The Best Cheap Renters Insurance in Georgia (2025)

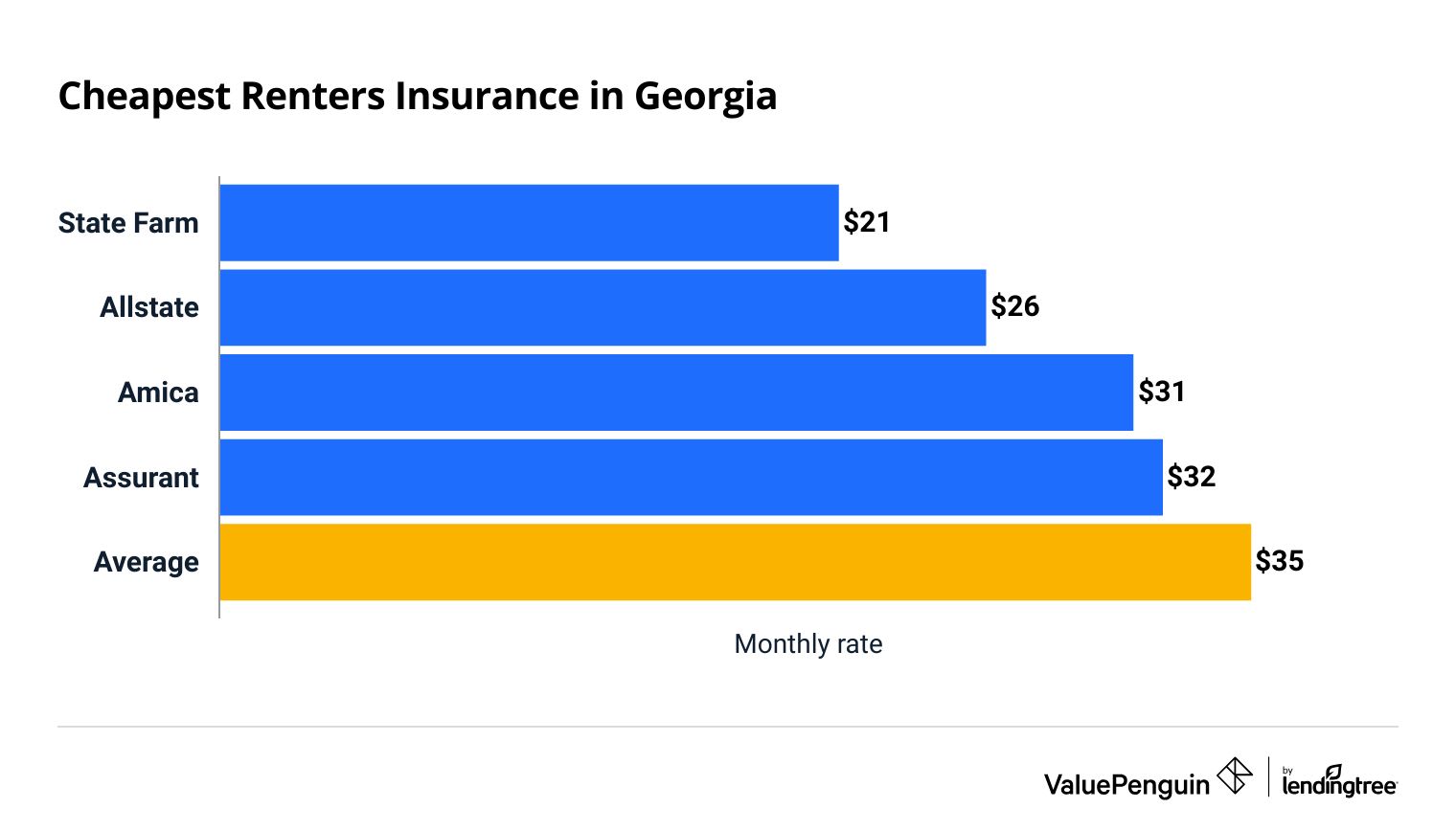

State Farm has the cheapest renters insurance in Georgia, at $21 per month, on average.

Compare Cheap Renters Insurance Quotes in Georgia

Best Cheap Renters Insurance in GA

Our editors rated renters insurance companies based on quality of service and coverage options, in addition to cost. To find the best cheap renters insurance in Georgia, ValuePenguin collected 175 renters insurance quotes across 25 of the largest cities in the state.

