Who Has the Cheapest Motorcycle Insurance In Virginia?

Progressive has the cheapest motorcycle insurance in Virginia, with an average of $18 per month.

Compare Motorcycle Insurance Quotes in Virginia

Best cheap motorcycle insurance in Virginia

ValuePenguin compared quotes from four top companies across 43 of the largest cities in Virginia to help you find the best cheap motorcycle insurance in VA.

We ranked the best motorcycle insurance companies in Virginia based on customer service, cost and coverage availability.

To find the most affordable companies, we compared quotes for a full coverage policy with higher liability limits than the state minimum, plus collision and comprehensive coverage. See our full methodology.

Cheapest motorcycle insurance in Virginia

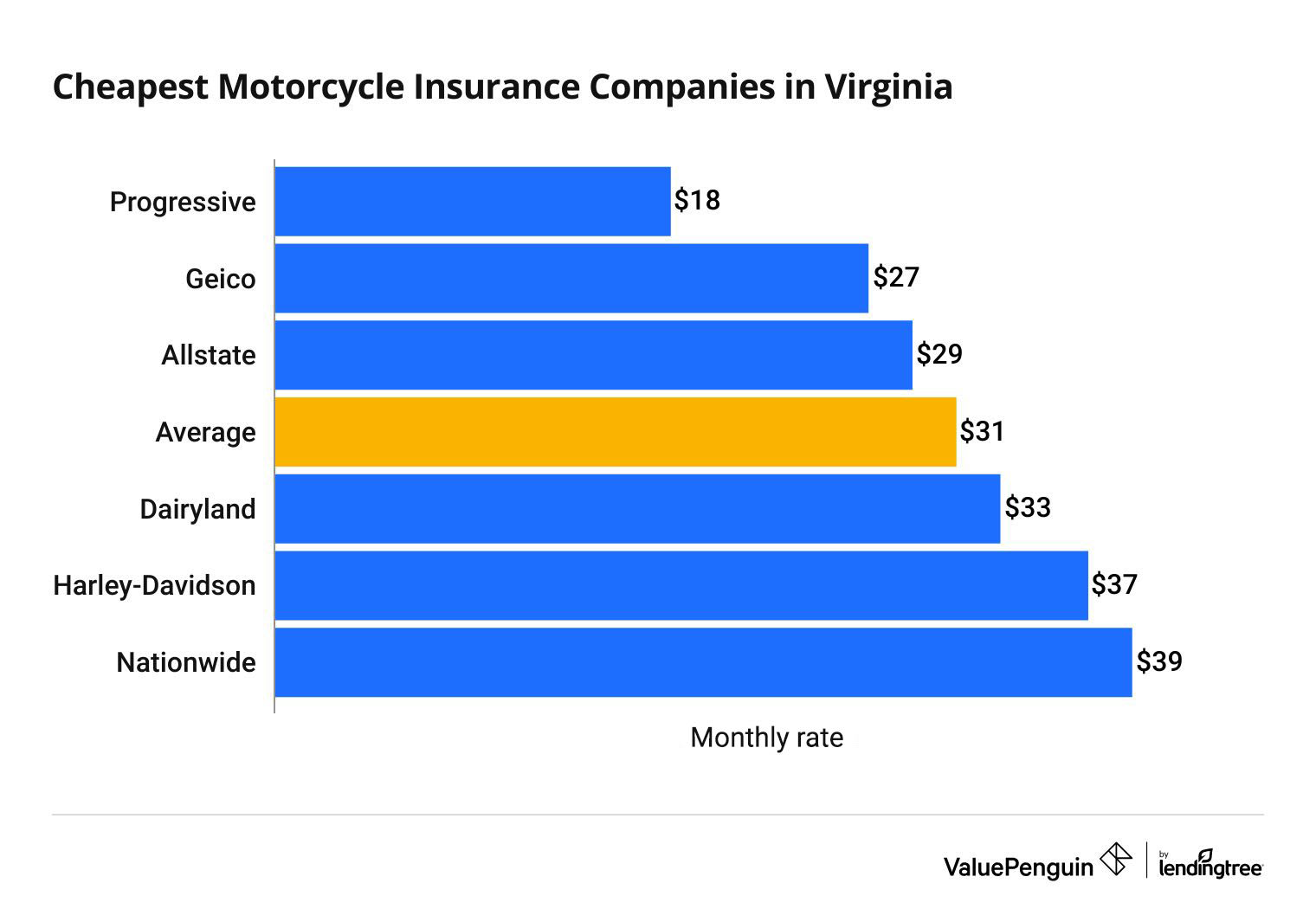

The cheapest motorcycle insurance in Virginia comes from Progressive. It costs an average of $18 per month for a full coverage policy. That's 41% cheaper than the state average.

Compare Motorcycle Insurance Quotes in Virginia

The average cost of motorcycle insurance in Virginia is $31 per month, or $366 per year.

Cheapest motorcycle insurance companies in VA

Company | Monthly rate | ||

|---|---|---|---|

| Progressive | $18 | ||

| Geico | $27 | ||

| Allstate | $29 | ||

| Dairyland | $33 | ||

| Harley-Davidson | $37 | ||

Best motorcycle insurance for most people: Progressive

-

Editor rating

-

Monthly rate

$18 ?

