Best Cheap Health Insurance in Oregon (2025)

Kaiser Permanente has the best cheap health insurance in Oregon. Plans start at $467 per month before discounts.

Find Cheap Health Insurance Quotes in Oregon

Best and cheapest health insurance in Oregon

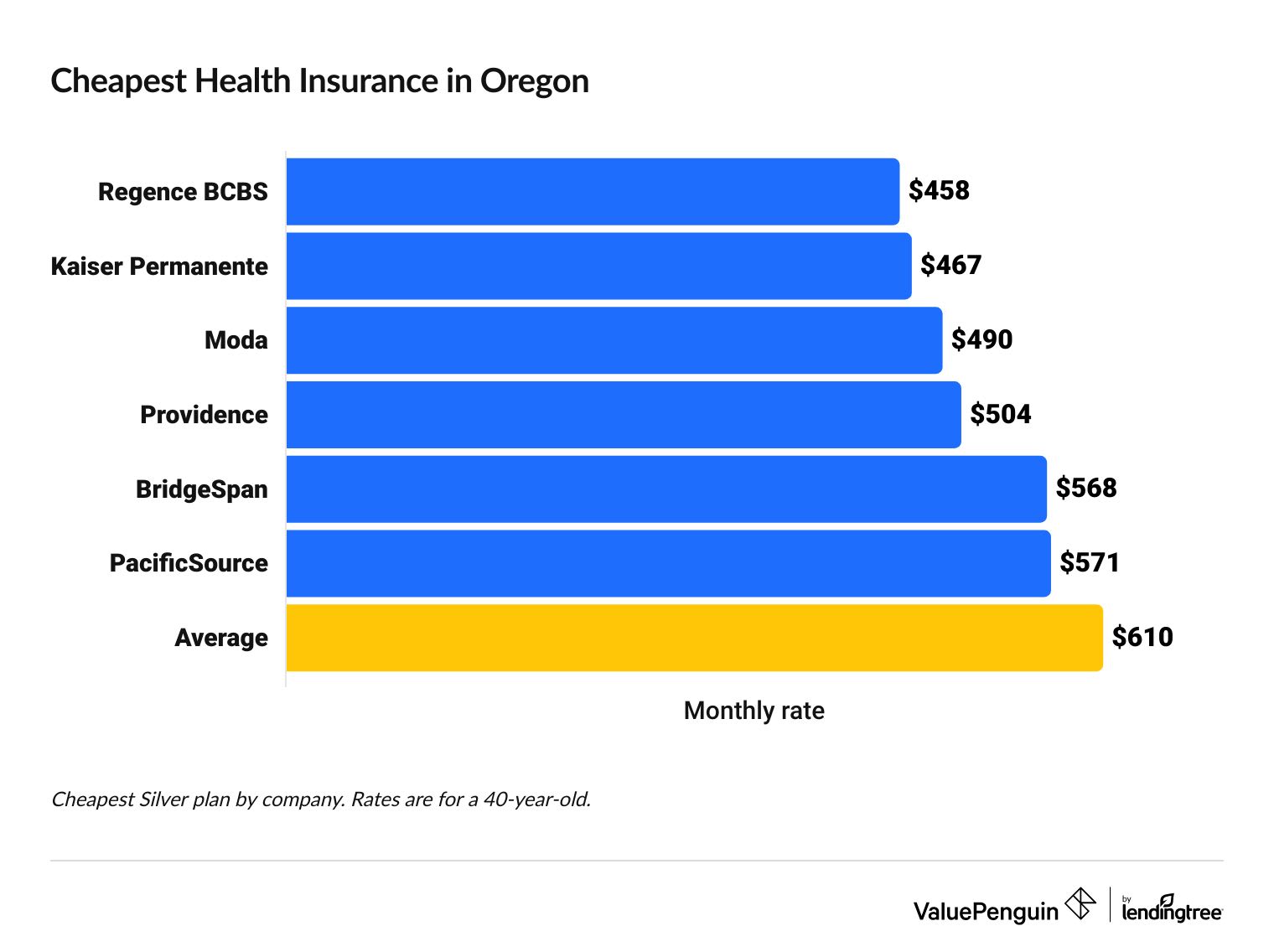

Cheapest health insurance companies in Oregon

Regence BlueCross BlueShield has the cheapest Silver health plans in Oregon, at $458 per month before discounts.

Find Cheap Health Insurance Quotes in Oregon

Affordable health insurance in Oregon

Company |

Cost

| |

|---|---|---|

| Regence BlueCross BlueShield of Oregon | $458 - $693 | |

| Kaiser Permanente | $467 - $545 | |

| Moda Health Plan, Inc. | $490 - $649 | |

| Providence Health Plan | $504 - $771 | |

- Kaiser Permanente is the most popular health insurance company in Oregon. Kaiser sells about four out of every 10 plans in the state.

