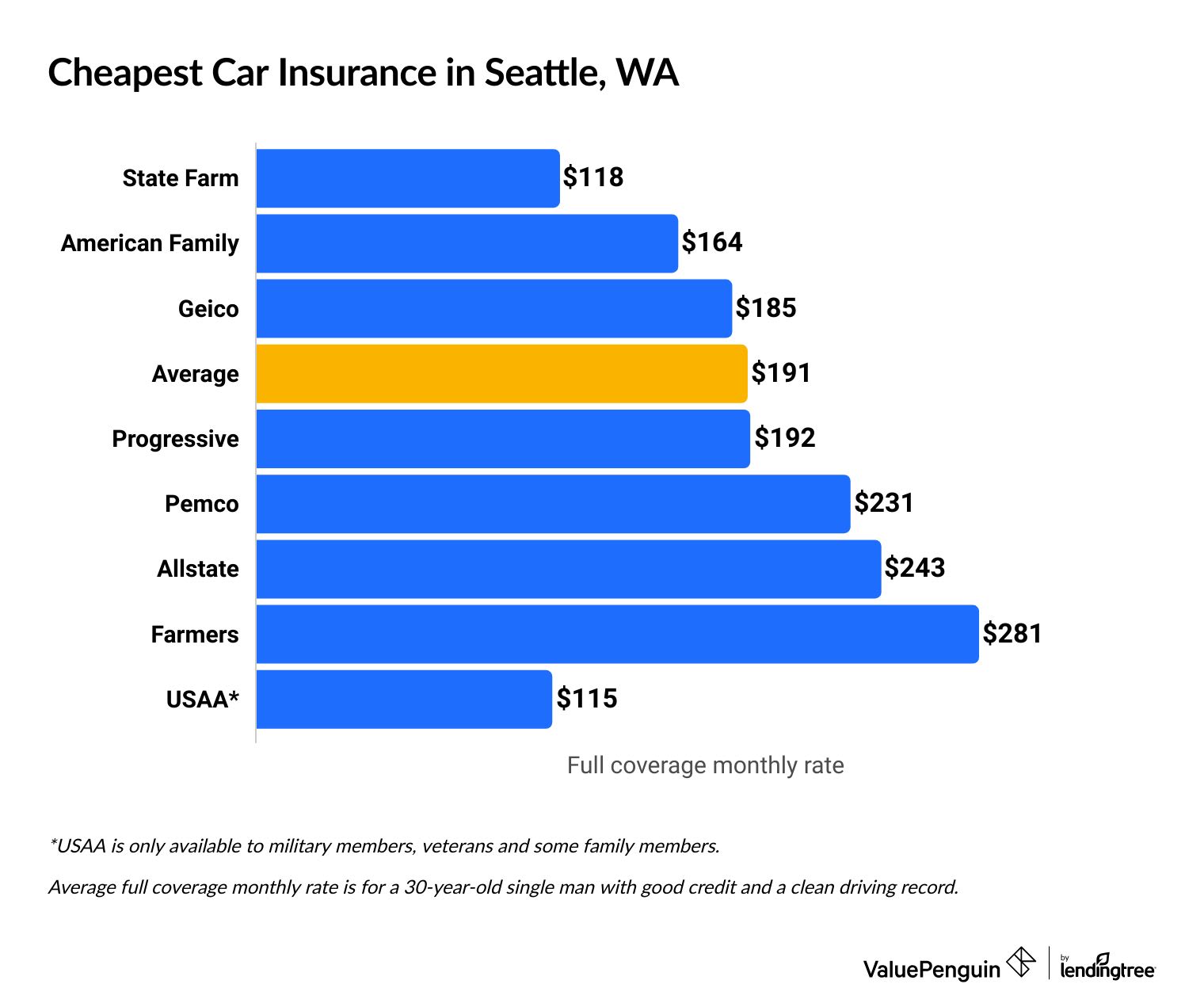

State Farm has the cheapest car insurance in Seattle. A full coverage policy costs an average of $118 per month.

