Chubb Insurance Review: Excellent Customer Service, But At A Price

Chubb offers excellent auto and home insurance coverages and customer service. But its rates are expensive.

Find Cheap Homeowners Insurance Quotes in Your Area

Chubb has excellent customer service. It also offers auto and home insurance coverage options that other companies don't.

However, Chubb charges high prices for great service. Its insurance policies may be best suited for high-net-worth individuals with expensive cars and properties. Shoppers looking for the cheapest rate should consider other insurance companies.

ValuePenguin studied Chubb's prices, coverage options, customer service and unique value, and compared them to other top companies in the industry. Using those factors, we give a star rating to give you a clear picture if this company is right for you.

Pros and cons

Pros

Offers specialized coverage for high-net-worth individuals, expensive cars and homes

Great customer service

Local agents offer personalized service

Cons

Typically not the cheapest option

Chubb insurance review: Our thoughts

Bottom line: Chubb's excellent reputation for customer service and extra coverage options make its auto and home insurance worth considering.

However, Chubb's excellent service quality and rare coverage offerings come at an expensive price. If you're simply looking for the cheapest rate, you may find better value with other auto and home insurance companies.

Chubb relies on a strong national network of independent insurance agents and brokers to offer its customers personalized relationships. As a result, Chubb has few customer complaints compared to insurance market national averages.

Chubb has a wide agent and broker network. You can also file a claim and chat with an agent on its mobile app. Plus, Chubb offers coverage options other insurance companies rarely do. These include high policy limits, cash settlement opportunities and identity theft protection.

Chubb's standard policies, for both auto and home insurance, are known as Chubb Masterpiece.

However, Chubb's service quality comes at a price. Annual rates for both auto and home insurance are generally more expensive than those of top competitors. For that reason, Chubb is a good fit for high-net-worth individuals.

Compare Chubb to other top insurance companies | |

|---|---|

| |

| |

| |

| |

| |

Chubb homeowners insurance

Chubb homeowners insurance coverage

Chubb offers standard homeowners insurance, as well as condo and co-op, renters and flood insurance policies. Many policy benefits are rare, even with large companies. These protections are especially valuable to high-net-worth individuals or those prone to risks like cyberattacks.

Chubb Masterpiece home insurance policies have extended replacement cost, cash settlement and risk consulting services. Homeowners also have several unique add-on coverage options like family protection and cyber insurance. And as with auto insurance, Chubb offers high liability limits of up to $100 million in personal liability.

Chubb Masterpiece's rare base coverages include:

Extended replacement cost

Pays for home repairs, rebuilding costs and building code upgrades.

Cash settlement

Homeowners can choose to receive a cash payout after a covered total loss, like a fire. This can help if you're not rebuilding your home.

Risk consulting

Offers free home appraisals as well as security and fire prevention advice.

Temporary living arrangements

Helps homeowners find other living arrangements after a covered loss. This is a common add-on. But Chubb can also help you find a temporary home in your current school district.

Replacement cost coverage

Fully pays to replace your appliances and fixtures with the same or newest model. Homeowners can also choose a cash settlement instead of repair or replacement.

HomeScan

Analyzes your home to identify any potential problems in your home, such as missing insulation, electrical issues and water leaks.

Wildfire Defensive Services

Helps homeowners in certain states protect their home from wildfires. It also includes support after a fire and during the claims process.

Tree removal

Removes fallen trees after a storm.

Electronic data restoration

Retrieves data lost after a computer virus.

Lock replacement

Replaces lost or stolen keys.

Water backup

Covers repairs resulting from interior sewers and drains.

Chubb also offers several add-on coverages. Availability may vary by state.

Equipment breakdown

Pays for the full replacement or repair of your home's appliances and equipment in the event of sudden and unexpected damage. It's available in both Essential and Enhanced coverages.

Family protection

Helps customers pay for expenses following traumatic events like home invasion, carjacking or cyberbullying.

Cyber insurance

Cyber insurance covers cyber extortion, cyber financial loss and cyber personal protection for high-value home insurance policies.

Chubb's basic home insurance policy offers standard coverages. That includes liability, personal belongings, medical payments and additional living expenses.

