Best Cheap Health Insurance in Vermont (2025)

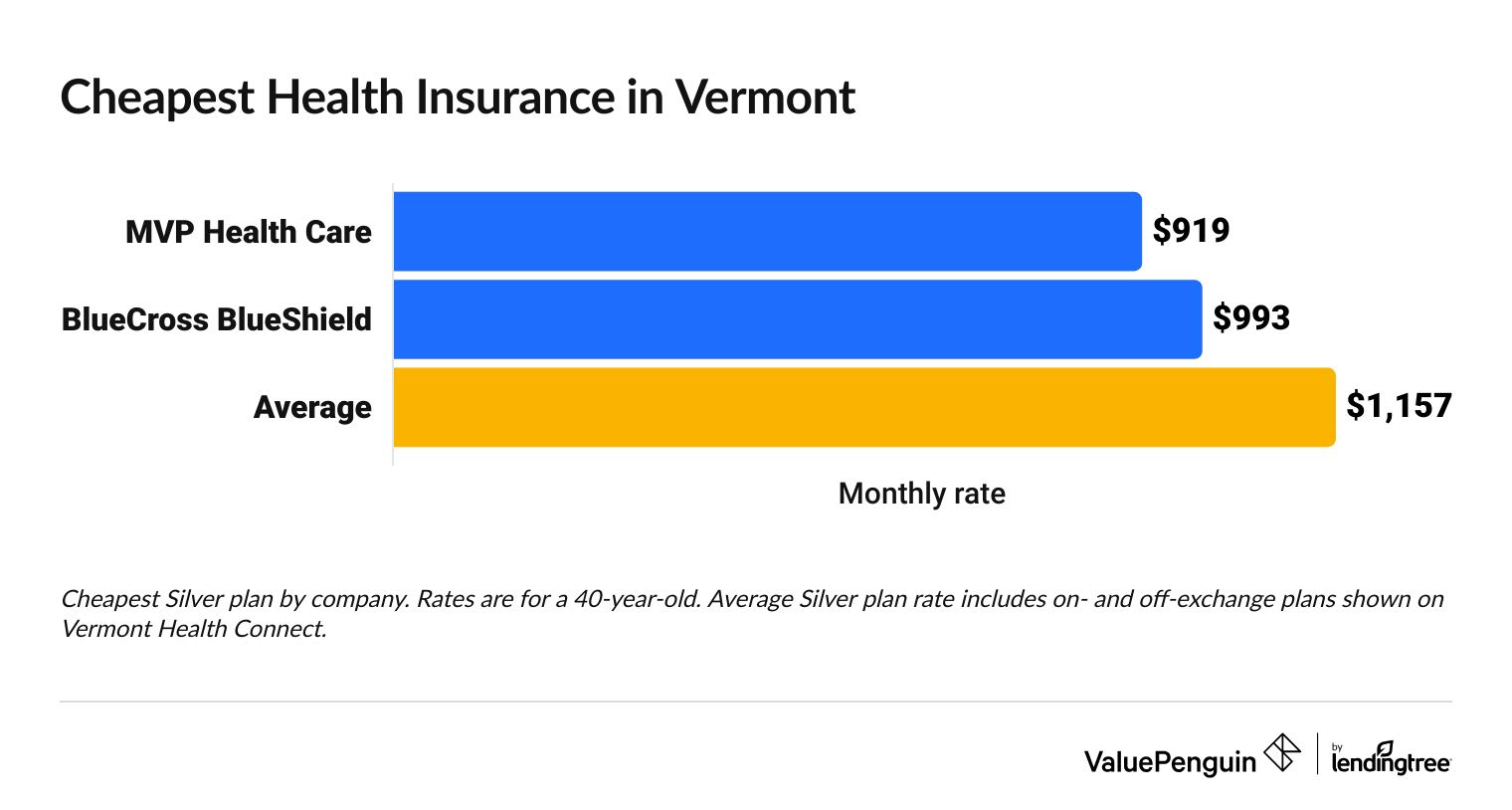

BlueCross BlueShield is the best health insurance company in Vermont. Its cheapest Silver plans start at $993 per month before discounts.

Find Cheap Health Insurance Quotes in Vermont

Best and cheapest health insurance in Vermont

Cheapest health insurance companies in Vermont

MVP Health Care sells the cheapest health insurance in Vermont, with Silver plans starting at $919 per month before discounts.