- Regence BlueCross BlueShield has the cheapest rates in the Portland metro area.

- Moda has the cheapest plans in much of Oregon. The company offers the most affordable rates in 22 of Oregon's 36 counties. However, they only account for about one in five people in the state.

Best health insurance companies in Oregon

Kaiser Permanente is the best health insurance company in Oregon.

Kaiser Permanente is the only company with a perfect five-star rating from HealthCare.gov in Oregon. Star ratings measure customer satisfaction, plan quality and management.

Best-rated health insurance companies in Oregon

Company |

Editor rating

|

ACA rating

|

|---|---|---|

| Kaiser Permanente | 5.0 | |

| Regence BlueCross BlueShield of Oregon | 4.0 | |

| Moda Health Plan, Inc. | 4.0 | |

| BridgeSpan Health Company | NA | |

| PacificSource Health Plans | 4.0 |

Find Cheap Health Insurance Quotes in Oregon

The main drawback to Kaiser Permanente is that customers can only get medical services at Kaiser hospitals and clinics unless it's an emergency. That makes getting care tricky if you don't live near a Kaiser facility.

However, the interconnected hospital and insurance systems make getting care and filing claims easier.

Best health insurance in Oregon for flexible coverage

PacificSource Health Plans is the only company on the Oregon health insurance marketplace to sell PPO (preferred provider organization) plans. PPO plans let you see doctors outside of your network. You also don't need to choose a primary care doctor or get a referral to see a specialist with a PPO.

Other companies on the Oregon healthcare marketplace offer EPO (exclusive provider organization) plans. An EPO restricts you to a network of doctors unless you need emergency medical care. But EPOs don't require that you choose a primary care doctor or get a referral before seeing a specialist, although you may need permission from your insurance company, called prior authorization, first.

EPOs are slightly cheaper than PPOs, on average.

