Auto Insurance

Insurance is a Source of Conflict for 39% of Married Couples — and Nearly a Quarter Have Never Discussed it At All

Insurance is a key aspect of financial health in a marriage, but people don't always discuss insurance when they talk about their finances. We surveyed married Americans to understand how they managed their insurance with their partner.

Key findings

- 39% of married couples have argued or disagreed over insurance. The two primary disagreements were over which insurer to use (16%) and making claims (11%).

- More married couples have joint policies for auto insurance than they do for health insurance. Nearly three-quarters of married Americans have a joint auto policy, while just over half share the same health insurance policy.

-

Older Americans are more likely to share auto insurance policies with their spouse, while people under 50 are more likely to share health insurance policies. This is partly due to the fact that older Americans may be on Medicare, in which each person has a separate policy.

- Nearly a quarter of married consumers have never discussed or reviewed insurance policies with their spouse. These couples could be missing out on savings and may not be adequately covered as their lives change.

Opinions about providers, claims cause disagreements

Among the people we surveyed, 39% said they'd fought with their spouse about insurance. Surprisingly, men were much more likely to say they had argued with their spouse over insurance — 52% of men said they had, while just 24% of women agreed. This suggests men are more likely to perceive insurance-related conversations as an "argument."

But couples appear to disagree less as they get older. Fifty-three percent of millennials and Gen Xers said they'd argued with their spouses about insurance, while just 15% of people over 55 said the same.

The most common reason for an argument (16%) was choosing an insurer, and 11% argued over making an insurance claim.

Who is responsible for insurance shopping?

One aspect couples tend to agree on is who should be responsible for making insurance decisions. Only 6% of couples said this was a source of conflict. But men reported being more likely to take on the responsibility of shopping for insurance — 57% of male respondents said they were responsible, versus just 40% of women.

Overall, 69% of respondents said it was primarily one partner's job to shop for insurance. About 1 in 5 (21%) said they did it together, and 10% said "it depends" or "we do not regularly shop for insurance." However, sharing the job of shopping for insurance got more common as respondents aged. While 72% of millennials and Gen Xers said the responsibility fell to one partner, people over 55 did the same only 63% of the time.

Should couples share insurance policies? Saving money is a key reason to combine, but people aren't always willing to switch insurers.

The decision of whether or not to share an insurance policy with your spouse is a personal one. It's based on each of your coverage needs, how much you want to spend on insurance and how you want to manage your finances. Here's what people reported:

Car insurance

Among the people we surveyed, nearly three-quarters (74%) said they shared their car insurance with their spouse. Among them, they noted saving money as a main reason. We've found that sharing a car insurance policy with your spouse can save you up to 32% per year.

Half of respondents who share car insurance with their spouse also noted convenience as a key factor. Sharing an insurance policy means you only have to pay one bill, and you're both protected while driving each others' cars.

