Comparing State Farm vs. Geico vs. Progressive vs. Allstate vs. Farmers

State Farm has the lowest rates among large insurance companies. On average, you'll pay $597 per year for a liability-only policy and $1,589 for full coverage.

Find Cheap Auto Insurance Quotes in Your Area

Best auto insurance company for cheap car insurance: State Farm

State Farm is the best option for most drivers looking for the cheapest car insurance. The company charges $427 less per year compared to Geico for a full-coverage policy. You can save even more with State Farm compared to Progressive, Allstate or Farmers. State Farm has the cheapest rates in most states, outside USAA, which is only available to military families.

Find Cheap Auto Insurance Quotes in Your Area

Average cost of car insurance

Minimum coverage

Full coverage

Company | Monthly cost | |

|---|---|---|

| State Farm | $50 | |

| Geico | $65 | |

| Progressive | $65 | |

| Farmers | $92 | |

| Allstate | $95 |

Minimum coverage

Company | Monthly cost | |

|---|---|---|

| State Farm | $50 | |

| Geico | $65 | |

| Progressive | $65 | |

| Farmers | $92 | |

| Allstate | $95 |

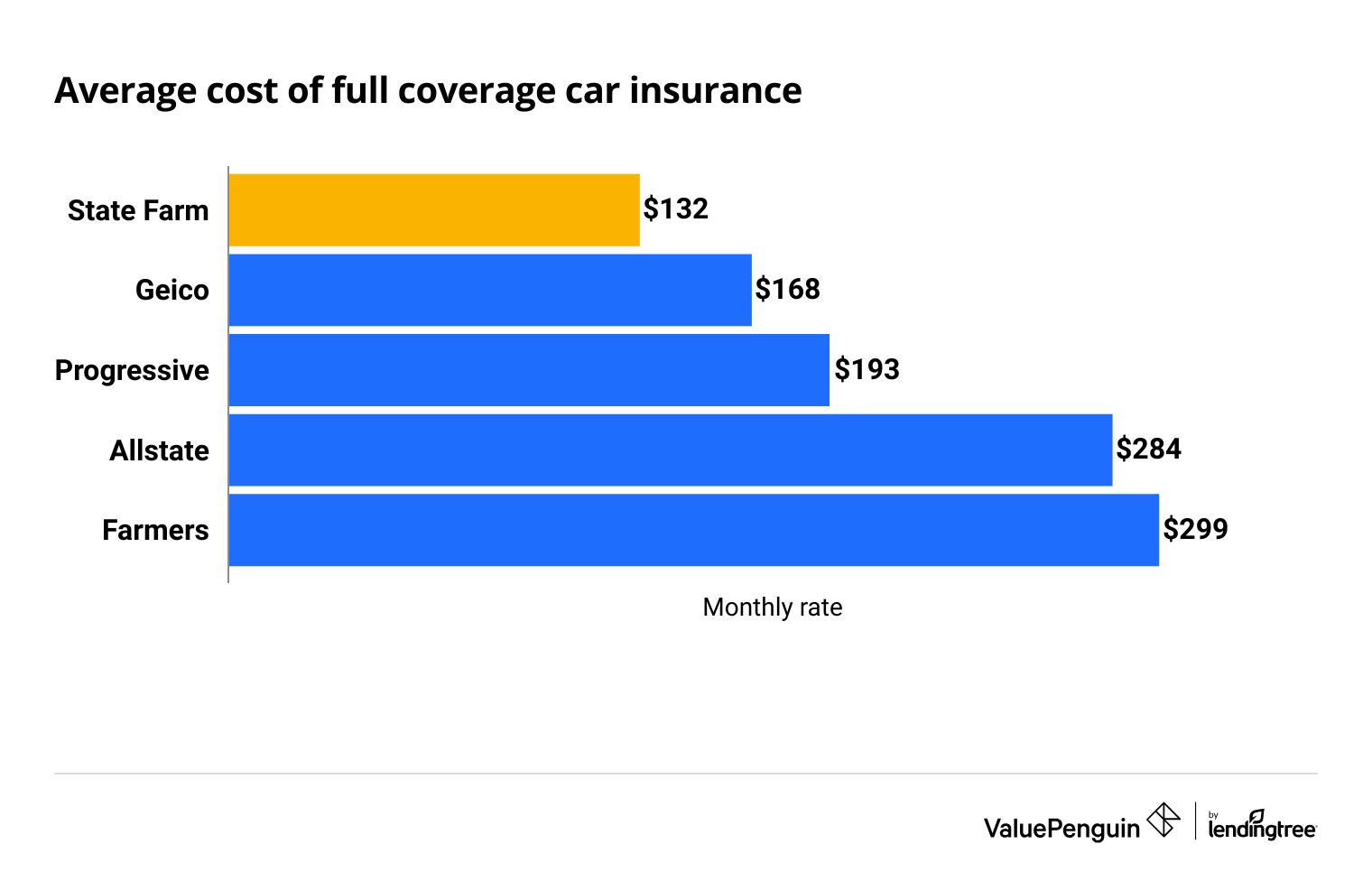

Full coverage

Company | Monthly cost | |

|---|---|---|

| State Farm | $132 | |

| Geico | $168 | |

| Progressive | $193 | |

| Allstate | $284 | |

| Farmers | $299 |

Best auto insurance company for car insurance discounts: Geico

However, Geico may have better rates for drivers who qualify for any of its discounts. Geico has the most affordable car insurance in six states, second-most Behind State Farm. Geico also has more discounts than State Farm, including savings if your car has safety features and multi-vehicle discounts.

