Cheapest Auto Insurance Quotes in Laredo, Texas

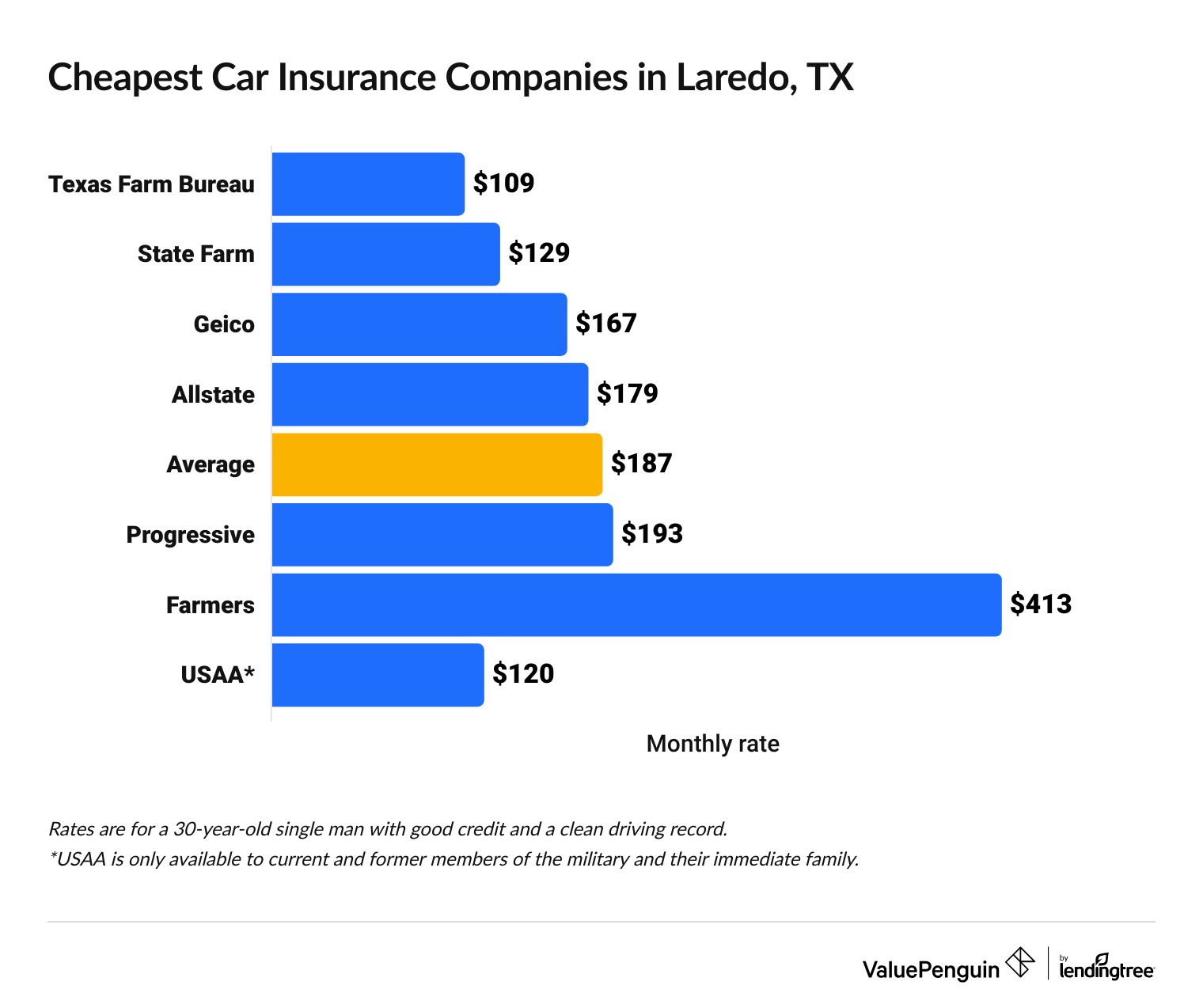

Texas Farm Bureau has the cheapest car insurance in Laredo, at $109 per month for full coverage and $41 per month for minimum liability insurance.

Compare Car Insurance Rates in Laredo TX

Best cheap car insurance in Laredo, TX

How we chose the top companies

Best and cheapest car insurance in Laredo

- Cheapest full coverage: Texas Farm Bureau, $109/mo

- Cheapest minimum liability: Texas Farm Bureau, $41/mo

- Cheapest for young drivers: Texas Farm Bureau, $75/mo

- Cheapest after a ticket: Texas Farm Bureau, $109/mo

- Cheapest after an accident: State Farm, $147/mo

- Cheapest for teens after a ticket: Texas Farm Bureau, $75/mo

- Cheapest after a DUI: State Farm, $135/mo

- Cheapest for poor credit: Allstate, $179/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Texas Farm Bureau offers the best combination of reliable customer service and cheap rates in Laredo, TX.