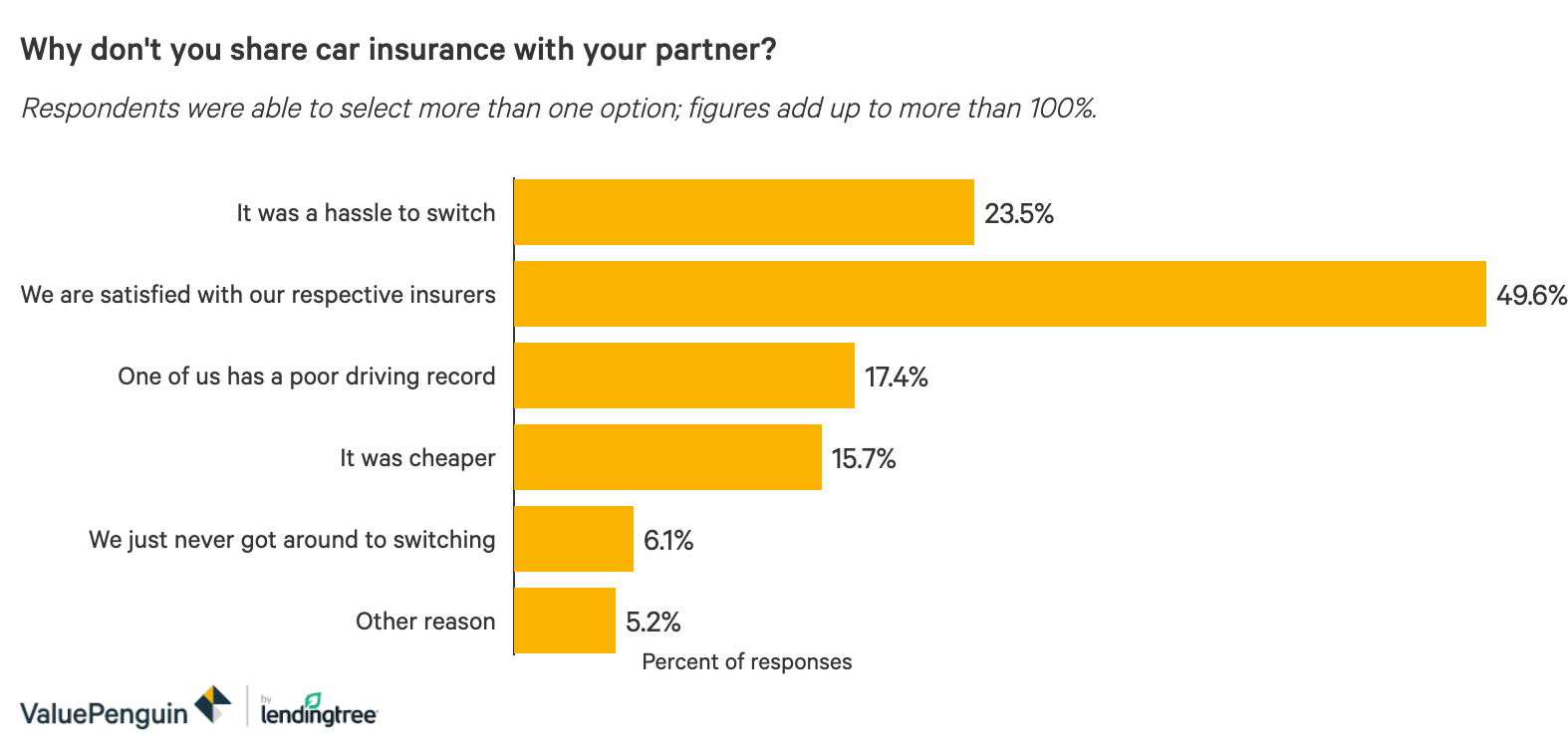

As for people who don't share insurance, they cited satisfaction with their current insurer as the reason. Surprisingly, 31% of those who don't have a joint policy said their spouse is not listed as an authorized driver on their policy. That means their spouse can't ever drive their car, as auto insurance policies require you to name everyone in your household who plans to drive the car.

Health insurance

Respondents were far more likely to have separate health insurance than car insurance. Nearly half (46%) of our respondents maintained a separate health insurance policy from their spouse.

In particular, older Americans were much more likely to have separate health insurance policies. More than half (51%) of baby boomers keep their own policies. This disparity may be partly due to the fact that Medicare plans are managed on the individual level; even if you and your spouse are both on Medicare, you technically have different insurance plans.