Pros and cons

Progressive is the most affordable car insurance in Virginia, and the best option for most riders. Progressive offers an unmatched variety of coverage options for motorcycle riders while still offering affordable rates and a positive customer service experience.

The average price for motorcycle insurance from Progressive was $18 per month. That's 41% below the average rate in Virginia and $9 less costly than the second-cheapest option, Geico.

Progressive also shines with its coverage options. While all insurers offer liability, collision and comprehensive coverage, Progressive has far more choices than other motorcycle insurers. For example, it offers up to two years of full replacement cost coverage, which means if your bike is totaled in a crash, Progressive will pay for a new bike. You also have the option to add original equipment manufacturer (OEM) parts coverage and carried contents coverage.

Riders may be able to reduce Progressive's already-low rates by taking advantage of its many discounts. For example, riders can get a lower premium if they also insure a car with Progressive, as well as for being a member of certain affinity groups.

Best for members of the military: USAA

-

Editor rating

Monthly rate

$17 ?

Pros and cons

Virginia residents in the military looking for motorcycle insurance may be interested in buying a policy from USAA. The company is well known for its great customer service that is tailored to military members, as well as affordable insurance rates.

USAA doesn't actually sell motorcycle insurance directly. Instead, it directs its members to a partner, Progressive, where they receive a 5% discount off the standard rate. But Progressive is an excellent option for motorcycle insurance, and a discount is a nice extra.

USAA also has very few in-person locations, so you may want to look at another insurer if you prefer to buy insurance in person.

Best for daily riders: Allstate

-

Editor rating

-

Monthly rate

$29 ?

Pros and cons

Allstate is an option worth considering in Virginia for riders who use their bikes as their primary mode of transit. The ability to pair roadside assistance and rental reimbursement means you will rarely be caught without a vehicle after an accident.

Roadside assistance provides 24/7 towing and service for situations that include battery issues, a flat tire or mechanical problems. Riders can also get supplies of fuel, oil, fluid or water. Rental reimbursement will give riders the funds for 30 days of a rental vehicle while their bike is in the shop.

Allstate's prices are about average for Virginia riders. Its price of $29 per month is $2 cheaper than the state average.

Allstate also has a slightly better-than-average number of complaints, an indicator of good customer service. It scored a 0.78 rating in the NAIC complaint index, which means it receives 13% fewer complaints than expected for a company of its size.

Motorcycle insurance cost in Virginia by city

Bristol, Harrisonburg Staunton and Winchester have the cheapest motorcycle insurance in Virginia, with an average cost of $26 per month for a full-coverage policy.

Riders in Norfolk pay the highest rate in the state, at $65 per month.

The cost of motorcycle insurance in Virginia can vary by up to $22 per month, depending on where you live. That's because riders who live in a city with poorly maintained roads or high theft rates are more likely to make a claim — especially given how easy motorcycles are to steal.

Average motorcycle insurance cost in Virginia by city

City | Monthly cost | % from average |

|---|---|---|

| Alexandria | $34 | 11% |

| Arlington | $36 | 18% |

| Bedford | $28 | -8% |

| Big Stone Gap | $28 | -8% |

| Bristol | $26 | -14% |

Virginia motorcycle insurance requirements

Virginia requires all riders to have motorcycle insurance as of July 1, 2024.

In the past, motorcyclists in Virginia could pay an "uninsured motor vehicle fee" instead of buying an insurance policy. However, this is no longer an option.

All riders in Virginia must have an insurance policy with a minimum amount of liability coverage, which is sometimes written as 30/60/20.

- Bodily injury liability: $30,000 per person and $60,000 per accident

- Property damage liability: $20,000 per accident

On January 1, 2025, Virginia will raise the minimum insurance requirement to 50/100/25.

Your insurance company should increase your coverage limits automatically when the new law goes into effect. But you may see an increase in your motorcycle insurance rates.

Virginia riders should consider getting more liability insurance than the state requires, along with extra coverage options.

For example, medical payment coverage will help pay your own medical bills if you're hurt in an accident, even if it's your fault. Comprehensive and collision coverages pay to repair or replace your bike if it's damaged.

Frequently asked questions

How much is motorcycle insurance in VA?

The average cost of motorcycle insurance is $31 per month in Virginia. That's slightly less expensive than the national average, which is $33 per month.

What is the minimum insurance for a motorcycle in Virginia?

Virginia requires motorcycle riders to have a minimum of $30,000 of bodily injury liability coverage per person and $60,000 per accident, along with $20,000 of property damage liability.

Who has the best motorcycle insurance in Virginia?

Progressive has the best motorcycle insurance for most riders in Virginia. Its full coverage policy costs $18 per month, which is 41% cheaper than average. Progressive also has lots of useful coverage options and dependable customer service.

Compare motorcycle insurance in Virginia vs other states

Methodology

To find the best cheap motorcycle insurance in Virginia, ValuePenguin collected more than 250 quotes across the state. Rates are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

All quotes are for a full coverage policy, which includes higher liability limits than required in Virginia, along with comprehensive and collision coverage.

Quote coverage limits

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $25,000 per accident

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.