Laredo drivers should also compare rates from State Farm and USAA. Both companies have great customer service, although they're usually more expensive than Texas Farm Bureau.

Cheapest auto insurance in Laredo, TX: Texas Farm Bureau

Texas Farm Bureau has the cheapest full coverage car insurance in Laredo.

At $109 per month, full coverage insurance from Texas Farm Bureau is $78 per month less than the Laredo average. It's also $20 per month less than the second-cheapest option, State Farm.

Compare Car Insurance Rates in Laredo TX

The average cost of car insurance in Laredo, TX is $187 per month for a full coverage policy. That's $5 per month more than the Texas state average.

Laredo sits along the border between the United States and Mexico. It's the 11th largest city in Texas by population, which could help explain the city's higher average car insurance cost.

Cheapest full coverage car insurance in Laredo

Company | Monthly rate | |

|---|---|---|

| Texas Farm Bureau | $109 | |

| State Farm | $129 | |

| Geico | $167 | |

| Allstate | $179 | |

| Progressive | $193 |

*USAA is only available to current and former military members and their families.

Cheapest liability insurance quotes in Laredo: Texas Farm Bureau

Texas Farm Bureau has the best rate for a minimum liability policy in Laredo.

At $41 per month, minimum liability insurance from Texas Farm Bureau costs $26 per month less than the citywide average.

Cheap minimum liability car insurance in Laredo, TX

Company | Monthly rate |

|---|---|

| Texas Farm Bureau | $41 |

| State Farm | $45 |

| Allstate | $58 |

| Progressive | $60 |

| Geico | $63 |

*USAA is only available to current and former military members and their families.

Compare Car Insurance Rates in Laredo TX

Cheapest Laredo car insurance for teens: Texas Farm Bureau

Texas Farm Bureau has the most affordable insurance for young drivers in Laredo.

A minimum liability policy from Texas Farm Bureau costs around $75 per month for an 18-year-old. That's one-third of the Laredo average, and half the cost of the second-cheapest company, State Farm.

Texas Farm Bureau also has the cheapest full coverage quotes for Laredo teens. At $173 per month, full coverage from Texas Farm Bureau is less than one-third the citywide average.

Cheap car insurance in Laredo, Texas for teens

Company | Liability only | Full coverage |

|---|---|---|

| Texas Farm Bureau | $75 | $173 |

| State Farm | $152 | $345 |

| Geico | $155 | $355 |

| Allstate | $192 | $510 |

| Progressive | $318 | $966 |

*USAA is only available to current and former military members and their families.

Teen drivers in Laredo pay around three times more for car insurance as older drivers. That's because teens have less experience behind the wheel, which suggests they'd be more likely to make a mistake and cause a crash.

The best way for teen drivers to get cheaper car insurance rates is by sharing a car insurance policy with their parents or an older relative. A family policy is typically much cheaper than two separate policies.

In addition, many car insurance companies offer discounts geared toward young drivers, like good student discounts. You may also be able to earn a discount for taking a defensive driving or driver training class.

Cheapest Laredo car insurance after a speeding ticket: Texas Farm Bureau

Texas Farm Bureau has the cheapest full coverage rates for Laredo drivers after a speeding ticket, at $109 per month. That's less than half the citywide average of $225 per month.

Best cheap insurance in Laredo after a speeding ticket

Company | Monthly rate |

|---|---|

| Texas Farm Bureau | $109 |

| State Farm | $129 |

| Allstate | $179 |

| Geico | $201 |

| Progressive | $258 |

*USAA is only available to current and former military members and their families.

A speeding ticket will increase your car insurance rates by an average of 20% in Laredo. That's a difference of $38 per month for a full coverage policy.

Cheapest car insurance in Laredo after an accident: State Farm

State Farm offers the best car insurance rates for Laredo drivers with an at-fault accident on their record. At $147 per month, a full coverage policy from State Farm is less than half the Laredo average after a crash.

Cheap car insurance in Laredo, Texas after an accident

Company | Monthly rate |

|---|---|

| State Farm | $147 |

| Texas Farm Bureau | $163 |

| Allstate | $192 |

| Geico | $262 |

| Progressive | $309 |

*USAA is only available to current and former military members and their families.

On average, car insurance rates go up by 84% after an at-fault car accident in Laredo.

You don't have to rush to switch car insurance companies right after your accident. Your insurance bill won't go up until your current policy renews.

Instead, wait for your current company to send you a renewal letter a few weeks to a month before your policy expires. Then, you should shop around for quotes from multiple companies to find the best policy for you.

Cheap insurance in Laredo for teens with a bad driving record: Texas Farm Bureau

Texas Farm Bureau has the most affordable rates for young drivers in Laredo with a speeding ticket or accident on their record.

