Who Has the Cheapest Renters Insurance Quotes in Oregon? (2025)

Lemonade has the cheapest renters insurance in Oregon, at $12 per month on average.

Compare Cheap Renters Insurance Quotes in Oregon

Best Cheap Renters Insurance in OR

ValuePenguin editors found the best cheap renters insurance companies in Oregon by looking at rates, customer satisfaction, coverage options and discounts.

Our experts calculated average renters insurance rates by gathering quotes from eight top companies across 25 of Oregon's largest cities.

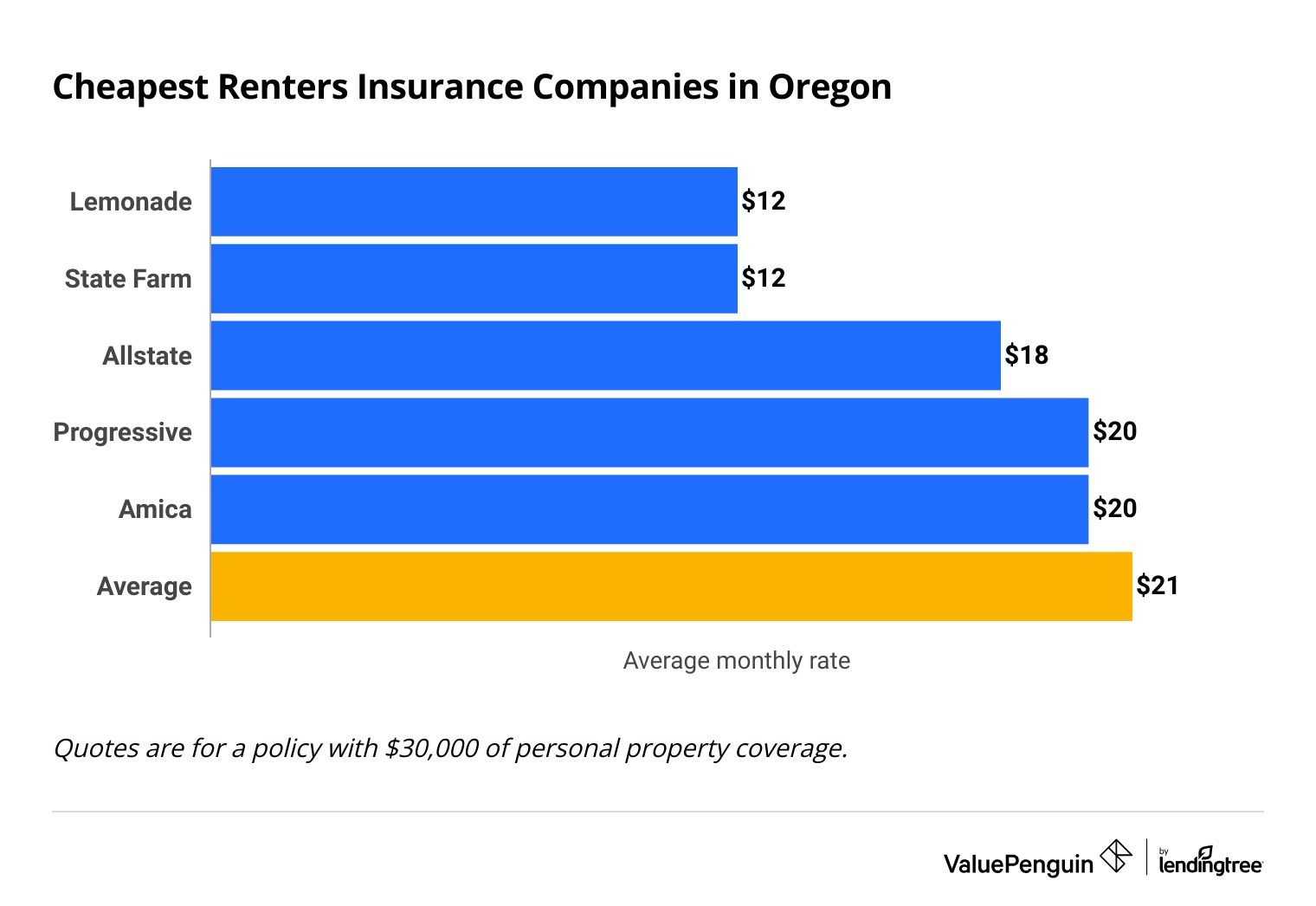

Cheapest renters insurance companies in Oregon

Lemonade has the cheapest renters insurance in Oregon, at $12 per month for $30,000 of personal property coverage. That's 44% cheaper than the Oregon state average.

