Cheapest Auto Insurance Quotes in Rhode Island (2025)

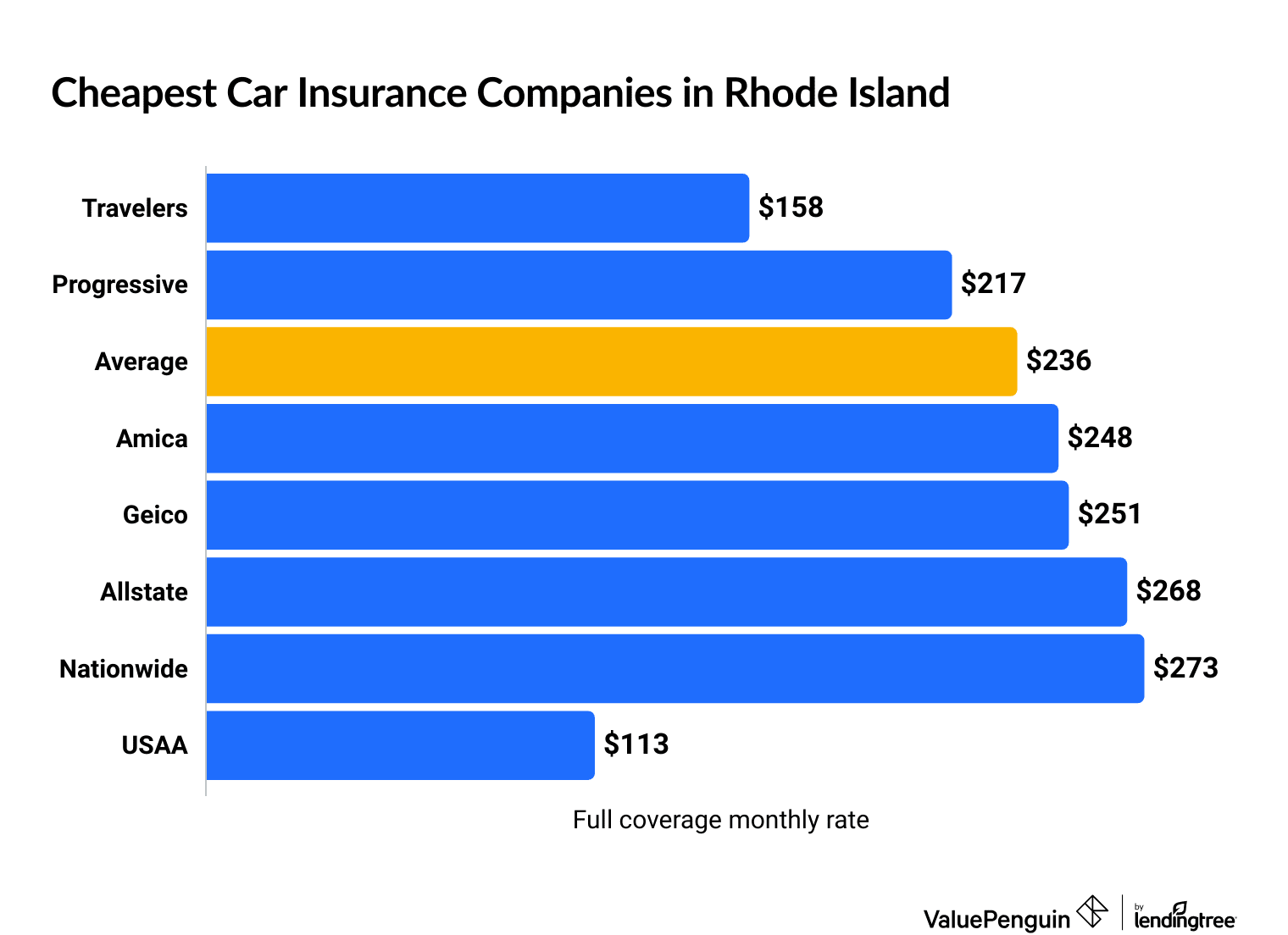

Travelers has the cheapest car insurance in Rhode Island, at $158 per month for full coverage.

