Earthquake Insurance, Explained

Find Cheap Homeowners Insurance Quotes in Your Area

Earthquake insurance covers damage to your home, personal belongings and additional living expenses if you need to temporarily live somewhere else after an earthquake. Standard homeowners and renters insurance policies typically don't include earthquake coverage, but you may add it to an existing homeowners insurance policy as an endorsement or purchase it as a separate policy.

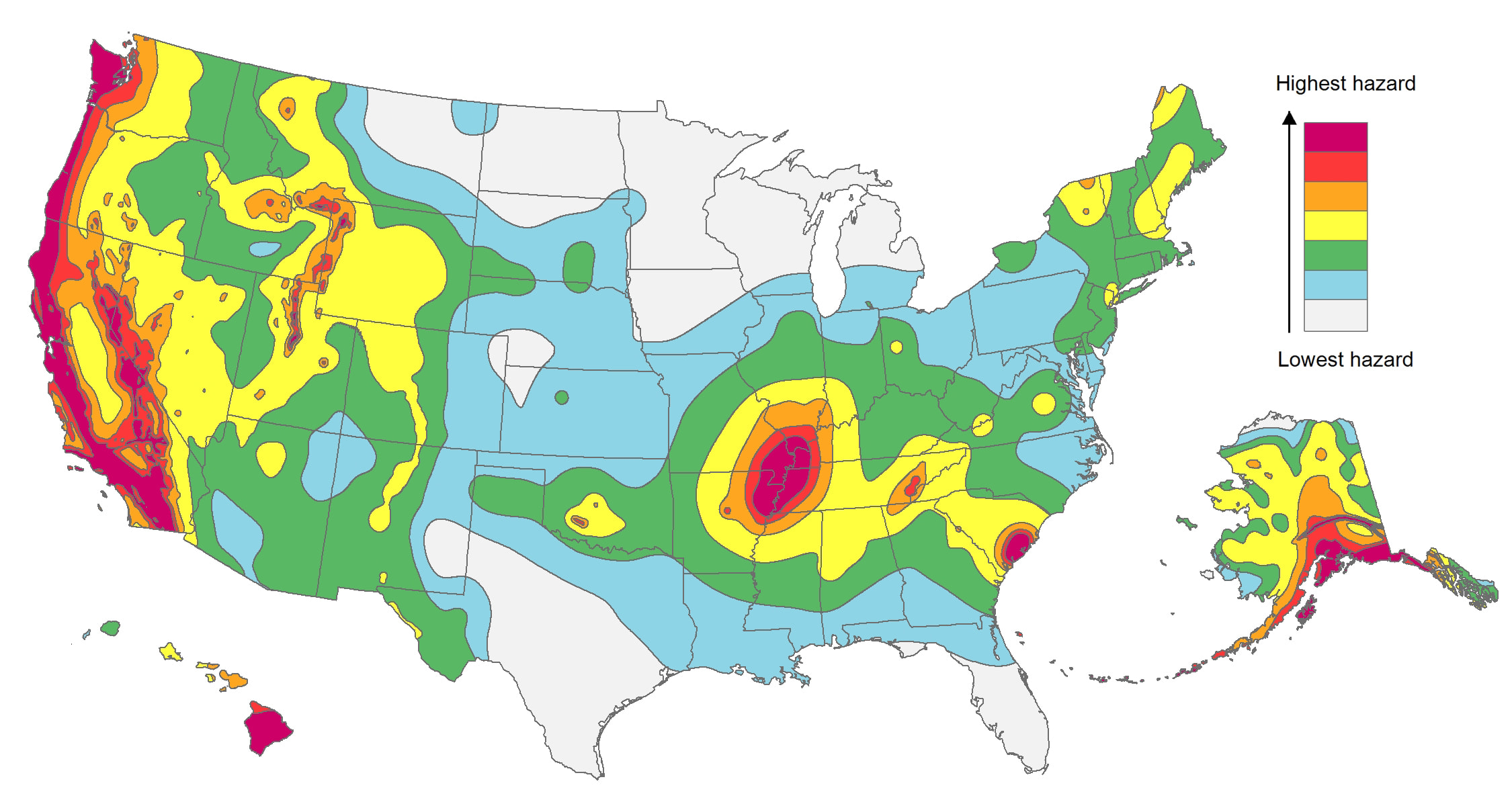

Earthquakes happen when a movement in the earth's crust causes sudden, violent shaking in the ground. Roughly 20,000 earthquakes occur around the globe each year, and in the United States, they're typically concentrated in 16 states (though many more will experience occasional quakes), according to the U.S. Geological Survey. Most earthquakes are small and cause little or no damage, but others can be catastrophic.

Depending on where you live, it might be a good idea to purchase this type of coverage.

