Cheap Car Insurance Quotes in Michigan 2025

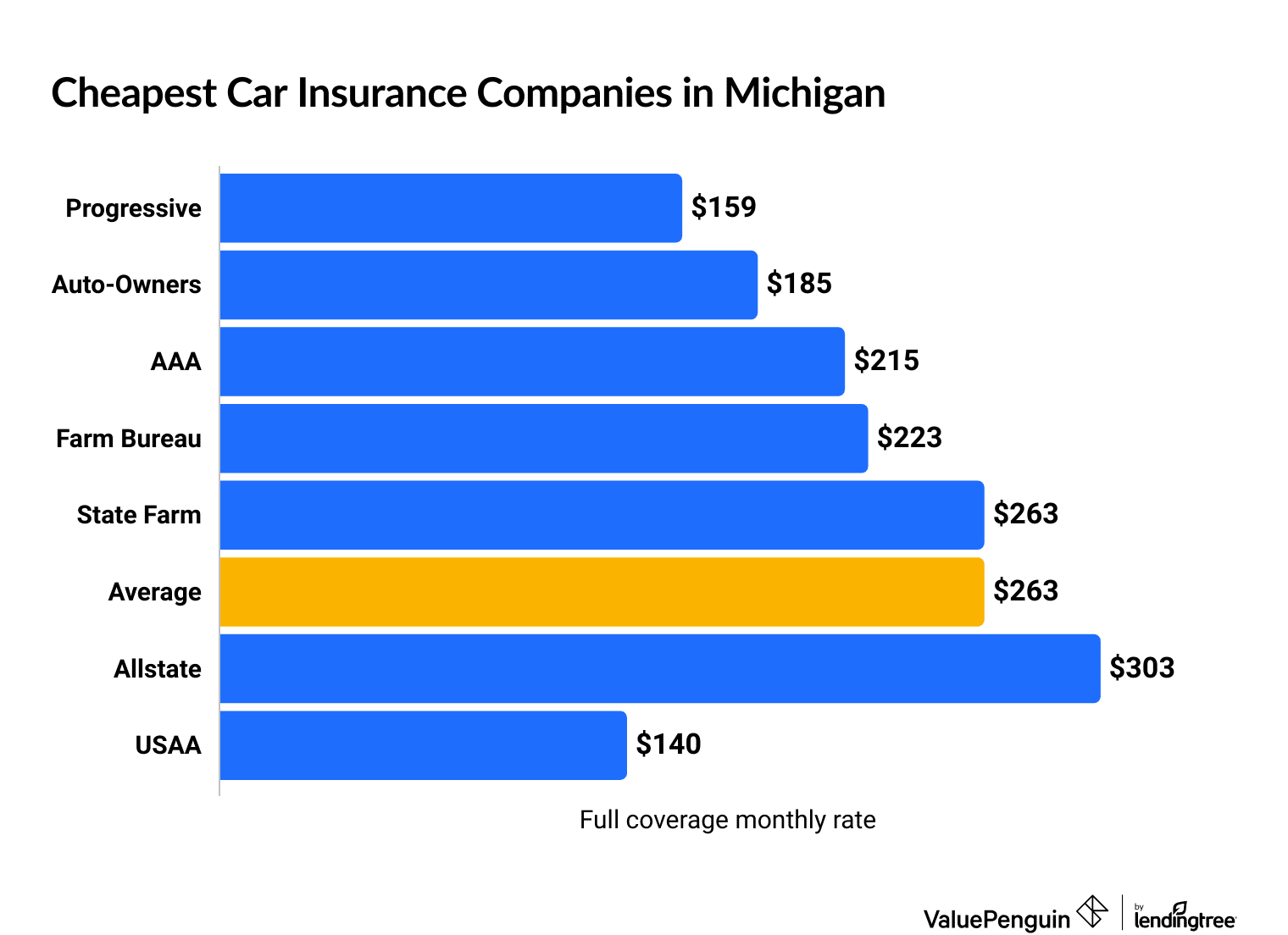

Progressive has the cheapest auto insurance in Michigan, at $159 per month for full coverage.

Find Cheap Car Insurance Quotes in Michigan

Best cheap auto insurance in Michigan

How we chose the top companies

Best and cheapest car insurance in Michigan

- Cheapest full coverage: Progressive, $159/mo

- Cheapest minimum liability: Auto-Owners, $79/mo

- Cheapest for young drivers: Auto-Owners, $125/mo

- Cheapest after a ticket: Progressive, $192/mo

- Cheapest after an accident: Auto-Owners, $216/mo

- Cheapest for teens after a ticket: Auto-Owners, $146/mo

- Cheapest after a DUI: Progressive, $181/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Auto-Owners has the best mix of affordable rates and great customer service in Michigan. But Auto-Owners doesn't offer online quotes, so you need to contact an agent to compare rates.

Progressive has the cheapest online quotes in Michigan. You can quickly compare rates and buy a policy on the company's website. However, Progressive's customer service isn't as good as Auto-Owners' customer support.

Cheapest car insurance in Michigan: Progressive

Progressive has the cheapest full coverage car insurance in Michigan.

