The Best and Cheapest Homeowners Insurance Companies in New Jersey (2025)

State Farm has the best cheap homeowners insurance in New Jersey. It costs $932 per year for $350,000 of dwelling coverage on average.

Find Cheap Home Insurance Quotes in New Jersey

Best Cheap Home Insurance in New Jersey

ValuePenguin collected thousands of quotes from top homeowners insurance companies across hundreds of New Jersey ZIP codes.

Our experts compared factors including costs, coverage, customer satisfaction and discounts to find the best home insurance companies in New Jersey.

The cheapest home insurance quotes in NJ

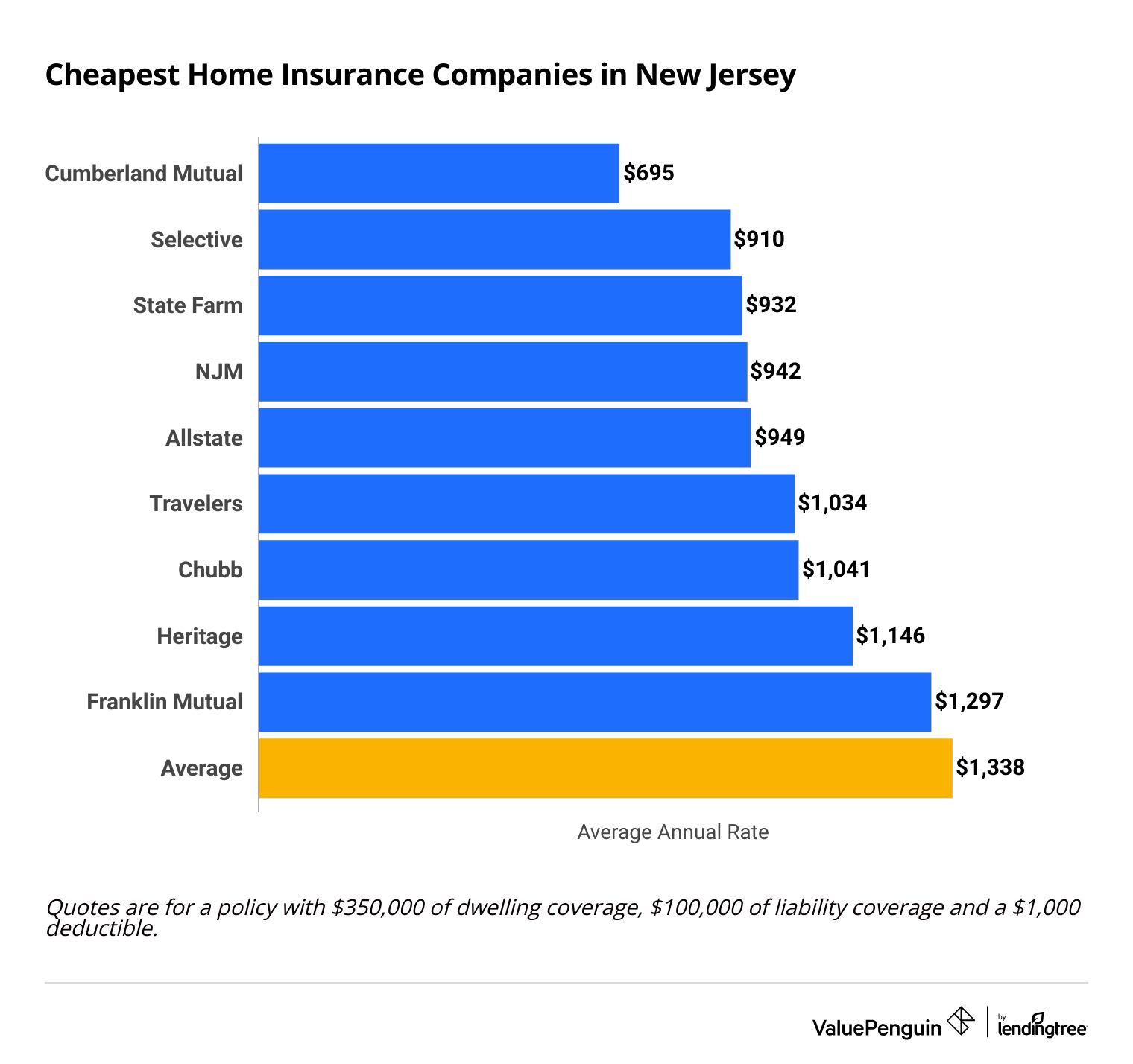

Cumberland Mutual sells the cheapest homeowners insurance policies in New Jersey. It charges $695 per year for $350,000 of coverage to repair your home after an accident, called dwelling coverage.