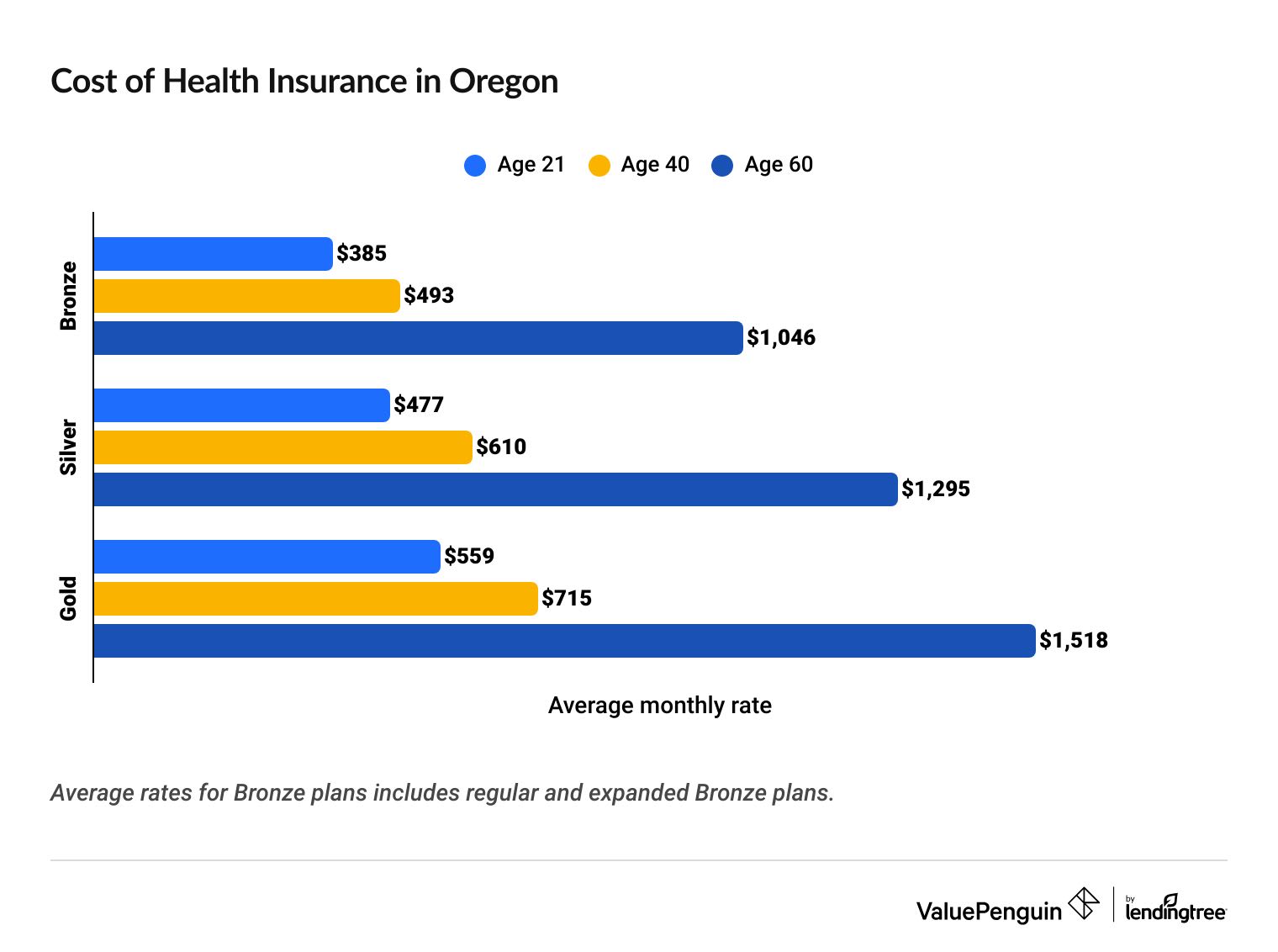

How much is health insurance in Oregon per month?

Health insurance in Oregon costs an average of $610 per month or $164 per month after discounts based on your income.

Plan tiers don't have to do with the type of care you get. In other words, a Bronze and a Gold plan may cover the same set of services and prescriptions.

Instead, plan tiers relate to how much you pay for medical care. Higher plan tiers have expensive monthly rates, but low costs when you visit the doctor. Lower plan tiers have cheap rates, but you pay more when you go to the hospital.

Your age has a big influence on how much you pay for health insurance. Rates rise slowly in your 20s and 30s before increasing dramatically in middle age. A 60-year-old pays more than twice as much as a 40-year-old for the same coverage in Oregon, on average.

Get affordable medical insurance in Oregon

Medical insurance in Oregon costs an average of $164 per month after discounts.

Four out of every five people who buy Obamacare plans in Oregon are eligible for discounts, called subsidies or premium tax credits. Your income helps set the size of your discount. If you earn less, you'll typically have a bigger discount. About 15% of Oregonians pay less than $10 per month for Affordable Care Act (ACA) coverage.

You can apply ACA subsidies to any Bronze, Silver or Gold plan sold on the Oregon health insurance exchange. But these discounts don't apply to short-term health plans, supplemental coverage or COBRA.

Cheap Oregon health insurance plans by city

Regence BlueCross BlueShield of Oregon has the cheapest quotes in Portland.

Regence also has the most affordable plans in major Portland suburbs like Gresham, Hillsboro and Beaverton.

Kaiser Permanente has the best rates in some of Oregon's other larger cities, such as Eugene, Salem and Corvallis.

Cheapest health insurance by OR county

County | Cheapest plan | Monthly rates |

|---|---|---|

Baker | Moda Health Affinity Silver | $607 |

Benton | Kaiser Permanente OR Silver | $507 |

Clackamas | Regence BCBS Silver Legacy | $458 |

| Clatsop | Moda Health Affinity Silver | $584 |

Columbia | Kaiser Permanente OR Silver | $467 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Oregon

Best health insurance by level of coverage

Find the best health insurance for you by considering your financial situation and your overall health.

Gold plans: Best for expensive medical needs

| Gold plans pay for about 80% of your medical care. |

Gold plans are a good choice if you need a lot of medical care. That's because these plans have low deductibles. Also, Gold plans have lower limits on how much you'll pay in total for care in a single year, called an out-of-pocket max.

However, Gold plans have expensive average rates. If you don't expect to use a lot of medical care in the coming year, you'll probably pay more than you need to with a Gold plan.

In Oregon, Gold plans cost $715 per month and have a deductible of $1,327, on average.

Silver plans: Best for normal medical needs

| Silver plans pay for about 70% of your medical care. |

Silver health plans balance middle-of-the-road rates and affordable costs that you're responsible for paying when you go to the hospital. Consider Silver health insurance if you have fairly average healthcare needs.

People who earn a low income may be eligible for extra discounts, called cost-sharing reductions, that can help you pay for out-of-pocket costs, such as your deductible, copays and coinsurance.

In Oregon, Silver plans cost $610 per month and have a deductible of $4,841, on average.

Bronze plans: Best if you're young and healthy

| Bronze plans pay for about 60% of your medical care. |

Bronze plans have cheap rates, but you'll pay a large amount of money before most coverage starts, called a deductible.

That means Bronze plans are a good choice for healthy people who can afford to pay a large, unexpected bill from their savings.

