Car Insurance Rate Increases with a Speeding Ticket

A single speeding ticket will raise your car insurance rate by 23%, on average.

Speeding tickets stay on your driving record for around three years. How a ticket affects your insurance rates depends on a few factors. These include your driving record, how fast you were going and which company insures your car.

Find Cheap Auto Insurance Quotes after a Speeding Ticket

Do speeding tickets affect insurance?

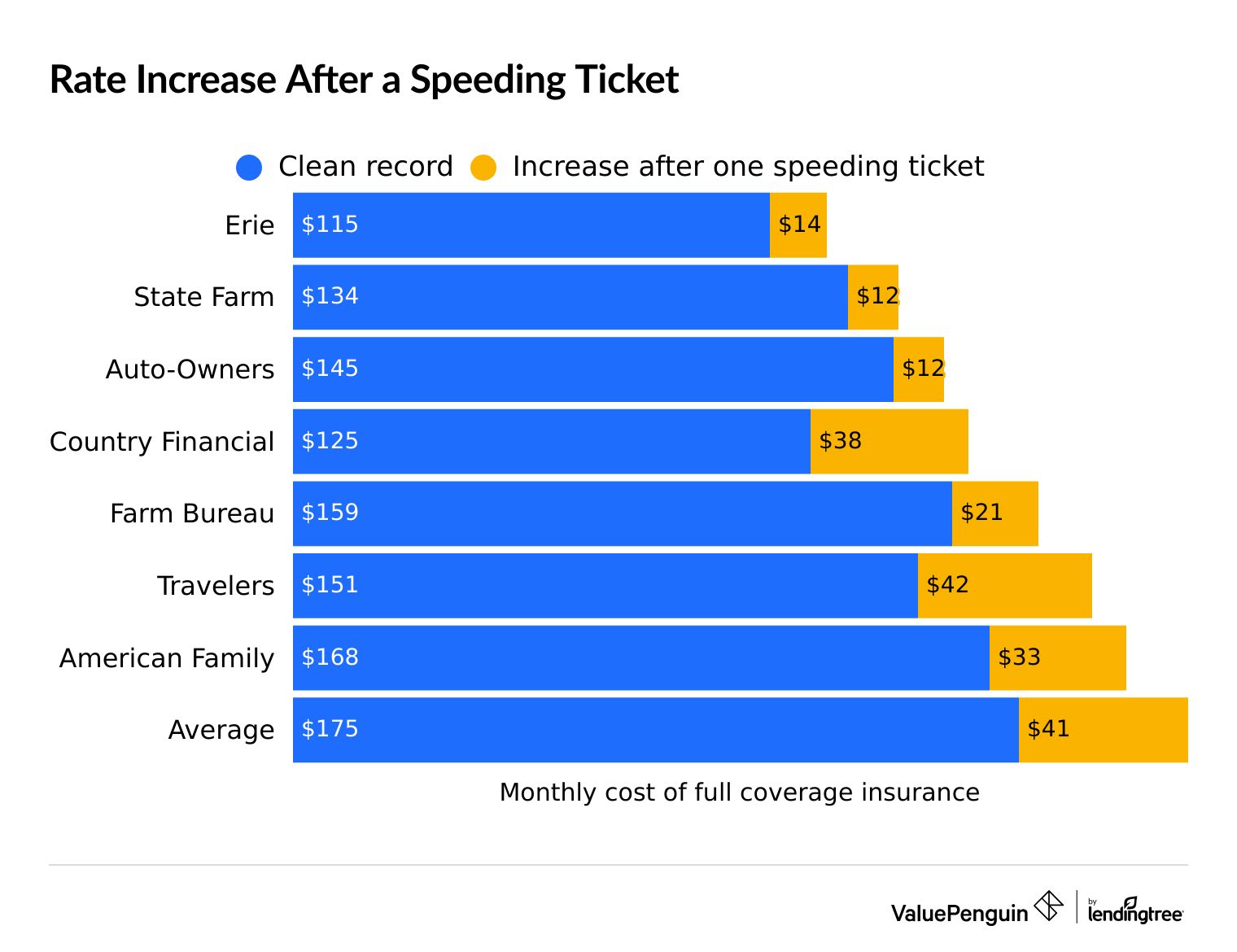

One speeding ticket raises full coverage car insurance rates by $41 per month, on average.

