SR-22 Insurance in Texas: What is It? How Much Does it Cost?

Find Cheap SR-22 Auto Insurance Quotes in Texas

Texas drivers may be required to get SR-22 insurance if they get certain tickets, such as driving while intoxicated (DWI). To reinstate your licenses, you usually need to get an SR-22 form, which proves that you carry the legally required liability insurance for your vehicle.

If you don't own a car, you can still meet this requirement by getting non-owner SR-22 insurance, which is typically cheaper than an owner's policy.

How to file an SR-22 with the Texas DPS

To file an SR-22 certificate with the Texas Department of Public Safety (DPS), follow these key steps:

Find an authorized insurer or contact your current provider. Some insurers do not provide SR-22 coverage for drivers who need it, so confirm with your provider if it can file the form on your behalf.

Pay the appropriate SR-22 fee. Your insurer may charge a flat fee between $15 and $50 to file the form on your behalf. To get your driver's license reinstated, you first need to pay a reinstatement fee, which is typically around $100, online or to the Texas DPS in Austin before submitting an SR-22 form.

Have an insurer file proof of insurance or file directly to the Texas DPS. You can either mail the SR-22 insurance certificate to the DPS or deliver it in person, or your insurer can file it electronically on your behalf. If you want to file the form yourself, you'll need to first ask your insurer for the certificate.

Get confirmation. Once the fees are paid and SR-22 documents sent in, you can check your driver eligibility status online via the Texas DPS website. Your status will be updated to "eligible" from "ineligible" after your documents have been processed.

You may also need to show proof that you've completed a repeat-offender DWI program if you were found guilty of driving while intoxicated and this was required by the court. If there are any changes to your license status, the DPS will notify you by mail, so make sure it has your current mailing address on file.

How much does SR-22 insurance cost in Texas?

