Who Has the Best Car Insurance Rates in Columbus, Georgia?

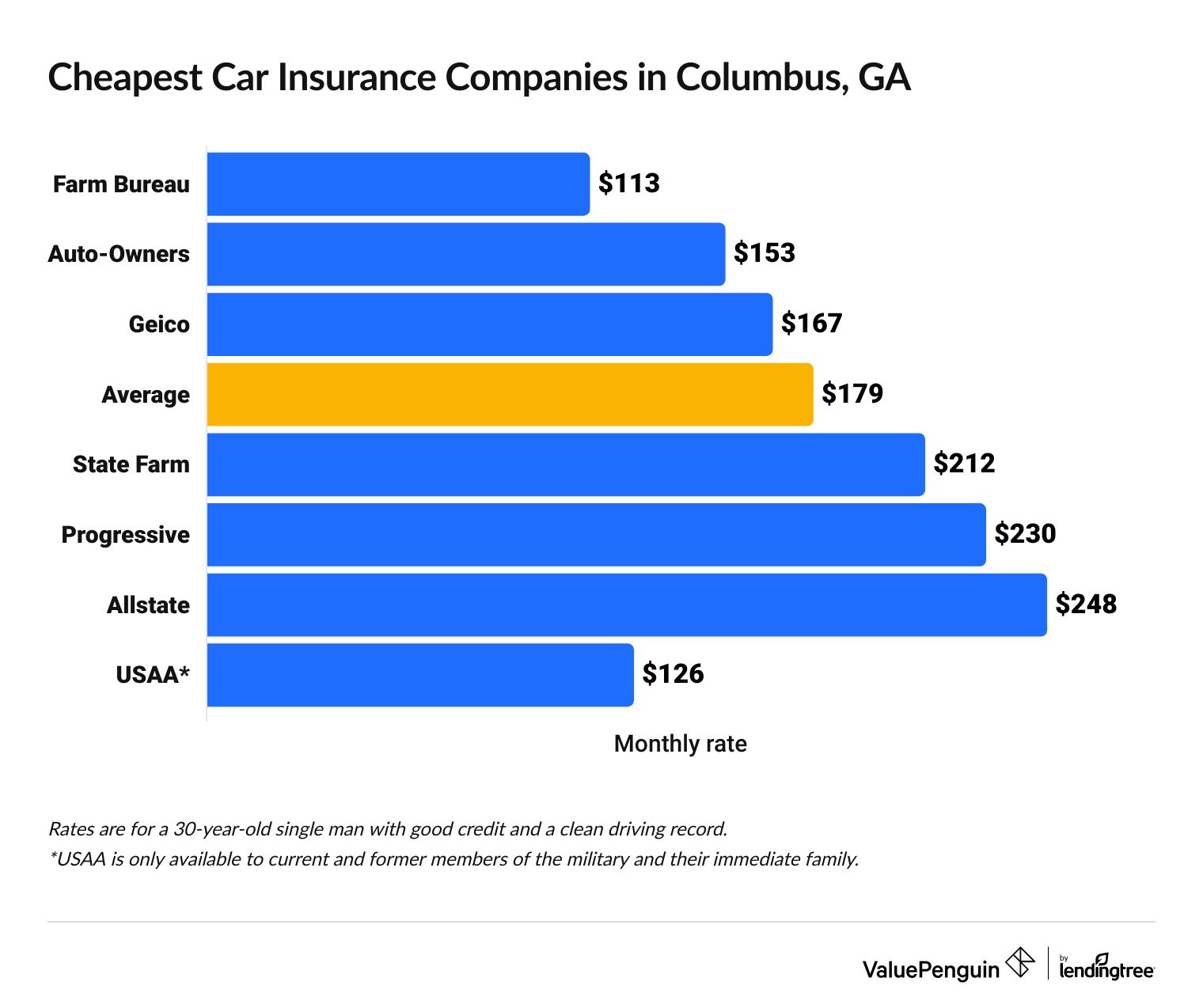

Farm Bureau has the cheapest car insurance in Columbus, GA, at $113 per month for full coverage and $49 per month for minimum coverage.

Find Cheap Auto Insurance Quotes in Columbus

Best cheap auto insurance in Columbus, GA

How we chose the top companies

Best and cheapest car insurance in Columbus, Georgia

Farm Bureau offers the best combination of great customer service and cheap rates in Columbus, GA. USAA is also an excellent choice, but only military members, veterans and some of their family members can buy a policy.

- Cheapest full coverage: Farm Bureau, $113/mo

- Cheapest minimum liability: Farm Bureau, $49/mo

- Cheapest for young drivers: Farm Bureau, $162/mo

- Cheapest after a ticket: Farm Bureau, $124/mo

- Cheapest after an accident: Farm Bureau, $124/mo

- Cheapest for teens after a ticket: Farm Bureau, $179/mo

- Cheapest after a DUI: Farm Bureau, $219/mo

- Cheapest for poor credit: Farm Bureau, $113/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Cheapest car insurance in Columbus: Farm Bureau

Farm Bureau has the cheapest full coverage car insurance in Columbus.