A speeding ticket almost always raises your car insurance rates. How much your rate goes up depends on your insurance company, where you live and your driving history.

Find Cheap Auto Insurance Quotes after a Speeding Ticket

State Farm raises rates the least among major auto insurance companies for a first speeding ticket. Full coverage rates from State Farm go up by around 9%, or about $12 per month.

Some insurance companies don't increase car insurance rates after a single ticket. Others charge drivers with a ticket more than double those with a clean record.

Cheap car insurance with speeding tickets

It's important to shop around for auto insurance after a ticket to make sure you get the best possible rate.

However, the ticket won't affect your rates until your policy renews. So you should compare quotes when your policy is close to expiring.

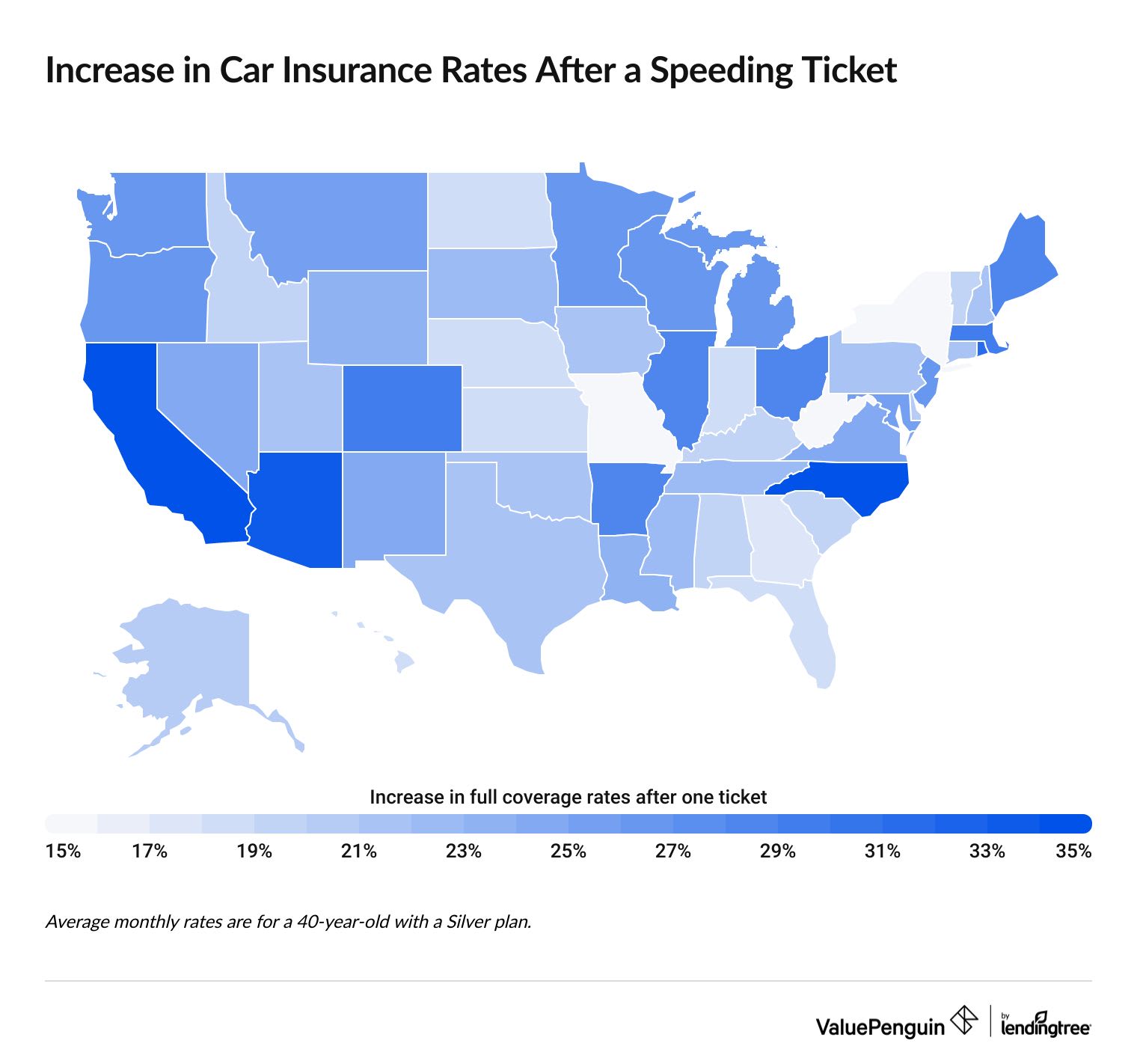

How a speeding ticket affects your insurance, by state

California has the largest increase in insurance rates after a speeding ticket.

