Clearcover Car Insurance Review: A Cheap, New Company

Clearcover offers low rates and a good digital experience. As a newer company, it doesn't have the customer service track record you would expect from a large insurer.

Find Cheap Auto Insurance Quotes in Your Area

Pros and cons

Pros

Cheap rates

Offers rideshare insurance

Cons

Can't bundle with other policies, like home or renters insurance

Unproven customer service

Clearcover Insurance: Our thoughts

Bottom line: Clearcover has cheap rates, but it's a new company. It's hard to say if you can rely on Clearcover to get you back on the road quickly after an accident, though the limited number of online reviews are generally positive.

Clearcover's rates are typically about $300 cheaper per year than major insurance companies. Because it only takes a few minutes to get a quote, it's usually worth it to see how much you can save.

Clearcover costs less than major companies like Geico and State Farm. Its coverage options are fairly basic, but there are a few great add-ons. One unique option is alternate transport coverage, which will pay for a rental car, rideshare services or public transportation if you can't drive your car after an accident.

Clearcover's user-friendly website makes it easy to get a quote in a few minutes.

One potential issue with Clearcover is its short track record. It hasn't earned enough customer reviews to establish a reputation, good or bad. It can be risky to use an insurance company without a long history of financial stability and customer satisfaction because you don't know how well the company will handle claim payouts in the future.