At $113 per month, full coverage from Farm Bureau costs $65 per month less than the citywide average. It's also $40 per month less than the second-cheapest option, Auto-Owners.

Find Cheap Auto Insurance Quotes in Columbus

The average cost of car insurance in Columbus, GA, is $179 per month for a full coverage policy. That's $4 per month less than the Georgia state average.

Best cheap full coverage car insurance in Columbus

Company | Monthly rate | |

|---|---|---|

| Farm Bureau | $113 | |

| Auto-Owners | $153 | |

| Geico | $167 | |

| State Farm | $212 | |

| Progressive | $230 |

*USAA is only available to current and former military members and their families.

Columbus drivers with military ties should also compare quotes from USAA. At $126 per month, full coverage from USAA is $13 per month more than Farm Bureau, on average. However, USAA may be the cheapest option for some people, and its exceptional customer service could be worth the extra cost.

Cheapest liability-only insurance in Columbus: Farm Bureau

Farm Bureau offers the cheapest liability car insurance rates in Columbus for most people.

Minimum liability car insurance from Farm Bureau costs $49 per month, on average. That's $30 per month less than the Columbus average.

USAA has the cheapest rates overall, at just $47 per month. However, only military members, veterans and some of their family members can buy car insurance from USAA.

Cheap minimum liability car insurance in Columbus

Company | Monthly rate |

|---|---|

| Farm Bureau | $49 |

| Auto-Owners | $60 |

| Geico | $68 |

| Progressive | $78 |

| State Farm | $113 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Columbus

Cheapest insurance companies in Columbus, GA, for teens: Farm Bureau

Farm Bureau has the lowest rates for teen drivers in Columbus for both minimum and full coverage.

Minimum liability coverage from Farm Bureau costs $162 per month for an 18-year-old. That's $137 per month less than the Columbus average.

Teens pay around $361 per month for a full coverage policy from Farm Bureau, which is $258 per month less than the citywide average.

Cheap auto insurance companies in Columbus for teens

Company | Liability only | Full coverage |

|---|---|---|

| Farm Bureau | $162 | $361 |

| Auto-Owners | $230 | $444 |

| Geico | $232 | $508 |

| State Farm | $396 | $668 |

| Progressive | $414 | $1,125 |

*USAA is only available to current and former military members and their families.

In Columbus, 18-year-old drivers pay around three and a half times more for car insurance than 30-year-old drivers. That's because insurance companies believe young drivers take more risks than older, more experienced drivers.

Teen drivers can lower their insurance costs by:

-

Joining a parent's car insurance policy. This typically increases the price of your parent's policy, but it should still be much cheaper than two separate policies.

- Qualifying for discounts. Many car insurance companies offer discounts geared towards young drivers, like good student discounts. When you're comparing quotes, ask about discounts so you can take advantage of any savings you qualify for.

Cheapest car insurance in Columbus after a speeding ticket: Farm Bureau

Farm Bureau offers the cheapest rates in Columbus after a speeding ticket. Full coverage car insurance from Farm Bureau costs around $124 per month after one speeding ticket, which is $83 per month less than the citywide average.

Affordable car insurance quotes after a speeding ticket

Company | Monthly rate |

|---|---|

| Farm Bureau | $124 |

| Auto-Owners | $153 |

| Geico | $199 |

| State Farm | $227 |

| Allstate | $282 |

*USAA is only available to current and former military members and their families.

On average, a speeding ticket raises rates by 16% in Columbus, GA. That's an increase of $28 per month for a full coverage policy.

Cheap car insurance in Columbus, GA, after an accident: Farm Bureau

Farm Bureau has the most affordable full coverage rates in Columbus after an at-fault accident. At $124 per month, Farm Bureau costs less than half the citywide average. It's also $88 per month less than the second-cheapest company, Auto-Owners.

Cheapest car insurance after an accident in Columbus

Company | Monthly rate |

|---|---|

| Farm Bureau | $124 |

| State Farm | $212 |

| Auto-Owners | $222 |

| Geico | $295 |

| Progressive | $386 |

*USAA is only available to current and former military members and their families.

An accident raises full coverage rates in Columbus by an average of 45%.

Don't switch car insurance companies right after your accident. Your rates won't go up until your current policy expires. But any quotes you get will factor in your accident, so they'll probably be more expensive than your current rate.

Instead, wait until your current company sends your renewal offer. Then, shop around for quotes from multiple companies to find the cheapest rates for you.

Cheapest quotes for teens with bad driving records: Farm Bureau

Farm Bureau has the most affordable car insurance for young drivers in Columbus with a speeding ticket or accident on their record. A minimum liability policy from Farm Bureau costs $179 per month after a ticket or accident, which is around half the Columbus average.