Compare Cheap Renters Insurance Quotes in Oregon

Renters insurance in Oregon costs $21 per month for $30,000 of personal property coverage , on average. That's 8% cheaper than the national average of $23 per month.

Oregon has more expensive renters insurance rates than nearby Washington, California and Idaho . Oregon has the 25th most expensive renters insurance nationwide.

Top renters insurance companies in Oregon

Company | Monthly cost | ||

|---|---|---|---|

| Lemonade | $12 | ||

| State Farm | $12 | ||

| Allstate | $18 | ||

| Progressive | $20 | ||

| Amica | $20 | ||

Best renters insurance in Oregon for most people: State Farm

-

Editor's rating

- Cost: $12/mo

State Farm offers the best combination of cheap rates and strong customer service in Oregon.

-

Affordable quotes

-

High customer satisfaction

-

Good renters-auto bundling discount

-

Flood insurance available

-

Few discounts

State Farm has some of the cheapest rates in Oregon, at $12 per month for $30,000 of coverage to replace the items you own, called personal property coverage. That's 43% less than the Oregon state average. State Farm costs just a few cents more than the cheapest renters insurance in Oregon, Lemonade.

State Farm has a strong reputation for customer service. The company scored above average on a recent customer satisfaction survey by J.D. Power. It's important to choose a renters insurance company with good service because you're less likely to have problems when you file a claim.

State Farm has a good renters-auto bundling discount. Consider State Farm for your renters insurance if you already have State Farm auto insurance.

State Farm lets you personalize your policy with coverage extras. Oregon renters can protect themselves against common like floods and earthquakes with add on coverage.

Cheapest renters insurance quotes in Oregon: Lemonade

-

Editor's rating

- Cost: $12/mo

Lemonade has some of the cheapest renters insurance in Oregon.

-

Cheap quotes

-

Many extra coverage options

-

Easy online shopping experience

-

Few discounts

-

High number of customer complaints

Lemonade has the cheapest renters insurance quotes in Oregon, at $12 per month for $30,000 of personal property coverage. That's $112 per year cheaper than the Oregon state average.

You can save even more on your Lemonade policy by putting burglar and smoke alarms in your rental unit and by bundling your renters and auto insurance.

Lemonade has a mixed service reputation. It scored well on a recent J.D. Power survey for customer satisfaction among top renters insurance companies. However, Lemonade gets far more complaints than an average company its size according to the National Association of Insurance Commissioners (NAIC), an industry group.

Lemonade makes getting a quote easy with its digital-first approach to selling insurance. It only takes a few minutes to get a quote or file a claim online. However, you won't get the same level of personalized service offered by a local agent. Consider State Farm if you prefer a human touch.

Best renters insurance for extra coverage and discounts in Oregon: Progressive

-

Editor's rating

- Cost: $20/mo

Progressive offers a wide range of discounts and extra coverage options.

-

Affordable rates

-

Many extra coverage options and discounts

-

Weak customer service

You can lower your monthly rate by taking advantage of one or more of Progressive's many discounts.

Progressive discounts for Oregon renters

- Renters-auto bundling

- Electronic document delivery

- Gated community

- Quote in advance

- Single deductible

- Pay in full

Progressive lets you tailor your renters policy to your needs with a range of coverage add-ons. For example, you can buy a separate earthquake or flood insurance policy.

Progressive also lets you personalize your renters insurance with identity theft protection, umbrella coverage, higher limits for expensive items , equipment breakdown and damage caused by mold.

Progressive renters insurance costs $20 per month for $30,000 of personal property coverage on average. That's 5% cheaper than the Oregon state average of $21 per month.

Progressive has a poor customer service reputation.

Progressive ranked last in the most recent J.D. Power customer satisfaction survey for renters insurance. The company also gets 43% more complaints than an average company its size, according to the NAIC. If customer satisfaction is a high priority for you, consider Amica. It gets significantly fewer complaints than an average company its size, and Amica has roughly the same rates as Progressive.