Compare Car Insurance Rates in Seattle, WA

Best cheap car insurance in Seattle, WA

How we chose the top companies

Best and cheapest car insurance in Washington state

- Cheapest full coverage: State Farm, $118/mo

- Cheapest minimum liability: State Farm, $47/mo

- Cheapest for young drivers: State Farm, $147/mo

- Cheapest after a ticket: State Farm, $128/mo

- Cheapest after an accident: State Farm, $139/mo

- Cheapest for teens after a ticket: State Farm, $164/mo

- Cheapest after a DUI: American Family, $207/mo

- Cheapest for poor credit: American Family, $164/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

State Farm has the best auto insurance for most people in Seattle, WA. The company has cheap rates and good customer service.

USAA has the cheapest quotes and best customer service among top car insurance companies in Seattle. But, you can only get coverage if you or an immediate family member are a current or former member of the military.

Cheapest car insurance in Seattle: State Farm

State Farm has the most affordable auto insurance in Seattle, WA.

A full coverage car insurance policy from State Farm costs $118 per month, on average. That's 38% cheaper than the Seattle city average of $191 per month.

Find Cheap Auto Insurance Quotes in Seattle

USAA has slightly cheaper rates than State Farm, at an average of $115 per month. But, coverage through USAA is only available to current military members, veterans and their immediate family.

Cheapest full coverage car insurance in Seattle

Company | Monthly rate | |

|---|---|---|

| State Farm | $118 | |

| American Family | $164 | |

| Geico | $185 | |

| Progressive | $192 | |

| Pemco | $231 |

*USAA is only available to current and former military members and their families.

Cheapest minimum coverage in Seattle: State Farm

State Farm has the most affordable car insurance in Seattle for minimum liability coverage, at an average of $47 per month.

That's 40% cheaper than the Seattle city average of $78 per month.

Pemco also has cheap auto quotes, at $48 per month.

Best cheap liability auto insurance

Company | Monthly rate |

|---|---|

| State Farm | $47 |

| Pemco | $48 |

| Geico | $79 |

| Progressive | $83 |

| American Family | $86 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Seattle

Cheapest car insurance in Seattle for teens: State Farm

State Farm has the cheapest car insurance for Seattle teen drivers, at an average of $147 per month for minimum liability coverage.

State Farm is also the most affordable choice for full coverage auto insurance, at $334 per month, on average. That's roughly 40% cheaper than the citywide average for both full and minimum coverage.

Monthly car insurance rates for teen drivers

Company | Liability only | Full coverage |

|---|---|---|

| State Farm | $147 | $334 |

| Pemco | $156 | $670 |

| American Family | $216 | $375 |

| Progressive | $239 | $567 |

| Geico | $254 | $555 |

*USAA is only available to current and former military members and their families.

Seattle teen drivers can lower their monthly rate by sharing a policy with their parents. You'll pay even less if you take advantage of common discounts for good students or student away from home.

Most affordable auto insurance in Seattle after a speeding ticket: State Farm

State Farm has the cheapest coverage for Seattle drivers who have a speeding ticket on their record.

The company charges an average of $128 per month for a full coverage policy after a ticket. That's roughly half the citywide average of $242 per month.

Cheapest coverage after a speeding ticket

Company | Monthly rate |

|---|---|

| State Farm | $128 |

| American Family | $207 |

| Pemco | $270 |

| Allstate | $270 |

| Progressive | $274 |

*USAA is only available to current and former military members and their families.

Cheapest auto insurance in Seattle after an accident: State Farm

State Farm has the cheapest coverage in Seattle for drivers with an at-fault accident on their record.

The company charges an average of $139 per month. That's less than half the Seattle average of $280 per month.

Cheapest car insurance after an accident

Company | Monthly rate |

|---|---|

| State Farm | $139 |

| American Family | $265 |

| Pemco | $287 |

| Geico | $314 |

| Progressive | $344 |

*USAA is only available to current and former military members and their families.

After an at-fault accident, Seattle drivers typically see rates increase by $89 per month.

You can lower the amount you pay for car insurance after a crash by shopping around and comparing quotes. The difference between the most expensive company after an accident, Farmers, and the cheapest, State Farm, is $241 per month, on average.

Cheapest car insurance for teens after a ticket: State Farm

State Farm has the cheapest car insurance for Seattle teen drivers with a ticket on their record.