Cheapest renters insurance in Georgia

State Farm offers the cheapest renters insurance in Georgia.

A policy from State Farm costs around $19 per month.

Allstate and Amica are other affordable options with rates cheaper than the state average.

Compare Cheap Renters Insurance Quotes in Georgia

The average renters insurance cost in Georgia is $35 per month.

Renters insurance in Georgia is expensive compared to the rest of the country. Renters insurance rates are lower in neighboring Florida ($26 per month) and Alabama ($32 per month). This could be because Georgia has higher-than-average property crime rates.

Best affordable renters insurance in Georgia

Company | Monthly cost | ||

|---|---|---|---|

| State Farm | $21 | ||

| Allstate | $26 | ||

| Amica | $31 | ||

| Assurant | $32 | ||

| Lemonade | $37 | ||

Best renters insurance in Georgia for most people: State Farm

-

Editor's rating

- Cost: $21/mo

State Farm has the cheapest rates for most Georgia renters.

-

Cheapest quotes in GA

-

Best rates in Atlanta

-

Highly-rated mobile app

-

Mediocre customer service

-

Few coverage add-ons and discounts

State Farm is the best choice for renters insurance in Georgia. The average price of insurance from State Farm is $21 per month, or $256 per year. That's $5 per month less than the price you'll pay from the second-cheapest company, Allstate.

State Farm also offers the cheapest renters insurance in Atlanta, at $25 per month.

That's $13 less each month than the average cost of Atlanta renters insurance, which is $38 per month.

A State Farm policy comes with enough coverage for most renters. But it doesn't offer many ways to upgrade your protection. For example, you can't get replacement cost coverage, which replaces your stuff with brand-new items, regardless of wear and tear.

If you prefer to manage your policy online, you might find State Farm's highly-rated mobile app useful. You can view policy documents, pay your bill and file a claim within the app. State Farm also has lots of local agents for those who prefer to have a personal relationship with their agent.

However, it may take a while for you to replace your damaged stuff if you choose State Farm. It earned a good score on J.D. Power's renters insurance customer survey. But State Farm gets 5% more complaints than an average company its size, according to the National Association of Insurance Commissioners. If you're looking for a company with exceptional customer service, you should consider Amica instead.

Best customer service for Georgia renters: Amica

-

Editor's rating

- Cost: $31/mo

Amica has the best-rated customer service in Georgia.

-

Very few customer complaints

-

Highly-rated claims process

-

Lots of discounts

-

Average rates

Amica is among the best-rated insurance companies in the country. It only gets one-third as many complaints as similar-sized companies, according to the NAIC.

In addition, Amica earned the top score on J.D. Power's property claims study. That means you can count on Amica to get your life back to normal quickly after your stuff is damaged.

Amica also offers a few ways to upgrade your renters insurance coverage for an extra fee. For example, Amica will replace your belongings with brand new items if you add replacement cost coverage to your policy. You can also add extra coverage for expensive items, like electronics, jewelry and artwork.

However, you'll have to pay extra for Amica's great service. At an average rate of $31 per month, it's $10 per month more than a policy from State Farm.

You may be able to reduce your rates by bundling policies. Amica offers a discount of up to 15% when you buy car insurance in addition to renters coverage. You can also save when you sign up for automatic payments or to get your bills via email.

Best coverage options: Assurant

-

Editor's rating

- Cost: $32/mo

Assurant offers lots of ways to upgrade your protection.

-

Basic policy includes extra coverage

-

Lots of coverage upgrades available

-

May offer flood insurance in coastal areas

-

Lots of customer complaints

-

Not the cheapest option

Assurant has lots of coverage extras for renters who have more complex insurance needs than a typical apartment-dweller.

A basic policy from Assurant comes with replacement cost coverage, which most companies charge extra for. It also includes mold protection, which many other companies don't offer.

In addition, Assurant offers lots of coverage upgrades that you can add for an extra fee. For example, you may have the option to add flood insurance and food spoilage coverage. These coverage options are especially helpful for renters living near the coast who worry about hurricane damage.

Assurant isn't the cheapest option in Georgia. But at $32 per month, it's still $3 per month less than the state average. The extra cost may be worth it if you consider the upgraded coverage built into its standard policy.

The biggest drawback to Assurant is its poor customer service.

It gets five times more complaints than other companies of a similar size, according to the NAIC. The majority of Assurant's complaints are from renters who are unhappy with their experience with the company's adjusters. So you may have a lot of back and forth with Assurant before you get a check after a claim.