Oregon renters insurance: Costs by city

Albany, a midsize city in the Willamette Valley, has the most expensive renters insurance among Oregon's larger cities, at $27 per month.

Redmond, a small town outside Bend, has the cheapest rates, averaging $19 per month.

How much you pay for renters insurance will depend on where you live in Oregon. Factors like the crime rate in your city, the frequency of certain natural disasters like wildfires and labor and materials costs can all impact your monthly rate.

City | Monthly rate | % from average |

|---|---|---|

| Albany | $27 | 26% |

| Beaverton | $21 | -3% |

| Bend | $22 | 1% |

| Bethany | $25 | 18% |

| Corvallis | $19 | -9% |

Tips for getting cheap renters insurance in Oregon

Compare quotes, use discounts and find your coverage needs to get the lowest price on your Oregon renters insurance policy.

Add up the cost of the items you own to find out how much coverage you need. The amount of coverage to replace your personal belongings, called personal property coverage, will have a big impact on your monthly rate.

It's important to buy the right amount of coverage to replace the items you currently have. If you buy too much coverage, you could pay hundreds of dollars in extra costs each year.

You can save hundreds of dollars per year without sacrificing coverage by comparing quotes. The most expensive renters insurance company in Oregon, American Family, costs $353 per year more than the cheapest company, Lemonade, for the same level of coverage.

It's a good idea to compare quotes each year because rates can change over time. The cheapest company today might not have the best rates when you renew your policy.

Most Oregon renters insurance companies offer one or more discounts.

It's important to consider which discounts you might qualify for when comparing quotes. That's because discounts can lower your final costs significantly.

Common renters insurance discounts in Oregon

- Renters-auto bundling

- Claims free discount

- Automatic payments

- Pay in full

- Loyalty

- Home protection device

Common natural disasters in Oregon

If you rent in Oregon, you may need protection against floods, earthquakes and wildfires.

Oregon wildfires

More than 1 million acres in Oregon burned from wildfires in 2024.

Most renters insurance policies will pay for damage caused by fire and smoke. However, some renters insurance companies refuse to sell fire coverage to people who live in an area with frequent wildfires.

If you're unable to buy wildfire coverage because of where you live, consider Oregon's insurance of last resort, called the FAIR Plan. Keep in mind that FAIR Plan policies tend to be expensive.

Flood insurance for Oregon renters

Renters insurance will not pay for flood damage.

You may need separate coverage to protect yourself against flooding if you live in a basement or ground floor apartment in a high-risk area.

You can find your risk level by using the flood map tool available on the Federal Emergency Management Agency (FEMA) website.

Many companies that sell renters insurance also sell flood insurance. For example, both and State Farm sell flood insurance.

Earthquake coverage for Oregon renters

Renters insurance will not pay for damage caused by earthquakes.

Like other Western states, Oregon experiences frequent earthquakes. In Oregon, the Portland metropolitan area is at particularly high risk.

Many companies that sell renters insurance also offer earthquake insurance. You may qualify for a bundling discount if you buy earthquake and renters coverage through the same company.

