Cheapest Car Insurance Quotes in New Jersey (2025)

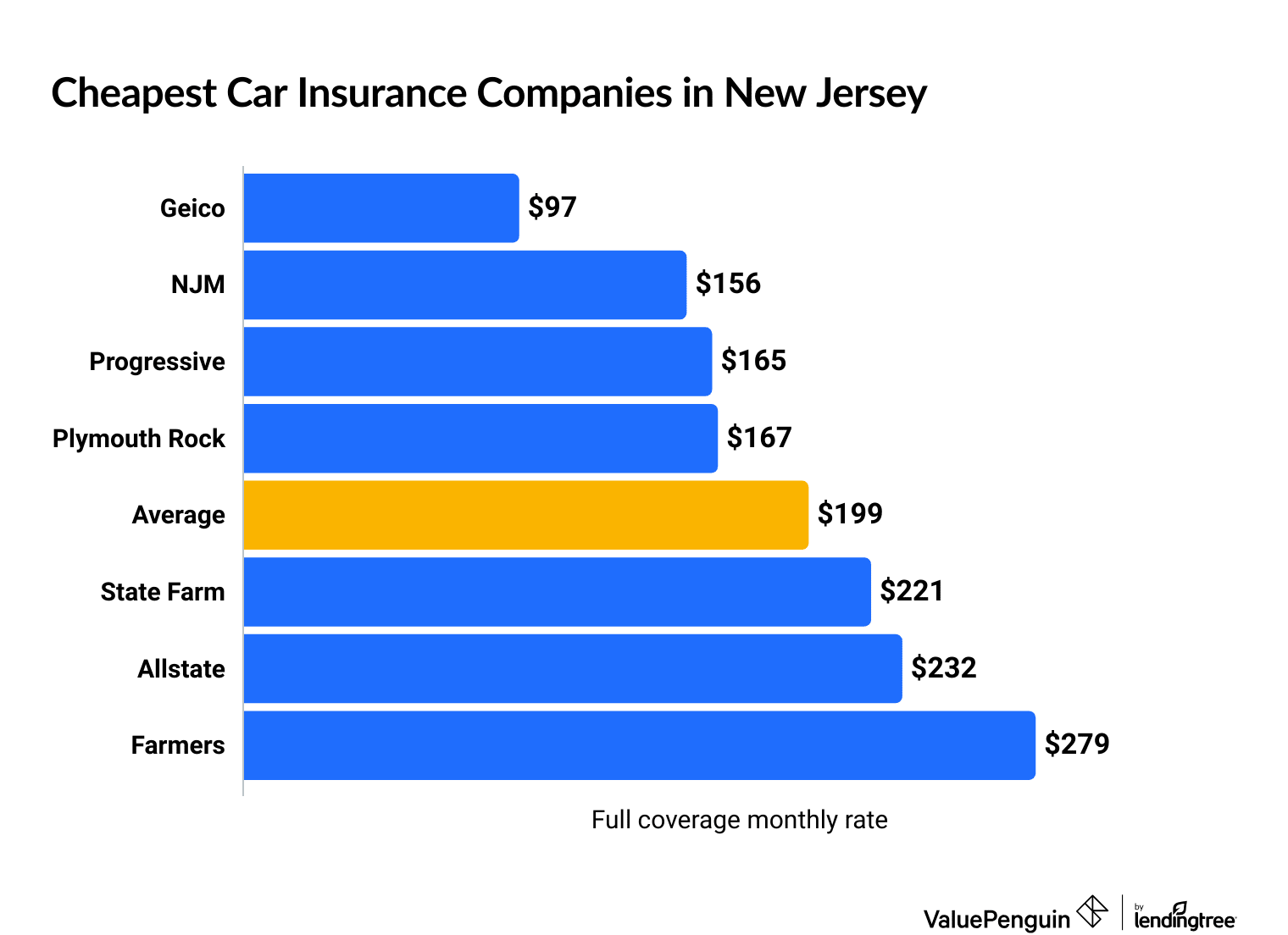

Geico has the cheapest auto insurance in New Jersey, at $97 per month for full coverage.

