Compare 2025 Car Insurance Rates

Most drivers pay $175 per month for full coverage car insurance and $69 per month for liability only, on average. You could save around $203 per month by comparing car insurance quotes.

Find Cheap Auto Insurance Quotes in Your Area

How to compare auto insurance rates

Car insurance rates comparison

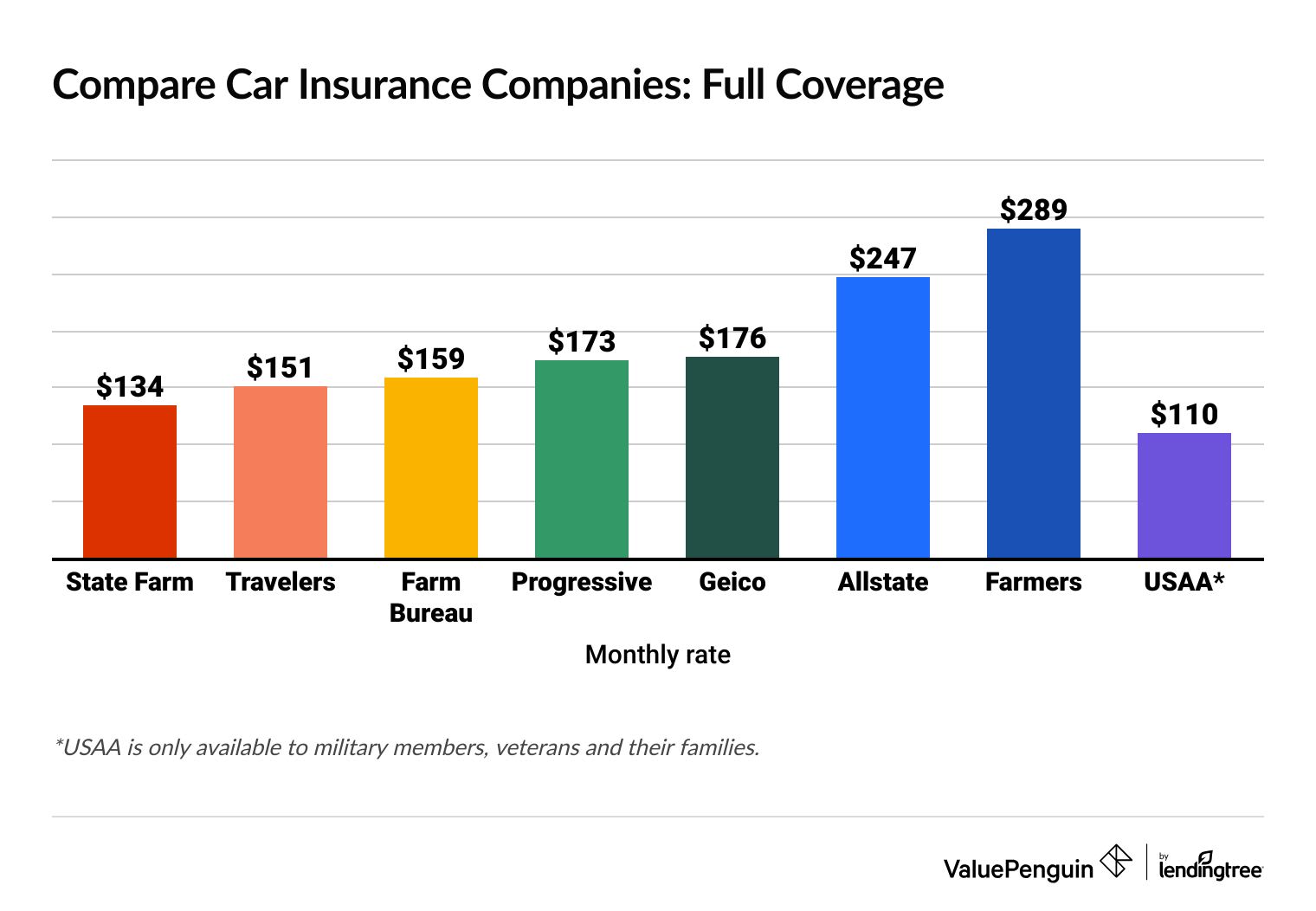

State Farm, Travelers and USAA are the three national companies with the cheapest auto insurance rates for full coverage, on average.