Find Cheap Health Insurance Quotes in Vermont

Most affordable health insurance in Vermont

Company |

Cost

| |

|---|---|---|

| MVP Health Care | $919 - $1,303 | |

| BlueCross BlueShield | $993 - $1,458 | |

- MVP Health Care sells the cheapest Silver plans no matter where you live in Vermont. But it's still a good idea to review all your options. Sometimes, it's even cheaper to buy a plan directly from a company instead of applying on Vermont Health Connect, the state's marketplace.

- Most people don't pay full price for health insurance in Vermont. Vermont has the highest health insurance rates in the country, and the state is working to make coverage more affordable. If you can get discounts based on your income, you could pay an average of $178 monthly. Vermont plans to add more financial help to its 2025 plans.

- Both MVP Health Care and BlueCross BlueShield are available throughout Vermont. It's a good idea to get quotes and compare rates from both companies, no matter where you live or what plan level you're looking for. That way, you can make sure you're getting the best deal on the coverage you need.

When to buy health insurance directly from a health insurance company

In Vermont, it can be cheaper to buy coverage directly from a health insurance company.

If you can't get discounts on your monthly rate, then buying a Silver plan directly from a health insurance company is often cheaper than buying it on Vermont Health Connect. You can still see these "off-exchange" plans on Vermont Health Connect, labeled with a red oval and the words "off-marketplace." But when you click on a plan, you'll be taken directly to the company to apply for and buy coverage, rather than doing it on Vermont Health Connect.

If you can get rate discounts, it's better to buy a plan on Vermont Health Connect. If you shop directly from a company, you won't be able to apply discounts to your plan.

Vermont Health Connect shows you options for both on-exchange and off-exchange plans. So you can still shop on the marketplace and see all your options. Off-exchange plans are marked with a red oval that says "off marketplace." If you decide an off-exchange plan is a better option, you'll be taken to the company's website to apply.

Best health insurance companies in Vermont

BlueCross BlueShield is the best health insurance company in Vermont.

BlueCross Blue Shield (BCBS) has one of the biggest doctor networks in the country, which makes it easy to get medical care. More than 90% of all doctors and hospitals in the country take BCBS insurance. That's even more important for people in Vermont, where health care wait times can be long. If you have a plan with a large doctor network, like BlueCross BlueShield, you may be able to go to an out-of-state doctor to get care faster.

BlueCross BlueShield is also the most popular health insurance company in Vermont. More than 6 out of every 10 health insurance plans in the state come from BCBS.

Best-rated health insurance companies in Vermont

Company |

Editor rating

|

ACA rating

|

|---|---|---|

| BlueCross BlueShield | 4.0 | |

| MVP Health Care | 4.0 |

Find Cheap Health Insurance Quotes in Vermont

MVP Health Care is also an excellent choice for health insurance in Vermont. MVP has the cheapest rates in the state and it also had an excellent score from HealthCare.gov. Only two companies sell health insurance plans in VT, and they both have good service and coverage. It's a good idea to compare both options to find the right company and plan for your needs.

How much does health insurance cost in Vermont?

