The Best and Cheapest Home Insurance in Michigan (2025)

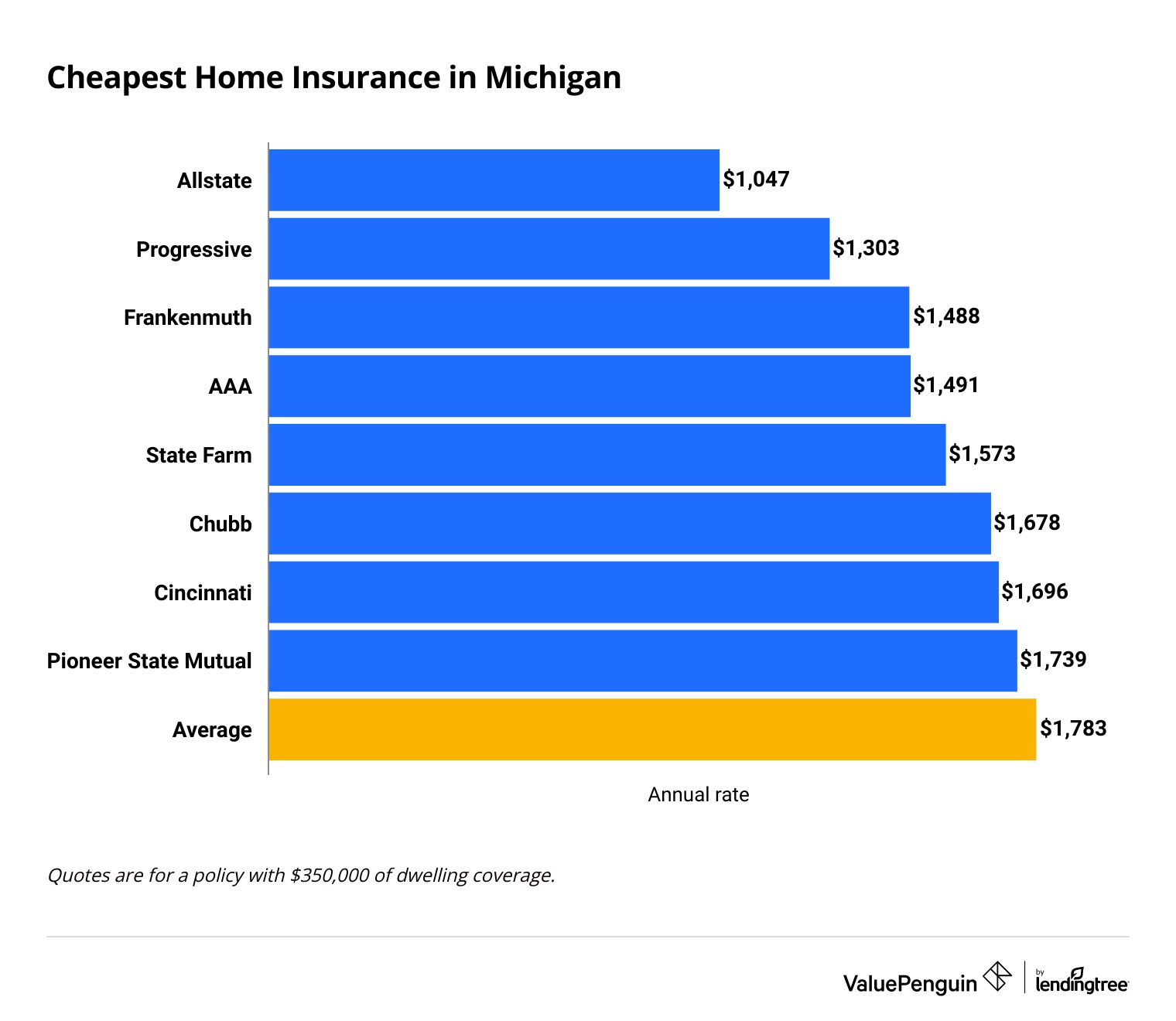

Allstate has the cheapest home insurance in Michigan, with an average rate of $1,047 per year.

Compare Home Insurance Quotes in Michigan

Best Cheap Home Insurance in Michigan

ValuePenguin collected home insurance quotes from top companies in hundreds of ZIP codes in Michigan to find the state's cheapest rates. Our experts used those rates, along with coverage options, available discounts and several customer service ratings, to pick the best homeowners insurance companies in Michigan. See the full methodology.