Car insurance rates in California go up by 43% after one speeding ticket.

Drivers in Missouri, New York and West Virginia see the smallest increase in rates after one speeding ticket, at just 15%.

Full coverage rates after a speeding ticket

State | Monthly rate | % increase |

|---|---|---|

| Alabama | $231 | 19% |

| Alaska | $169 | 20% |

| Arizona | $290 | 33% |

| Arkansas | $247 | 28% |

| California | $241 | 43% |

When will a speeding ticket show up on insurance?

After you get a speeding ticket, the court notifies the DMV so it can update your driving record. Insurance companies typically check your record with the DMV before your policy renews. They do this to determine your rate for the next policy period.

Your rates will only go up when your policy renews.

So, you shouldn't rush to switch insurance companies after a speeding ticket. Instead, wait to shop for quotes until your current policy is about to expire.

How multiple tickets can raise your auto insurance rates

No. of tickets | Rate increase |

|---|---|

| 1 | 20% |

| 2 | 67% |

| 3 | 111% |

Drivers with more than one speeding ticket usually pay more for insurance than those with one ticket.

For example, one ticket increases rates with Geico by more than 20%. A second ticket raises rates by 38% more.

Drivers with two or three speeding tickets pay between 67% and 111% more than drivers with no tickets.

How to lower insurance after a speeding ticket

The best way to find cheap car insurance after a speeding ticket is to compare quotes from multiple companies.

There are some other options that can help. But you should always check with your insurance company to see what steps you can take to reduce your rate.

You may be able to get your ticket dismissed by taking a defensive driving course.

This isn't the case in all states. You can also fight the ticket in court or ask the judge for ways to keep a ticket off your record.

Some states tie citations to points on a driver's license. Those points can impact how much insurance rates go up.

Insurance companies can also set rates based on your driving record instead of license points. That means efforts to reduce points, like taking a defensive driving course, might not keep your insurance rates down.

How long does a speeding ticket affect insurance?