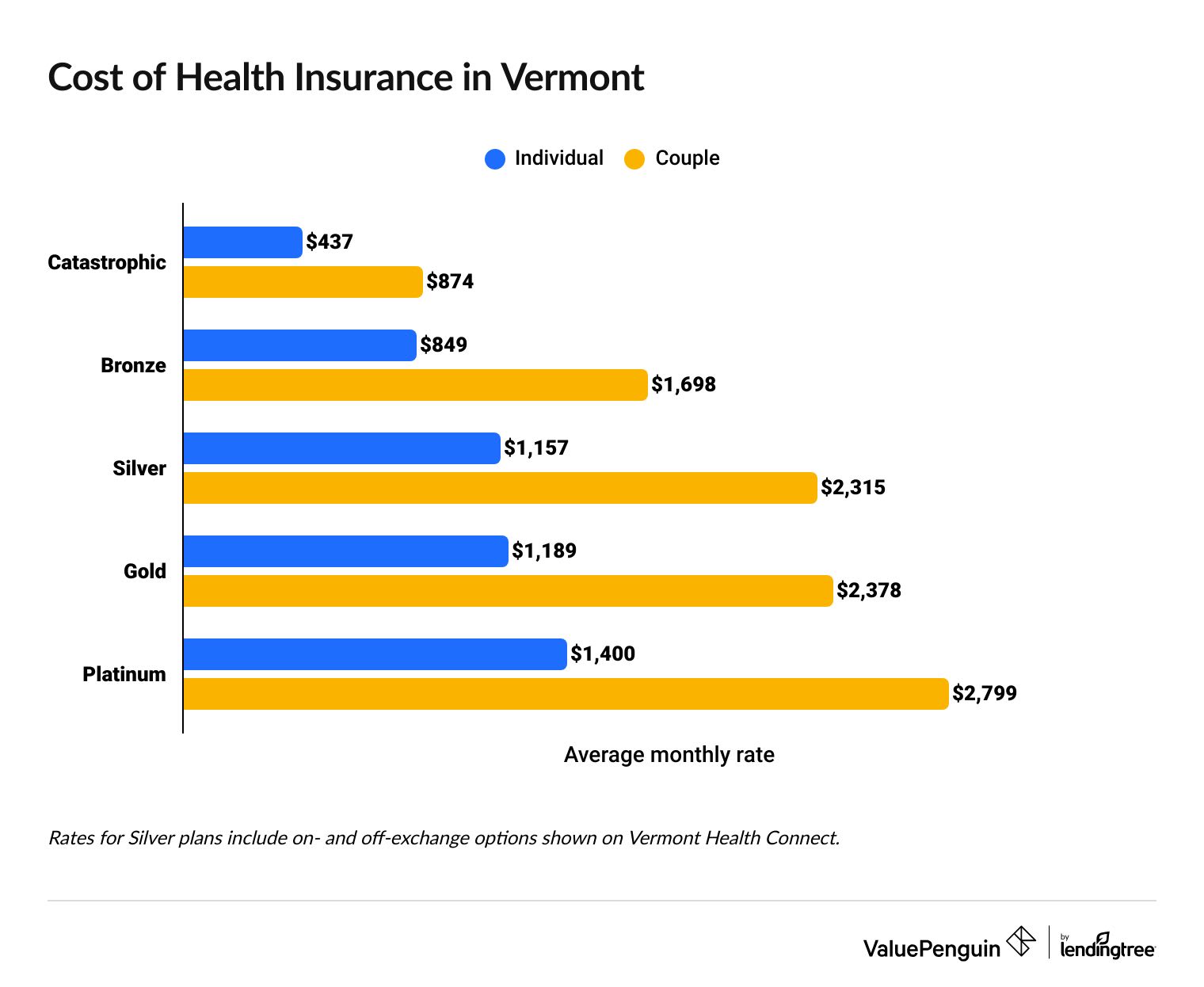

Health insurance in Vermont costs an average of $1,157 per month, but you could pay an average of $178 per month if you get discounts based on your income.

- Vermont has the most expensive health insurance rates in the country. A Silver plan costs $1,157 per month, on average. That's 86% higher than the national average of $621 per month.

- But most people in Vermont can get cheaper health insurance with discounts. If you qualify, you could pay an average of $178 per month for health insurance. That's much lower than the cost of health insurance without discounts.

- Your health insurance rate in VT will only vary based on the plan level you pick, where you live in Vermont, how many people your plan covers and the health insurance company you choose. Unlike other states, Vermont doesn't use your age or tobacco use to rate your plan.

Get affordable health insurance in Vermont with subsidies

Vermont health insurance costs $178 per month, on average, with discounts based on your income.

These discounts are called subsidies or tax credits, and they make your monthly rate cheaper Nearly 9 in 10 people who shop on Vermont Health Connect, the state's marketplace, can get subsidies.

How to get subsidies in Vermont

Usually, you can get subsidies if you make between $15,606 and $60,240 per year as a single person or between $31,200 and $124,800 per year as part of a family of four.

Because health insurance in Vermont is so expensive, more people can get discounts.

That's because the price of health insurance is capped at 8.5% of your income. So if a typical health insurance plan is set to cost more than 8.5% of what you make in a year, you can still get a discount on the monthly rate.

It's always a good idea to put your income into Vermont Health Connect when you're shopping for plans, to see if you can get discounts. You can only get discounts if you buy your plan on Vermont Health Connect. If you buy directly from an insurance company, the savings won't apply. And you can't use subsidies on Catastrophic plans.

Vermont health insurance rates with subsidies ($50,000 income)

Plan tier | Rate before subsidies | Rate after subsidies |

|---|---|---|

| Bronze | $849 | $1 |

| Silver | $1,345 | $352 |

| Gold | $1,189 | $198 |

| Platinum | $1,400 | $406 |

Average rates for health insurance before and after subsidies for someone who makes $50,000 per year.

If you can get subsidies, a Gold plan can be cheaper than a Silver plan and gives you more coverage.