Cheapest home insurance companies in Michigan

Allstate has the cheapest home insurance in Michigan, for multiple levels of dwelling coverage.

Allstate's average rate for $350,000 in dwelling coverage is $736 cheaper than the state average of $1,783. Even if you need $1 million in dwelling coverage, Allstate is a cheap option.

Find Cheap Home Insurance Quotes in Michigan

But Frankenmuth, State Farm and Cincinnati also have cheap rates, and all three companies have better customer service than Allstate. To find the best homeowners insurance in Michigan for your specific needs, you should shop around and compare quotes.

Cheap home insurance in Michigan

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $668 | ||

| AAA | $824 | ||

| Frankenmuth | $947 | ||

| Pioneer State Mutual | $1,035 | |

| Chubb | $1,056 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $668 | ||

| AAA | $824 | ||

| Frankenmuth | $947 | ||

| Pioneer State Mutual | $1,035 | |

| Chubb | $1,056 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $1,047 | ||

| Progressive | $1,303 | ||

| Frankenmuth | $1,488 | ||

| AAA | $1,491 | ||

| State Farm | $1,573 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $1,417 | ||

| Progressive | $1,924 | ||

| State Farm | $2,100 | ||

| AAA | $2,154 | ||

| Chubb | $2,308 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $2,653 | ||

| Westfield | $3,222 | ||

| State Farm | $3,650 | ||

| Progressive | $3,978 | ||

| USAA | $4,293 | ||

What kind of home insurance coverage do I need in Michigan?

Ice storms, freezing temperatures, thunderstorms, wind and hail are all common in Michigan. Tornadoes are less common but do happen, and they can cause extensive damage. Damage from these types of storms is usually covered, but it's a good idea to check your policy to be sure.

Cheapest home insurance in Michigan: Allstate

-

Editor's rating

- Cost: $1,047/yr

Allstate has cheap rates for both less expensive and luxury homes.

Pros:

-

Cheap rates

-

Lots of add-on coverage options

-

Numerous discounts

Cons:

-

Below-average customer service

Allstate has the cheapest home insurance rates in Michigan. Whether you need $200,000, $350,000, $500,000 or $1 million in dwelling coverage, Allstate is the cheapest company, on average.

The company also lets you personalize your coverage with a range of add-ons and discounts. Michigan homeowners might want to add water backup coverage, which pays for water damage in basements and crawl spaces when sump pumps fail or drains back up. You can also add coverage for your landscaping, musical instruments and sports equipment. And you can save by bundling your policies, being a new customer or buying a new or new-to-you house.

But Allstate doesn't have good customer service. The company has 30% more complaints than average for a company its size, according to the National Association of Insurance Commissioners (NAIC). Poor service can be particularly hard to handle during claims, when it might mean you have to wait longer to get your home repaired.

Best home insurance in Michigan for customer service: Cincinnati

-

Editor's rating

- Cost: $1,696/yr

Cincinnati has excellent customer service and cheap rates.

Pros:

-

Cheap rates

-

High customer satisfaction

-

Several add-on coverages

Cons:

-

No online quotes

-

Not as many discounts as other companies

Cincinnati is the best home insurance in Michigan if good customer service is your priority. The National Association of Insurance Commissioners (NAIC) reports that Cincinnati has 78% fewer complaints than expected for a company its size. If you have to make changes to your policy, ask questions or file a claim, Cincinnati's good customer service can make the process smoother.

Cincinnati also has policies geared toward high-value homes, along with several add-on coverage options to help you build a policy that fits your specific needs.

But Cincinnati isn't a good option if you want to get home insurance online. The company doesn't currently offer online quotes, so you have to work with a local agent to get quotes. And while the company's overall rates are cheap, it doesn't have as many discounts to lower your rates as some other companies.

Best home insurance in Michigan for bundling: Progressive

-

Editor's rating

- Cost: $1,303/yr

Progressive has cheap rates for auto and home insurance in Michigan.

Pros:

-

Cheap rates for home insurance

-

Good rates for auto insurance

-

Lots of online and digital tools

Cons:

-

Poor customer service

-

Not many extra coverage options

Progressive has cheap rates on auto and home insurance in Michigan, making it a good option if you want to bundle your policies. A Progressive home insurance policy with $350,000 in dwelling coverage costs $1,303 per year in Michigan, which is 27% less than the state average. And a full coverage car insurance policy is $253 per month with Progressive. That's cheap compared to the state average of $386.