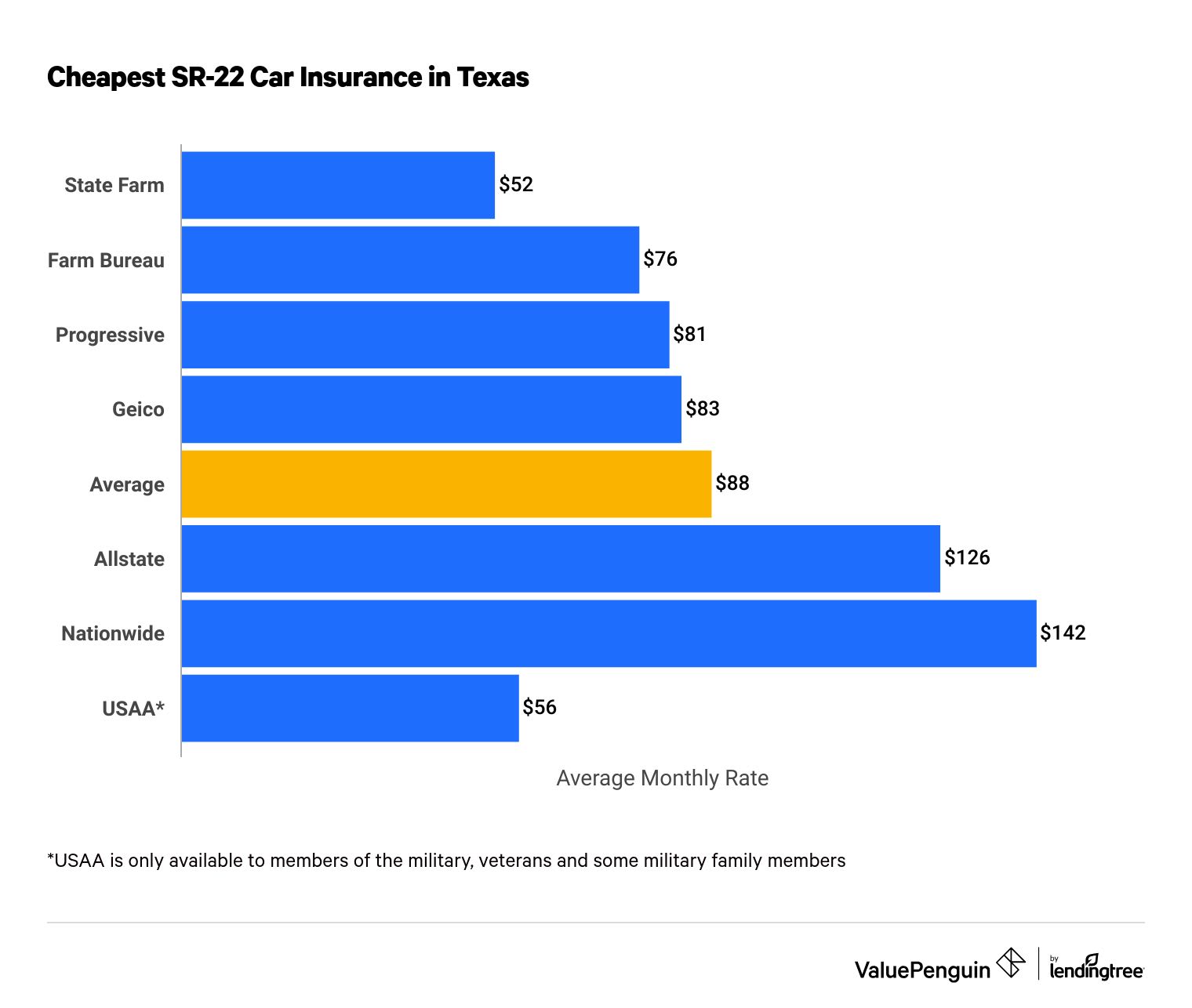

An SR-22 insurance policy costs an average $88 per month for minimum coverage after a DUI, which is 72% higher than with a clean record. This is primarily due to the DUI, or whatever ticket caused you to need an SR-22 filing. Each insurer in Texas determines SR-22 rates using different methods.

Among major widely-available insurance companies in Texas, State Farm offers the lowest average rate of $52 per month, while Nationwide charges an average $142 per month.

Find Cheap SR-22 Auto Insurance Quotes in Texas

Cheapest SR-22 car insurance companies in Texas

Insurer | Cost per month | Cost per month with SR-22 and DUI | |

|---|---|---|---|

| State Farm | $30 | $52 | |

| Farm Bureau | $35 | $56 | |

| Progressive | $32 | $76 | |

| Geico | $75 | $81 | |

| Allstate | $46 | $83 |

*USAA is only available to current and former military members and their families.

The average cost of auto insurance in Texas with a clean record is $51 per month. That increases to $88 per month after a DUI that requires an SR-22 insurance policy.

To get cheaper rates for SR-22 insurance in Texas, you should compare quotes from multiple insurers. Since each insurance company evaluates drivers differently, you can help ensure you get your best rates by getting competing quotes.

When getting an SR-22 insurance quote, make sure to ask about discounts an insurer offers. There are some that you can only qualify for based on your vehicle or driving record, but you can get others, such as defensive driver course discounts, by completing some simple steps.

What is SR-22 insurance in Texas?

If you've been convicted of certain moving violations in Texas, such as driving under the influence, or you have committed too many traffic offenses within a period of time, the state may require you to file an SR-22 form with the Texas DPS. This can also be called "getting SR-22 insurance", and it is often required to reinstate your license if it has been suspended due to high-risk tickets. SR-22 insurance may also be required if you display a fake license plate or commit certain drug offenses.

An SR-22 auto insurance policy complies with Texas's minimum liability insurance requirements, but the insurer also files a certificate directly with the state, indicating that your policy complies with Texas's financial responsibility laws. Though an SR-22 form is essentially proof of coverage, the state won't accept your insurance card or your policy as alternatives.

In order to meet the Texas liability insurance requirements, your SR-22 insurance must have limits of at least:

- $30,000 of bodily injury coverage per person injured in an accident

- $60,000 of bodily injury coverage per accident

- $25,000 of property damage coverage per accident

The period of time you'll need to have SR-22 insurance varies, but it typically extends for two years after the date of your conviction in Texas.

If your policy lapses or is canceled during this period, the insurer is required to notify the state.

If you fail to file a new SR-22 after cancellation or nonrenewal, your license and registration can be suspended again. You'll not only have to buy a new auto insurance policy, but you'll also have to pay the reinstatement fees a second time, so it's important not to have a gap in coverage.

Once you've had an SR-22 policy for the period required by court order, it's your responsibility to notify your insurer that the form no longer needs to be filed. Otherwise, your insurance company will continue filing the SR-22 with the Texas DPS.

What is SR-22A insurance?

Instead of SR-22 insurance, the court might require you to get SR-22A insurance in order to reinstate your license. SR-22A insurance, which is specific to a few states, including Texas, requires payments in six-month installments rather than the usual monthly billing for a standard SR-22.

An SR-22A requirement is typically only imposed if you have been caught driving without insurance and in violation of Texas's financial responsibility law multiple times.

Non-owner SR-22 insurance in Texas

If you need an SR-22 filing to reinstate your license, but you don't have a vehicle registered in your name, you can get a non-owner SR-22 insurance policy to meet the state's requirement. Non-owner SR-22 insurance in Texas provides liability coverage that meets the state's requirements and provides coverage whenever you drive a car belonging to someone else.

Since it's limited to liability coverage, and you presumably drive less regularly if you don't own a car, non-owner SR-22 insurance tends to have much lower rates than owner's SR-22 insurance.

Methodology

To find the cheapest SR-22 car insurance rates in Texas, ValuePenguin collected thousands of quotes from top companies across every ZIP code in the state, across all residential ZIP codes. Rates are for a 30-year-old single man with good credit who drives a 2015 Honda Civic EX. Policies include the minimum required coverage in Texas.

Rate analysis was compiled using Quadrant Information Services rate data. Quotes are publicly sourced from insurer filings. They should be used only for comparative purposes, as your quotes will likely be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.