Cost of earthquake insurance

The cost of earthquake insurance will vary on factors such as the price of your home and the risk of the area you live in. In some high-risk regions, the cost of earthquake insurance might exceed the cost of a homeowners insurance policy. California is one of the most expensive states for earthquake insurance since it is located on multiple hazardous fault lines.

Rates for earthquake coverage in California average $1.75 per month for every $1,000 of coverage. So if you want to purchase earthquake insurance for a home worth $250,000, it would cost about $438 per month. In some low-risk areas, earthquake coverage costs as little as 50 cents per $1,000 of coverage. So for the same $250,000 home, a policyholder might pay $125 per month.

Other factors affecting the cost of earthquake insurance

Other factors can affect the cost of earthquake insurance outside of geography and home value are:

- The age of your home: Newer homes tend to have better materials and can be designed with earthquakes in mind, so they typically cost less to insure compared to older homes.

- The number of stories (including the basement): Taller homes have a greater chance of toppling over, so they're usually more expensive to insure.

- Framing materials: Homes with wood frames cost less to insure because wood is more elastic than brick, stone and other materials.

- Foundation materials: Raised foundations give a home elasticity, which is crucial during an earthquake. This could help lower your earthquake insurance premiums. Homes built on sandy soil instead of clay or rock will have lower premiums for the same reason.

Homeowners can retrofit their homes to give it more protection and save on insurance costs. For example, you can bolt your home to the foundation, brace the chimney and water heater, install automatic gas cut-off valves, and use plywood to strengthen crippled walls. These methods can stabilize your home so it's less likely to sustain serious damage in a quake.

Determining if earthquake insurance is worth it

When thinking about if you need earthquake insurance:

1. Check to see if your homeowners insurance covers earthquake damage.

Most homeowners insurance policies do not extend to earthquakes — but if it does, there is no need to purchase additional insurance.

2. Check whether you live in a high-risk area for earthquakes.

There are 42 states at risk for earthquakes — and 16 are considered high risk. But keep in mind: Tremors can be felt miles away from the epicenter. So even if you don't live in a high-risk area, your home could still sustain damage from an earthquake.

If you live in a high-risk area where earthquakes are frequent and powerful, you should get earthquake insurance.

States with highest risk for earthquakes

- Alaska

- California

- Hawaii

- Idaho

- Kentucky

- Missouri

- Montana

- Oregon

- South Carolina

- Tennessee

- Washington

- Wyoming

3. Consider how you would rebuild your life after an earthquake.

Ask yourself these questions:

- Can I afford the cost of repairing or rebuilding my home entirely if it's damaged or destroyed by an earthquake?

- Can I afford to replace the personal belongings in my home after an earthquake?

- Can I pay for temporary housing if my home is deemed uninhabitable, either due to an area hazard or structural damage?

If you answered "no" to one or more of the above, then you should consider getting earthquake insurance.

What does earthquake insurance cover?

There are three main components to earthquake coverage: damage to your home (referred to as a "dwelling" in policies), personal property and additional living expenses (ALE).

For example, let's say an earthquake damages the walls inside your home and destroys your TV and living room furniture. Additionally, you have to evacuate and spend a week in a hotel because of the earthquake. The dwelling portion of your policy would cover the cracks in your walls, the personal property portion covers your TV and furniture, and the ALE portion covers your hotel stay. Depending on your policy, you may need to submit a separate claim for each of these along with a separate deductible.

Earthquake insurance may exclude certain items, such as your vehicles, fence, pool and collectible items in your home. Damage to your land, such as landscaping, is also usually not covered. However, some policies include "engineering cost" options, which helps cover the cost to stabilize the land that supports your home as well as engineer or demolish structures that were damaged.

For example, let's say an earthquake caused damage to your in-ground pool, plus it started a fire that burned down a portion of your home. In this scenario, you don't have an engineering cost option. The pool damage would not be covered by your earthquake policy, and the fire damage to your home would be covered by your homeowners insurance policy.

Another important exclusion to earthquake insurance is external water damage. Flooding and tsunamis are common results of earthquakes, but their damage does not fall under earthquake insurance. A flood insurance policy would cover both of these events, as well as damage caused by a sewer or drain backup that was a result of an earthquake.

How earthquake insurance and claims work

The cost of earthquake insurance varies with each policy and policyholder. Typically, earthquake insurance covers your dwelling up to the same limit as your homeowners insurance, and policyholders pay a deductible of 10% – 20% of that limit.

For example, let's say an earthquake completely destroys your home. Your insurance company would pay you up to the coverage limit, minus the deductible.

- Earthquake insurance policy: Coverage limit: $150,000; deductible: 15%

- Claim submitted: $150,000

- Homeowners responsibility: 15% of the $150,000 claim = $22,500

In this example, your insurer pays you $127,500 to cover the damage to your home: $150,000 coverage limit - $22,500 = $127,500.

To file an earthquake insurance claim, call your insurance provider and report visible damage. It can be difficult to evaluate, so it might be worth getting a home inspection — especially if your home is old.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.