Full coverage from Progressive costs $159 per month on average, which is $104 per month cheaper than the state average.

Find Cheap Car Insurance Quotes in Michigan

The average cost of full coverage auto insurance in Michigan is $263 per month. That makes Michigan the third-most expensive state in the U.S. for full coverage insurance. This is mostly because of Michigan's high car insurance requirements.

Cheapest full coverage insurance in Michigan

Company | Monthly rate | |

|---|---|---|

| Progressive | $159 | |

| Auto-Owners | $185 | |

| AAA | $215 | |

| Farm Bureau | $223 | |

| State Farm | $263 |

*USAA is only available to current and former military members and their families.

USAA offers even cheaper auto insurance quotes to members of the military, veterans and their families. USAA's full coverage policy costs $140 per month, which is $19 less per month than Progressive.

Cheapest liability car insurance quotes in Michigan: Auto-Owners

Auto-Owners has the cheapest minimum coverage auto insurance in Michigan.

An Auto-Owners policy costs around $79 per month. That's $54 per month less than the Michigan state average, which is $133 per month.

Best cheap Michigan auto insurance

Company | Monthly rate |

|---|---|

| Auto-Owners | $79 |

| Progressive | $86 |

| AAA | $87 |

| Farm Bureau | $110 |

| Allstate | $129 |

*USAA is only available to current and former military members and their families.

Find Cheap Car Insurance Quotes in Michigan

Progressive offers the cheapest online quotes in Michigan for minimum coverage, at $86 per month.

Auto-Owners is cheaper than Progressive, but it doesn't offer online auto insurance quotes in Michigan. You'll have to speak with an independent insurance agent to get a quote.

Cheapest auto insurance in MI for young drivers: Auto-Owners

Auto-Owners has the most affordable car insurance for Michigan teens.

Auto-Owners insurance costs an average of $125 per month for a teen buying minimum coverage. That's $290 per month cheaper than the state average.

Auto-Owners also has the cheapest full coverage rates for teens, at $315 per month for an 18-year-old.

Young drivers can find even cheaper rates at USAA, where a minimum coverage policy costs just $89 per month. But USAA is only available to military members, veterans and their immediate families.

Best cheap Michigan car insurance for teens

Company | Liability only | Full coverage |

|---|---|---|

| Auto-Owners | $125 | $315 |

| AAA | $171 | $447 |

| Farm Bureau | $179 | $363 |

| Allstate | $274 | $656 |

| Progressive | $321 | $717 |

*USAA is only available to current and former military members and their families.

In Michigan, 18-year-old drivers pay nearly three times as much for minimum coverage car insurance as older drivers.

Insurance companies charge teens more for insurance because they have less driving experience and are more likely to get in an accident.

The best way for young drivers to pay less for car insurance is to join a family insurance plan. Also, many companies offer car insurance discounts for taking driver safety classes or having good grades.

Cheapest MI car insurance after a speeding ticket: Progressive

Progressive has the cheapest car insurance quotes in Michigan for drivers with a recent speeding ticket. A full coverage policy from Progressive costs $192 per month, which is $140 per month less than the state average.

Company | Monthly rate |

|---|---|

| Progressive | $192 |

| Auto-Owners | $216 |

| Farm Bureau | $223 |

| AAA | $256 |

| State Farm | $335 |

*USAA is only available to current and former military members and their families.

A single speeding ticket increases insurance quotes for Michigan drivers by $69 per month for full coverage insurance, on average.

Cheapest Michigan car insurance after an accident: Auto-Owners

Auto-Owners has the cheapest quotes for Michigan drivers with an accident on their records. Full coverage from Auto-Owners costs $216 per month, which is $143 per month less than the state average.

Company | Monthly rate |

|---|---|

| Auto-Owners | $216 |

| Progressive | $223 |

| Farm Bureau | $273 |

| AAA | $307 |

| State Farm | $311 |

*USAA is only available to current and former military members and their families.

In Michigan, an at-fault accident raises rates by an average of 37%, or $96 per month for full coverage.

Don't rush to switch insurance companies right after an accident.

Your rates won't go up until your policy renews. You should get a letter or email beforehand with your new rates. That's a good time to start shopping around for quotes.

Cheapest for young drivers after a ticket or accident: Auto-Owners

Auto-Owners is the cheapest option for young drivers in Michigan who have a recent speeding ticket or accident.

The company's rates average $146 per month for minimum coverage after either an at-fault accident or a speeding ticket.

Cheap insurance in Michigan for teens with a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Auto-Owners | $146 | $146 |

| Farm Bureau | $179 | $218 |

| AAA | $189 | $217 |

| Progressive | $336 | $360 |

| Allstate | $373 | $395 |

*USAA is only available to current and former military members and their families.

After a speeding ticket, young drivers in Michigan pay an average of $98 more per month for minimum coverage car insurance. An accident raises rates by an average of $96 per month.

Cheapest MI auto insurance quotes after a DUI: Progressive

Progressive has the cheapest Michigan car insurance quotes for drivers with a DUI. Full coverage rates from Progressive average $181 per month. A policy from Progressive costs nearly three and a half times less than the Michigan average.

