Cheap Life Insurance for Smokers

Find Cheap Life Insurance Quotes in Your Area

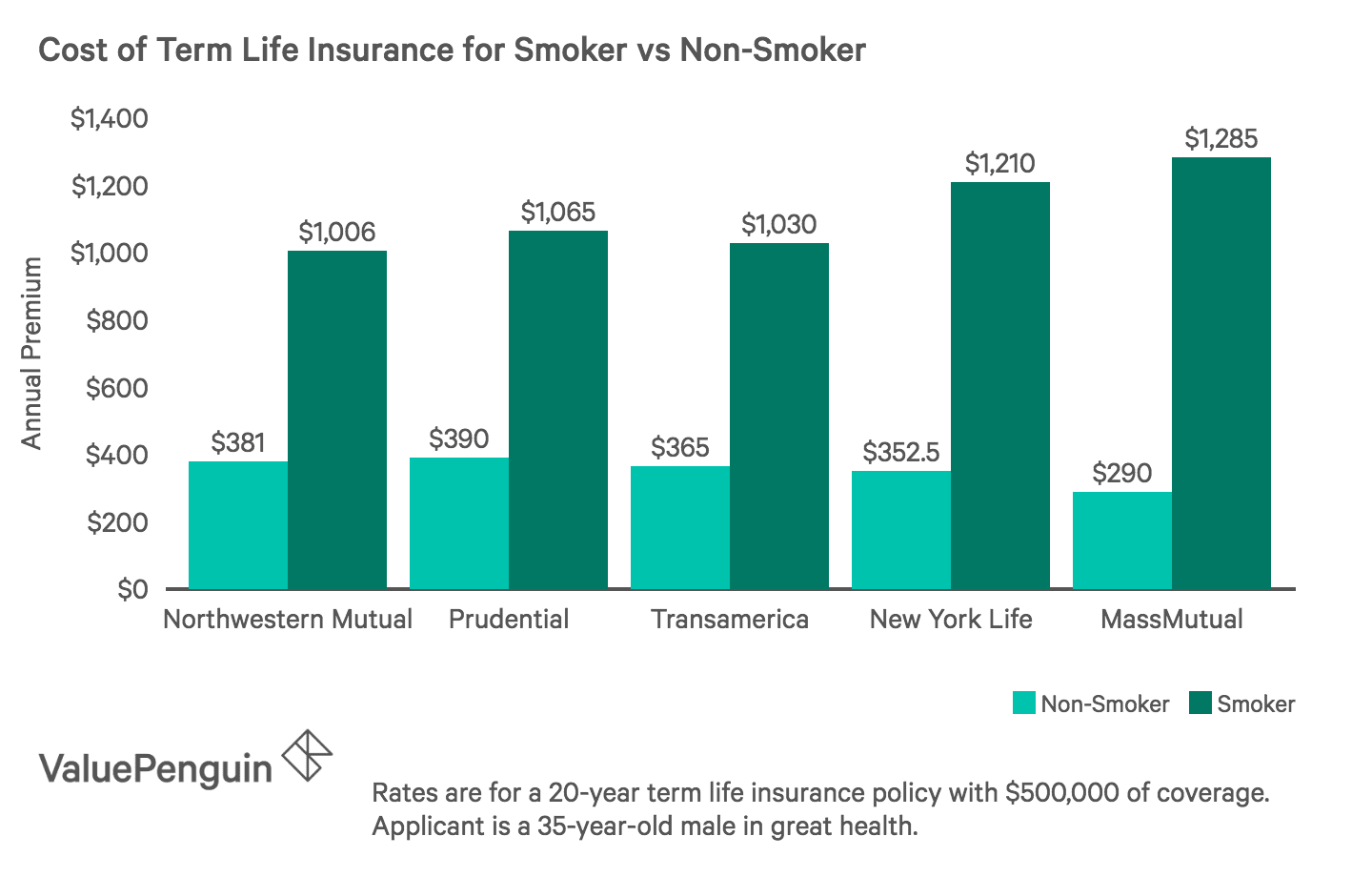

Being a smoker doesn't mean you can't get life insurance, but you will pay a much higher rate for coverage. In quotes from five national insurance companies, smokers paid 215% more, on average, for coverage than nonsmokers.