On the other hand, State Farm offers the Steer Clear discount. Drivers under the age of 25 can save on their monthly rate if they have an accident-free driving history and they complete several course requirements including a mentor log and course training.

Farmers offers more discounts than Geico. However, Geico's full-coverage rates are less than half of what Farmers charges, on average. This means Farmers' long list of discounts won't automatically make it cheaper than Geico.

Car insurance discounts by company

Discount | Geico | State Farm | Allstate | Progressive | Farmers |

|---|---|---|---|---|---|

| Accident-free | |||||

| Defensive driving | |||||

| Good student | |||||

| Vehicle safety | |||||

| New vehicle |

Comparing each company's discounts for good driving habits

State Farm, Geico, Allstate, Progressive and Farmers all offer app-based safe-driver discounts, called telematics or usage-based driving programs.

Enrolling in a telematics program is an easy way to save on your car insurance. That's especially true if you have a safe driving history. However, a major downside to these programs is that you'll have to allow your insurance company to track where you drive and give up some of your privacy.

- State Farm: The Drive Safe and Save program offers a discount of up to 30% for drivers who demonstrate good driving habits, like not speeding and driving less.

- Geico: Geico's telematics program lets drivers reduce their rates in 20 states where it's currently available. Geico assigns drivers a score based on their habits, which translates to savings. However, some drivers may see a rate increase if they show bad driving habits.

- Allstate: Allstate's Drivewise measures your driving habits. It looks at your speed, braking habits and when you typically drive. In return for access to this data, Allstate offers a discount for every six months you use Drivewise.

- Progressive: The Snapshot program at Progressive can help you save if you have good driving habits. For example, it measures your speed, alert driving and if you avoid late-night driving. According to the company, most people save $47 after signing up, and $145 after six months. Keep in mind that it's possible to experience a rate increase if you drive poorly.

- Farmers: Signal offers a 5% discount (up to 10% for young drivers) on your car insurance when you sign up for the program. Your driving habits may also qualify you for additional gifts and rewards.

Best for customer service: Allstate

Allstate offers the best customer service among large car insurance companies.

Consider Allstate if high-quality customer service is a top priority for you. This company gets fewer complaints than an average insurance company its size, according to the National Association of Insurance Commissioners (NAIC). A lower number of complaints could mean that you'll experience a smooth claims process.

Allstate also ranked high in a recent J.D. Power customer satisfaction survey. It beat out Geico, Progressive and Farmers.

Best auto insurance company for extra coverage: Farmers

Farmers Insurance offers the most auto insurance coverage add-ons, including many useful and uncommon options. For example, you can buy original equipment manufacturer (OEM) coverage. This pays for factory-grade replacements on vehicles 10 years old or younger.

Farmers Insurance customers can also protect any spare parts they keep on hand along with the custom upgrades they've made to their vehicles with the company's spare parts and custom equipment coverage options.

How much car insurance do you need? Each state requires a different amount of car insurance coverage. Typically, you'll need coverage to pay for injuries to other people and property damage that you cause. Extra coverage options vary by company and state. It's also usually a good idea to buy comprehensive and collision coverage, roadside assistance and rental reimbursement for added protection.

Car insurance coverage options

Coverage | Farmers | State Farm | Geico | Allstate | Progressive |

|---|---|---|---|---|---|

| Roadside assistance | |||||

| Accident forgiveness | |||||

| Rental reimbursement | |||||

| Mechanical breakdown | |||||

| Gap coverage |

Although Farmers has the most ways to upgrade a car insurance policy, you should consider Progressive if you're financing your vehicle. That's because Progressive sells gap insurance, which covers you if your car gets totaled before you've paid it off or your lease ends. With this coverage, you won't be stuck paying off a loan or lease for a car you no longer have.

How the biggest car insurance companies compare with each other

Geico usually has better rates than Progressive and a State Farm auto policy tends to cost less than equivalent coverage through Allstate. However, it's important to compare quotes from each company since the average cost of car insurance will differ depending on your specific details.

Geico vs. Progressive

Compared to Progressive, Geico has the cheapest car insurance quotes for most drivers. However, you'll pay roughly the same for a minimum coverage policy from either company. The gap between Geico and Progressive is larger for other drivers. Teenage drivers will pay $3,048 per year more for a full coverage policy from Progressive compared to Geico.