Cheap Vermont health insurance plans by city

MVP Health Care sells the cheapest health insurance in Burlington.

In fact, no matter where you live in Vermont, MVP Health Care sells the cheapest Silver health insurance plan.

But a cheap health insurance plan isn't always the best option. MVP Health Care is a good company, but a more expensive plan or a plan from BlueCross BlueShield might be a better fit. Think about your medical needs as well as your monthly budget, and choose a plan that fits both.

Cheapest health insurance by VT county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Addison | MVP Plus Reflective Silver 1 | $919 |

| Bennington | MVP Plus Reflective Silver 1 | $919 |

| Caledonia | MVP Plus Reflective Silver 1 | $919 |

| Chittenden | MVP Plus Reflective Silver 1 | $919 |

| Essex | MVP Plus Reflective Silver 1 | $919 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Vermont

Best health insurance by level of coverage

The best health insurance for you and your family will depend on your medical and financial situation.

It also depends on what plans you can get where you live. As you shop for a plan, think about what you can afford to pay each month and how much medical care you expect to need throughout the year.

Platinum plans: Best for expensive medical needs

| Platinum plans pay for about 90% of your medical care. |

Platinum plans are the highest plan tier in Vermont, which means they cover the largest amount of your medical bills. Because they cover so much, they cost more each month.

If you have a chronic or complex medical condition that requires a lot of care or expensive treatments, a Platinum plan might be the best option. It can be worth it to spend more each month when your medical bills are high, and you could save money overall.

Platinum plans cost an average of $1,400 per month in Vermont. You could pay an average of $406 per month if you make around $50,000 per year and get rate discounts.

Gold plans: Best if you get rate discounts

| Gold plans pay for about 80% of your medical care. |

Gold plans have the cheapest monthly rates in Vermont if you can get discounts based on your income. They also cover a large portion of your medical bills, so they're a good option if you need frequent medical care or just want good coverage.

Gold plans cost an average of $1,189 per month in Vermont if you pay full price. But you'll pay an average of $198 per month for a Gold plan with rate discounts if you make around $50,000 per year.

Silver plans: Best if you buy directly from a company

| Silver plans pay for about 70% of your medical care. |

If you have a moderate or high income, a Silver plan can be a good option. That's because you won't qualify for rate subsidies if you have a higher income. Getting a Silver plan can help you save money. It's cheaper to buy a full-price Silver plan directly from a health insurance company rather than on Vermont Health Connect, the state's marketplace website.

You can still see these "off-marketplace" plans on Vermont Health Connect. They're clearly marked with a red "off-marketplace" label. If you choose one of these plans, you'll be directed to the company's website to buy the coverage.

Rates if you get subsidies

If you can get rate discounts, you'll pay an average of $352 per month for a Silver plan if you make about $50,000 per year. That's $154 per month higher each month than you'd pay for a Gold plan with subsidies, which is why Gold plans are better if you can get rate discounts.

Rates if you don't get subsidies

On Vermont Health Connect, Silver plans cost $1,345 per month, on average. You can get a Silver plan directly from a health insurance company for an average of $970 per month. If you can't get rate discounts, buying a Silver plan directly from a company is the best and cheapest option.

The overall average rate of a Silver plan is $1,157 per month.

Bronze plans: Best if you're young, healthy and have emergency savings

| Bronze plans pay for about 60% of your medical care. |

Bronze plans only pay for about 60% of your medical bills, so they're only a good option if you don't go to the doctor often. If you're young and healthy, a Bronze plan can be a good way to have coverage for emergencies but still save money each month. Just be sure you have savings in the bank to pay your share of the bills if you're seriously ill or injured.

Bronze plans cost $849 per month, on average, in Vermont. But if you get rate discounts, you could pay around $1 per month if you make about $50,000 per year. That's because the subsidy for that level of income pays for almost the entire cost of a Bronze plan.

Catastrophic plans: Best if it's your only option

You should only buy a Catastrophic plan if you can't afford anything else. If you have a low income, Medicaid is a better option. And if you get rate discounts, you can get a higher-tier plan at a lower rate and have better coverage.

You have to pay up to $9,200 of your medical bills each year before a Catastrophic plan starts paying. That can put a serious strain on your finances if you don't have savings. But preventive care, like vaccines, is still covered before you reach the deductible.

You can only get a Catastrophic plan if you're under 30 or qualify for an exemption. You might qualify if you've recently experienced a natural disaster, homelessness or domestic violence.

Catastrophic plans cost $437 per month, on average, in Vermont. You can't use rate discounts to get a cheaper price on Catastrophic plans.