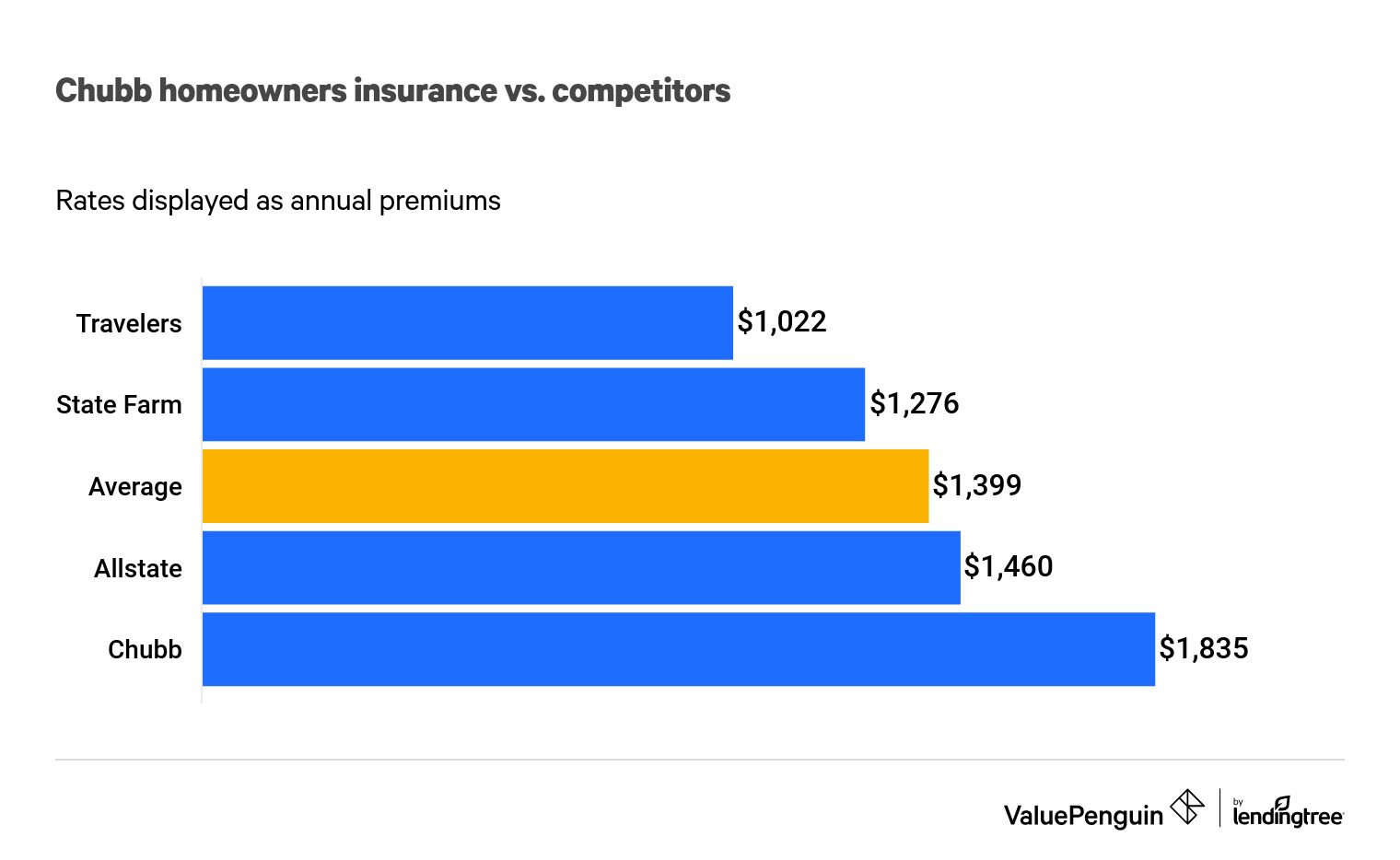

Chubb homeowners insurance quote comparison

Homeowners insurance quotes at Chubb are generally more expensive than rates offered by other large national insurance companies. However, Chubb offers many homeowners discounts that could earn valuable savings for eligible customers.

Find Cheap Homeowners Insurance Quotes in Your Area

Chubb home insurance rates vs. competitors

Company | Annual rate |

|---|---|

| Chubb | $1,835 |

| Allstate | $1,460 |

| Average | $1,399 |

| State Farm | $1,276 |

| Travelers | $1,022 |

The rates above reflect costs for a New York home built in 1961 and worth $314,500. Home insurance quotes vary depending on your location and your home. You should always compare quotes from several companies to find the cheapest rate.