In Oregon, Bronze plans cost $493 per month and have a deductible of $8,255, on average.

Affordable and free health insurance in Oregon for people who earn a low-income

Oregon residents who earn a low income may be eligible for free or discounted health insurance.

Medicaid: Best free health insurance for those who earn a low-income

You may qualify for free health coverage from the government, called Medicaid, if you earn less than about $21,000 per year as a single person.

You may qualify for Medicaid with a higher income if you're pregnant, under 19 or you have a qualifying illness or disability.

Basic Health Program: Best free coverage for those who don't qualify for Medicaid

Oregon offers free health insurance, called the Basic Health Program, to help bridge the gap between Medicaid and discounted health insurance marketplace plans. You can enroll in the Basic Health Program if you make between about $21,000 and $30,000 per year as a single person.

The Basic Health Plan also covers legally present non-U.S. citizens who earn less than about $21,000 per year.

Silver plans with cost-sharing reductions: Best for discounted coverage

| Silver plans will pay 73% to 94% of your medical costs if you make a low income. |

You may be eligible for extra discounts, called cost-sharing reductions, if you make less than roughly $38,000 per year as a single person. These discounts help you pay for the costs you're responsible for when you visit the doctor, such as your deductible, copay and coinsurance.

Cost-sharing reductions are only available if you have a Silver health plan. A Silver plan with cost-sharing reductions and subsidies is usually a better option than a Bronze plan.

Are health insurance rates going up in Oregon?

The average cost of health insurance in Oregon increased by 9% between 2024 and 2025.

Bronze plans rose by 11%, on average, and Gold plans got 10% more expensive, on average. Silver plans had the smallest average increase, at 6%.

Are health insurance rates going up in OR?

Tier | 2024 | 2025 | Change |

|---|---|---|---|

| Bronze | $445 | $493 | 11% |

| Silver | $578 | $610 | 6% |

| Gold | $650 | $715 | 10% |

Monthly costs are for a 40-year-old.

Plans bought through the Oregon health insurance marketplace are required to cover certain services, called essential benefits. These include services like maternity care, coverage for newborns and mental health services.

Other protections offered by marketplace plans include limits on the amount you'll pay when you visit the doctor, called an out-of-pocket maximum. Plus, companies aren't allowed to deny coverage or charge higher rates based on your health history.

Cost of Oregon health insurance by family size

In Oregon, a couple with two children under age 15 pays an average of $1,826 per month for a Silver health insurance plan.

It costs $303 per month to add a child who is 14 or younger to your Silver health insurance plan. Until your child turns 15, they are charged a flat rate each month that doesn't change with age. Once they turn 15, their rates will increase with each year.

Family size | Average monthly cost |

|---|---|

| Individual | $610 |

| Individual + Child | $913 |

| Couple, age 40 | $1,219 |

| Family of three | $1,522 |

| Family of four | $1,826 |

Averages based on a Silver plan for 40-year-old adults and children who are under age 15.

Short-term health insurance in Oregon

You can get short-term coverage in Oregon for up to three months including renewals.

Short-term health insurance can help you bridge a temporary coverage gap. But, these plans usually offer worse coverage than regular health insurance. Plus, short-term health insurance offers fewer protections than marketplace plans.

Pros of short-term health insurance in OR

Cons of short-term health insurance in OR

Frequently asked questions

Who has the best health insurance in OR?

Kaiser Permanente has the best health insurance in Oregon because of its quality coverage, affordable rates and high levels of customer satisfaction. The company has a perfect 5 out of 5-star rating from Healthcare.gov.

What's the average cost of health insurance in Oregon?

Health insurance in Oregon costs $610 per month or $164 per month after discounts, on average. The amount you pay for health insurance depends on factors like your age, income and the plan tier and company you choose.

How much do you have to make to qualify for Oregon Health Plan?

You can qualify for Oregon Health Plan if you earn about $21,000 per year or less as a single person ($44,000 for a family of four). If you earn between $21,000 and $30,000 ($43,000 to $62,000 for a family of four), you may qualify for a different free health insurance program, called the Basic Health Program.

Methodology

Oregon health insurance rate data for 2024 is from the Centers for Medicare & Medicaid Services (CMS) website. ValuePenguin used the CMS public use files (PUFs) in calculations to average rates across a variety of factors such as plan tier, county and family size. Plans and insurance companies for which county-level data was included in the CMS Crosswalk file were used in our reporting. Those excluded from these files were not included in our analysis.

Rates are for a 40-year-old with a Silver plan, unless otherwise noted. Other sources include S&P Global Capital IQ, NAIC (National Association of Insurance Commissioners) and the Oregon Department of Health and Human Services.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.