Car insurance prices differ based on where you live, your driving history and more.

Find Cheap Auto Insurance Quotes in Your Area

Compare full coverage car insurance rates by company

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $134 | ||

| Travelers | $151 | ||

| Farm Bureau | $159 | ||

| Progressive | $173 | ||

| Geico | $176 | ||

*USAA is only available to members of the military, veterans and their families.

What affects your car insurance rates?

Your age, location, car, driving record and credit score can all raise or lower your car insurance rates.

Compare rates by:

Car insurance price comparison by state

Full coverage car insurance varies by up to $183 per month depending on which state you live in.

This is in part because of state laws. Each state can decide how much car insurance coverage its drivers need. Most insurance companies must also have their rates approved by state officials before they can make changes.

Rates also vary based on factors like population density, crime rates and severe weather patterns.

Comparing monthly auto insurance rates by state can show how much state requirements affect the price of car insurance where you live.

Full coverage auto insurance comparison by state

State | State avg. | Cheapest rate | |

|---|---|---|---|

| Alabama | $194 | State Farm | $103 |

| Alaska | $141 | State Farm | $115 |

| Arizona | $218 | State Farm | $138 |

| Arkansas | $193 | State Farm | $113 |

| California | $168 | Geico | $124 |

Compare insurance rates by age

Full coverage car insurance for 18-year-old drivers is nearly three times more expensive than coverage for 30-year-old drivers.

Age is a major factor when comparing car insurance rates. Younger drivers pay more for auto insurance than older drivers. That's because insurance companies consider them more likely to get into an accident.

Full coverage auto insurance price comparison for young drivers

18

21

25

Full coverage rates for 18-year-olds

Company | Monthly rate |

|---|---|

| State Farm | $390 |

| Travelers | $397 |

| Geico | $458 |

| Progressive | $580 |

| Allstate | $638 |

| USAA* | $342 |

*USAA is only available to military members, veterans and their families.

18

Full coverage rates for 18-year-olds

Company | Monthly rate |

|---|---|

| State Farm | $390 |

| Travelers | $397 |

| Geico | $458 |

| Progressive | $580 |

| Allstate | $638 |

| USAA* | $342 |

*USAA is only available to military members, veterans and their families.

21

Full coverage rates for 21-year-olds

Company | Monthly rate |

|---|---|

| Travelers | $234 |

| State Farm | $241 |

| Geico | $282 |

| Progressive | $295 |

| Allstate | $444 |

| USAA* | $188 |

*USAA is only available to military members, veterans and their families.

25

Full coverage rates for 25-year-olds

Company | Monthly rate |

|---|---|

| State Farm | $159 |

| Travelers | $175 |

| Progressive | $194 |

| Geico | $221 |

| Allstate | $339 |

| USAA* | $154 |

*USAA is only available to military members, veterans and their families.

Find Cheap Auto Insurance Quotes in Your Area

Compare auto insurance rates after an accident

State Farm typically has the cheapest rates after an accident among major companies.

A full coverage policy from State Farm costs $154 per month after one accident. That's $108 per month less than the national average.

Compare full coverage rates after an accident

Company | Monthly rate |

|---|---|

| State Farm | $154 |

| Travelers | $210 |

| Farm Bureau | $216 |

| Progressive | $259 |

| Geico | $303 |

*USAA is only available to military members, veterans and their families.

Compare car insurance rates by credit score

American Family typically has the cheapest rates for drivers with poor credit among major companies.

A full coverage policy from American Family costs $276 per month for drivers with a bad credit score. Midsize companies like Farm Bureau may offer cheaper rates, but you typically need to contact an agent to get a quote.

Find Cheap Auto Insurance Quotes in Your Area

In most states, credit scores help determine your auto insurance rates.

Drivers with good or excellent credit scores tend to pay lower car insurance rates. Those with poor or bad credit scores pay nearly twice as much for full coverage car insurance.

Monthly full coverage rates by credit score

Company | Poor credit | Good credit |

|---|---|---|

| Farm Bureau | $267 | $159 |

| American Family | $276 | $168 |

| Geico | $284 | $176 |

| Travelers | $285 | $151 |

| Nationwide | $295 | $200 |

*USAA is only available to members of the military, veterans and their family members.