Find Cheap Auto Insurance Quotes in New Jersey

Best cheap car insurance in NJ

How we chose the top companies

Best and cheapest car insurance in New Jersey

- Cheapest full coverage: Geico, $97/mo

- Cheapest minimum liability: Geico, $42/mo

- Cheapest for young drivers: Geico, $79/mo

- Cheapest after a ticket: Geico, $97/mo

- Cheapest after an accident: Geico, $135/mo

- Cheapest for teens after a ticket: State Farm, $64/mo Geico, $79/mo

- Cheapest after a DUI: Geico, $193/mo

- Cheapest for poor credit: Geico, $221/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Geico offers the cheapest rates in New Hampshire, but NJM is the best company for people who value great service. NJM has very few customer complaints, and its rates are typically cheaper than average.

Cheapest car insurance in New Jersey: Geico

Geico has the cheapest full coverage car insurance in NJ.

Full coverage from Geico costs an average of $97 per month, which is half the statewide average.

New Jersey drivers should also compare quotes from the second-cheapest company, NJM. At $156 per month, NJM is much more expensive than Geico. But it's still $42 per month less than average.

In addition, NJM's full coverage policy includes coverage that most other companies charge extra for, like rental car reimbursement. It may end up being more affordable if you need extra protection.

Find Cheap Auto Insurance Quotes in New Jersey

The average price of car insurance in NJ is $199 per month for a full coverage policy. That's almost twice as expensive as the average liability-only policy.

Cheap full coverage car insurance in NJ

Company | Monthly rate | |

|---|---|---|

| Geico | $97 | |

| NJM | $140 | |

| Plymouth Rock | $152 | |

| Progressive | $157 | |

| State Farm | $168 |

Cheapest liability car insurance in NJ: Geico

Geico has the cheapest liability car insurance quotes in New Jersey.

At $42 per month, a minimum coverage standard policy from Geico is $62 per month less than the state average. The average cost of liability-only car insurance in New Jersey is $106 per month.

Cheapest car insurance quotes in NJ for liability only

Company | Monthly rate |

|---|---|

| Geico | $42 |

| Plymouth Rock | $65 |

| NJM | $86 |

| Progressive | $86 |

| Travelers | $114 |

*USAA is only available to current and former military members and their families.

Drivers can also get cheap car insurance in New Jersey from Plymouth Rock, NJM and Progressive. All three companies have cheaper rates than average in New Jersey.

Find Cheap Auto Insurance Quotes in New Jersey

Cheapest NJ auto insurance for young drivers: Geico

Geico has the cheapest car insurance quotes for 18-year-old drivers in New Jersey.

A minimum liability standard policy from Geico costs around $79 per month. That's less than one-quarter of the average rate in New Jersey.

Geico also offers the cheapest full coverage for 18-year-old drivers. At $206 per month, Geico's policy is roughly one-third the state average.

Best auto insurance in NJ for teens

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $79 | $206 |

| NJM | $204 | $341 |

| Travelers | $262 | $578 |

| Allstate | $309 | $652 |

| Plymouth Rock | $438 | $1,199 |

*USAA is only available to current and former military members and their families.

The average cost of car insurance for young drivers in New Jersey is three and a half times more than the cost for a 30-year-old driver.

Teen drivers pay higher car insurance rates because they have less driving experience and tend to get in more accidents.

Young drivers should stay on their parent's insurance policy to save on car insurance rates. Adding an 18-year-old driver to an existing policy is much more affordable than buying a stand-alone policy as a teen.

Cheap auto insurance in NJ after a speeding ticket: Geico

Geico has the cheapest car insurance quotes in New Jersey for drivers with one speeding ticket. After a ticket, a full coverage policy from Geico costs $97 per month. Geico doesn't raise rates for some drivers after their first traffic violation, so that's the same price you'd pay if you hadn't gotten a speeding ticket.

Plymouth Rock also has affordable rates after a speeding ticket. However, coverage from Plymouth Rock is $70 per month more expensive than Geico.

Cheapest NJ auto insurance after a ticket

Company | Monthly rate |

|---|---|

| Geico | $97 |

| Plymouth Rock | $167 |

| NJM | $209 |

| State Farm | $221 |

| Progressive | $230 |

*USAA is only available to current and former military members and their families.

New Jersey drivers with a speeding ticket pay about 26% more for insurance than those with a clean record. That's an average increase of $52 per month for a full coverage policy.

