What Does Full-Coverage Motorcycle Insurance Cover?

Find Cheap Motorcycle Insurance Quotes in Your Area

Full coverage motorcycle insurance covers repairs or replacement of your bike if it is damaged or stolen, as well as damage you cause to others in an accident. Typically, it includes comprehensive and collision insurance and any state-mandated liability coverage.

A full-coverage policy is the best way to protect your bike but much more expensive than state minimum liability policies.

How much is full-coverage motorcycle insurance?

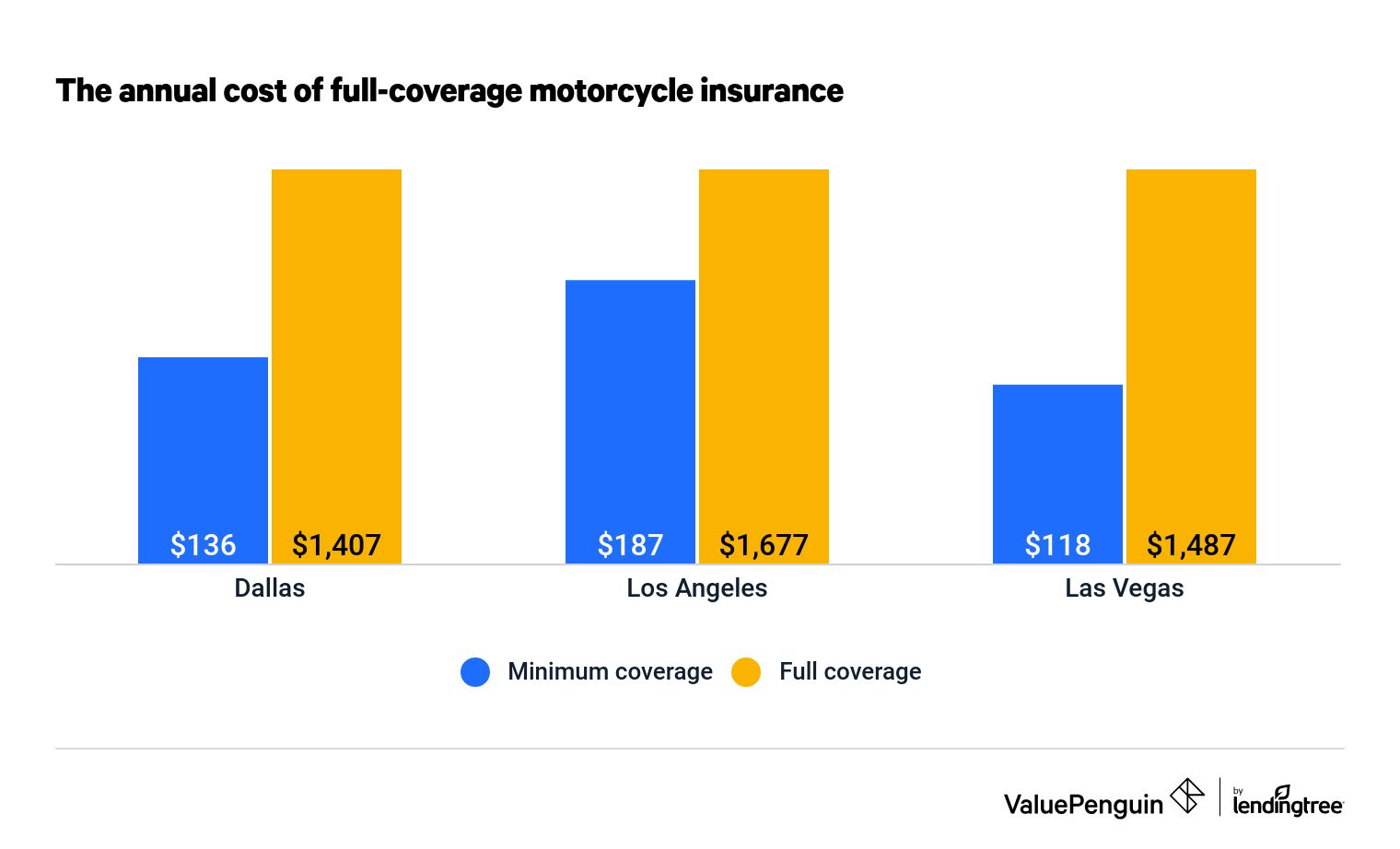

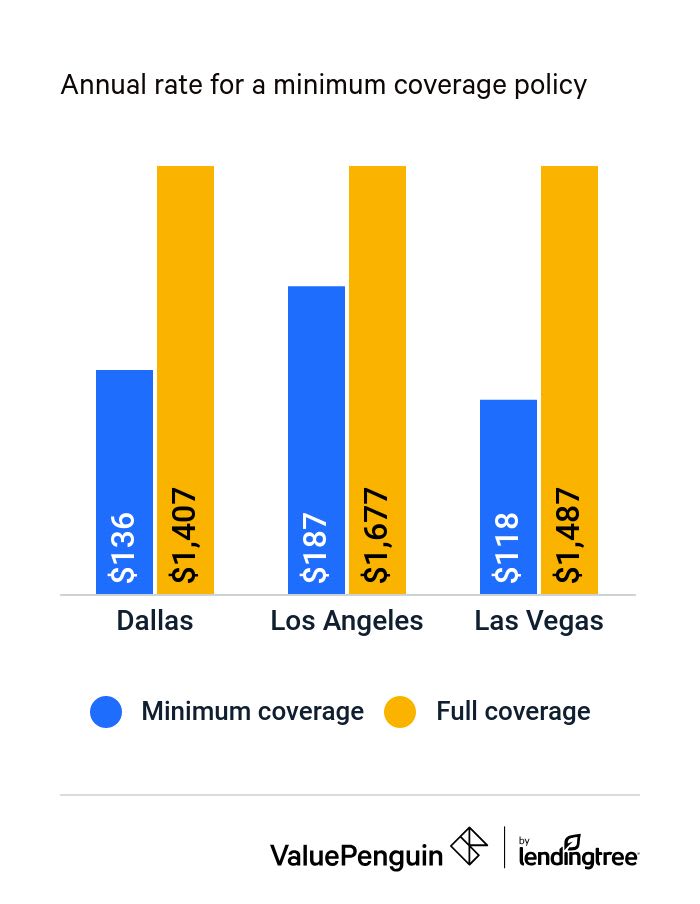

While your rates will depend on a variety of factors — your driving record, age and motorcycle make and model — full-coverage motorcycle insurance typically costs much more than a basic policy with liability insurance only. Based on the quotes gathered, buying a full-coverage that includes the minimum required liability insurance plus collision and comprehensive is an average of 10 times more expensive than state minimum liability insurance and PIP (when required).

Compare Cheap Motorcycle Insurance Quotes

City | Minimum coverage | Full coverage |

|---|---|---|

| Dallas | $136 | $1,407 |

| Los Angeles | $187 | $1,677 |

| Las Vegas | $118 | $1,487 |

What's included in a full-coverage motorcycle insurance policy?

The defining feature of a full-coverage motorcycle policy is collision and comprehensive insurance. But it also includes the coverages required by your state.

State-mandated coverages for riders often include:

- Bodily injury liability

- Property damage liability

- Uninsured motorist coverage

- Personal injury protection

Collision and comprehensive coverage

Comprehensive and collision coverage pay to repair or replace your motorcycle for a covered loss. Collision pays for damage from an accident with another vehicle or object, including incidents like hit-and-runs, while comprehensive covers theft and "acts of God". This includes damage to your bike from flooding, fire, hail or falling objects.

Comprehensive coverage can be particularly helpful for seasonal riders, as it protects your bike while it is stored. So when it's not riding season — which can be a significant amount of time for some — or you don't get your bike out very often, you're still protected against possible damage.

When you file a collision or comprehensive claim, your insurance company will pay to repair or replace your bike if your claim is approved. Most policies cover your bike up to its actual cash value, also known as current market value.

Some companies offer the option to upgrade to the replacement cost for newer motorcycles, which ensures you'll be able to buy a brand-new bike if yours is totaled. Custom bike owners can also choose an agreed value policy, which pays to repair or replace the bike's custom features.