Insurance companies use a calculation called a credit-based insurance score to give each customer a rating. Your score doesn't have anything to do with your driving habits. But companies believe people with lower credit scores are more likely to file claims.

Nationwide has the smallest rate increase for drivers with poor credit. It only raises rates by 48% for drivers with a poor credit history.

State Farm has the biggest upcharge. Drivers with poor credit pay four times more than drivers with good credit at State Farm.

Some states, such as California and Michigan, don't allow insurance companies to use your credit score to help set your car insurance rates. In these states, your credit score won't affect your car insurance rates.

How to compare car insurance rates

Before comparing rates, decide how much coverage you need. You should also get ready for a few questions about your car and driving history.

Gather your personal info

Online auto insurance comparison tools and insurance agents can provide you with estimates. But the rates you get will only be as accurate as the info you provide. To compare prices online, have some basic personal info ready.

What info do I need to get a quote?

- Name

- Age

- Address

- Driver's license number

- Current insurance company

- Info about other drivers on the policy

- Year, make and model

- Vehicle identification number (VIN)

- Date of purchase

- Mileage

- Ticket and accident history

- License suspensions

Decide how much coverage you need

The amount of car insurance coverage you choose has a big impact on your rates.

Most states require drivers to have a minimum amount of coverage. However, it's usually a good idea for most drivers to get a full coverage policy.

It can be helpful to start with the current coverage you have. You can find your current coverage online or on your policy declaration page. This page is part of the policy documents you get when you buy a new policy. It outlines the types of coverage and limits you have.

When comparing car insurance rates, select the same coverage limits from each company for an apples-to-apples comparison.

Collision and comprehensive insurance don't have limits, so make sure you select the same deductibles.

Every insurance company should offer the same basic car insurance coverages. Most states require you to have bodily injury and property damage liability coverage. Some states require uninsured and underinsured motorist coverage, personal injury protection or medical payments coverage.

States never require comprehensive and collision coverage. However, your lender typically requires these coverages if you have a car loan or lease.

Most companies also let you add extra coverage for a few dollars per month. But you often need to have full coverage first. Popular coverage add-ons include:

Collect and compare car insurance rates

Visit insurance company websites and use their online tools to compare auto insurance rates from different companies. Start by getting quotes from the cheapest companies or the best companies near you. You can also call an agent at the insurance company, or work with an independent agent who can help you compare multiple rates at once.

Car insurance prices change over time. When collecting rates, save the reference number so you can get back to the quote later. Also, rates may expire after a few weeks. If you find a good price, you might have to buy coverage sooner to get that rate.

Frequently asked questions

Why should I compare auto insurance rates online?

Every driver gets a different price for insurance based on their address, car and driving history. You will also find a different rate from each insurance company. The only way to find the best car insurance rate for you is to get multiple quotes from different companies. This only takes a few minutes when you use an online tool.

When should I compare car insurance?

You should compare insurance every year to make sure you're always getting the best price. At the very least, you should shop for quotes any time something in your life changes that could affect your rates. This includes buying a new car, moving, changing drivers on your policy, getting a ticket or being in an accident.

What do I need to compare insurance rates?

To compare car insurance rates, you'll need your address, your car's make and model, and info about any recent tickets or accidents. You might need your driver's license number, Social Security number and VIN for the most accurate quote.

It can be helpful to have a copy of your current insurance declaration page. This can help you make sure your quotes have the same amount of coverage you have now.

How much should I be paying for car insurance?

On average, drivers pay $69 per month for minimum liability insurance and $175 per month for full coverage insurance. If you're currently paying more, you should shop around to see if you can find a better rate. However, rates vary based on where you live, your driving record and your age.

Methodology

To find the average cost of car insurance, ValuePenguin gathered rates across 50 states and Washington, D.C., for 39 insurance companies in all ZIP codes in each state. Our experts only included insurance companies that are available in at least five states.

Rates are for a 30-year-old man with good credit and a clean driving record, unless otherwise noted. He owns a 2015 Honda Civic EX.

Rates for minimum coverage meet state minimum auto insurance requirements. Full coverage auto insurance rates include collision and comprehensive plus higher liability limits:

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

- Personal injury protection: Minimum when required by state

Rates for young drivers include quotes from four of the most populated states in the country.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own rates may be different.