But Progressive doesn't have good customer service. The company has 43% more complaints than an average company its size, according to the National Association of Insurance Commissioners (NAIC). And Progressive doesn't have as many add-ons to help you build a personalized home insurance policy.

Best local home insurance company in Michigan: Frankenmuth

-

Editor's rating

- Cost: $1,488/yr

Frankenmuth Insurance has a long history in Michigan.

Pros:

-

Excellent customer service

-

Cheap rates

-

Local to Michigan

Cons:

-

No online quotes

-

Fewer discounts than some companies

Frankenmuth Insurance was founded in its namesake town in 1868 and still has its headquarters there today. If you want to keep your insurance with a local company, Frankenmuth is a great option.

The National Association of Insurance Commissioners (NAIC) reports no complaints for Frankenmuth's home insurance. And the company works with independent agents across Michigan, so you can probably find a local point of contact to help with your coverage.

But Frankenmuth is a smaller insurance company, and it doesn't have as many optional coverage types as larger companies. You also can't get quotes online, although the company does have a mobile app for you to use once you have a policy.

How much is homeowners insurance in Michigan?

Michigan home insurance costs an average of $1,783 per year for a policy with $350,000 in dwelling coverage.

That's cheaper than Indiana, where the same amount of coverage costs $2,144 per year. That's probably because Indiana is more likely to experience severe summer storms, including tornadoes.

Home insurance is cheaper in Ohio, though, where a policy costs an average of $1,436 per year. It's also cheaper to insure a home in Wisconsin, where the average rate for $350,000 in dwelling coverage is $1,394 per year.

Average cost of home insurance in Michigan by dwelling amount

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,153 |

| $350,000 | $1,783 |

| $500,000 | $2,477 |

| $1,000,000 | $4,757 |

You'll pay higher rates if you need more coverage. More expensive homes cost more to repair or rebuild if they're damaged or destroyed. So insurance companies charge higher rates to account for the increased risk of large claims.

Cost of home insurance in Michigan by city

Traverse City, a northern city along Lake Michigan, has the cheapest home insurance in the state, at $1,327 per year, on average.

Homeowners in Detroit pay the highest rates, with a $350,000 dwelling coverage policy costing $3,187 per year, on average. That's 79% more than the state average.

Home insurance costs vary by location. You might pay more for coverage if you live in an area with high crime, or in a rural area without a nearby fire department. Rates in Michigan vary by over $1,800 per year depending on where you live.

City | Annual rate | % from avg. |

|---|---|---|

| Acme | $1,451 | -19% |

| Addison | $1,655 | -7% |

| Adrian | $1,537 | -14% |

| Afton | $1,483 | -17% |

| Ahmeek | $1,483 | -17% |

Rates are for a policy with $350,000 of dwelling coverage.

Best-rated homeowners insurance companies in Michigan

Cincinnati, State Farm and USAA have the best homeowners insurance in Michigan.

All three companies have good customer satisfaction and coverage. But USAA has high average rates, and it's an option only for military members, veterans and their families.

Company |

Rating

|

Complaints

|

|---|---|---|

| Cincinnati | Low | |

| State Farm | Average | |

| USAA | Average | |

| Hanover | Low | |

| Pioneer State Mutual | Low |

What home insurance coverage is important in Michigan?

Michigan's location in the Upper Midwest means it faces storms year-round. In summer, thunderstorms can bring wind and hail. And in winter, freezing temperatures and lake-effect snow are common. Understanding the ways your home can be damaged helps you ensure you get the home coverage you need.

Does home insurance in Michigan cover wind?

High winds can happen in both summer and winter in Michigan. Wind damage is almost always covered by home insurance, but it's a good idea to make sure. You might have a separate wind and hail deductible, and if you do, you should be aware of it and make sure you can afford to pay it if your home is damaged in a windstorm.

High winds were at least partially responsible for the sinking of the Edmund Fitzgerald in November 1975. The ship was caught in a storm on Lake Superior near Whitefish Point. Winds were blowing around 67 miles per hour and gusting up to 81 miles per hour, causing massive waves. And if Michigan's winds are strong enough to sink a ship, they're strong enough to damage houses.

