MetLife Life Insurance Review: Cheap Prices but Weak Customer Service

MetLife's subsidiary company, Brighthouse Financial, sells affordable term life insurance but has low customer satisfaction ratings.

Find Cheap Life Insurance Quotes in Your Area

MetLife no longer offers individual life insurance policies. Employers can still buy group plans. However, if you want to buy a policy for yourself, you'll need to go through Brighthouse Financial, a MetLife subsidiary.

Brighthouse Financial term life insurance policies are affordable and offer a range of coverage options. However, you cannot buy a term life plan through Brighthouse if you are older than 50 or if you smoke.

Pros and cons

Pros

Affordable prices

Widespread availability

Multiple policy options

Cons

Not available for smokers or people older than 51

Poor customer service

Can't buy a policy online

MetLife Brighthouse

In 2017, MetLife stopped selling individual life insurance policies. It spun off those lines of business into a new company, Brighthouse Financial.

Brighthouse Financial sells individual term life insurance, hybrid, universal and whole-life policies.

You can still buy a MetLife group life insurance policy if your employer offers it.

Brighthouse Financial term life insurance

You can choose from several different term life insurance plans through Brighthouse including its SimplySelect 10-, 20- and 30-year policies. You can choose a Brighthouse SimplySelect term life policy with a death benefit ranging from $100,000 to $3 million. Your coverage options may be limited by the state you live in and your financial situation.

Brighthouse doesn't require a medical exam for its SimplySelect term life policy. However, you will have to fill out a health questionnaire and complete a phone interview with an insurance agent.

Brighthouse Financial does not sell term life insurance to tobacco users or to those aged 51 and up. If you fall into either of those categories, we recommend MassMutual as the best life insurance company for term life policies.

MetLife’s term life insurance policies keep your monthly rate the same for the length of the policy. After the initial term, the policy automatically renews on a one-year basis, meaning your yearly rates increase each year based on your age.

So if you bought a 10-year term policy that costs $11 per month, you would pay that amount for the first 10 years of coverage. Starting in year 11, your monthly premium might increase to $13, then to $16 in year 12.

If you're 50 or younger, you can get another fixed policy. However, if you're over the age of 50, then you have to continue on a one-year renewal cycle or move to another term life insurance provider. The longest-term coverage will last until you turn 95.