If you use tobacco, choosing the best life insurance company will depend on how frequently you use it and your method of tobacco use. Some companies offer cheaper rates for people who only smoke occasionally or use a pipe or chewing tobacco instead of smoking cigarettes.

How much more do life insurance companies charge smokers?

Companies charge higher rates for smokers, but the cost of life insurance is also based on age (the older you are, the greater the increase), overall health, family medical history and type of coverage . As shown below, the premiums for term life insurance would be between 164% and 343% more expensive for smokers versus nonsmokers.

Find Cheap Life Insurance Quotes in Your Area

Across the quotes from five sample companies, the average cost of life insurance for a 35-year-old smoker was $1,119 per year, or 215% more expensive than nonsmoker rates.

When you apply for life insurance, the company will determine which rating category you fall into, based on smoking status, personal and family health history, and other lifestyle factors. Each company has a different system, but "preferred smoker" and "smoker" categories generally pay higher premiums. These categories are applied at the time of purchase, so if you started smoking after you bought coverage, your rates wouldn't increase.

Typical Life Insurance Rating Categories

- Preferred plus: Nonsmokers in great health with little to no family history of medical conditions

- Preferred: Nonsmokers in good health who may have a minor condition, such as high blood pressure

- Standard plus: Nonsmokers in good health who have a couple of minor conditions or a higher BMI

- Standard: Nonsmokers who are of average health or have a family history of medical conditions

- Preferred smoker: Smokers, including people who recently quit, in great health with little to no family history of medical issues. If they didn't smoke, these individuals would qualify for the "preferred plus" category.

- Smoker (standard): Smokers with good or average health

- Table rating: Reserved for those with below-average health. Table ratings generally carry the highest life insurance rates.

This rating system applies for term, whole life and universal life insurance coverage.

In some cases, if you purchased a life insurance policy as a smoker but later quit, your company might change your rating and lower your premiums. Ask your insurance company if this option is available.

How life insurance companies define a smoker

Depending on the company, you may be considered a smoker if you use any kind of nicotine product, not just cigarettes. That could include cigars, pipes, e-cigarettes, nicotine gum or the patch. Life insurance companies will ask about your use of these products when you apply. They will then confirm your responses by referencing your physician records and conducting a medical exam (unless you choose a no-exam policy).

Companies use saliva, urine or blood tests to see if there's nicotine or cotinine in your system. These chemicals will appear if you've used tobacco or nicotine products. Some products will not cause you to be rated as a smoker if you just use them occasionally, such as a celebratory cigar a few times a year. But a test won't show the difference if you smoke within days of your medical exam, so make sure to abstain for at least a month beforehand. Nicotine can stay in your system for about 3 days, while cotinine can stay in your system for up to 10 days.

You typically won't be considered a nonsmoker for a life insurance rating until it's been at least 12 months since you quit. How frequently you used to smoke and the amount of time since you quit will be limiting factors in getting the best rates. For instance, depending on the company, you may not qualify for "preferred" rates for at least two to four years after you've stopped regularly smoking cigarettes.

Chewing tobacco

Chewing tobacco generally means paying smoker rates. And how frequently you chew tobacco will further affect your cost of coverage. The blood test in a medical exam tests for nicotine, which will appear in your system if you've recently used chewing tobacco. A company won't be able to distinguish between chewing tobacco and smoking cigarettes, so make sure you specify that in your application.

Cigars and pipes

Cigar and pipe smokers will likely receive smoker life insurance rates if they:

- Smoke more than one cigar per month

- Test positive for nicotine (a cigar will show up on a nicotine test if you've smoked recently)

- Use any other tobacco products

If you smoke less than one cigar per month, don't use other forms of tobacco and are in great health, many companies won't consider you a smoker, and you'll qualify for the best life insurance rates.

However, some companies, like MetLife, are relatively strict, allowing only four cigars per year before you're considered a smoker.