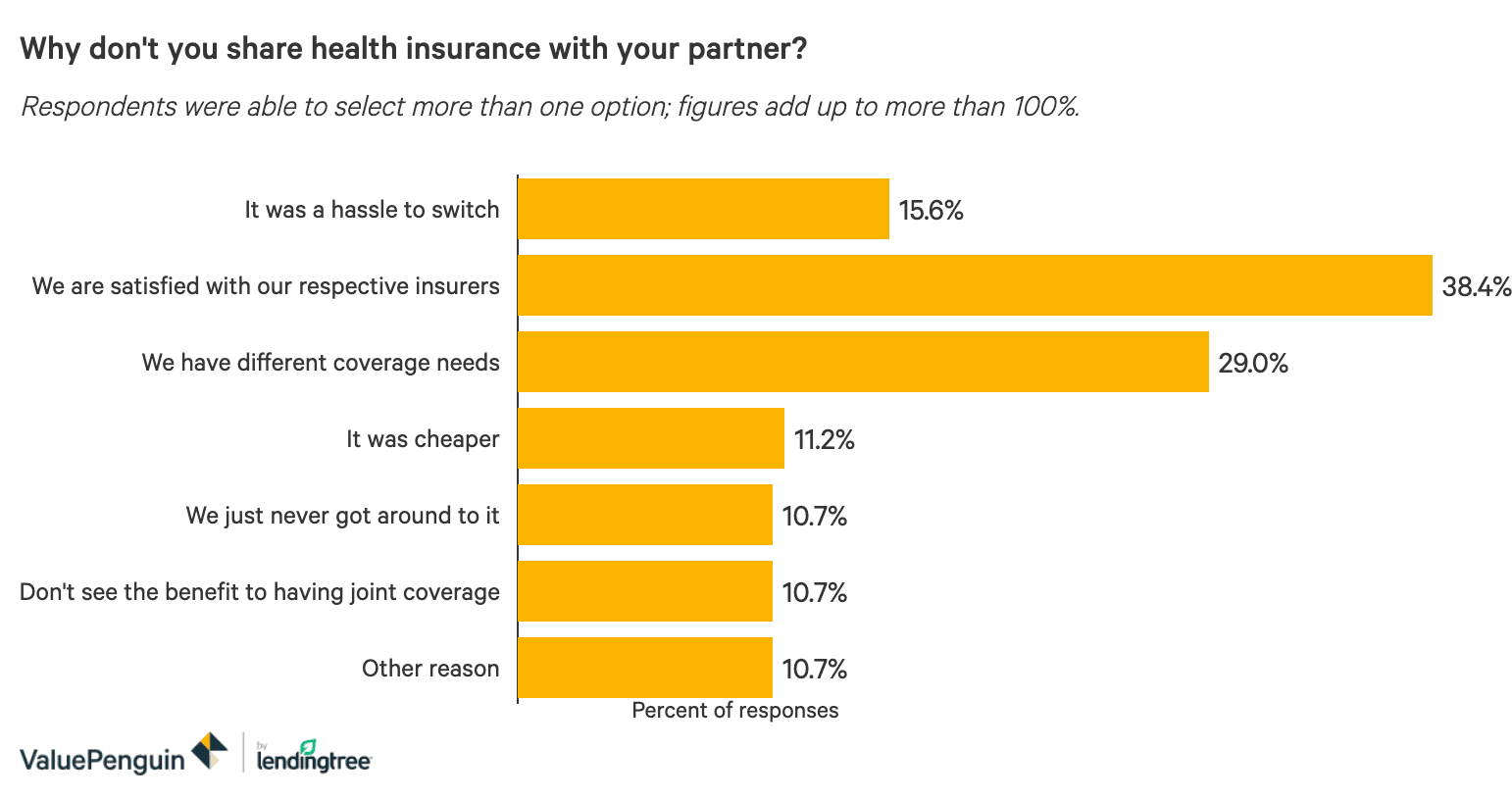

We found that satisfaction with a current insurer (38%) and differing coverage needs (29%) were the main reasons couples decided not to combine insurance policies. Doctors may not accept every health insurance plan, so if your doctor doesn't accept your spouse's, then it makes sense that you'd keep a separate policy.

Among people who do share health insurance with their spouse, 60% said it's mainly because they save on their premiums and deductibles. In addition to a potentially lower monthly bill, sharing a policy means you only have one annual deductible, not two — meaning you stand to save money in two ways.

Couples commonly said they share insurance because only one person's employer offers coverage — 29% of respondents cited this reason. According to the Kaiser Family Foundation, about half of Americans get their insurance from their jobs, and employers often pay part of the cost. If you can only get coverage from one employer, it's not a surprise that you'd combine policies.

Why reviewing insurance needs is important

Everyone's insurance needs change over time, and it's essential to review your needs from time to time to make sure you're getting the best deal and the right coverage.

Reviewing your insurance regularly is essential for two reasons. First, it can help you save money. Insurers change their prices constantly, and the company that offered the best deal a few years ago may not be the best choice now.

Second, your insurance needs change over time. For example, if you get a swimming pool, you'll likely need to tell your homeowners insurance company. Otherwise, you could be stuck with a big bill if it's damaged during a storm or if someone is injured.