That's $643 per year or around half NJ state average of $1,338 per year.

Find Cheap Home Insurance Quotes in New Jersey

New Jersey homeowners insurance rates can differ dramatically from one company to the next. You could save $2,206 per year by switching from the most expensive home insurance company in New Jersey, American Family, to the cheapest, Cumberland Mutual.

Cheap annual home insurance quotes in NJ

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Cumberland Mutual | $592 | |

| State Farm | $695 | ||

| Selective | $702 | ||

| Allstate | $724 | ||

| Chubb | $761 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Cumberland Mutual | $592 | |

| State Farm | $695 | ||

| Selective | $702 | ||

| Allstate | $724 | ||

| Chubb | $761 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Cumberland Mutual | $695 | |

| Selective | $910 | ||

| State Farm | $932 | ||

| NJM | $942 | ||

| Allstate | $949 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| Cumberland Mutual | $966 | |

| NJM | $1,189 | ||

| Selective | $1,203 | ||

| State Farm | $1,242 | ||

| Heritage | $1,330 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Heritage | $1,963 | ||

| Cumberland Mutual | $1,990 | |

| Selective | $2,059 | ||

| NJM | $2,118 | ||

| State Farm | $2,150 | ||

Common natural disasters in New Jersey

New Jersey homeowners should make sure that they're protected from powerful storms, flooding and heavy snowfall.

If you live in a low-lying area or close to a large body of water, you may also need to buy a separate flood insurance policy.

Best homeowners insurance in NJ for most people: State Farm

-

Editor's rating

- Cost: $695/yr

State Farm has the best combination of good customer satisfaction and cheap rates in New Jersey.

Pros:

-

Cheap rates

-

Quality customer service reputation

-

Good home-auto bundling discount

-

Strong network of local agents

Cons:

-

Few coverage extras and discounts

An average State Farm homeowners policy costs 30% less than the New Jersey statewide average.

That amounts to an annual savings of $405 for $350,000 of dwelling coverage.

Although State Farm isn't the cheapest home insurance company in New Jersey, it offers better customer service than many competitors. State Farm gets fewer complaints than an average insurance company its size, according to the National Association of Insurance Commissioners (NAIC). It also scored above average for customer satisfaction on a recent J.D. Power survey that compared top home insurance companies.

Choosing a company that gets few complaints can help you avoid the headache of a slow claims process down the road.

Unlike many of its competitors, State Farm offers few discount opportunities. However, it's a good idea to take advantage of its auto-home bundle discount if you already have a State Farm auto policy.

Best New Jersey homeowners insurance for low rates: Cumberland Mutual

-

Editor's rating

- Cost: $695/yr

Cumberland Mutual has the cheapest home insurance quotes in NJ by far.

Pros:

-

Cheap home quotes

-

Network of local agents

Cons:

-

No online quotes available

-

More complaints than average

A Cumberland Mutual homeowners policy costs $695 per year for $350,000 of coverage to repair your home after a covered accident, called dwelling coverage. That's an annual savings of $643 compared to the NJ state average.

Cumberland Mutual doesn't offer online quotes. Instead, you have to work with a local agent to buy a policy. This makes comparison shopping less convenient, although some customers prefer the more personalized experience offered by an agent.

Keep in mind that Cumberland Mutual is a small, local company. That means you may not have access to the same range of services that you'd normally get from a larger business.

Cumberland Mutual gets about one-fifth more complaints than an average insurance company of the same size. This means Cumberland Mutual customers are somewhat dissatisfied with their service.

Cumberland Mutual only offers a few coverage add-ons. These include replacement cost , sump pump or sewer overflow coverage and higher limits on personal valuables, like jewelry, clothing and art.

Best homeowners insurance in NJ for coverage add-ons: Selective

-

Editor's rating

- Cost: $910/yr

Selective lets you customize your homeowners policy with a wide range of coverage add-ons.

Pros:

-

Cheap home quotes

-

Many extra coverage options

-

Expansive network of local agents

Cons:

-

Few discounts

-

No online quotes

-

Below average customer satisfaction

Selective stands out for its highly customizable homeowners policy. You can choose from an array of coverage extras that include standard options like ID protection and more uncommon choices like special coverage for expensive spirits and wine.

Selective coverage add-ons

- Wine and spirits

- Service line

- Identity protection

- Home cyber protection

- Home systems protection

- Hydrostatic pressure

- Inland flood

- Flood insurance

Selective also stands out for its cheap rates. A Selective homeowners policy costs $427 less per year compared to the New Jersey state average for $350,000 of dwelling coverage .

The main drawback to using Selective is its poor customer service. Selective gets 32% more complaints than an average insurance company of the same size according to the NAIC.

