Best Car Insurance Rates in Buffalo, NY

Progressive offers the cheapest car insurance in Buffalo, at $95 per month for full coverage. NYCM has the cheapest minimum coverage, at $40 per month.

Find Cheap Auto Insurance Quotes in Buffalo

Best cheap car insurance companies in Buffalo

How we chose the top companies

Best and cheapest car insurance in New York

- Cheapest full coverage: Progressive, $95/mo

- Cheapest minimum liability: NYCM, $40/mo

- Cheapest for young drivers: NYCM, $70/mo

- Cheapest after a ticket: Progressive, $98/mo

- Cheapest after an accident: NYCM, $121/mo

- Cheapest for teens after a ticket: NYCM, $70/mo

- Cheapest after a DUI: Progressive, $99/mo

- Cheapest for poor credit: Nationwide, $184/mo

Monthly rates are for full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Progressive is the best choice for most Buffalo drivers. Its prices are consistently among the lowest available and it has a convenient online signup process.

Cheapest car insurance in Buffalo: Progressive

Progressive offers Buffalo's cheapest rates for full coverage auto insurance.

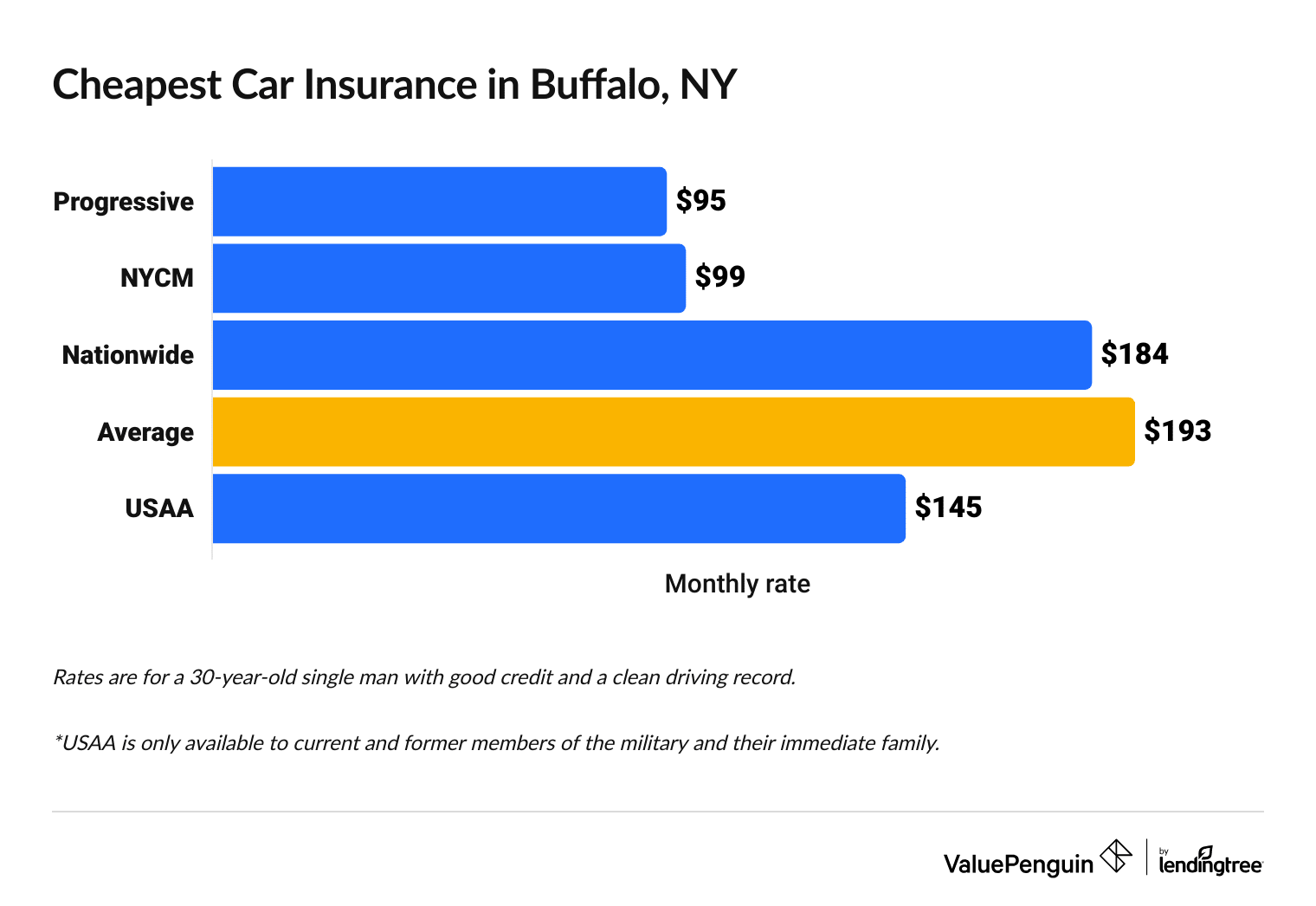

Progressive's average monthly rate is $95, half the city average of $193 per month.

NYCM is also worth a look, as it's only $4 more than Progressive and has top-rated customer service.

Find Cheap Auto Insurance Quotes in Buffalo

Cheapest full coverage car insurance in Buffalo

Company | Monthly rate | |

|---|---|---|

| Progressive | $95 | |

| NYCM | $99 | |

| Nationwide | $184 | |

| Geico | $212 | |

| Travelers | $260 |

*USAA is only available to current and former military members and their families.

Cheapest liability insurance quotes in Buffalo: NYCM

NYCM offers the cheapest widely available minimum liability car insurance rates in Buffalo.

With an average rate of $40 per month, NYCM costs two-thirds less than the average rate of $107 per month.

Cheapest minimum-coverage insurers in Buffalo, NY

Company | Monthly rate |

|---|---|

| NYCM | $40 |

| Progressive | $54 |

| Nationwide | $92 |

| Geico | $110 |

| Travelers | $143 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Buffalo

Cheapest car insurance for young drivers: NYCM