Georgia renters insurance rates by city

Albany, a town in Southwest Georgia, has the cheapest renters insurance compared to other major cities in Georgia.

A renters insurance policy costs around $25 per month in Albany, which is $10 per month less than the Georgia average.

Gainesville, a suburb in Northeast Atlanta, is the most expensive city for renters insurance in Georgia.

The average cost of renters insurance in Gainesville is $56 per month, which is $21 per month more than the statewide average. This could be because Gainesville has high property crime rates.

Average renters insurance in Georgia by city

City | Monthly rate | % from average |

|---|---|---|

| Albany | $27 | -20% |

| Alpharetta | $34 | 2% |

| Athens | $29 | -15% |

| Atlanta | $38 | 14% |

| Augusta | $27 | -21% |

Renters insurance rates vary by more than $30 per month across the 25 largest cities in Georgia.

Your bill might be lower if you live in an area with a low crime rate, or higher if you live far from a fire station. That's because insurance companies consider how likely you are to file a future claim when calculating your insurance rates.

How to find cheap renters insurance in Georgia

To find the most affordable renters insurance in Georgia, you should make sure you have the right coverage, shop around for multiple quotes and look for discounts.

Make sure you're buying the right amount of coverage. It's important that you take the time to inventory your stuff before shopping for renters insurance. That way you know how much money you need to replace all of your belongings after a major emergency, like a house fire.

The amount of personal property you have is typically one of the largest factors in how much you pay for renters insurance. You don't want to pay for coverage you don't need. But having too little coverage could result in a big bill if you have to replace your stuff.

Compare quotes from multiple companies. There's a difference of $32 per month between the most and least expensive renters insurance companies in Georgia.

In addition, all companies calculate renters insurance rates differently. Some place more value on your insurance history, while others might focus on the structure of your home. For that reason, the cheapest company for you may be different from your neighbors, friends or family.

Look for discounts. Renters can typically get the largest discount by bundling their auto and renters insurance policies with the same company.

Some companies offer discounts that are easy to get. For example, you may save money by choosing automatic payments or signing up to get your bills via email. You may also get a discount if you haven't filed a renters insurance claim in the last three to five years.

What renters insurance do I need in GA?

Renters across Georgia should make sure they have protection against hurricane damage. Hurricanes can affect both coastal Georgia and inland areas. Tornadoes can also cause damage to homes across the state.

Does Georgia renters insurance cover hurricanes?

Renters insurance typically protects against most types of hurricane damage, including wind, hail and lightning.

Renters near the coast may have a separate deductible for damage caused by named hurricanes and tropical storms. That means you could end up paying more than one deductible, depending on the cause of damage.

Your hurricane deductible is usually higher than your regular deductible. So be prepared to pay more if a hurricane damages your stuff.

Renters insurance doesn't cover flood damage. If you live near the coast, a lake or river, or your home is in a low-lying area, you should consider buying a separate flood insurance policy.

Does renters insurance in Georgia cover tornadoes?

Renters insurance typically covers wind and hail, which are the main types of tornado damage.

However, if your area has frequent tornadoes, your policy may have a separate wind insurance deductible. That means you may have to pay two deductibles if your stuff is damaged by both wind and another type of destruction, like lightning.