Cheap NJ auto insurance after an accident: Geico

Geico has the cheapest rates for New Jersey drivers with an accident on their record. The average cost of full coverage with Geico is $135 per month. That's nearly one-third of the average cost for car insurance in New Jersey after an accident.

Company | Monthly rate |

|---|---|

| Geico | $135 |

| NJM | $171 |

| Plymouth Rock | $238 |

| Progressive | $285 |

| State Farm | $367 |

*USAA is only available to current and former military members and their families.

Cheap NJ car insurance for teens with a ticket or accident: Geico and NJM

Geico offers the cheapest car insurance for young drivers with a speeding ticket. A minimum liability policy from Geico costs $79 per month after a ticket, which is the same price teens with a clean driving record pay. That's because Geico doesn't always increase your rates after a speeding ticket.

NJM has the best rates for teens with an accident on their record. A liability-only policy from NJM costs $204 per month for an 18-year-old with a recent crash. That's less than one-third the average cost of insurance for a teen after an accident.

Best quotes in NJ for teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Geico | $79 | $90 |

| NJM | $255 | $204 |

| Travelers | $335 | $440 |

| Plymouth Rock | $438 | $658 |

| State Farm | $446 | $748 |

*USAA is only available to current and former military members and their families.

Affordable car insurance in NJ after a DUI: NJM

Geico has the cheapest car insurance quotes in New Jersey for drivers with a DUI (driving under the influence). Full coverage insurance from Geico costs $193 per month after a recent DUI, which is 45% less than the average DUI rate.

Plymouth Rock, Progressive and NJM all also offer below-average rates, so it's worth comparing quotes from these companies as well.

Company | Monthly rate |

|---|---|

| Geico | $193 |

| Plymouth Rock | $204 |

| Progressive | $206 |

| NJM | $209 |

| Allstate | $355 |

*USAA is only available to current and former military members and their families.

After a DUI, the average cost of car insurance in New Jersey increases to $305 per month for full coverage. That's $106 per month more than a driver with a clean record pays for coverage.

Low-cost car insurance in NJ for drivers with poor credit: Geico

Geico has the cheapest car insurance quotes for New Jersey drivers with poor credit scores. At $221 per month, full coverage car insurance from Geico is less than half the average for drivers with bad credit.

Company | Monthly rate |

|---|---|

| Geico | $221 |

| Progressive | $272 |

| NJM | $273 |

| Plymouth Rock | $399 |

| Allstate | $417 |

*USAA is only available to current and former military members and their families.

Drivers in New Jersey with poor credit pay more for insurance because companies believe they're more likely to make a claim. Drivers with bad credit can expect to pay around four times more for full coverage in New Jersey than those with good credit scores.

Best car insurance in NJ

NJM is the best car insurance company in New Jersey for most people.

NJM has very few customer complaints for a company its size. It also has affordable rates, and its basic policy comes with protection that most other companies charge extra for.

Top auto insurance in NJ

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| NJM | 711 | A+ | |

| State Farm | 657 | A++ | |

| Geico | 637 | A++ | |

| Travelers | 616 | A++ | |

| Farmers | 619 | A |

State Farm is also a highly-rated auto insurance company for New Jersey drivers. In particular, it offers online tools that are easy to use. However, State Farm tends to be expensive in New Jersey.

Average cost of car insurance in NJ by city

Madison, a borough outside of Newark, has the cheapest car insurance policies in NJ.

Drivers in Madison pay around $169 per month for full coverage. That's $30 per month cheaper than the state average.

Irvington, another suburb of Newark, is the most expensive city in New Jersey for car insurance. At $298 per month, full coverage in Irvington costs nearly $100 per month more than the New Jersey average.

NJ car insurance quotes by city

City | Monthly Rate | % from average |

|---|---|---|

| Absecon | $218 | 10% |

| Adelphia | $196 | -1% |

| Allendale | $185 | -6% |

| Allenhurst | $193 | -2% |

| Allentown | $181 | -8% |

The price of car insurance changes based on where you live. Areas with narrow, poorly maintained roads that lead to more car accidents, or places with high rates of car theft, generally have higher rates.