Find Cheap Life Insurance Quotes in Your Area

Life insurance rates table

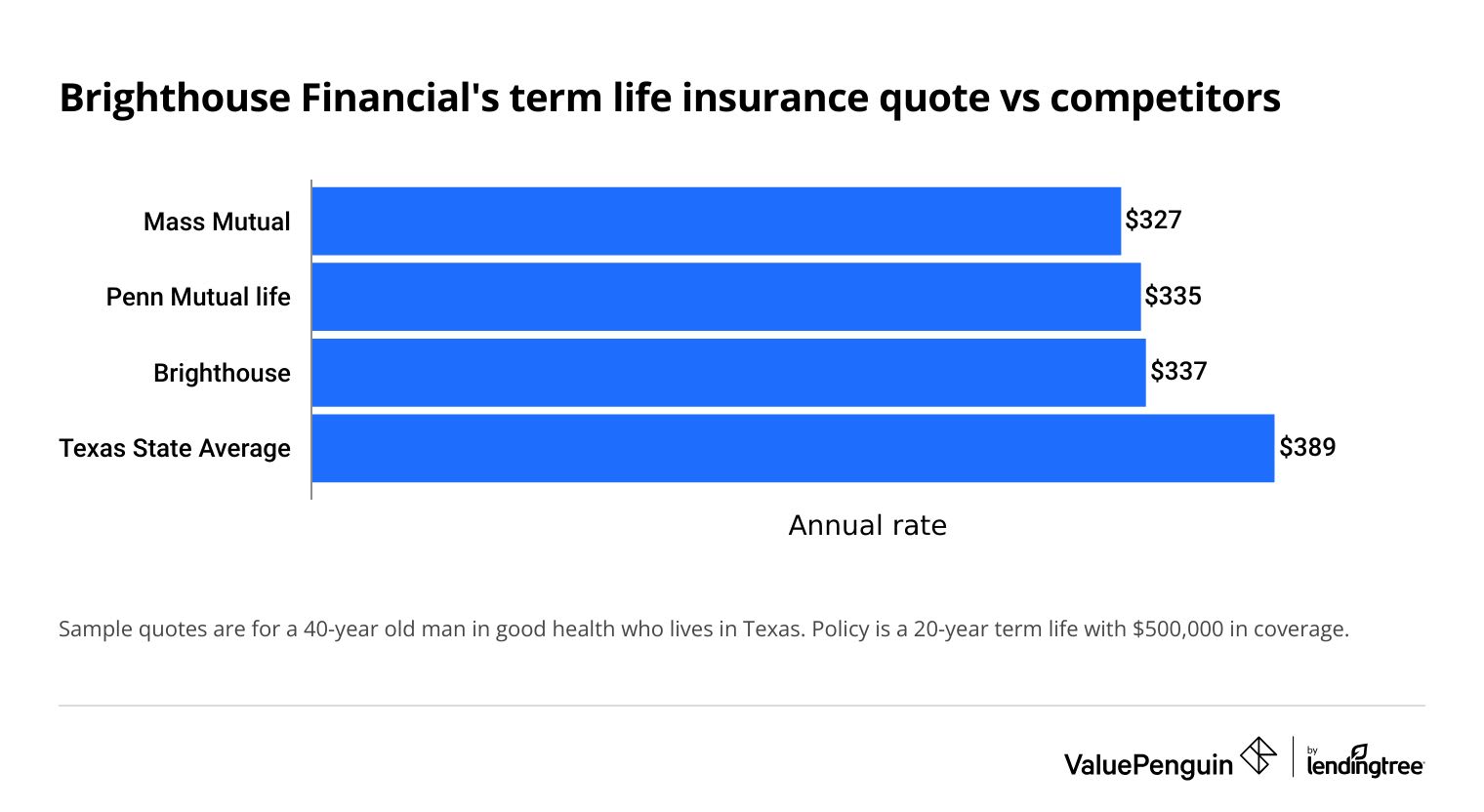

Annual cost | |

|---|---|

| MassMutual | $327 |

| Penn Mutual | $335 |

| Brighthouse | $337 |

| Texas state average | $389 |

Sample quotes are for a 40-year-old man in good health who lives in Texas. The policy is a 20-year term life policy with $500,000 in coverage.

Although Brighthouse is comfortably cheaper than average for term life insurance, it's not the cheapest provider on the market. MassMutual and Penn Mutual both offer slightly better deals for a 20-year term life policy with $500,000 in coverage.

Brighthouse's Whole Life Conversion option lets you turn your term life policy into a whole life policy.

Brighthouse also offers a one-year term life policy. This plan is not a good idea for most situations. However, it might come in handy if you're between jobs, or if you'd like more coverage before you start receiving Social Security benefits.

Brighthouse term life insurance add-ons

Brighthouse's term life insurance policies all offer an accelerated death benefit that lets you receive a portion of your policy’s death benefit while you’re still alive. To qualify, you must have been diagnosed with a terminal illness (meaning you have less than 12 or 24 months to live depending on your state).

This can be very helpful for your family, as serious illnesses often come with high medical bills, which you may have trouble paying out of pocket. You can ask for up to 100% of the life insurance policy's value. For example, if you have a $500,000 policy, you could receive all $500,000 if you wanted.

Accidental death and dismemberment add-ons pay an additional death benefit on top of your policy if you pass away due to a qualified accident, such as a car crash. Unfortunately, Brighthouse does not offer an accidental death rider.

Both accidental death and dismemberment and accelerated death benefits are common life insurance add-ons that are offered by many providers.