Cheap car insurance quotes in Columbus, GA, for teens with bad records

Company | Ticket | Accident |

|---|---|---|

| Farm Bureau | $179 | $179 |

| Auto-Owners | $230 | $369 |

| Geico | $277 | $325 |

| State Farm | $431 | $396 |

| Progressive | $459 | $495 |

*USAA is only available to current and former military members and their families.

On average, car insurance rates for teens go up by 15% after one speeding ticket and 30% after an accident. That's less than the increase for adults because teens already pay much higher rates, even with a clean record.

Cheapest car insurance in Columbus after a DUI: State Farm

Farm Bureau has the cheapest full coverage car insurance for Columbus drivers with DUIs, at $219 per month. That's $139 per month cheaper than the citywide average, and $78 per month less than the next-cheapest company, Auto-Owners.

Cheap auto insurance in Columbus, GA, after a DUI

Company | Monthly rate |

|---|---|

| Farm Bureau | $219 |

| Auto-Owners | $297 |

| Progressive | $310 |

| Allstate | $341 |

| Geico | $502 |

*USAA is only available to current and former military members and their families.

In Columbus, a DUI nearly doubles the cost of full coverage insurance.

You may also have to get SR-22 insurance after a DUI in Georgia. Most companies charge between $15 and $50 to file an SR-22 form for you, in addition to any increase in your car insurance rates.

Cheapest quotes for Columbus drivers with poor credit: Farm Bureau

Farm Bureau has the lowest rates for drivers with poor credit in Columbus. A full coverage policy from Farm Bureau costs around $113 per month. That's less than one-third of the Columbus average. It's also half the cost of the second-cheapest company, Geico.

Affordable car insurance for drivers with poor credit

Company | Monthly rate |

|---|---|

| Farm Bureau | $113 |

| Geico | $238 |

| Progressive | $350 |

| Auto-Owners | $406 |

| Allstate | $419 |

*USAA is only available to current and former military members and their families.

Drivers with poor credit pay twice as much for full coverage insurance in Columbus as those with good credit. That's because insurance companies believe drivers with bad credit scores are more likely to file claims in the future.

Average car insurance quotes in Columbus, GA, by neighborhood

Fort Benning and parts of southern Columbus have the cheapest car insurance rates in the area, at $185 per month for full coverage insurance.

Full coverage quotes by Columbus ZIP code

ZIP | Monthly rate | % from average |

|---|---|---|

| 31808 | $190 | 1% |

| 31820 | $186 | -1% |

| 31901 | $190 | 1% |

| 31903 | $187 | -1% |

| 31904 | $191 | 1% |

A relatively small city, Columbus has a difference of only $7 per month between the cheapest and most expensive ZIP codes. Areas with higher population density, traffic and crime tend to have higher car insurance rates.

For example, people living in Phenix City, AL — located on the other side of the Chattahoochee River — pay an average of $195 per month for full coverage insurance. That's partially because

Phenix City has higher auto theft rates than Columbus.

What's the best car insurance coverage in Columbus, GA?

Full coverage car insurance is the best choice for most people in Columbus.

Full coverage auto insurance can have higher liability limits than the state requires and includes collision and comprehensive coverages.

- Collision coverage pays to fix your car if you hit another vehicle or object, regardless of whose fault it is.

- Comprehensive coverage pays for damage due to theft, natural disasters and other events outside of your control, sometimes called "acts of God."

If you have a car loan or lease, most lenders require you to have collision and comprehensive coverage. You should also consider adding these coverages if your car is less than eight years old or worth more than $5,000.

In addition, higher liability limits can help you avoid an expensive bill after an accident. That's because the minimum amount of coverage required in Georgia may not be enough to cover the full cost of a serious crash.

For example, if you hit and total a brand new or expensive car, $25,000 of property damage liability coverage probably won't be enough to fully cover the cost to replace it.

Frequently asked questions

What are the best insurance companies in Columbus, GA?

Farm Bureau is the best choice for most Columbus drivers because of its cheap rates and reliable customer service. USAA is typically a little more expensive, but its excellent customer service makes it a great option for military members, veterans and their families.

How much is Geico in Columbus, GA?

Full coverage car insurance from Geico costs $167 per month in Columbus, on average. While that's $12 per month less than the citywide average, it's $54 per month more than the cheapest company for full coverage in Columbus, Farm Bureau.

How much is Progressive insurance in Columbus, GA?

Progressive charges around $230 per month for full coverage insurance in Columbus. That's $51 per month more expensive than the city average. Columbus drivers can typically find cheaper rates at Farm Bureau, Auto-Owners and Geico.

Methodology

To find the best cheap auto insurance in Columbus, Georgia, ValuePenguin editors collected data from seven of the largest insurance companies in the state. Rates are for a 30-year-old man with good credit and a clean driving record who owns a 2015 Honda Civic EX.

Full coverage quotes include higher liability limits than the Georgia requirement along with collision and comprehensive coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision and comprehensive coverage: $500 deductible

The analysis uses insurance rate data from Quadrant Information Services that is publicly sourced from insurance company filings. Rates should be used for comparative purposes only. Your rates will likely differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.