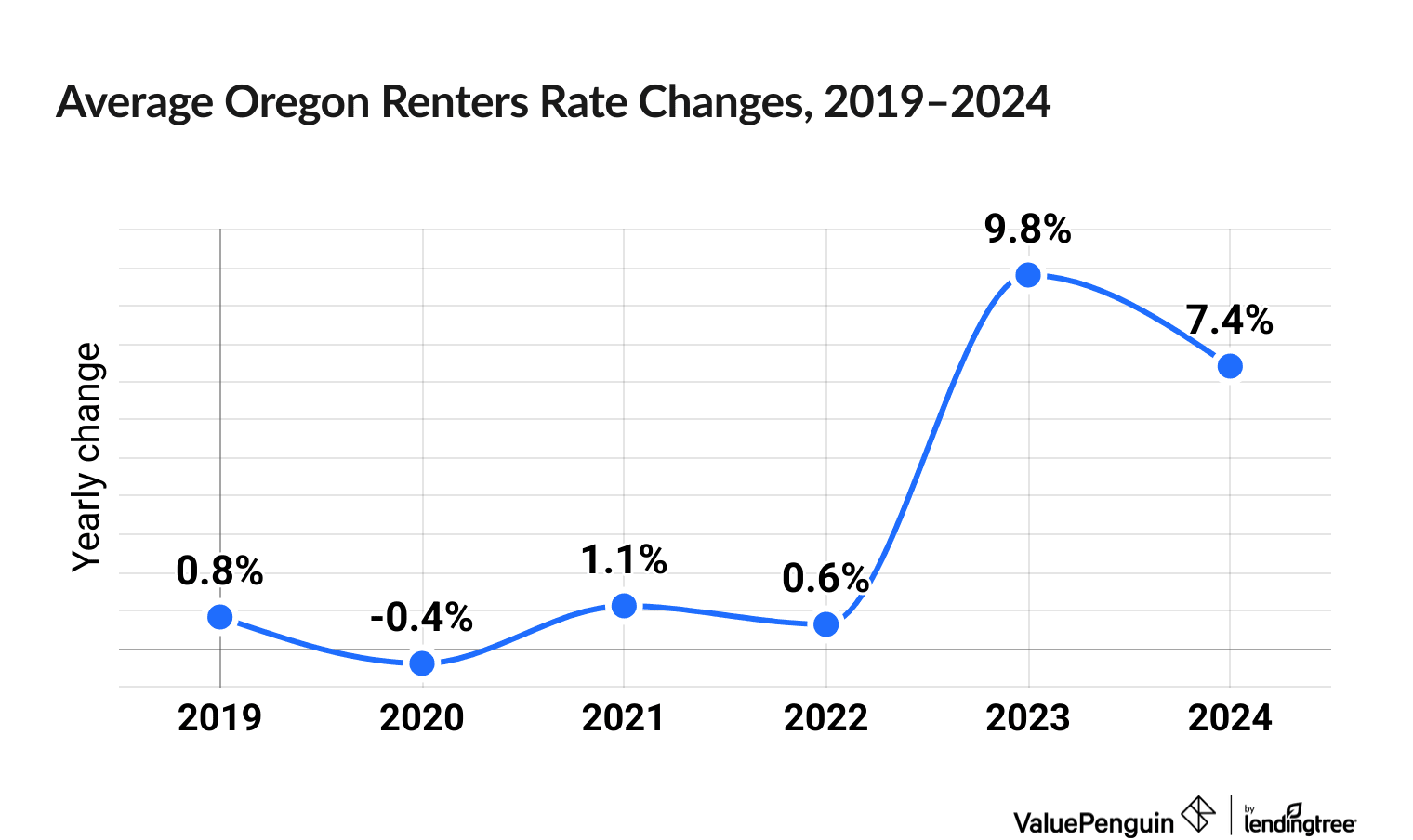

Oregon renters insurance trends

Renters insurance prices have gone up 20.5% in Oregon over the last six years.

In Oregon, renters insurance rates went up between 1.0% and 83.1%, depending on the company, over the last six years.

Renters insurance prices, on average, actually decreased by 0.4% in 2020, but then saw a steep uptick of 17.8% across 2023 and 2024.

Among the major OR insurers, the biggest increases have been at Liberty Mutual (83.1%), Chubb (42.6%) and Country Insurance (30.0%).

Renters insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

What company has the cheapest renters insurance in Oregon?

has the cheapest renters insurance quotes in Oregon at $12 per month for $30,000 of coverage to repair or replace your personal items, called personal property coverage.

State Farm is another good choice for renters insurance in Oregon because of its cheap rates and good customer service.

Can a landlord require renters insurance in Oregon?

Yes, a landlord can require that you buy renters insurance as part of your lease agreement. Even if your landlord doesn't require renters insurance, it's still a good idea to get coverage.

How much does renters insurance cost in Portland, Oregon?

Renters insurance in Portland, Oregon costs $21 per month for $30,000 of personal property coverage. That's 3% less than the overall state average.

Methodology

ValuePenguin collected more than 180 quotes from across Oregon's 25 largest cities for a single 30-year-old woman who has never filed a renters insurance claims. Coverage limits include:

- $30,000 of personal property coverage

- $9,000 for loss of use

- $500 deductible

- $100,000 of personal liability

- $1,000 of medical payments to guests

Customer service ratings were created using cost data, information from the National Association of Insurance Commissioners (NAIC) complaint index scores and J.D. Power's 2023 renters insurance customer satisfaction study rankings.

These rates should be used for comparative purposes only. Your quotes will likely differ.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.