New Jersey auto insurance coverage requirements

New Jersey drivers need to have a minimum amount of car insurance to drive legally. This includes 25/50/25 of liability insurance along with personal injury protection.

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection (PIP): $15,000

New Jersey drivers have the option of choosing between different types of policies:

- A basic policy is the minimum coverage required by the state. These are the cheapest car insurance plans available. Some basic policies do not let you add on comprehensive and collision insurance, depending on the company.

- A standard policy has better liability coverage than the basic plan. You also have the option to add on uninsured or underinsured motorist coverage.

- A full coverage plan is when you add comprehensive and collision coverage to a standard policy. If you have a car loan or lease, you'll typically need to have full coverage.

What's the best car insurance coverage in NJ?

Most New Jersey drivers should get a full coverage policy.

Full coverage policies include comprehensive and collision insurance. These are coverages that pay for damage to your car, even if you cause the accident. Comprehensive and collision insurance are typically required if you have a car loan or lease.

Minimum-coverage auto insurance quotes meet the car insurance requirements in New Jersey. That includes $25,000 in bodily injury liability per person, as well as $50,000 per accident, $25,000 in property damage coverage and $15,000 of personal injury protection (PIP).

However, minimum coverage might not provide enough protection after a serious accident. For example, if you crash into a new luxury car, $25,000 may not be enough to pay for the expensive repairs.

Full coverage insurance typically has higher liability limits, which can help you avoid a large, unexpected bill.

Limited vs. unlimited right to sue for noneconomic losses

New Jersey's car insurance regulations are unique because drivers who buy a standard or full coverage policy have the choice of a limited or unlimited right to sue for noneconomic losses after a car crash. Basically, this is the ability to sue for pain and suffering.

What are noneconomic losses?

Noneconomic losses are losses that can't be easily determined, such as the loss of companionship or pleasure in life. They're often referred to as "pain and suffering" losses. This is different from suing for measurable damages, like lost income from missing work or medical payments to cover your hospital bills.

What's the difference between a limited and unlimited right to sue?

A limited right to sue means you agree beforehand not to sue for pain and suffering. You can only sue for pain and suffering if your injury results in the loss of a limb, major disfigurement or scarring, a displaced fracture, the loss of a fetus, permanent injury to a body part or organ so that it can't heal normally, or death.

Picking a limited right to sue (basic policies) usually means paying lower rates. An unlimited right to sue (standard policies) can cost about 75% more than the limited option.

You can sue for economic losses with either type of policy, but you have to pick between a limited right to sue and an unlimited right to sue for noneconomic losses.

Frequently asked questions

How much is car insurance in NJ?

The average cost of auto insurance in New Jersey is $199 per month for a full coverage policy and around $106 per month for a minimum coverage policy.

Who has the cheapest car insurance rates in New Jersey?

Geico has the cheapest car insurance quotes in New Jersey for most drivers. A minimum coverage policy from Geico costs around $42 per month, while full coverage insurance from Geico costs $97 per month, on average.

Why is NJ car insurance so expensive?

New Jersey is the fourth-most expensive state for minimum-coverage insurance, and the 10th most expensive for full coverage. This is partly because New Jersey is a no-fault state. That means drivers must have personal injury protection (PIP) coverage, which can be pricey.

How much car insurance do I need in New Jersey?

New Jersey drivers with standard or full coverage policies are required to have at least $25,000 per person and $50,000 per accident of bodily injury liability coverage, $25,000 of property damage liability coverage and $15,000 of PIP.

New Jersey also has a "basic" car insurance policy available with even lower limits. However, if you opt for a basic plan, you limit your right to sue the other party after an accident, so it's not recommended unless it's the only policy you can afford.

Methodology

To find the best cheap NJ auto insurance companies, ValuePenguin collected thousands of rates from ZIP codes across New Jersey for the largest insurance companies in the state. Rates are for a 30-year-old man with good credit who owns a 2015 Honda Civic EX.

Rates are for a full coverage policy with collision and comprehensive coverage plus higher liability limits than state minimum requirements.

- $50,000 of bodily injury liability coverage per person, and $100,000 per accident

- $25,000 of property damage liability

- $50,000 of bodily injury uninsured motorist coverage per person, and $100,000 per accident

- $15,000 of personal injury protection (PIP)

- Collision and comprehensive coverage with a $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.