You'll have access to standout features such as cash settlement and risk consulting. But that access comes at a far higher price point. In fact, insurance from Chubb costs 31% more than the average of the four companies in our study.

Chubb homeowners insurance discounts

Customers can lower the high base prices of Chubb's policies with its large list of discounts. Discounts vary from state to state and can depend on whether you live in an urban, suburban or rural community. To give an idea of the company's offerings, however, we've listed the discounts available in New York state below:

Multipolicy

Buy both home and auto coverage from Chubb.

Valuable articles multipolicy

Get $25,000 or more in valuable articles coverage from Chubb.

Burglar alarm

Install a central station burglar alarm.

Fire alarm

Install a central station fire alarm.

Fire resistance

When constructing your home's exterior walls, floors and roof, use fire resistant materials with a rating of two hours or more.

Storm shutter

Have eligible storm shutters covering all exterior glass or other windstorm protections on all exterior glass and skylights.

Suburban rating

Install a central station or direct fire alarm in your home. Live in an area where the fire department meets specific requirements.

Gated community

Live in a gated community with a guard or lock. The community must require visitors' identification to enter.

Gated community patrol service

Live in a gated community with a 24-hour patrol service linked to your home's alarm systems. Your fire and burglar alarm can alert the patrol service.

Residential sprinkler system

Have an eligible and properly maintained sprinkler system in your living areas, basement and heating system area.

Masonry construction

Own a home constructed through masonry methods.

New house

Own a house built in the last seven years.

Renovated house

Own a house that you renovated in the last 10 years.

Chubb also offers a Superior Protection Discount for people who have any combination of the following to protect their home:

- Closed-circuit TV cameras

- Motion activated detection system

- 24-hour alarm protection

- Permanently installed backup generator

- Temperature monitoring system

- Explosive gas leak detector

- Lighting protection system

- 24/7 security guard

- Full-time caretaker

- Sprinkler system water-flow alarm

- Automatic seismic shutoff valve

- Water leak detection system

- Perimeter gate

Chubb condo and co-op owners insurance coverage

Chubb's condo and co-op insurance stands out because it includes high loss assessment coverage limits. Loss assessment coverage offers protection for damage to common area property, like the pool or lobby. This coverage contributes to the condo or co-op owner's share of loss assessment. This is usually an add-on coverage at other companies. Chubb's base coverage is $50,000, and higher limits are available in some states.

Chubb renters insurance coverage

Chubb renters insurance policies are similar to those found at other companies, including personal property, liability and additional living expenses coverage.

Chubb also offers rental car coverage with its renters insurance. If your liability limit is $1 million or more, you get worldwide rental car coverage. That means you're protected no matter where you travel.

Chubb flood insurance coverage

Chubb flood insurance is more comprehensive than other private flood insurance and the government sponsored National Flood Insurance Program (NFIP).

Chubb flood insurance coverage limits are higher than most private companies. And its limits are much higher than the NFIP. It's a good choice if you have an expensive home in a high-risk flood area.

Chubb flood insurance coverages include:

- Up to $15 million in property coverage.

- The full replacement cost to repair or rebuild your home and belongings without deductions for depreciation, up to your policy limits. NFIP policies only offer actual cash value for personal property.

- Up to $5,000 in multiple high-value categories, such as art, collectibles, jewelry and silverware, up to $5,000 each.

- Up to $7,500 in temporary living expenses, with higher limits available for an extra fee. While some other private flood insurance policies may cover this, NFIP policies do not.

- Up to $5,000 in protective measures coverage. This includes expenses like sandbags and flood barriers to protect your home when an official flood warning is issued. This type of coverage is rare for flood insurance companies.

- Extra protection for finished basements.

Chubb auto insurance

Chubb Masterpiece auto insurance policies have standard protections plus unique coverage options. But rates are expensive.