Does Michigan home insurance cover snow damage?

Snow might not seem like it can do damage, but don't be fooled. Snow and ice are heavy, especially if the snow formed over the Great Lakes. This is called "lake-effect snow," and it can be very wet, heavy and plentiful. The weight of the ice or snow could cause your roof to collapse. And sometimes, the snow on your roof melts but can't fully drain into your gutters if they're frozen over. This is called an ice dam, and it can cause water to leak back into your house.

Luckily, you're usually covered. Damage caused by the weight of ice or snow is covered on most home policies, and water damage caused by snow or ice is too. Keep in mind, though, that home insurance won't pay if the damage is caused by a lack of maintenance. Before winter hits, have a professional check your roof and siding and make sure it's in good condition.

Does home insurance in Michigan cover flooding?

Floods are common in many parts of Michigan, especially the lower part of the Lower Peninsula and the Upper Peninsula. But home insurance doesn't cover the damage. If you want coverage for flooding, you need a separate flood insurance policy.

True floods happen when an area that's usually dry is covered in water. This can happen when it rains hard, lots of snow melts, or a river or body of water jumps its banks.

But not all kinds of "flooding" are considered true floods. For example, your home insurance likely covers water damage caused by a washing machine overflowing. And it's common in Michigan for basements to "flood" during heavy rains, but what's usually happening is called "water backup." Sump pumps, which usually keep extra water out of basements, can fail, and the water can back up into your basement. This kind of damage is covered, but only if you buy an add-on.

How to save on Michigan home insurance

The best way to save on home insurance in Michigan is to shop around and compare rates.

Different companies charge different amounts, so shopping around can help you find the cheapest rate for the coverage you need. But if you still need to get your rate down, there are a few things you can try.

Bundle your policies. Bundling discounts are often some of the biggest savings you can get. Usually, this means buying your auto and home insurance from the same company. But you might also get a bundling discount for having an umbrella, boat, motorcycle or other insurance policy along with your home insurance.

Maintain your home. One of the best ways to keep your home insurance rates down in the long term is to avoid filing claims. While you can't avoid all home damage, you can make it less likely by maintaining your home. Check your roof, siding, windows and doors for damage and make repairs when you need to.

Update your roof. Your home's roof is the first line of defense against rain, wind, hail and snow. New roofs are less likely to be damaged, so home insurance companies usually give you a discount. If your roof is 15 years old or has recently had damage, have a professional look at it. It might be fine, but it might be time for a new one.