Motorcycle accessories — fairings, saddlebags, windshields, luggage racks and more — may not be covered by full-coverage motorcycle insurance. Some companies automatically include a certain amount of coverage, such as Progressive, which includes $3,000 for accessories. Others let you add it on when you buy collision and comprehensive coverage. And some may not offer it at all.

It's important to check your policy's limitations when it comes to custom parts, original equipment manufacturer parts and new vehicle replacement.

Bodily injury and property damage liability

Bodily injury and property damage liability insurance pay for damage you cause to other motorists and their property in an accident. For example, if you crash your motorcycle into someone's car and cause $10,000 of damage to their vehicle and injure them, resulting in medical expenses, that would be covered by liability insurance. This is required in many states. But even if it isn't required, it's best to buy liability coverage to protect your assets if you cause an accident.

Uninsured or underinsured motorist coverage

Uninsured or underinsured motorist (UM/UIM) covers losses from an accident caused by a driver who has insufficient liability insurance or none at all. There are two kinds of UM/UIM coverage — bodily injury and property damage — which function like liability insurance.

UM/UIM bodily injury coverage will pay for medical bills if you are injured by a motorist who has no insurance or insufficient bodily injury liability limits to cover the costs. Similarly, UM/UIM property damage insurance covers damage to your bike caused by a motorist without sufficient property damage limits.

Personal injury protection

Personal injury protection (PIP) is insurance that pays for your own medical expenses and lost wages due to an injury from an accident, regardless of fault. PIP is required in one-third of states but available in nearly half. Because PIP is no-fault coverage, your medical bills will likely be paid quicker than with liability insurance, where an insurance company will only pay out when it is determined who's at fault.

Frequently asked questions

Why is full-coverage motorcycle insurance more expensive?

The main reason that full-coverage is so much more expensive than a basic liability policy is that insurance companies see motorcycle riders as very likely to get into an accident. This means your company assumes you'll end up filing a collision claim and, therefore, be more costly to insure.

Which company has the cheapest full-coverage motorcycle insurance?

Motorcycle insurance costs can vary a lot, based on where you live, your age, the type of motorcycle you drive and your driving history. Nationwide has the best rates for full-coverage motorcycle insurance, with an average premium of $593 a year. Along with inexpensive rates, Nationwide offers a range of coverage limits, vanishing deductibles and high customer satisfaction ratings.

Should you get full-coverage motorcycle insurance?

Whether you should opt for full-coverage over the required liability coverage depends on two factors: the value of your bike and whether it's your main mode of transportation.

If your motorcycle is worth more than $5,000 or is a classic or custom ride, you should strongly consider getting full coverage. For bikes of this value, the increased premiums for comprehensive and collision coverage are justified when you consider the potential loss.

For bikes worth less than $5,000, you'll likely pay more in insurance costs than you'll get out of the coverage. So the cheapest option may be to buy a policy without collision or comprehensive coverage, save the money you would have otherwise spent and simply pay out of pocket for repairs.

However, it's best that you gather your own quotes and consider your riding safety and financial situation before ruling out a full-coverage policy.

You should also consider a full-coverage if you rely on your motorcycle for everyday transportation. If you get into an accident and have collision coverage, you won't have to wait for another driver's insurance to pay out for repairs. That means your bike will be back on the road sooner. Similarly, with comprehensive coverage, you won't be without a vehicle if your bike is stolen and you don't have the cash on hand to replace it.

Methodology

Thousands of quotes were collected from six major insurance companies across the country to determine the average annual cost of motorcycle insurance nationally.

To calculate the difference between the annual cost of state minimum and full-coverage motorcycle insurance, quotes were compared for a single, 35-year-old male with a clean driving record who has been riding a motorcycle for 10 years. The quotes were for a 2021 Yamaha V Star 250, Kawasaki Ninja 400 ABS and BMW R 1250 RS, with the following limits for full-coverage policy quotes:

Coverage | Limit |

|---|---|

| Bodily injury liability | $50,000 per person and $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured or underinsured motorist bodily injury | $50,000 per person and $100,000 per accident |

| Medical payments | $5,000 |

| Comprehensive and collision | $500 deductible |

| Uninsured motorist property damage | None |

| Rental car reimbursement | None |

| Roadside assistance | None |

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.