Do I Need Renters Insurance as a College Student?

Find Cheap Renters Insurance Quotes for College Students

Every college student should consider buying renters insurance, but not everyone needs a policy. Whether you need to buy renters insurance as a college student depends on a variety of factors, including whether you live on campus and if you have coverage from your parents.

Lemonde is the best cheap renters insurance company for college students.

College students can find affordable rates by comparing quotes from multiple companies and choosing the right coverage limits.

Do college students need renters insurance?

In general, it's a good idea for college students to have insurance or some kind of financial protection for their property. Although it might not seem like you have many personal belongings, such as a your laptop, software, your television, art supplies, furniture or jewelry, and their value can add up quickly.

All together, that could be thousands of dollars of property in your apartment or dorm room.

College students usually have little money saved in the event of an emergency, so losing your possessions would mean spending most of what you have to replace your belongings. However, a student who has renters insurance would be able to file a claim and only have to pay a deductible to replace their personal property.

The most important considerations are whether you live on or off campus and whether you are protected by your parents' homeowners or renters insurance policy.

Living on campus

If you're a student living on campus in a dorm room or apartment owned by your university, and you leave campus during breaks, you may not need to buy a student renters insurance policy. You are likely protected by your parents' homeowners or renters insurance policy, since you still legally reside in your parents' home. Still, you should confirm with your parents' insurance company that you're protected.

Even if you are covered by your parents' home insurance, it may be worth it to buy your own policy. Homeowners insurance policies are created with much higher limits than would typically apply to a college student.

A standard homeowners insurance policy might have a maximum payout of hundreds of thousands of dollars, with a deductible of $1,000 or more — which is how much you must pay toward a claim. It's also the minimum amount for which you can make a claim. For instance, if your $700 smartphone is stolen, your parents' plan with a $1,000 deductible wouldn't cover you at all.

Meanwhile, a renters insurance policy typically has a smaller payout of tens of thousands of dollars, but a much lower deductible: around $100 to $500. This means a renters insurance policy will pay out smaller claims and cover a higher percentage of the costs of your losses.

Getting your own renters insurance vs. sharing your parents' policy

Your own renters insurance policy | Parents' renters/home insurance policy | |

|---|---|---|

| Is off-campus housing covered? | Yes | No |

| Deductible | $100 to $500 | Often $1,000 or more |

| Cost | $10 to $20 per month | No cost, besides existing insurance premium |

| Liability coverage | Included | Included |

| Property coverage limit | $10,000 to $100,000 | A certain percent of total home coverage limit |

Some universities partner with specific renters insurance providers to offer coverage to their students. For example, GradGuard partners with a range of colleges — including the University of Southern California, University of Oregon and University of South Carolina — to offer college renters insurance. It can be convenient to buy a renters insurance policy this way, but they don't usually offer discounts. You might save money by going with another company.

Living off campus

If you live off campus in an apartment or house where you've signed a lease, you should consider buying a renters insurance policy — and this goes for off-campus fraternities and sororities, too. Unlike a dorm resident, you legally live in your own apartment, so you will likely not be covered under your parents' policy. You likely also have a greater deal of legal liability than a college student who lives on campus. If you host a party in your off-campus apartment and someone is hurt, you may be held liable for their injuries.

Renters insurance is generally quite cheap, though. With enough coverage for liability and all your belongings, you'll generally spend only $5 to $20 per month.

You might also be required to buy a renters insurance policy, especially if you live in an apartment. Landlords commonly require them, especially for properties they rent to students, which can be subject to more wear and tear than other rental properties.