Selective also doesn't offer online quotes. This makes it a poor choice for people who value convenience over the personalized service offered by a local agent.

Average cost of home insurance in New Jersey

New Jersey has the eighth-cheapest home insurance rates in the U.S.

New Jersey home insurance costs an average of $1,337 per year for $350,000 of dwelling coverage. That's a savings of 38% over the national average of $2,151 per year.

Average cost of home insurance in NJ

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,043 |

| $350,000 | $1,338 |

| $500,000 | $1,790 |

| $1,000,000 | $3,291 |

Cost of New Jersey home insurance by city

Atlantic City has the most expensive home insurance rates in New Jersey with average rates of $2,246 per year.

The cheapest rates can be found in Hibernia, a small inland community of a few hundred people. Home insurance there costs just $1,016 per year on average. That's less than half of what you'd pay in Atlantic City.

City | Annual rate | % from avg |

|---|---|---|

| Absecon | $1,825 | 36% |

| Adelphia | $1,557 | 16% |

| Allendale | $1,104 | -17% |

| Allenhurst | $1,913 | 43% |

| Allentown | $1,268 | -5% |

Rates are for a policy with $350,000 of dwelling coverage.

Areas prone to storms and other natural disasters often have high home insurance costs. Factors like property crime rates and building and labor costs will also influence how much you pay for home insurance.

The best home insurance companies in New Jersey

NJM, USAA and State Farm offer the best customer service among home insurance companies in New Jersey.

These companies get fewer complaints compared to their competitors when adjusted for size. In addition, all three score highly for customer satisfaction according to a recent J.D. Power home insurance survey.

USAA also has a strong customer satisfaction reputation, but you can only buy a USAA policy if you or a family member are a current or former member of the military.

Company |

Rating

|

Complaints

|

|---|---|---|

| NJM | Low | |

| State Farm | Average | |

| USAA | Average | |

| Franklin Mutual | Low | |

| Chubb | Low |

You should consider more than just your monthly rate when shopping for home insurance. It's important to choose a company that also has a good reputation for customer service.

Companies that get few complaints typically have smoother claims processes. Choosing a company with a smooth claims process can help you avoid a headache down the road when you're trying to repair your home after a storm or other accident.

Natural disasters in New Jersey

New Jersey residents may be at risk for floods, nor'easters and blizzards.

Coastal homeowners should make sure they're protected against nor'easters and other powerful storms. Most home insurance policies will pay for damage caused by storms and heavy winds. However, it's a good idea to check your homeowners insurance policy to make sure you're covered.

Standard home insurance policies don't protect against flood damage.

Your mortgage company will probably require that you buy flood coverage if you live in a high-risk area .

Even if you don't live in a high-risk flood zone, it's still a good idea to consider flood insurance. About a quarter of all flood insurance claims come from low to moderate-risk areas and flooding can be costly.

A single inch of flood water can cause tens of thousands of dollars in damage according to FEMA.

Blizzards commonly occur throughout New Jersey during the winter. While you won't typically need to buy extra coverage to protect yourself against snow damage, it's a good idea to take precautionary measures like wrapping your pipes and keeping your windows closed when it's snowing.

That's because insurance companies commonly deny claims caused by damage you could have prevented.

Tips to save money on your New Jersey home insurance

Shop around to get the lowest rate on your New Jersey home insurance policy.

Comparing home insurance quotes can save you hundreds or even thousands of dollars a year in New Jersey. For example, switching to the cheapest home insurance company in New Jersey, Cumberland Mutual, from the most expensive, American Family, would save you $2,206 per year.

It's also a good idea to factor in home insurance discounts when comparing rates. Many companies offer multiple discounts for everything from bundling your home and auto policies to going a certain length of time without filing a claim. These discounts can save you hundreds of dollars or more each year.

You can lower your monthly rate by raising the amount of money you need to pay on qualifying repairs before your insurance starts working, called a deductible.

However, you should never raise your deductible beyond what you can easily afford to pay from your savings account. Otherwise, you might be stuck with more repairs than you can afford.