Nicotine gum and patches

If you use nicotine gum or patches, they will show up in a blood or urine test, so it's important to disclose your usage in the application. Some life insurance companies treat smoking cessation products, such as nicotine gum, the same as cigarettes when setting rates, while others will treat you as a nonsmoker. Tell your insurance company if you use these products but no longer smoke. They may also ask how long it's been since you last smoked, which will determine your rating.

Vaping and e-cigarettes

Life insurance companies typically consider vaping a form of smoking, meaning you'll be rated as a smoker. That said, some may offer a better rate for people who vape only, so you should still clarify on your application that you vape. When you get a medical exam, your blood and urine may be tested for nicotine and cotinine, which will appear in your system whether you use e-cigarettes or traditional ones. If you don't specify which, the company will assume you're a traditional smoker and rate you as such.

As greater data is collected on vaping, more companies may give e-cigarette smokers better rates, but Prudential is one of the few companies that currently considers it a different category. How vaping affects your life insurance rates will also depend on how frequently you use e-cigarettes and whether you have any health conditions.

Marijuana smokers

Insurance exam blood tests check for drug use, including THC, the main psychoactive compound in cannabis. They'll typically ask on your application if you smoke marijuana.

You can get life insurance as a cannabis user, but not from every company. Some will automatically reject your application due to drug use. Cannabis users may be classified as smokers, meaning that even if you're offered coverage, you wouldn't qualify for the cheaper, non-tobacco life insurance rates, depending on the company. We recommend being honest about your marijuana use, as failing to do so could be considered fraud. Your policy could be canceled or claim denied.

Depending on how frequently you smoke cannabis, some life insurance companies will offer nonsmoker rates. For example, if you smoke twice a month, you could qualify for above-average life insurance ratings from Prudential and Aviva, as long as your blood test comes back negative. But keep in mind that some marijuana tests can come back positive 30 days after your last use.

If you use medical marijuana, the situation is essentially the same, except you're likely to face even higher life insurance rates due to the condition you obtained the prescription for in the first place. (Medical cannabis is often used to treat serious illnesses, such as cancer.)

Best life insurance rates for smokers

Among the top-rated insurance companies, Banner Life Insurance, Northwestern Mutual and Transamerica offer some of the best term life rates for cigarette smokers. If you use other forms of tobacco, such as e-cigarettes, cigars or nicotine products, the cheapest life insurance company may vary based on your usage. Prudential, for instance, may offer nonsmoker rates if you vape, use nicotine gum or patches or chew tobacco.

If you're currently a smoker but looking to quit, you likely won't qualify for the best life insurance rates for at least 12 to 24 months after you've stopped using tobacco. In this case, the most affordable option may be to buy a cheaper, short-term policy and then switch to a longer-term policy once you've quit for long enough to qualify for nonsmoker rates. Alternatively, you could purchase your policy and then ask for a health class reconsideration, but you should ask your life insurance company if this is even an option.

No-exam life insurance for smokers

A no-exam life insurance policy is a good option for smokers who would have trouble passing a medical exam due to other conditions and don't need a large death benefit. It's also good for smokers who need coverage quickly. These simplified issue policies are available for both term and whole life insurance coverage, but they have some limitations:

- The maximum death benefit is significantly lower than what you could buy with a medically underwritten policy.

- No-exam life insurance tends to be more expensive, because companies are unable to test and confirm your health information.

Note that, even though you won't be tested for nicotine and cotinine with a no-exam policy, you'll still need to answer questions regarding tobacco use. It's equally important to be honest about any smoking, vaping or other tobacco use. Otherwise, your beneficiary may not receive a payout if you die and the company can demonstrate that you were untruthful in your application.

Lying on a life insurance application about smoking

Every life insurance application will ask whether you've smoked or used tobacco products, as well as how recently and frequently. Lying is a bad idea, and we strongly recommend against it.

First, if your policy requires a medical exam, your insurance company may find out about your tobacco use by seeing cotinine or nicotine in your blood or urine test results. And if your medical records indicate you've been a smoker, this will also be taken into account when setting your rates. Even if you manage to secure a life insurance policy as a nonsmoker, if the company learns of your tobacco use postmortem, they may deny your beneficiary's claim. So, while you may have secured a lower premium while you were alive, your beneficiary won't receive the benefit you intended for them.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.