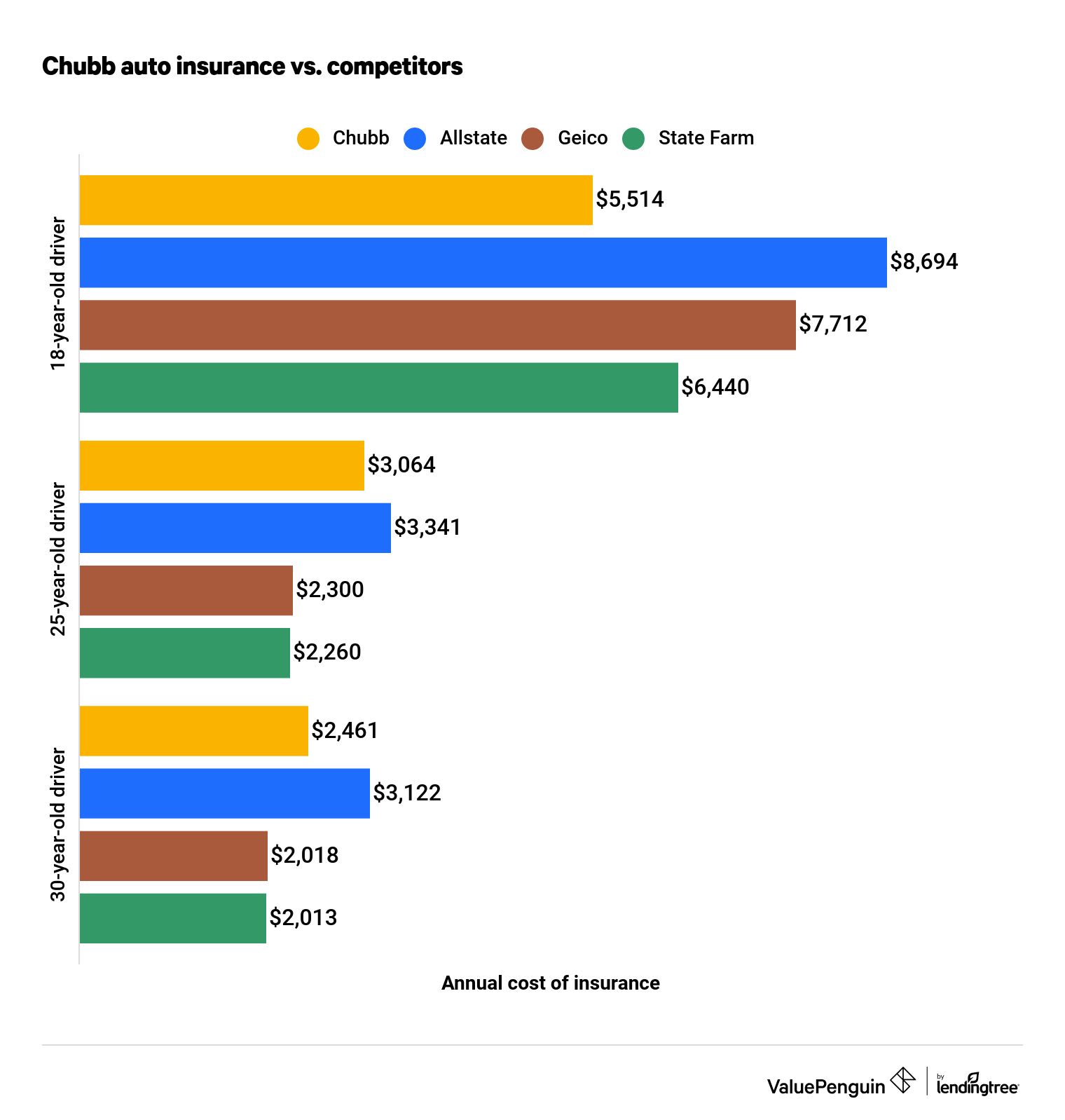

Chubb auto insurance quote comparison

Auto insurance rates available at Chubb are generally more expensive than those offered by other insurance companies.

Bundle & Save

Auto

Home

Chubb car insurance rates vs. competitors

Company | 18-year-old | 25-year-old | 30-year-old |

|---|---|---|---|

| Chubb | $5,514 | $3,064 | $2,461 |

| Allstate | $8,694 | $3,341 | $3,122 |

| Geico | $7,712 | $2,300 | $2,018 |

| State Farm | $6,400 | $2,260 | $2,013 |

Drivers get a lot of unique coverages from Chubb, but you'll pay extra for them.

The only exception is 18-year-olds. Chubb's quotes for these drivers are 22% cheaper than average.