Cheap or free health insurance in Vermont if you have a low income

Health insurance in Vermont can be expensive. If you have a low income, you might be able to get low-cost or free health insurance through Medicaid. And if you can't get Medicaid, a Silver plan can help you lower your medical bills.

Medicaid in Vermont

Medicaid is a government-funded free health insurance program for people with low incomes. If you make less than about $1,750 per month as a single person or $3,667 per month as a family of four, you could qualify for Medicaid in Vermont. If you are pregnant, you can make more and still qualify.

If you are under age 19, you may qualify for "Dr. Dynasaur coverage," which is Vermont's program for children and teens. Pregnant women can also qualify. Having Medicaid or Dr. Dynasaur coverage can drastically reduce or even eliminate your medical bills.

Use cost-sharing reductions for cheaper medical care

If you have trouble paying for medical care, think about buying a Silver plan. Even with rate discounts, they're more expensive than Gold plans, but the higher monthly cost might be worth it. You can compare the monthly cost for the plans versus how much medical care you need to see which option is cheaper overall.

Silver plans have extra discounts that make your doctor visits and prescription medications cheaper. They're called cost-sharing reductions, and you can only get them if you buy a Silver plan.

To qualify, you have to make between $15,060 and $37,650 per year if you're single or between $31,200 and $78,000 per year if you're a family of four. About half of everyone who shops on Vermont Health Connect can get cost-sharing reductions. But if you can get Medicaid, you can't get cost-sharing reductions.

Are health insurance rates going up in VT?

Across all plan tiers, Vermont health insurance is 16% more expensive in 2025 compared to 2024.

The price of Silver plans, the most popular plan tier in the state, went up 27% between 2024 and 2025. Platinum plans went up the least, by 10% more in 2025 compared to 2024. Gold and Bronze plans went up by 13% and 14%, respectively.

Tier | 2024 | 2025 | Change |

|---|---|---|---|

| Bronze | $742 | $849 | 14% |

| Silver | $908 | $1,157 | 27% |

| Gold | $1,056 | $1,189 | 13% |

| Platinum | $1,271 | $1,400 | 10% |

Monthly costs are for a 40-year-old.

Short-term health insurance in Vermont

You can't buy short-term health insurance in Vermont.

It's technically legal for companies to sell short-term health insurance in Vermont. But the state has strict rules around coverage, and no insurance companies are currently offering short-term plans.

If you need health insurance for a short amount of time, you can still buy a plan on Vermont Health Connect. You can cancel it at any time without a fee. If you need coverage when you're between jobs, you could get COBRA insurance, which lets you keep the plan you had with a former job when you quit, retire or get fired.

Frequently asked questions

Is health insurance free in Vermont?

If you can get Medicaid, you might be able to get free health insurance in Vermont. Medicaid is a type of health insurance that comes from the government, but you have to have a low income to qualify. If you can't get Medicaid, you might still be able to get cheap health insurance using rate discounts called subsidies.

What is Obamacare called in Vermont?

Vermont's state health insurance marketplace is called Vermont Health Connect. If you don't qualify for health insurance through your job, you can get a policy on Vermont Health Connect between November 1 and January 15 each year, unless you have a life change that qualifies you to get coverage outside this time period.

What is the average cost of health insurance in Vermont?

Health insurance costs $1,157 per month, on average, in Vermont. But the amount you pay depends on what tier of insurance you buy and whether you can get discounts based on your income. If you can get discounts, you could pay an average of $178 per month.

Methodology

To find the cost of health insurance in Vermont for 2025, ValuePenguin gathered rates from Vermont's health insurance exchange, Vermont Health Connect. Our experts organized the plans by plan tier to find the cheapest plans and average costs. Age and tobacco use are not used to set premiums for health insurance in Vermont.

Rates are for a Silver plan, unless another plan tier is specifically mentioned. Unless otherwise specified, average rates for Silver include all full-price plans on Vermont Health Connect, including those labeled as off-exchange plans.

The average rate for a plan with subsidies is from the Centers for Medicare & Medicaid Services (CMS) and includes data for everyone who shopped for a plan during the 2024 open enrollment period and got advance premium tax credits (APTCs). Subsidized rates by plan tier come from Vermont Health Connect and are for someone who makes $50,000 per year.

KFF provided info about the most popular plan tier in Vermont, as well as info about the long wait times for medical care. Other sources include the National Association of Insurance Commissioners (NAIC) and S&P Global Capital IQ.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.