Compare Clearcover to other top auto insurance companies | |

|---|---|

| |

| Read review |

| Read review |

| Read review |

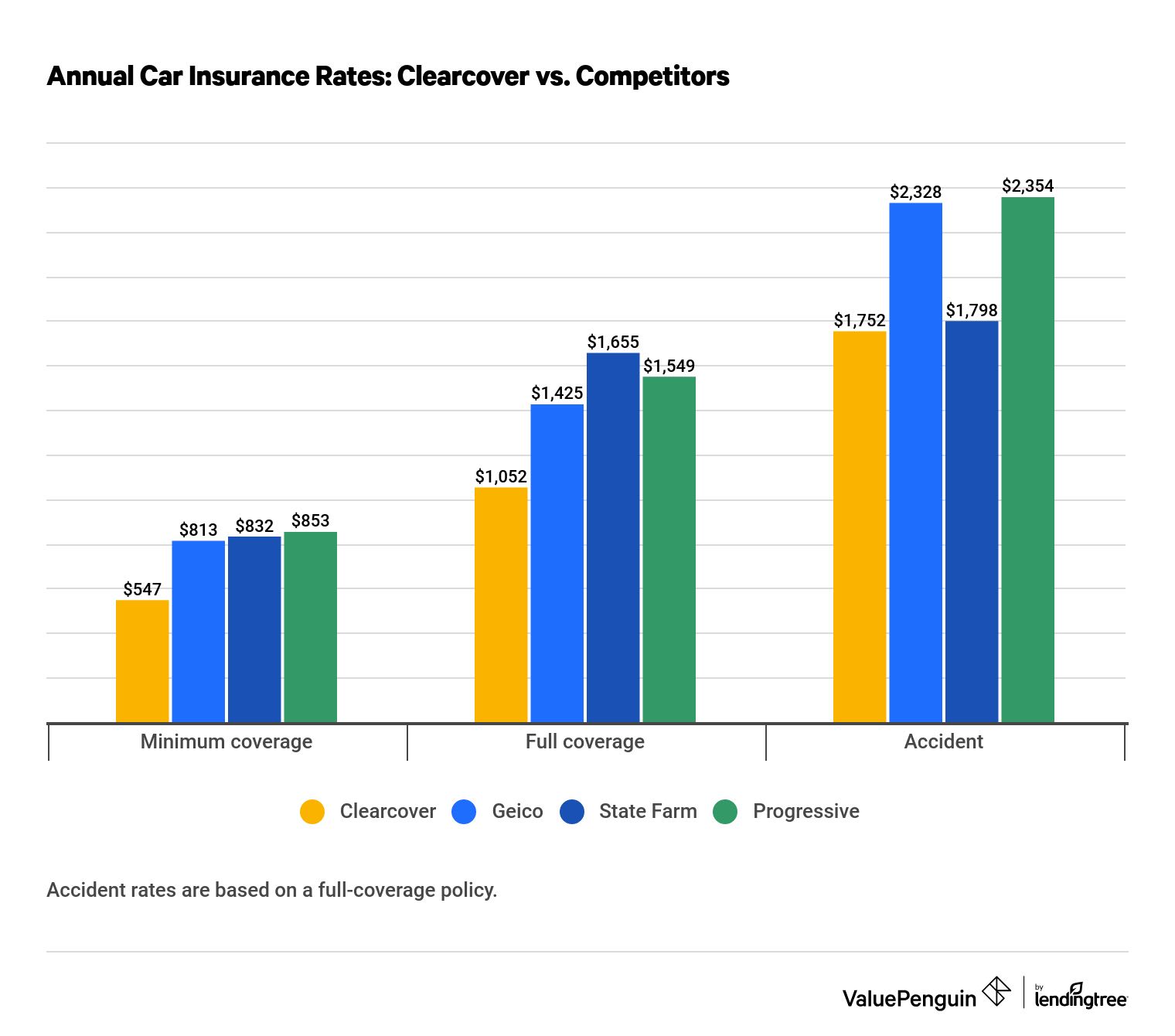

Clearcover insurance quotes vs. competitors

Clearcover offers cheaper rates than its competitors for most drivers. A minimum-coverage policy from Clearcover costs an average of $547 per year for drivers in Texas — that's $265 less expensive than the next-cheapest insurer, Geico. Drivers looking for a full-coverage policy can also find the cheapest rates with Clearcover, where the average cost is 1,052 per year.

Find Cheap Auto Insurance Quotes in Your Area

Clearcover also has the cheapest rates for drivers who have an at-fault accident on their records. However these drivers can also find affordable rates from State Farm, whose full-coverage policy is only $46 more per year.

Annual car insurance rates

Company | Minimum coverage | Full coverage | Accident |

|---|---|---|---|

| Clearcover | $547 | $1,052 | $1,752 |

| Geico | $813 | $1,425 | $2,328 |

| State Farm | $832 | $1,655 | $1,798 |

| Progressive | $853 | $1,549 | $2,354 |

Accident rates are based on a full-coverage policy.

Clearcover coverage options

Clearcover doesn't provide many extras or add-ons to drivers, but it does offer a few notable perks.

Highlighted benefit: Alternative transport coverage

In lieu of rental car coverage, Clearcover provides alternate transport coverage.

If your car is in the shop for repair after an accident, you receive a certain amount of money to spend on alternate transportation. This could be used to rent a car, but it can also be used to pay for rides with Lyft or Uber, public transportation or however else you prefer to get around.

This is a more flexible option than what is available from most insurers, which limit you to a rental car.

Highlighted benefit: Rideshare insurance

Clearcover also offers ridesharing insurance, meaning you can drive for Lyft, Uber or another transportation network company (TNC) with your Clearcover policy. While prices may vary, ridesharing endorsements can be as cheap as $10 per month.

Besides these, Clearcover also provides all the typical coverage you expect from a reputable insurance company. Standard coverage options include:

- Liability (bodily injury and property damage)

- Medical payments

- Collision

- Comprehensive

- Uninsured motorist (bodily injury and property damage)

Clearcover discounts

Clearcover takes a different approach to discounts compared to other insurers: it doesn't offer them explicitly.

The exception to this is Clearcover's military discount. It offers a 15% discount to active duty service members in all states except Louisiana, where active military personnel receive a 25% discount.

Most car insurance companies tell you when they are giving you a discount for things like safe driving and insuring multiple cars.

Clearcover still considers all the same details as a mainstream insurer when setting your rate, but they're directly factored into your quote, as opposed to being applied at the end.