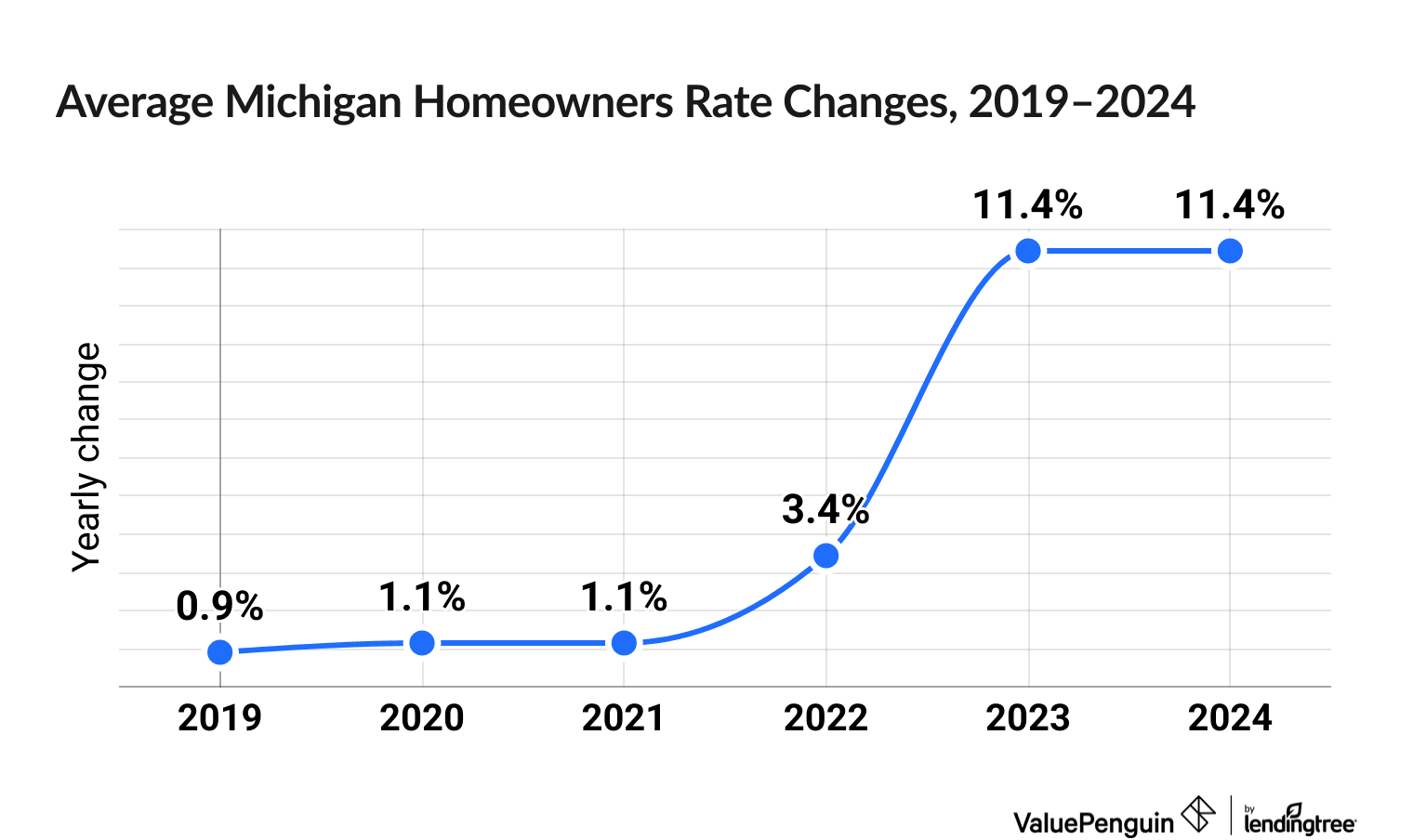

Change in Michigan home insurance costs over time

Home insurance prices are up 32.4% in Michigan over the last six years.

Michigan homeowners have seen a jump in their home insurance prices in the past two years, with an increase of 11.4% in both 2023 and 2024.

The Hanover Insurance Group experienced the biggest rate increase over the last six years, with a jump of 70.0%. They were followed by Liberty Mutual, at 59.0%.

The smallest increase among companies belonged to Allstate, which had an increase of only 13.3% over the five-year-period.

Home insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

What is the cheapest home insurance in Michigan?

Allstate has the cheapest home insurance in Michigan, for several levels of dwelling coverage. But Allstate doesn't have the best customer service. Frankenmuth, State Farm and Cincinnati all have cheaper-than-average rates and better service than Allstate.

What is the average homeowners insurance rate in Michigan?

Home insurance in Michigan costs an average of $1,783 per year for a policy with $350,000 in dwelling coverage. If you need less coverage, your rates will be cheaper. And if you need more coverage, you'll probably pay more. Your rates also depend on where you live and how many claims you've filed in the past.

What is the best insurance company in Michigan?

Cincinnati, State Farm and USAA are the best home insurance companies in Michigan, based on their customer satisfaction. But the best company for you will depend on your budget, where you live, the type of coverage you need and what you are looking for in a policy. Someone who wants the cheapest rates might choose Allstate, while someone who wants to keep their business local might opt for Frankenmuth.

Methodology

To find the best and cheapest home insurance companies in Michigan, ValuePenguin got quotes from the state's largest home insurance companies in hundreds of ZIP codes. The quotes are for a 45-year-old married man with no home insurance claims. Our experts used the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin used Quadrant Information Services, which in turn uses publicly available insurance company filings, to get the quotes. Rates will vary based on your age, home details, location, claim history and more. Your rates will likely be different from the rates shown here.

To choose the best home insurance companies in Michigan, ValuePenguin used average rates, coverages, discounts, customer complaint data from the National Association of Insurance Commissioners (NAIC), scores from J.D. Power's home insurance customer satisfaction survey and our experts' own editorial reviews and ratings.

Other sources include the Allstate, Cincinnati, Frankenmuth and State Farm websites. Sources for weather information include the Federal Emergency Management Agency (FEMA), the Great Lakes Shipwreck Museum, SciJinks.gov, the Storm Prediction Center and Weather.gov.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.