Does Car Insurance Cover Hail Damage?

Yes, your car insurance will cover the cost of repairs due to hail damage, as long as you have comprehensive coverage.

Unfortunately, if you don't have comprehensive coverage, you will probably have to pay for the repairs yourself. If you live in an area that has frequent hailstorms, you should consider purchasing a comprehensive policy for your car.

Find Cheap Auto Insurance Quotes in Your Area

When does car insurance cover hail damage?

If you have comprehensive insurance, your car will be protected from hail damage after paying a deductible. If you have a liability-only policy, however, damage from hail won't be covered. No state requires drivers to carry comprehensive insurance, but if you add it to your policy, it will cover situations like this.

If you’re not concerned about something like hail damage, comprehensive coverage is still a good idea if your car is worth more than $3,000 or is less than 10 years old.

In addition to protecting you from hail, comprehensive coverage also pays to repair damage that doesn't involve a crash. This includes vandalism, theft and falling debris. When you make a comprehensive claim, you will typically pay a deductible, which usually ranges from $50 to $2,000.

If you don't have comprehensive insurance

If you do not have comprehensive car insurance, your insurance company will not pay for the damage. Comprehensive insurance is the only way to cover hail damage.

Generally, adding comprehensive coverage costs an extra $100 to $300 per year. Considering that a hailstorm can end up costing you thousands of dollars, it's not a burdensome expense to pay. This is especially true if you live in an area with frequent hailstorms, like Nebraska, Colorado or Wyoming.

Should you file a car insurance claim after a hailstorm?

Whether you file a claim after a hailstorm depends on the extent of the damage. The average insurance payout for hail damage for a car is around $5,000, according to State Farm, but for minor cases, it may not be greater than the cost of your deductible.

Let's say your deductible is $500, and hail chips your windshield. Most windshield chips can be repaired for less than $130. In this case, it would be more cost-effective to pay for the repairs yourself rather than file a claim with your insurer and pay the $500 deductible.

Even if the price of repairs ends up being slightly higher than your deductible, you might not want to file a claim. Although comprehensive claims are not supposed to raise your rates, they can in some cases. It may actually be cheaper for you to pay slightly more than your deductible so you don't have to pay more for your policy in the long run.

After a big hailstorm, local repair shops may be flooded with hail-damaged cars that need repairs. This can lead to longer-than-average wait times while parts come back in stock or repair technicians are spread thin.

How to file an auto insurance claim for hail damage

Filing a claim for hail damage follows the same process as other types of car insurance claims. You should contact your insurer, either online or by phone, as soon as possible after the storm passes. Keep in mind that if there is a major storm in the area, many of your neighbors will also likely be calling to file a claim, so it could take longer for your claim to be processed.

The faster you call, the faster your insurer can help you. After you file a claim, your auto insurance company will send a claims adjuster to assess the damage and determine how much your insurer will pay.

Can hail damage total a car?

Although hail almost never will damage your car enough that it's not drivable, the damage can easily be enough for an insurance company to deem it a total loss. Your insurance company will consider a car totaled when the price of repairs is higher than the actual cash value of the vehicle minus your deductible and, in some states, the salvage value.

Hail can often damage much of the outside of your vehicle, including the roof, windows, doors, front hood and trunk. Repairing all of those parts can get expensive quickly. If you have an older car, the repair costs can very often be higher than the value of the car.