Clearcover also only sells car insurance. You can't buy renters, homeowners or umbrella insurance from the company. If your insurer offers you a meaningful discount for bundling your policies together, you may save money elsewhere.

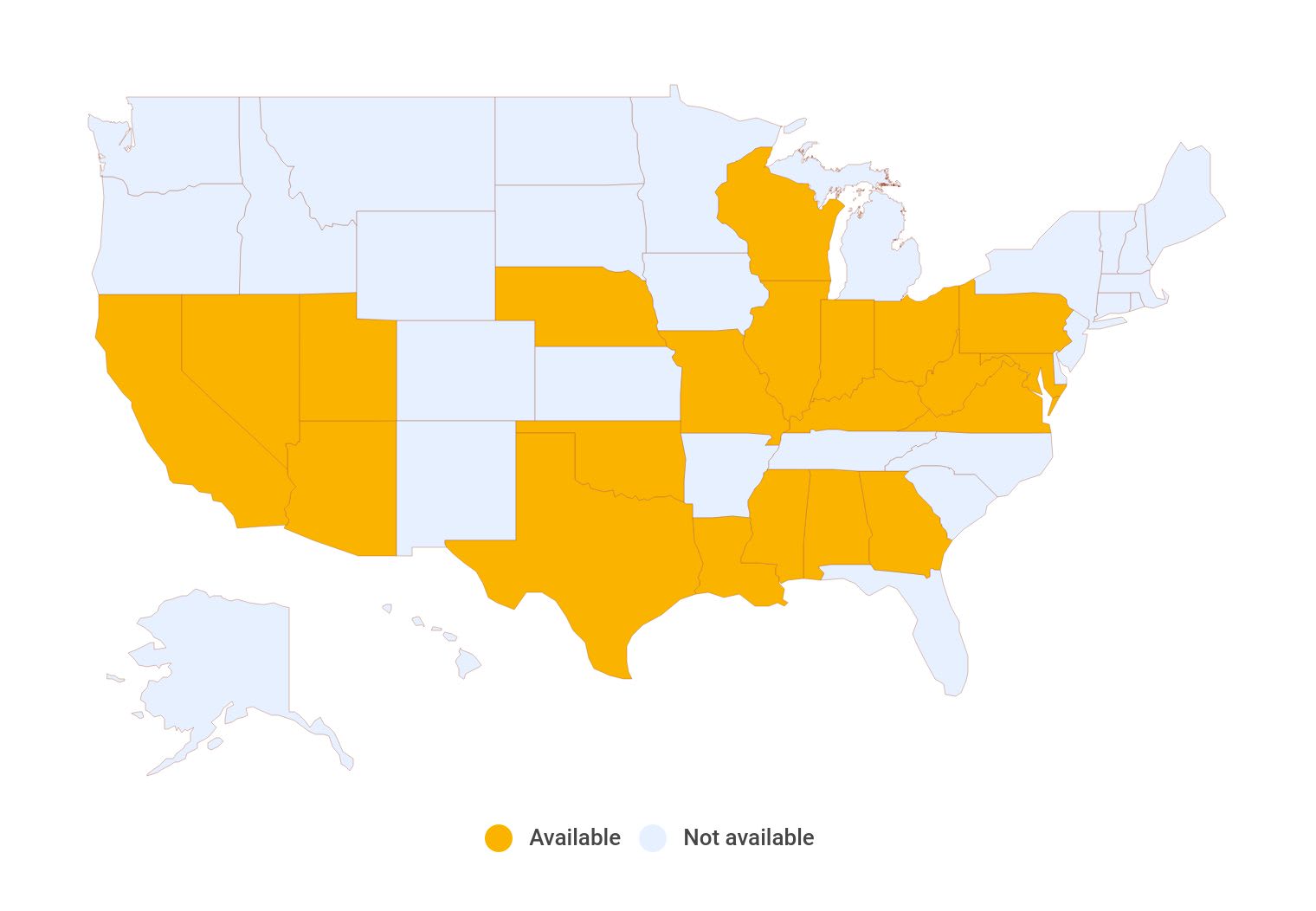

Where is Clearcover Insurance available?