The company charges an average of $164 per month, which is 45% cheaper than the city average of $296 per month.

Pemco has rates that are almost as cheap, at $164 per month, and Pemco also has the cheapest rates in Seattle for teen drivers who've had an at-fault accident, at $172 per month, on average. That's roughly half the citywide average of $347 per month.

Monthly minimum coverage rates for teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| State Farm | $164 | $180 |

| Pemco | $164 | $172 |

| American Family | $258 | $360 |

| Progressive | $279 | $312 |

| Geico | $354 | $397 |

*USAA is only available to current and former military members and their families.

Cheapest auto insurance in Seattle for drivers with a DUI: American Family

American Family has the cheapest quotes for Seattle drivers who've gotten a DUI, at an average of $207 per month.

That's roughly one-third less than the Seattle city average of $295 per month.

Cheapest Seattle car insurance after a DUI

Company | Monthly rate |

|---|---|

| American Family | $207 |

| Progressive | $240 |

| State Farm | $271 |

| Geico | $293 |

| Pemco | $326 |

*USAA is only available to current and former military members and their families.

A DUI raises your auto insurance by an average of $104 per month in Seattle.

After a DUI, it's a good idea to compare quotes and take advantage of discounts, such as bundling, safe driving discounts, and defensive driving.

Cheapest car insurance for Seattle drivers with bad credit: American Family

American Family has the most affordable auto insurance for Seattle drivers who have a low credit score, at $164 per month, on average.

That's about two-thirds the Seattle city average of $247 per month.

Cheap car insurance in Seattle for poor credit

Company | Monthly rate |

|---|---|

| American Family | $164 |

| Geico | $185 |

| Progressive | $192 |

| State Farm | $241 |

| Farmers | $281 |

*USAA is only available to current and former military members and their families.

Car insurance companies look at your credit score when setting rates. Companies think drivers who have low credit scores are more likely to file claims than drivers with good credit scores.

Average cost of car insurance in Seattle by neighborhood

Rainier Valley has the most expensive rates in Seattle, at $206 per month, on average.

This may reflect the neighborhood's reputation for high property crime rates. In contrast, Downtown Seattle has the cheapest rates, at $173 per month, on average. The cheaper rates for this neighborhood are likely because downtown residents are less likely to have their car stolen or vandalized since most are parking their vehicles in secured parking lots or garages.

Full coverage quotes by Seattle ZIP code

ZIP | Monthly Rate | % from average |

|---|---|---|

| 98101 | $173 | -8% |

| 98102 | $179 | -4% |

| 98103 | $179 | -4% |

| 98104 | $181 | -3% |

| 98105 | $183 | -2% |

Where you live will influence the amount you pay for car insurance in Seattle. Neighborhoods that experience more theft, vandalism and traffic tend to have higher rates than other areas.

Frequently asked questions

What's the cheapest car insurance in Seattle, WA?

State Farm has the cheapest car insurance in Seattle for most people, at $118 per month for a full coverage policy. USAA has cheaper average rates, at $115 per month, on average, but you can only get a USAA policy if your or an immediate family member are a current or former member of the military.

What is the best car insurance company in Seattle, Washington?

State Farm is the best car insurance company in Seattle for most people. The company has a high 4.5 out of 5 star rating from ValuePenguin editors, and State Farm has a good rating for customer satisfaction according to a recent J.D. Power study.

How much is car insurance in Seattle per month?

Car insurance in Seattle costs $191 per month, on average, for a full coverage policy. That's $32 per month more expensive than the Washington state car insurance average of $159 per month.

A minimum liability policy in Seattle costs $78 per month, on average. That's $15 per month more expensive than the Washington state average.

Methodology

To find the best cheap car insurance in Seattle, WA, ValuePenguin collected quotes from eight of the most popular insurance companies in Washington. Rates are for a 30-year-old single man with good credit and no accident history who drives a 2015 Honda Civic EX.

Full coverage policies include comprehensive and collision coverage, plus liability limits that meet the legal requirements for Washington.

- Bodily injury liability: $50,000 per person/$100,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection: $10,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates came from public insurance company filings and should be used for comparative purposes only. Your own quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.