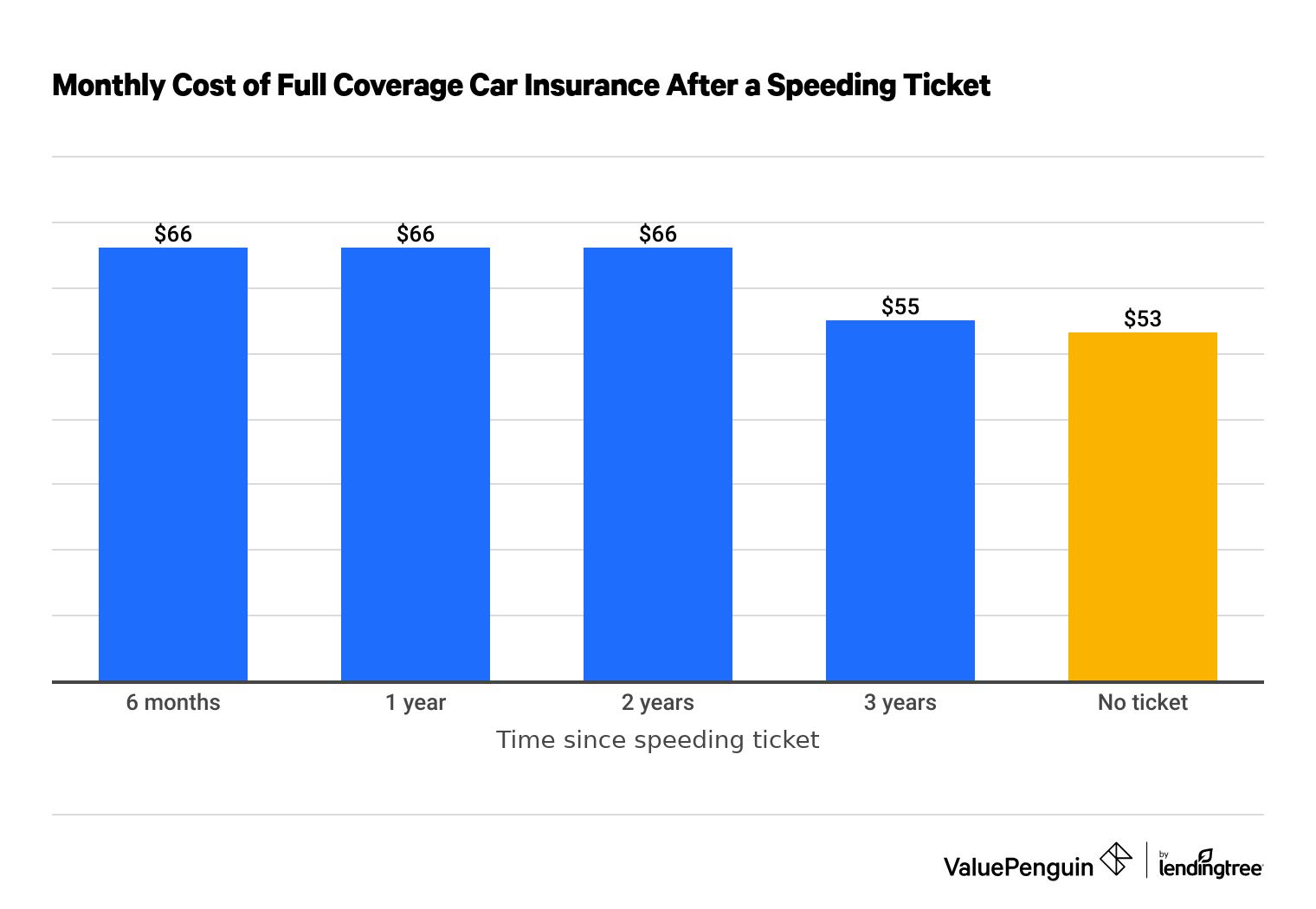

One speeding ticket will typically increase your insurance rates for between three and four years.

Car insurance rates go up by an average of 25% for the first two years after your ticket. Then, your insurance company will either reduce your rates to normal or reduce your penalty for the third year.

Allstate is the only major company that charges higher rates for a driver with a 4-year-old speeding ticket.

Cost of minimum coverage car insurance after one ticket

Time since ticket | Monthly cost | Increase |

|---|---|---|

| 6 months | $66 | 25% |

| 1 year | $66 | 25% |

| 2 years | $66 | 25% |

| 3 years | $55 | 5% |

| No recent ticket | $53 | — |

Different states have different laws regarding how long a ticket can stay on your driving record. In California, it only stays on your record for 39 months (three years and three months). In contrast, a citation in Virginia stays on your record for five years.

Frequently asked questions

How much does insurance go up after a speeding ticket?

One speeding ticket increases full coverage insurance rates by $41 per month, on average. However, the exact amount varies based on your driving history, where you live and your insurance company's rules.

How can I bring my rates down after a ticket?

The best ways to lower your insurance rates after a ticket are to shop around for a cheaper insurance company or take a driver education class. Otherwise, your rates will go back down over time.

What is the cheapest car insurance company after a speeding ticket?

State Farm is the cheapest major insurance company after a ticket, at $146 per month. That's an increase of just $12 per month, on average. Erie, USAA and Auto-Owners also have affordable rates after a ticket, but they're not available to everyone.

Does a first-time speeding ticket affect insurance?

Yes, your first speeding ticket will increase your insurance rates by around 20%. However, multiple tickets cause rates to increase much more. Drivers with two tickets pay 67% more for full coverage. And those with three tickets pay twice as much as people with a clean record.

How long do speeding tickets affect insurance?

Most drivers can expect their rates to go up for three to four years after a speeding ticket. Your penalty usually decreases in the third year. Most insurance companies will offer you normal rates by the fourth year.

Methodology

To compare the effects of a single speeding ticket on car insurance rates, ValuePenguin gathered quotes from every ZIP code across the United States. Rates are for a 30-year-old man with good credit who owns a 2015 Honda Civic EX.

Quotes are based on a full coverage policy with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

To study rates for a speeding ticket at 5 mph over the limit, rates for drivers with multiple tickets and the length of time a speeding ticket affects car insurance rates, we collected car insurance quotes from every ZIP code in Alabama, Ohio and Illinois.

This analysis used Quadrant Information Services to compile the insurance rate data, which was publicly sourced from insurance company filings. Rates should be used for comparative purposes only. Your quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.