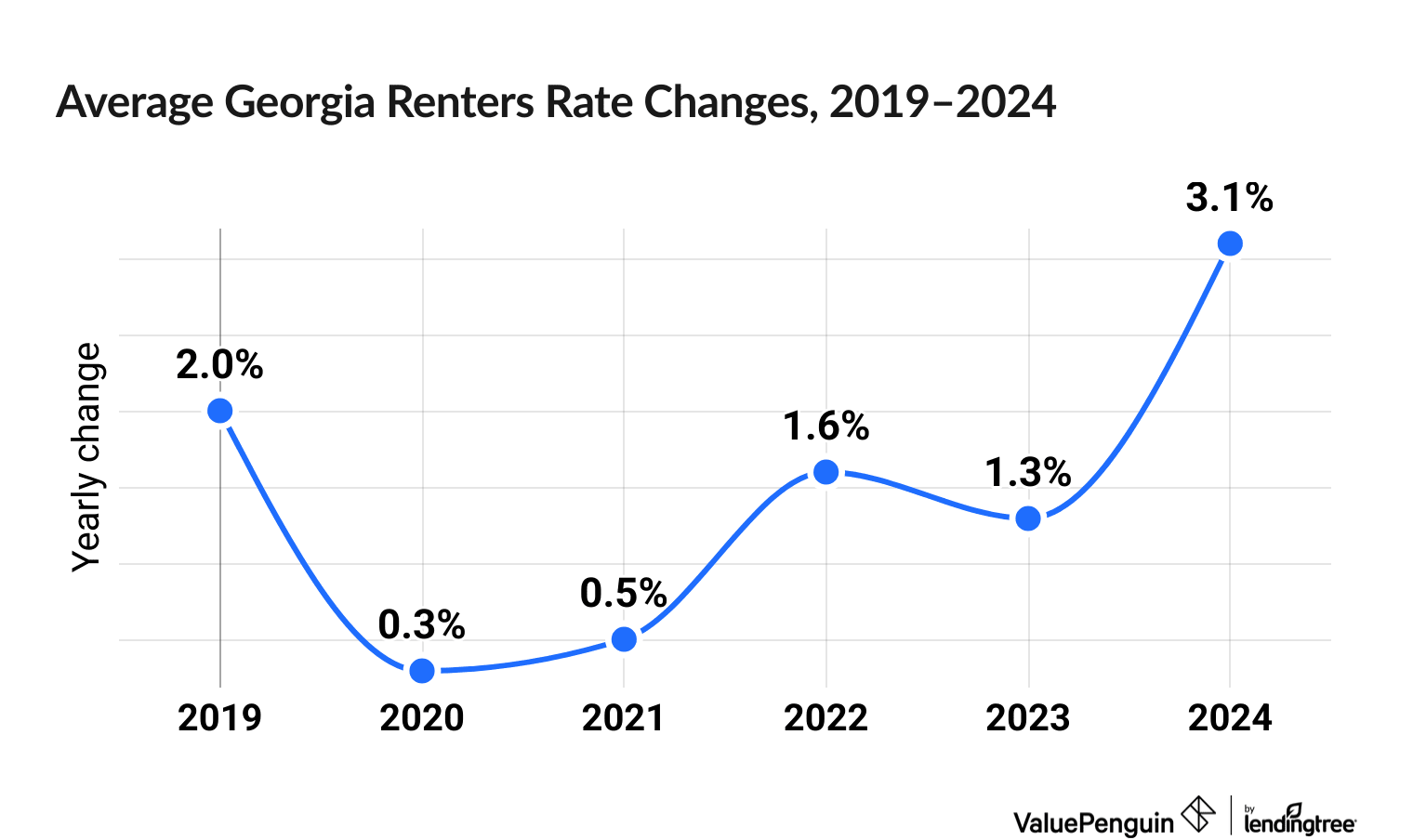

Georgia renters insurance trends

Renters insurance prices have gone up 9.1% in Georgia over the last six years.

Georgia renters insurance rates went up between 1.0% and 47.2%, depending on the company, over the last six years.

Renters insurance prices, on average, saw little to no increase between 2020 and 2022, but jumped up by 4.5% across 2023 and 2024.

Among the major GA insurers, the biggest increases have been at Chubb (47.2%), United Services Automobile Association (34.7%) and Liberty Mutual (31.3%).

Renters insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

How much is renters insurance in Georgia?

The average cost of renters insurance in Georgia is $35 per month. That's $9 per month more than neighboring Florida, and $3 per month more than Alabama.

Is renters insurance required in Georgia?

There's no law in Georgia that requires you to get renters insurance. However, some landlords may require you to get insurance as a part of your lease.

How much is renters insurance in Atlanta, GA?

The average cost of renters insurance in Atlanta is $38 per month. Atlanta renters can typically find cheaper rates with State Farm, Assurant, Allstate and Amica.

Methodology

ValuePenguin collected 175 renters insurance quotes from seven of the top insurance companies in Georgia from 25 major cities or areas around the state. Rates are for a 30-year-old single woman who lives alone and has no recent renters insurance claims.

Quotes include the following coverage limits:

- Personal property coverage: $30,000

- Personal liability: $100,000

- Loss of use: $9,000

- Medical payments: $1,000

- Deductible: $500

ValuePenguin experts selected top picks by analyzing rates, customer service and coverage options. Renters insurance star ratings are based on the National Association of Insurance Commissioners (NAIC) Complaint Index, the J.D. Power renter insurance customer satisfaction index and ValuePenguin's editors' rankings.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.