Inexpensive auto insurance in Michigan after a DUI

Company | Monthly rate |

|---|---|

| Progressive | $181 |

| Auto-Owners | $420 |

| AAA | $530 |

| Farm Bureau | $568 |

| State Farm | $709 |

*USAA is only available to current and former military members and their families.

In Michigan, having a DUI on your record can cause your car insurance rates to more than double. To get the cheapest car insurance, choose a company with low rates and look for discounts for things like taking a defensive driving class.

Best car insurance in Michigan

Farm Bureau is the best car insurance company in Michigan for most drivers.

Farm Bureau earned a good score on J.D. Power's customer satisfaction survey, and it only gets one-third as many complaints as an average company its size. In addition, Farm Bureau typically has affordable auto insurance in Michigan.

USAA has the highest customer satisfaction scores overall. However, not everyone can buy car insurance from USAA. You must be a military member, veteran or military family member to qualify.

Top-rated insurance companies in Michigan

Company |

Editor's rating

|

JD Power

|

AM Best

|

|---|---|---|---|

| USAA | 739 | A++ | |

| Farm Bureau | 673 | A | |

| AAA | 658 | ||

| State Farm | 657 | A++ | |

| Auto-Owners | 654 | A++ |

State Farm and AAA are also highly rated options in Michigan and are available to everyone. Both have strong customer service reputations. However, State Farm's rates tend to be more expensive than average.

Average car insurance cost in Michigan by city

Stevensville has the cheapest car insurance quotes in Michigan, while Hamtramck has the highest rates in the state.

Where you live can impact your auto insurance rates. In Michigan, rates vary widely from city to city. The difference between the most and least expensive locations is $603 per month for a full coverage policy.

Drivers living in Hamtramck, a Detroit neighborhood, pay an average of $773 per month for full coverage insurance. People in Stevensville, on Lake Michigan, can expect to pay $170 per month for the same coverage.

Michigan auto insurance quotes by city

City | Monthly Rate | % from average |

|---|---|---|

| Acme | $196 | -8% |

| Addison | $202 | -6% |

| Adrian | $191 | -11% |

| Afton | $194 | -9% |

| Ahmeek | $190 | -11% |

Michigan car insurance requirements

Michigan has the highest required car insurance limits in the country.

Michigan drivers must have a large amount of personal injury protection (PIP) along with the standard liability coverages that most states require.

Personal injury protection (PIP) pays for injuries to you or your passengers in an accident. It also helps replace lost income while you recover, no matter who is at fault.

In Michigan, you must have car insurance liability limits of 50/100/10.

- $50,000 in bodily injury liability coverage per person

- $100,000 in bodily injury liability coverage per accident

- $10,000 in property damage liability

You also need:

- $250,000 in personal injury protection (PIP), or you can opt out

- $1 million per accident in property protection insurance

Michigan is a no-fault state. That means your insurance pays for your medical bills without considering who caused the car accident.

What's the best car insurance coverage for Michigan drivers?

Full coverage car insurance is the best choice for most Michigan drivers.

Full coverage includes liability insurance, which pays for damage you cause in a crash, along with collision and comprehensive coverage.

- Collision insurance pays to repair your car after an accident you cause.

- Comprehensive insurance pays to repair your car if it's damaged by events like weather, theft or vandalism.

If you have a loan or lease on your car, your lender typically requires you to have comprehensive and collision coverage. It's also a good idea if your car is worth more than $5,000 or is less than 8 years old.

Minimum coverage insurance is the most affordable insurance option in Michigan. It costs $130 per month less than full coverage.

However, minimum car insurance coverage doesn't include comprehensive and collision. This means it won't pay for damage you cause to your own car.

For cheaper or older cars, you might save more by getting minimum coverage and paying for repairs yourself.

Frequently asked questions

Who has the cheapest car insurance rates in Michigan?

Auto-Owners has the cheapest car insurance quotes in Michigan, with an average rate of $79 per month for minimum coverage insurance. If you need full coverage, Progressive has the best rate, at $159 per month.

How much is car insurance in Michigan per month?

The average cost of auto insurance in Michigan is $263 per month for a full coverage policy. Minimum coverage costs an average of $133 per month.

Why is car insurance so expensive in Michigan?

Car insurance in Michigan is expensive because the state requires high coverage limits. Recent laws lowered the minimum requirement for personal injury protection (PIP). However, Michigan is still the most expensive state for minimum-coverage car insurance. Its rates are nearly double the national average.

What's the best insurance in Michigan?

Farm Bureau has the best car insurance for most Michigan drivers. Farm Bureau has excellent customer service and affordable rates. However, you can't compare quotes online.

Methodology

ValuePenguin collected thousands of rates from ZIP codes across Michigan for the largest insurance companies in the state. Quotes are for a 30-year-old man driving a 2015 Honda Civic EX with a good credit score.

Quotes are for a full coverage policy with the following coverage limits:

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection: $250,000

- Property protection insurance: $1 million per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These quotes were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.