After one speeding ticket, a minimum liability policy from Texas Farm Bureau costs $75 per month for an 18-year-old. That's just under a third of the Laredo average.

Texas Farm Bureau also has the cheapest rates after an accident. At $109 per month, minimum liability insurance from Texas Farm Bureau after an accident is a third of the citywide average.

Affordable Laredo car insurance for teens with a bad record

Company | Ticket | Accident |

|---|---|---|

| Texas Farm Bureau | $75 | $109 |

| State Farm | $152 | $172 |

| Geico | $171 | $228 |

| Allstate | $192 | $194 |

| Progressive | $323 | $332 |

*USAA is only available to current and former military members and their families.

Car insurance rates for teens in Laredo go up by 11% after one speeding ticket and 50% after an at-fault accident. That's less of an increase than most adults experience, as teens already pay much more for car insurance prior to a ticket or accident.

Cheapest car insurance for Laredo drivers with a DUI: State Farm

State Farm has the most affordable car insurance in Laredo for drivers with a recent DUI. At $135 per month, full coverage from State Farm costs around half the Laredo city average. It's also $77 per month less than the second-cheapest company, Texas Farm Bureau.

Affordable car insurance in Laredo after a DUI

Company | Monthly rate |

|---|---|

| State Farm | $135 |

| Texas Farm Bureau | $212 |

| Progressive | $225 |

| Allstate | $231 |

| Geico | $289 |

*USAA is only available to current and former military members and their families.

In Laredo, a DUI will raise your insurance rates by an average of 40%. In addition, you may need to get SR-22 insurance after a DUI in Texas. Most companies charge between $15 and $50 to file an SR-22 form for you, on top of any increase in your car insurance rates.

Cheapest insurance in Laredo, TX for poor credit: Allstate

Allstate has the cheapest full coverage rates for Laredo drivers with poor credit, at $179 per month. That's less than half the Laredo average.

Cheap auto insurance in Laredo, TX for drivers with poor credit

Company | Monthly rate |

|---|---|

| Allstate | $179 |

| Texas Farm Bureau | $246 |

| Progressive | $334 |

| Geico | $439 |

| Farmers | $687 |

*USAA is only available to current and former military members and their families.

Laredo drivers with poor credit pay more than double the full coverage car insurance rate for drivers with good credit.

If you can't get the cheapest rate because of your credit score, but generally drive safely or just don't drive much at all, consider a safe driving program. These programs — also called usage-based or telematics insurance — track your driving habits using an app or plug-in device and give you a discount for safe driving habits, like driving within the speed limit.

Improving your credit score will also help lower your rates, but this process can take time. However, paying your bills on time and keeping a low balance on your credit cards, your credit score should improve over time.

Average car insurance cost in Laredo by neighborhood

The 78045 ZIP code, which is north of Laredo, has the cheapest car insurance in the area.

People living in this ZIP code pay an average of $176 per month for full coverage insurance.

Residents of southeastern Laredo and nearby cities Rio Bravo and El Cenizo pay the highest rates in the city, at $184 per month. You may pay more for car insurance if your area has lots of traffic, poorly maintained roads or high crime rates.

Full coverage quotes in Laredo, TX by ZIP code

ZIP | Monthly Rate | % from average |

|---|---|---|

| 78040 | $178 | -1% |

| 78041 | $182 | 1% |

| 78043 | $182 | 1% |

| 78045 | $176 | -2% |

| 78046 | $184 | 2% |

Frequently asked questions

How much is car insurance from Progressive in Laredo, TX?

Full coverage insurance from Progressive costs an average of $193 per month. That's $84 per month more expensive than the cheapest company for full coverage in Laredo, Texas Farm Bureau.

What is the best cheap car insurance in Laredo, TX?

Texas Farm Bureau is the best car insurance company in Laredo for most people. It has very cheap rates and good customer service. State Farm and USAA are also good options for Laredo drivers, though they're typically more expensive than Texas Farm Bureau.

What is the best car insurance coverage in Laredo, TX?

Full coverage car insurance is the best choice for most Laredo drivers. That's because full coverage comes with collision and comprehensive coverage, which pay to fix damage to your own car. These coverages are typically required if you have a car loan or lease. Full coverage can also have higher liability limits than the state requirement, which could save you a lot of money if you cause a serious crash.

Methodology

To find the best cheap car insurance in Laredo, Texas, ValuePenguin editors gathered rates from seven of the top insurance companies in Texas. Rates are for a 30-year-old single driver with no accidents, DUIs or speeding tickets who owns a 2015 Honda Civic EX.

Full coverage quotes include higher liability limits than the Texas state requirement along with collision and comprehensive coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

This expert analysis compiled insurance rate data from publicly sourced company filings using Quadrant Information Services. Your actual quotes may vary.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.