Monthly car insurance rates

Coverage | Geico | Progressive |

|---|---|---|

| Minimum coverage | $65 | $65 |

| Full coverage | $168 | $193 |

| Accident | $266 | $297 |

| Poor credit | $199 | $269 |

| Teen driver | $445 | $699 |

State Farm vs. Geico

State Farm tends to offer cheaper coverage than Geico for most people. However, Geico has better rates for drivers with poor credit. On average, you'll save $36 per month with a Geico full coverage policy compared to State Farm if you have poor credit.

Monthly auto insurance quotes

Coverage | State Farm | Geico |

|---|---|---|

| Minimum coverage | $50 | $65 |

| Full coverage | $132 | $168 |

| Accident | $165 | $266 |

| Poor credit | $223 | $199 |

| Teen driver | $376 | $445 |

Allstate vs. Geico

For most drivers, Allstate costs more than Geico. Geico has the best prices for young drivers and people with different backgrounds and coverage limits.

Monthly car insurance costs

Coverage | Allstate | Geico |

|---|---|---|

| Minimum coverage | $95 | $65 |

| Full coverage | $284 | $168 |

| Accident | $436 | $266 |

| Poor credit | $321 | $199 |

| Teen driver | $761 | $445 |

State Farm vs. Farmers

State Farm tends to offer more affordable rates for most people compared to Farmers. A State Farm minimum coverage policy costs 46% less than its competitor. Drivers with poor credit pay 33% more on average with Farmers compared to State Farm.

Monthly auto insurance rates

Coverage | State Farm | Farmers |

|---|---|---|

| Minimum coverage | $50 | $92 |

| Full coverage | $132 | $299 |

| Accident | $165 | $419 |

| Poor credit | $223 | $297 |

| Teen driver | $376 | $648 |

State Farm vs. Allstate

State Farm has significantly lower prices than Allstate across the board. You'll save hundreds or even thousands of dollars a year with State Farm depending on the policy you buy and your background. For example, a teen driver will save $4,620 per year on average by switching from Allstate to State Farm.

Monthly car insurance quotes

Coverage | State Farm | Allstate |

|---|---|---|

| Minimum coverage | $50 | $95 |

| Full coverage | $132 | $284 |

| Accident | $165 | $436 |

| Poor credit | $223 | $321 |

| Teen driver | $376 | $761 |

Allstate vs. Progressive

Progressive tends to have cheaper car insurance than Allstate for many different types of drivers. However, drivers with poor credit and young drivers should consider either company. Drivers with poor credit pay only 19% more for Allstate compared to Progressive. Young drivers pay only 9% more for a policy with Allstate.

Monthly cost of auto insurance

Coverage | Allstate | Progressive |

|---|---|---|

| Minimum coverage | $95 | $65 |

| Full coverage | $284 | $193 |

| Accident | $436 | $297 |

| Poor credit | $321 | $269 |

| Teen driver | $761 | $699 |

State Farm vs. Progressive

On average, State Farm is 32% cheaper than Progressive. Young drivers can save $323 per month with State Farm, which makes it the best car insurance for teen drivers. Likewise, a driver with one prior accident will save 46% with State Farm compared to Progressive.

Monthly auto insurance rates

Coverage | State Farm | Progressive |

|---|---|---|

| Minimum coverage | $50 | $65 |

| Full coverage | $132 | $193 |

| Accident | $165 | $297 |

| Poor credit | $223 | $269 |

| Teen driver | $376 | $699 |

Frequently asked questions

Which is the cheapest and best car insurance company?

State Farm offers the cheapest quotes for most people among large car insurance companies. On average, its liability-only policies cost $50 per month and its full coverage plans are $132 per month. State Farm has the cheapest coverage in 10 states, the most states behind USAA, which only sells insurance to military members and their families.

Which insurance company has the most discounts?

Farmers has the most discounts. Many are easy for most people to qualify for, such as savings for signing up for coverage online or electronic and automatic bill pay. However, you'll probably save more with Geico because it's much cheaper than Farmers and also offers many discounts.

Which car insurance company has the best customer service?

Allstate has the best customer service reputation among large insurance companies. It gets far fewer complaints compared to other auto insurance companies when adjusted for size. State Farm also gets a small number of complaints making it another good choice if customer satisfaction is a high priority for you.

Which insurance company has the most optional coverage add-ons?

Farmers is the best car insurance company for add-on coverage options. Notably, you can add coverage for damaged custom and original parts.

Methodology

Using car insurance rates from across the country, ValuePenguin compared the cost of coverage from State Farm, Allstate, Geico, Progressive and Farmers. We gathered quotes for a 30-year-old male driver with no history of accidents and average credit unless otherwise noted.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were taken from public insurance company filings and should be used for comparative purposes only. Your quotes may differ.

ValuePenguin commissioned a survey and asked current customers about their satisfaction with claims and the customer service of their insurance company. In our table, the Claim Satisfaction Rating represents the percentage of respondents who were extremely satisfied with their most recent claim experience. The Customer Service Rating represents the percentage of respondents who rated the customer service of their insurance company as "excellent."

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.