Change in New Jersey home insurance costs over time

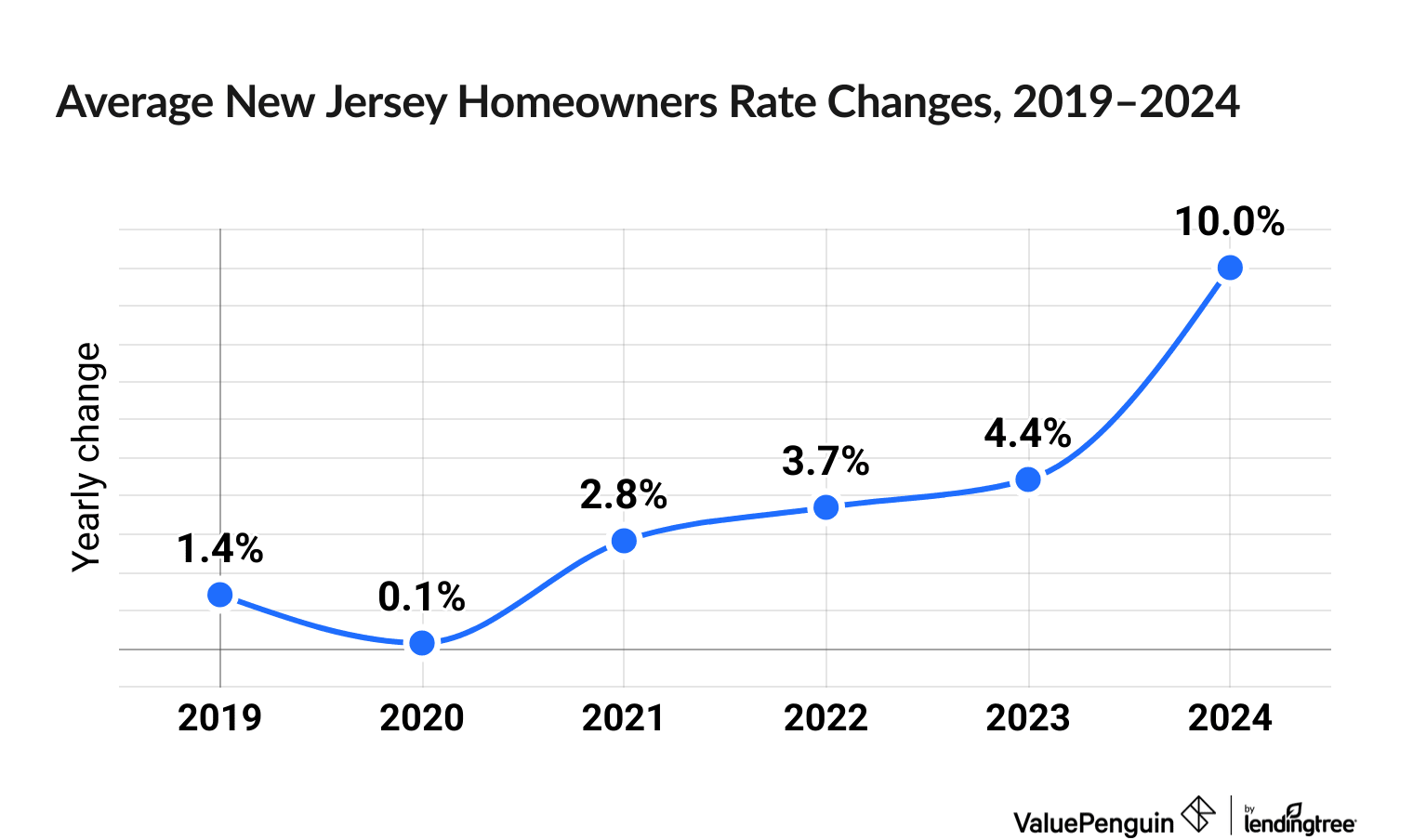

Home insurance prices are up 24.4% in New Jersey over the last six years.

New Jersey homeowners have seen an increase in their home insurance prices in recent years, experiencing an increase of 4.4% in 2023 followed by a 10.0% increase in 2024.

American Family Insurance saw the biggest increase among companies over the last six years, at 44.7%. The smallest increase belonged to State Farm at 12.9%.

Home insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

What's the best homeowners insurance company in New Jersey?

State Farm offers the best combination of low rates and good customer service in New Jersey. It has the third-cheapest home insurance rates in New Jersey, few complaints and a high customer satisfaction score according to a recent survey by J.D. Power.

What is the average cost of homeowners insurance in NJ?

A homeowners insurance policy costs $1,338 per year on average in New Jersey. That's 38% cheaper than the national average of $2,151 per year.

Is homeowners insurance required in New Jersey?

New Jersey does not require homeowners to buy insurance. However, mortgage companies commonly require borrowers to buy home insurance. Even if you own your house free and clear, it's still a good idea to carry home insurance to protect yourself against accidents and natural disasters.

Methodology

Quotes were taken across hundreds of ZIP codes from the largest home insurance companies in New Jersey. Rates are for a 45-year-old married man with no history of insurance claims.

Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. Quadrant's rates were taken from public filings and should only be used for comparative purposes.

Home insurance ratings were created using complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey and ValuePenguin's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.