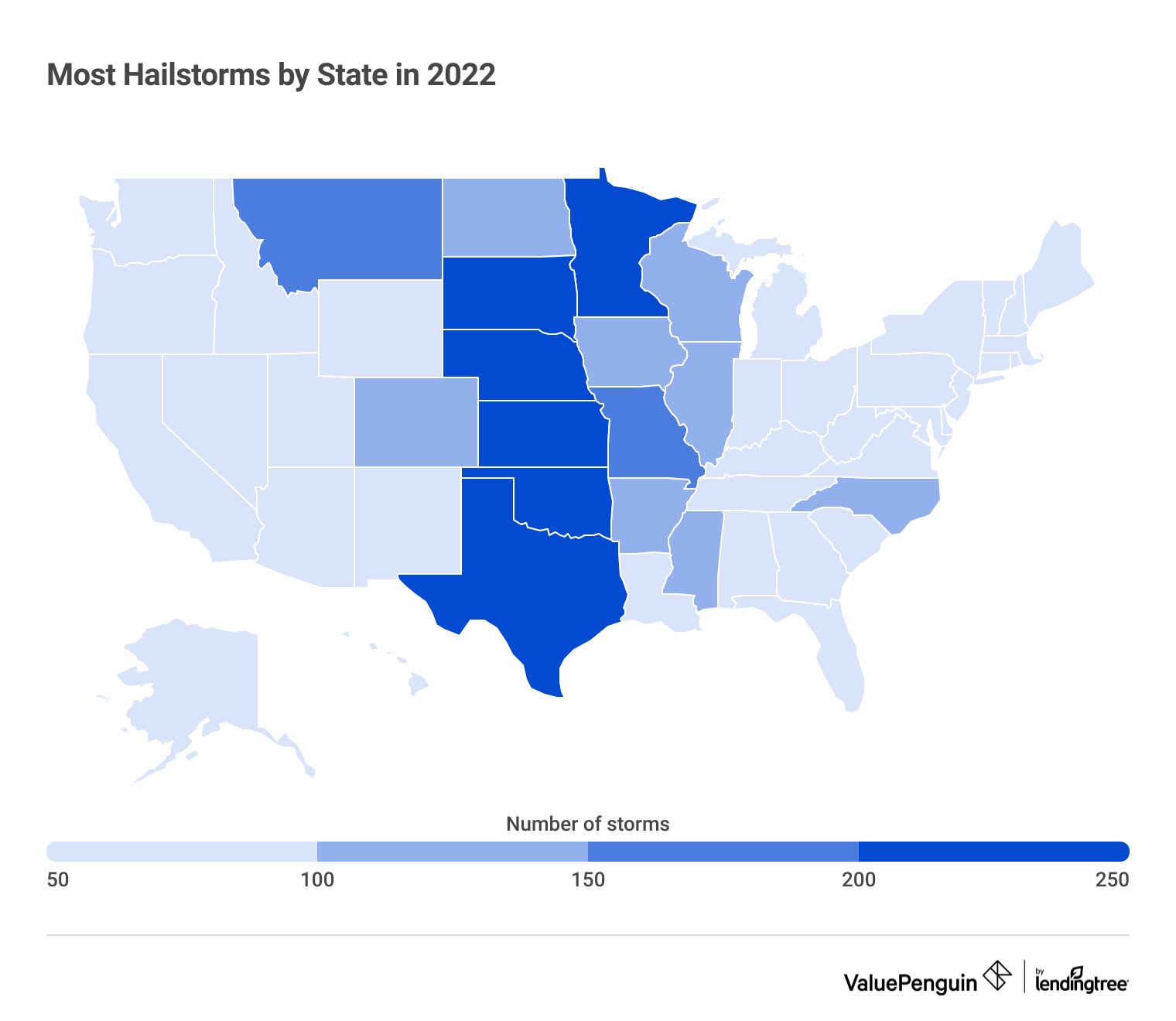

Which states have the most hailstorms?

Certain parts of the country are more prone to hailstorms, so you should be prepared if hail is a common occurrence in your area. If you are getting car insurance in Texas, Nebraska, Minnesota, Kansas or another state in the Midwest, hailstorms are more likely to damage your car, so you should purchase comprehensive insurance.

Paying out of pocket can end up costing you a lot more than paying for comprehensive insurance. For example, in 2022 hail did more than $600 million in damage to vehicles of State Farm customers alone.

How to protect your car from hail damage

If you live in one of the states prone to hailstorms, you should also consider taking some precautions to reduce the damage your car faces during a storm.

The most important step is storing your car in a garage or covered carport, which will protect your car most of the time.

You can also purchase a car cover to keep in your car. If you are on the road or parked away from home and a hailstorm hits, you can quickly pull out the cover to reduce the damage caused by hail. Hailstorms generally only last a few minutes, so you shouldn’t be stranded for long.

It is also a good idea to download a weather app that can send you alerts when a hailstorm is approaching. That gives you time to put up the cover or pull over into a covered area. If you can minimize the damage to your car, you may avoid repairs entirely or be able to cover the cost out of pocket without needing to file an insurance claim.

Frequently asked questions

Should I claim hail damage on my car?

You should make a claim for hail damage to your car if the repair cost is notably higher than your deductible. It's also important to consider that making a claim might raise your rates, especially if you already have many claims on your record.

Can hail damage total a car?

Hail damage can total a car. For a car to be considered totaled, the price of repairs only has to exceed the actual cash value of the car, minus your deductible and sometimes the vehicle's salvage value. Payouts for hail damage can regularly reach $5,000.

How long do you have to make a hail damage claim on a car?

In most states, you have at least a year, usually several, to file a car insurance claim. That said, you should file your claim as quickly as is convenient to get your car repaired sooner.

Sources

National Oceanic and Atmospheric Administration (NOAA) Annual Severe Weather Report State Farm Hail Claim Report National Severe Storms LaboratoryEditorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.