Best cheap renters insurance for college students

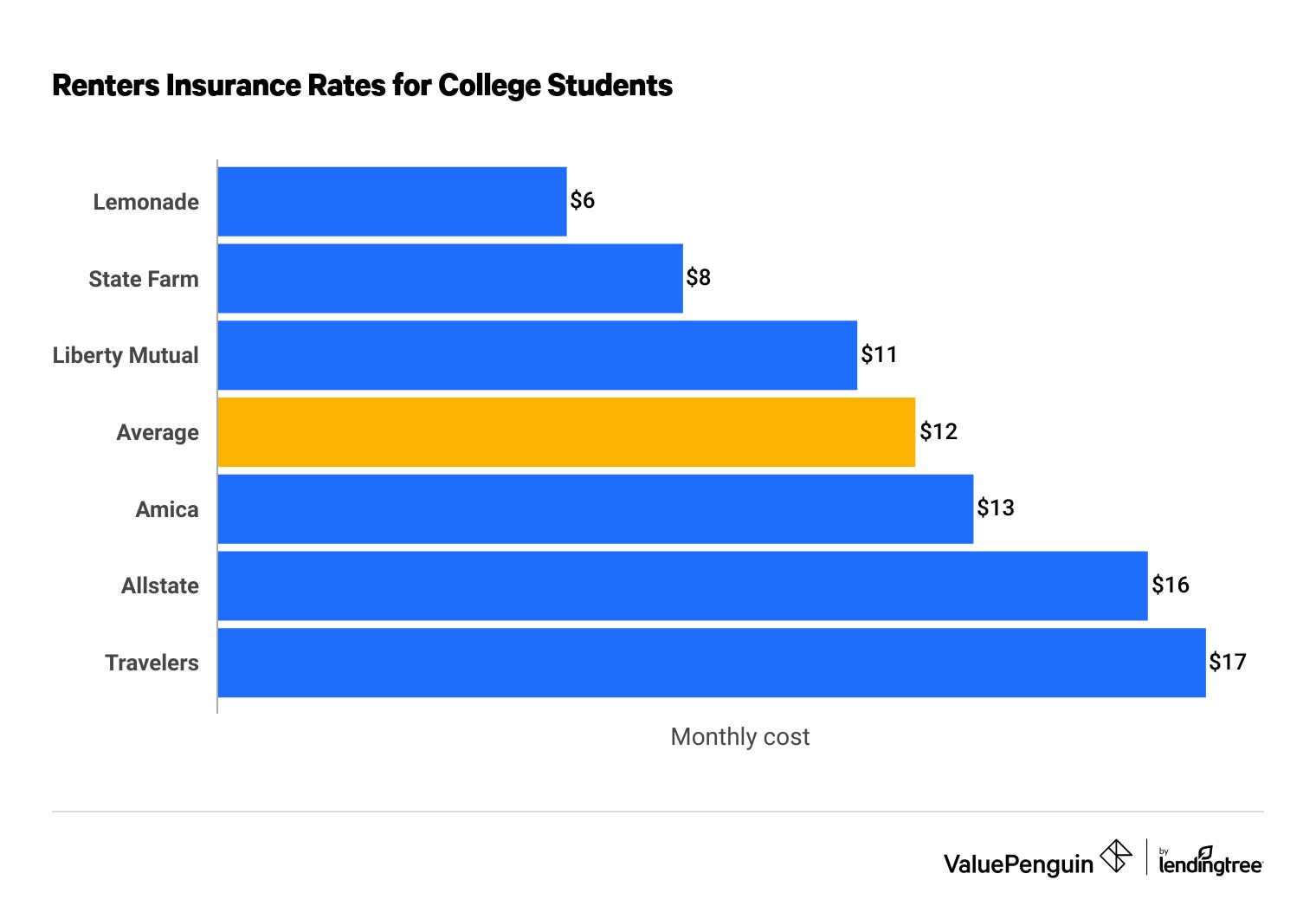

Lemonade offers the best cheap renters insurance for college students.

The company's average rate for a policy tailored to the amount of property in a typical college campus apartment complex is $6 per month. That's half the average of some of the largest insurance companies in the country, which is $12 per month.

Find Cheap Renters Insurance Quotes for College Students

Note that some renters insurance companies have minimum limits on personal property coverage that might be considerably higher than a college student's needs.

Cheap renters insurance rates for college students

Company | Monthly rate | |

|---|---|---|

| Lemonade | $6 | |

| State Farm | $8 | |

| Liberty Mutual | $11 | |

| Amica | $13 | |

| Allstate | $16 | |

| Travelers | $17 |

Dorm insurance: an affordable alternative for on-campus students

Dorm insurance is another cheap alternative to regular renters insurance for college students who live on campus. This type of policy has many names: personal property insurance, student insurance and personal articles insurance, among others. Dorm insurance is essentially the personal property coverage section from a typical renters insurance policy, leaving out liability coverage and additional living expenses (ALE).

However, personal articles insurance generally goes further than typical renters insurance in one important area: it includes accidental and water damage. These are two of the most common forms of damage to things like smartphones, laptops and tablets — some of the most valuable items a college student is likely to own. Renters insurance typically won't pay for repairs if you cause damage to your property accidentally, like if you drop your smartphone and break the screen, or if it gets wet after falling into a swimming pool.

Personal property insurance generally has a lower deductible than standard renters insurance, so you'll be able to make a claim even if the dollar amount of damage is relatively small.

Plus, these policies often include replacement cost coverage, meaning you won't have to pay for the depreciation of your belongings.

The costs per month are typically around the same price or lower than regular renters insurance. However, with this type of policy, you'll miss out on the liability and additional living expenses coverages of a standard renters insurance policy. So, personal property insurance is most beneficial when you already have that coverage from somewhere else — namely, your parents' home insurance.

Renters vs. dorm insurance

Renters insurance | Dorm insurance | |

|---|---|---|

| What's covered |

|

|

| What's not covered |

|

|

| Monthly price | $10 to $20 | $10 to $20 |

| Deductible | $100 to $500 | $25 to $100 |

| Coverage limit | $10,000 to $100,000 | $2,000 to $5,000 |

Not every renters insurance company offers a property-only plan, but many do. And a few companies, like NSSI, specialize in this type of policy. Here are a few insurer options for dorm insurance.