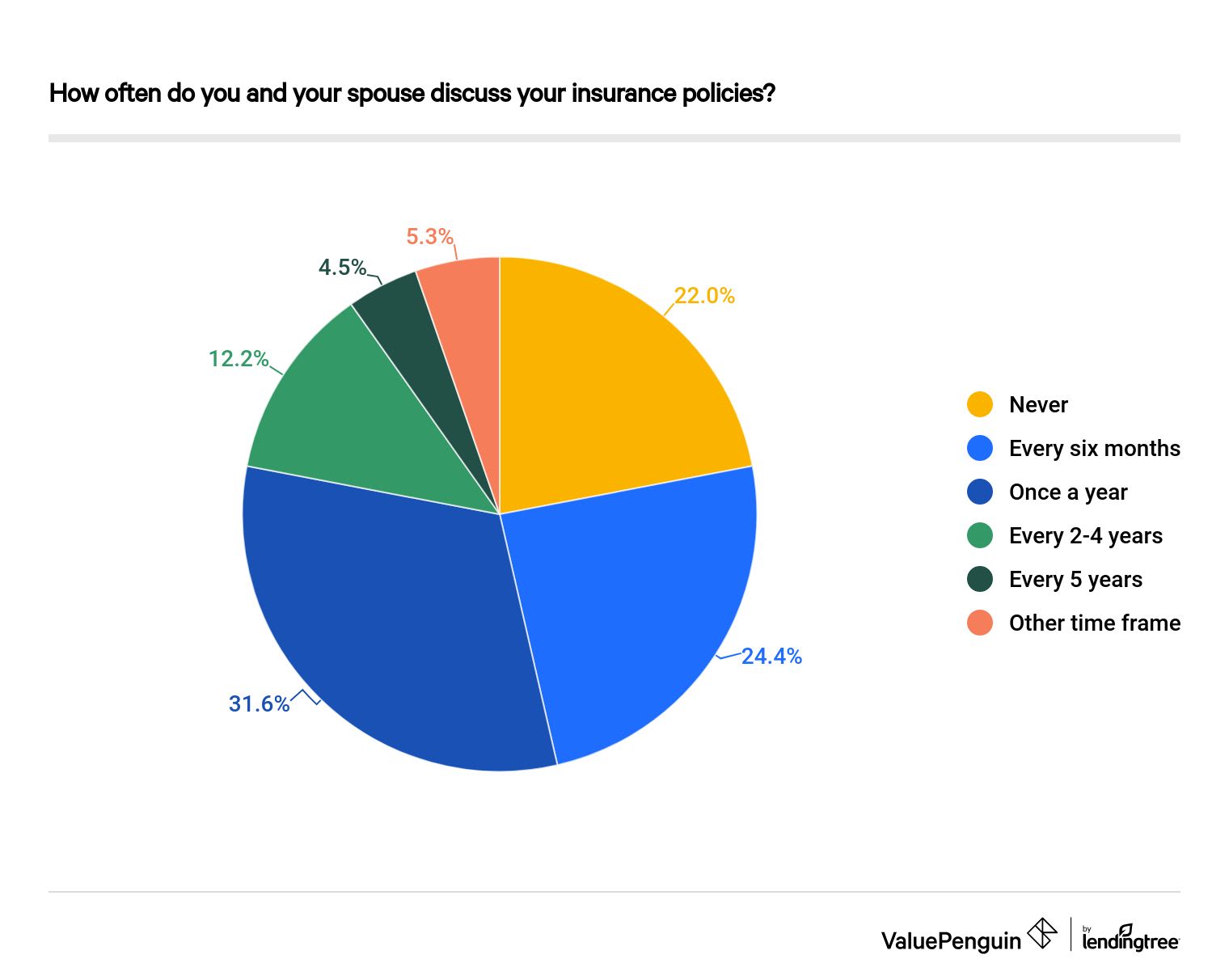

Our survey found that 22% of people never review their insurance policies with their spouse at all, while 24% do so every six months, and younger people are more likely to review their insurance needs more often. In fact, 35% of baby boomers said they "never" review insurance with their partner, while only 16% of millennials said the same.

How often to review your insurance

When it comes to insurance, the most important thing is to review each policy when a significant life change takes place that could affect your needs. For example, you should review your car insurance if you buy a new car, and look for a better deal on homeowners insurance if you remodel your basement.

With that major exception in mind, here's how often we recommend reviewing your policy (and shopping for alternatives):

- Car insurance: every year

- Health insurance: every year

- Homeowners insurance: every two years

- Renters insurance: every two years

- Motorcycle insurance: every three years

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 532 Americans who are currently married. The survey was fielded June 2–3, 2020.