NYCM offers the lowest rates in Buffalo for 18-year-old drivers. The company's average price is $70 per month for minimum coverage — 78% cheaper than the city average. NYCM also has the most affordable full coverage for a young driver, at $177 per month.

On average, 18-year-olds in Buffalo pay $323 per month for minimum coverage and $583 for full coverage.

Cheapest for young drivers in Buffalo

Company | Liability only | Full coverage |

|---|---|---|

| NYCM | $70 | $177 |

| Progressive | $178 | $291 |

| Nationwide | $271 | $542 |

| Travelers | $383 | $698 |

| Allstate | $394 | $744 |

*USAA is only available to current and former military members and their families.

Teen drivers are usually considered high-risk drivers and pay notably higher rates because of that.

Cheapest car insurance for people with a speeding ticket: Progressive

Progressive has Buffalo's best rates for drivers with a speeding ticket. Its average monthly price is $98 for full coverage, less than half the average price citywide .

NYCM is also a very affordable option, at just $1 more than Progressive. NYCM also has excellent customer service.

Cheapest car insurance for Buffalo drivers with a speeding ticket

Company | Monthly rate |

|---|---|

| Progressive | $98 |

| NYCM | $99 |

| Nationwide | $212 |

| Geico | $273 |

| Travelers | $298 |

*USAA is only available to current and former military members and their families.

Buffalo drivers with one speeding ticket pay, on average, 15% more than drivers with clean records. Insurance companies have found that someone with a ticket is more likely to make a claim on their car insurance.

Cheapest car insurance in Buffalo after an accident: NYCM

In Buffalo, NYCM Insurance offers the lowest insurance rates for drivers after an at-fault accident. NYCM's rate of $121 per month is half the average rate overall, which is $248 for full coverage.

Progressive's typical price of $151 per month is also well below the city average.

Cheapest car insurance after an accident

Company | Monthly rate |

|---|---|

| NYCM | $121 |

| Progressive | $151 |

| Nationwide | $244 |

| Allstate | $274 |

| State Farm | $331 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for young drivers after an incident: NYCM

NYCM has the cheapest prices for 18-year-olds after they've gotten a ticket or been in an accident.