Personal articles insurance companies

- State Farm

- Nationwide

- NSSI

- GradGuard

- Gallagher Student Renters Insurance

How to find cheap renters insurance for college students

Picking the right renters insurance company (and the right kinds of coverage) is key to ensuring you're protected without overpaying for services you don't need. There are a few tips for buying the right renters insurance while you're in college.

- Figure out how much coverage you need by estimating the value of your property. Some renters insurance companies have a minimum policy limit of around $10,000, which is as much as most college students need. This will ensure you're not spending more on coverage than you need to. Start with your most expensive items, like your laptop, smartphone and furniture, since those likely make up the majority of the dollar value of your property.

- Decide which additional coverages to look for. Renters insurance typically includes liability coverage, which is good to have, especially if you regularly throw big parties. You may also want to add additional living expenses (ALE), which pays for a hotel or alternative housing if your apartment is unlivable. You can probably skip additional living expenses if you live in a dorm.

- Collect renters insurance quotes from multiple insurers. Renters insurance is not very expensive. The average cost of renters insurance nationwide is $18 per month. But different companies offer different rates, so you can save money by shopping at several companies. Check with multiple reputable companies to see who will give you the best price — no small consideration for the tight budget of a college student.

- Consider working with an insurance agent. Students who are unfamiliar with how insurance works may benefit from an insurance agent's guidance. An agent can help explain the process of signing up for a policy and making a claim, and can help you choose the right coverages for your situation.

How college students are covered by renters insurance

Renters insurance protects you and your property in case of an accident. And despite the name, renters insurance covers you even if you live in a dorm or with a family member. There are three main coverages included in a typical renters insurance policy: personal property coverage, liability protection and additional living expenses.

Personal property coverage

Personal property coverage protects all your stuff. This includes your clothes, laptop, books and anything else you own. You're protected no matter where the things are, including in your home, in the classroom or even in another country. Renters insurance policies have a maximum coverage amount, for example, $10,000. Make sure your policy limit is high enough to protect all of your belongings in case of a total loss — like if your apartment catches fire. That way, you'll be able to replace your things without paying for it all yourself.

Keep in mind that personal property coverage only protects your belongings from certain covered perils. Most renters insurance policies include theft, fire, wind and other damage, but they exclude accidental damage or loss. Check your policy for exactly what is and is not covered.

Liability coverage

Liability coverage pays other people in cases where you are liable, or legally responsible, for what happened to them. For example, you're covered if a guest gets hurt at your home, or if your dog bites someone.

Additional living expenses

If your home becomes uninhabitable due to a covered peril, additional living expenses (ALE) coverage pays for temporary living expenses. For example, if your apartment catches on fire, additional living expenses coverage would pay for you to live in a nearby hotel until it's safe to move home.

What isn't covered by renters insurance

Not everything is covered by renters insurance, though. For instance, renters coverage only protects things you own; your roommates need their own policies. And damage to your home itself, whether you're in a dorm or privately owned apartment, is covered by the policy of whoever owns it — your university or landlord.

Cars also aren't covered under renters insurance, no matter whom they belong to. Damage to your car is covered by car insurance.

Frequently asked questions

Do college students need renters insurance?

College students are rarely required to have renters insurance, unless a landlord requires it as part of signing a lease. It can be helpful in protecting a student's property, and is usually inexpensive.

How much is renters insurance for college students?

Renters insurance for college students is usually cheap because college renters tend to not need much coverage. A ValuePenguin analysis found an average rate of $12 per month.

Do you need renters insurance for a college dorm?

You usually do not need renters insurance for a college dorm. A parents' home insurance often extends coverage to children in dorms. However, the deductible is often higher, so a renters policy could provide extra protection.

Methodology

ValuePenguin found the cheapest renters insurance rates for college students by collecting quotes for student apartments in five of the largest major universities in the country: Texas A&M, Ohio State, the University of Maryland, Arizona State University and the University of Minnesota. Rates are from six major insurance companies.

Quotes are for a 20-year-old with $10,000 in personal property coverage and $100,000 in liability coverage.

Coverage | Limit |

|---|---|

| Personal property | $30,000 |

| Personal liability | $100,000 |

| Medical payments | $1,000 |

| Deductible | $500 |

Managing Editor

Ben Breiner is the Managing Editor of ValuePenguin/LendingTree's insurance vertical. He oversees a team of writers who focus on guiding readers through the rigors of home and auto coverage. He still loves that moment when the words fall together and he can translate an intimidating topic so a reader can make the best choice.

Ben got involved in insurance in 2021 when he joined ValuePenguin. He moved up from writer to editor and watched the team grow to expand the ways it helps consumers. Before that, he spent a decade as a sportswriter for newspapers in the Southeast and Midwest.

Ben had to put off buying his first car because of high insurance rates, so he's keenly aware how the wrong policy can get in the way of your goals. He should've shopped around and looked to the experts.

Insurance tip

Always keep an eye out for insurance you can load up on at a low price. A lot more liability coverage won't break the bank and protects your hard-earned assets.

Expertise

- Car insurance

- Home insurance

- Renters insurance

Education

- BA, Economics and Journalism, University of Wisconsin-Madison

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.