According to the Centers for Disease Control and Prevention, unintentional injuries are America's fourth leading cause of death.

Brighthouse Financial universal life insurance

Brighthouse Financial hybrid life insurance lets you access your death benefit early to pay for assisted living care. It combines universal life insurance with a long-term care rider.

Universal life insurance is a kind of permanent life insurance. It works much like whole life insurance, although you have the option of paying more than your minimum monthly payment.

That extra cash grows tax-deferred. Unlike whole life insurance, universal life insurance doesn't give you a fixed interest rate. Brighthouse Financial offers universal life insurance that lets you invest in a fund that tracks the performance of the largest companies in the stock market.

You can choose a universal life insurance policy if you want flexibility with how you pay, a guaranteed death benefit and the option to build cash value. Brighthouse's SmartGuard Plus universal policy also has built-in protections against market downturns. That means your investments won't be wiped out if the stock market has a bad year.

However, you may be better served by buying a term life insurance policy and investing the money you save in a tax-advantaged account like an IRA or 401(k).

That's because universal and whole life policies typically cost significantly more than term life policies, and they provide lower returns than other good types of investments.

Brighthouse Financial customer reviews and complaints

Brighthouse Financial receives significantly fewer complaints compared to an average insurance company its size. However, when it comes to individual life insurance policies, the company gets 12% more complaints compared to the average life insurance provider.

A 2022 customer satisfaction survey by J.D. Power ranked Brighthouse Financial 20th out of 22 individual life insurance providers. Customer complaints on the Better Business Bureau (BBB) suggest some policyholders experience long wait times during the claims process.

Brighthouse life insurance payments

You can pay for your Brighthouse life insurance policy online or via app with your bank account. You can also pay with your credit card or Apple Pay using Doxo, a third-party payment processing service.

Accepted Brighthouse payment methods

- Visa

- Mastercard

- Discover

- Apple Pay

- Bank transfer

Brighthouse Financial lets you choose from monthly, quarterly, semiannual and annual billing cycles.

It's cheaper to pay quarterly, semiannually or annually than to pay monthly.

Filing a claim for MetLife term life insurance

If you purchase coverage from Brighthouse Financial or MetLife, you should let your beneficiaries know they will need the following items to make a claim if you pass away:

- Life insurance policy

- Death certificate (should be a certified death certificate if the death benefit is greater than $100,000, which can be provided by a funeral director)

- Claim form (available on Brighthouse's website)

Brighthouse Financial will ask your beneficiary if they want the full death benefit or to have it placed in a Total Control Account.

Other life insurance policies from MetLife

MetLife still offers group life insurance plans; however, the cost of your life insurance will vary according to the company you work for.

MetLife group health plans

- Term life insurance

- Accidental death

- Group universal life insurance

- Group variable universal life insurance

Frequently asked questions

How does MetLife term life insurance work?

MetLife only offers term life insurance through group plans. If you're unable to buy a MetLife term life insurance plan through your workplace, consider Brighthouse Financial for an individual policy.

Is MetLife financially stable?

Yes, both MetLife and Brighthouse are highly rated by AM Best, an organization that rates insurance companies on their financial stability. MetLife currently has an A+ (superior) rating, while Brighthouse has an A (excellent) rating.

Does MetLife insurance have good customer service?

MetLife overall receives 60% fewer complaints compared to the average insurance company (adjusted for size), but its life insurance gets more than four times as many complaints as average, according to the National Association of Insurance Commissioners (NAIC).

Brighthouse also has relatively few customer complaints overall but a high number of complaints related to its life insurance plans.

Sources and methodology

Sample rates are for a term life policy for a 40-year-old man in good health who does not smoke and lives in Texas. Customer complaint information is from the National Association of Insurance Commissioners (NAIC). Customer satisfaction survey data is from J.D. Power, and cause of death statistics are from the Centers for Disease Control and Prevention (CDC).

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.