After one speeding ticket, 18-year-olds will pay just $70 per month for a liability-only policy at NYCM. That's one-fifth the average rate of $366 per month.

And after an at-fault accident, NYCM charges teen drivers an average of $102 per month — 73% below the city average of $383 per month.

Company | Ticket | Accident |

|---|---|---|

| NYCM | $70 | $102 |

| Progressive | $178 | $203 |

| Nationwide | $291 | $306 |

| Travelers | $455 | $513 |

| Geico | $503 | $560 |

*USAA is only available to current and former military members and their families.

People who have recently gotten a speeding ticket or caused a car crash are statistically more likely to make a car insurance claim in the future, so they pay more for coverage than drivers with clean records. But the good news for teens is the price jump is smaller for young people than it is for older drivers.

Cheapest car insurance for drivers with a DUI: Progressive

Progressive offers the cheapest auto insurance rates for drivers with a DUI in Buffalo. The company's average rate is $99 per month for full coverage, which is only one quarter the typical price in Buffalo.

Cheapest car insurance for Buffalo drivers with a DUI

Company | Monthly rate |

|---|---|

| Progressive | $99 |

| NYCM | $151 |

| Nationwide | $307 |

| Travelers | $327 |

| Allstate | $383 |

*USAA is only available to current and former military members and their families.

A DUI is among the most serious driving infractions, and you'll likely face a steep increase in your car insurance rates if you're convicted. Rates in Buffalo typically double after a DUI.

Cheapest car insurance for drivers with poor credit: Nationwide

Nationwide has the best rates for Buffalonians with bad credit, with an average of $184 per month for full coverage. That's 57% lower than the city average.

Your credit score isn't impacted by how well you drive, but it can increase your rates. The average rate for full coverage more than doubles by 120% to $423 per month if your credit drops from good to poor.

Cheapest auto insurance for poor credit

Company | Monthly rate |

|---|---|

| Nationwide | $184 |

| NYCM | $238 |

| Geico | $302 |

| Allstate | $468 |

| Travelers | $527 |

*USAA is only available to current and former military members and their families.

Average car insurance cost in Buffalo, by neighborhood

The most expensive area in Buffalo for car insurance includes Willert Park and its surrounding neighborhoods, just outside of downtown.

There, car insurance costs an average of $244 per month for full coverage. That's $60 per month higher than the rate in the cheapest area near Buffalo for car insurance, Williamsville .

Car insurance tends to cost more if you live in an area with narrow roads, high traffic or frequent theft.

ZIP | Monthly rate | % from average |

|---|---|---|

| 14201 | $241 | 10% |

| 14202 | $240 | 10% |

| 14203 | $242 | 11% |

| 14204 | $244 | 11% |

| 14206 | $210 | -4% |

Factors such as crime levels, the rate of accident claim filings from that particular area and overall traffic density impact the price of insurance in any neighborhood or ZIP code. One of the top ways to save money on insurance is to compare quotes from multiple insurers.

What's the best car insurance coverage in Buffalo, NY?

Full coverage car insurance is the best choice for most people, because it will pay for damage to your car in a crash or due to other causes, like vandalism or theft.

Collision and comprehensive coverage are key parts of full coverage, offering protection for a driver's own vehicle in both an accident and other situations.

- Collision coverage: Covers damage from an at-fault accident with another vehicle or object.

- Comprehensive coverage: Offers protection from events outside the customer's control, such as hail, vandalism, theft and other events.

As the least expensive option, minimum liability coverage also offers you the least protection. Those who drive a lot, own an expensive car or would like a greater degree of financial protection should consider raising coverage beyond the minimum.

Methodology

To determine the best rates in Buffalo, data was collected from the largest insurers in New York. Rates are for a 30-year-old man who drives a 2015 Honda Civic EX. Unless otherwise stated, the driver has good credit and rates are for a full coverage policy.

Full coverage policies include comprehensive and collision coverage, plus higher liability limits than the state requires.

Coverage | Limit |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $50,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

This analysis used insurance rate data from Quadrant Information Services that was publicly sourced from insurer filings. Quotes should be used only for comparative purposes.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.