Clearcover Insurance is currently available in 20 states and will be expanding to offer auto insurance in Nevada and North Carolina in the near future.

Clearcover customer service reviews, ratings and financial stability

As Clearcover has only been selling insurance for a few years, it doesn't have as many customer reviews as more familiar brands such as State Farm.

Choosing a company with a strong customer service reputation is important. After an accident, reliable customer service can help you get back on the road quickly, while poor service can make claims and getting back to your routine take longer than necessary. Clearcover's lack of reviews from industry leaders makes it difficult to know what to expect if you have an emergency and need to use your insurance policy.

Clearcover is not rated by J.D. Power or the National Association of Insurance Commissioners (NAIC). However, reviews from sources like the Better Business Bureau and Trustpilot tend to be positive. The company received an "A" rating for financial stability from Demotech (an alternative to AM Best), which means that it has an "exceptional" ability to pay out claims, even in difficult economic times. This is the third-best rating available from Demotech.

Clearcover provides online quotes, and it has a smartphone app, both of which are easy to use. Unfortunately, the process is a little disjointed: Many important activities related to your car insurance policy can only be done on the website or the app, but not both.

Action | Where to do it |

|---|---|

| Get a quote | Website or independent agent |

| Chat with customer service | Mobile app, email or phone |

| View insurance card and documents | Mobile app only |

| File a claim | Mobile app, email or phone |

On the other hand, the Clearcover app experience has earned positive feedback among users, earning high marks in both the Google Play store and the Apple App Store for its iOS version. That should make contacting customer service or filing a claim much easier for drivers who prefer not to deal with an agent over the phone.

Contact Clearcover Insurance

Clearcover policyholders can contact customer service by phone at 855-444-1875 or via live chat on the website. Customer service is available from 8 a.m. to 9 p.m. Central Time on business days and 8 a.m. to 6:30 p.m. on weekends; however, customers can file a claim through the app 24 hours a day.

Frequently asked questions

Is Clearcover Insurance good?

Yes, Clearcover is a good insurer if you prefer interacting with your insurer via a mobile app. It has a highly rated app and cheap rates. However, as a newer company, it lacks the customer service track record of major insurers like Geico and State Farm.

How do I contact Clearcover?

Clearcover's phone number is 855-444-1875. You can also email them at [email protected] or use the chat function in the mobile app.

Is Clearcover affordable?

Clearcover offers very affordable rates for most drivers. On average, a minimum-coverage policy costs $547 per year, and full coverage costs $1,052 per year. However, every driver will get different rates, so it's important to compare quotes from multiple insurers.

What states is Clearcover available in?

Clearcover is currently available in 20 states: Alabama, Arizona, California, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maryland, Mississippi, Missouri, Nebraska, Ohio, Oklahoma, Pennsylvania, Texas, Utah, Virginia, West Virginia and Wisconsin.

The company will be expanding to offer insurance in Nevada and North Carolina soon.

Methodology

To calculate average annual premiums, we collected quotes in the ten most populated cities in Texas . Our sample driver is a 30-year-old man with a clean record driving a 2015 Honda Civic EX.

Quotes are based on the coverage limits below. Accident quotes are based on a full-coverage policy.

Coverage | Minimum coverage | Full coverage |

|---|---|---|

| Bodily injury liability | $30,000/$60,000 | $50,000/$100,000 |

| Property damage liability | $25,000 | $25,000 |

| Underinsured/uninsured bodily injury liability | Waived | $50,000/$100,000 |

| Underinsured/uninsured property damage | Waived | $25,000, $250 deductible |

| Collision/comprehensive | Waived | $500 |

| Alternate transportation | Waived | Waived |

| Ridesharing | Waived | Waived |

| Roadside assistance | Waived | Waived |

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.