If you're looking for cheap auto insurance, consider another company besides Chubb. Other insurance companies offer better, more affordable deals. If, however, unusual coverage and top-notch customer service are your priority, Chubb could be a solid choice. Always be sure to compare auto insurance quotes to find the cheapest policy, as rates vary by state and driver profile.

Chubb auto insurance coverage options

Chubb Masterpiece offers standard car insurance coverage options. These include liability insurance, uninsured and underinsured motorist coverage, personal injury protection and comprehensive and collision coverage.

Chubb's unique coverages in its basic policy stand out. It also offers several rare add-ons.

For instance, the standard Masterpiece policy includes worldwide rental car coverage, rarely seen from other companies.

Many of Chubb's standard coverages include some of the highest limits in the industry. Chubb offers up to $10 million in personal liability coverage and up to $1 million in uninsured and underinsured motorist coverage. Such high limits may be good options for high-net-worth individuals.

Below we list rare coverages available with Chubb's Masterpiece auto insurance policy.

Agreed value coverage

Agreed value coverage allows drivers of classic or exotic cars to determine the worth of their car, with the agreement of the insurance company, at the onset of their policy. In the event of a total loss claim, you'll receive the agreed amount.

Choice of repair shop

Allows drivers to choose their preferred mechanic and body shop to repair their vehicle or to use a Chubb facility.

Rental car reimbursement

Pays for transportation expenses when your car is being repaired.

Worldwide rental car coverage

Covers repairs to a rental car anywhere in the world.

Original equipment manufacturer (OEM) parts coverage

Pays for the cost of original factory parts.

Pet injury

Pays for any injuries to your pet in a covered accident, up to $2,000.

Child safety seat replacement

Replaces a child safety seat if it's damaged in a covered loss.

Lock and key replacement

Pays to replace lost, stolen or damaged keys or locks, without any deductible or out-of-pocket expense.

Personally identifiable info (PII) removal service

If your car is totaled, Chubb will remove any personally identifiable info remaining in its system.

Road service coverage

Offers roadside assistance, towing and pickup services following an accident.

Chubb also has collector car insurance policies. They include special coverage options for vintage or collector cars, like unlimited hobby use protection.

Chubb auto insurance discounts

Chubb auto insurance discounts are typical compared to the offerings of other large insurance companies. Although its discounts don't stand out, they will help you save on Chubb's expensive base auto insurance rates. Parents, for instance, who add a child to their existing policy could save further with good student and multicar discounts.

Available discounts include:

- Multipolicy - auto and home

- Good student

- Driver training

- Accident prevention course

- Air bag/passive restraint

- Anti-lock brake

- Anti-theft

- Multicar

- Daytime running lights

Chubb insurance customer service and ratings

Customers can expect excellent customer service with Chubb. For home insurance claims satisfaction, Chubb has much better reviews than its competitors.

According to the National Association of Insurance Commissioners (NAIC), Chubb received an overall complaint index of 0.91 in 2020. For personal auto insurance, Chubb's complaint index was 0.67, and for homeowners insurance, the company received a 0.29. The national average is 1.00. Chubb receives fewer complaints than expected for a company of its size.

Rating system | Score |

|---|---|

| NAIC - auto | 0.67 (lower is better) |

| NAIC - homeowners | 0.29 (lower is better) |

| A.M. Best | A++ (superior) |

Customers shouldn't worry about whether Chubb will have enough money to pay out their insurance claims. Chubb received an A++ financial strength rating from A.M. Best. That means Chubb has superior financial stability.

Chubb insurance policies and company structure

Chubb is one of the largest insurance companies in the U.S. It offers many types of policies, from auto and home to life, health and travel. Chubb's property and casualty division operates as the Federal Insurance Co. under the parent company of Chubb Holdings, or the Chubb Group of Insurance Cos. Chubb uses a national network of independent agents and brokers. You may find affiliate underwriters and partners like the Great Northern Insurance Co. or ACE American Insurance Co.

Methodology

ValuePenguin studied Chubb auto and home insurance quotes from ZIP codes across New York. Our sample home was built in 1961 and is worth $314,500 — the median home value in New York.

Our sample drivers were 18, 25 and 30 years old. All of them had a clean driving record and an average credit score. They put 12,000 miles each year on a 2015 Honda Civic EX that they own. In addition to the basic liability coverage, each had collision and comprehensive coverage with a $500 deductible.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.