Find Cheap Auto Insurance Quotes in Rhode Island

Best cheap car insurance in RI

How we chose the top companies

Best and cheapest car insurance in Rhode Island

- Cheapest full coverage: Travelers, $158/mo

- Cheapest minimum liability: Travelers, $61/mo

- Cheapest for young drivers: Allstate, $299/mo

- Cheapest after a ticket: Amica, $248/mo

- Cheapest after an accident: Progressive, $217/mo

- Cheapest for teens after a ticket: State Farm, $64/mo Allstate, $331/mo

- Cheapest after a DUI: Progressive, $247/mo

- Cheapest for poor credit: Geico, $359/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Travelers has the cheapest rates for most people in Rhode Island, but Amica is the best choice for people who value great customer service. While Amica is typically more expensive, it could be worth spending the extra money to know you'll be well taken care of after a crash.

Best cheap auto insurance in RI: Travelers

Travelers has the cheapest full coverage car insurance in Rhode Island.

A full coverage policy from Travelers costs $158 per month, which is $79 per month less than the Rhode Island average.

However, Travelers doesn't have great customer service reviews. Amica offers the best combination of reliable customer service and affordable rates, at $248 per month.

Find Cheap Auto Insurance Quotes in Rhode Island

USAA has the cheapest full coverage rates for Rhode Island drivers with military connections, at $113 per month. However, USAA is only available to military members, veterans and some of their family members.

Cheapest full coverage auto insurance quotes in RI

Company | Monthly rate | |

|---|---|---|

| Travelers | $156 | |

| Nationwide | $216 | |

| Geico | $218 | |

| Progressive | $222 | |

| Amica | $222 |

*USAA is only available to current and former military members and their families.

Cheapest liability car insurance quotes in RI: Travelers

Travelers is the cheapest option for minimum liability car insurance quotes in Rhode Island.

At just $61 per month, minimum liability coverage from Travelers costs $38 per month less than the Rhode Island average.

Rhode Island drivers should also compare quotes from Amica. It has cheaper-than-average rates and more reliable customer service than Travelers. That could be important if you're in an accident in the future.

Best cheap liability-only car insurance in Rhode Island

Company | Monthly rate |

|---|---|

| Travelers | $61 |

| Amica | $92 |

| Progressive | $99 |

| Geico | $103 |

| Nationwide | $126 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Rhode Island

Best auto insurance in RI for teens: Allstate

Allstate has the best rates for young drivers in Rhode Island.

A minimum liability policy from Allstate costs around $299 per month for an 18-year-old driver in Rhode Island. That's $124 per month cheaper than the state average.

Allstate also has the cheapest full coverage quotes for teens. At $675 per month, full coverage from Allstate costs $265 per month less than the Rhode Island average.

USAA offers even cheaper rates for Rhode Island teens, at $147 per month for a liability-only policy and $362 per month for full coverage. However, only military members, veterans and their families can buy car insurance from USAA.

Affordable insurance in RI for young drivers

Company | Liability only | Full coverage |

|---|---|---|

| Allstate | $299 | $675 |

| Geico | $342 | $755 |

| Progressive | $471 | $1,146 |

| Amica | $480 | $1,113 |

| Nationwide | $495 | $1,016 |

*USAA is only available to current and former military members and their families.

Rhode Island teens pay around four times more for car insurance than 30-year-old drivers. That's because teen drivers have less experience behind the wheel, which means they're more likely to have an accident.

The best way for young drivers to lower their car insurance payments is by sharing a car insurance policy with a parent or older relative. Shared policies are typically much cheaper than buying two separate policies.

In addition, many car insurance companies have discounts geared toward young drivers. For example, Allstate offers a smart student discount. You can earn this discount if you have a B- GPA or higher, complete a driver education program, or go to college away from home and don't bring your car with you.

Cheap auto insurance in Rhode Island after a speeding ticket: Amica

Amica has the best car insurance rates for Rhode Island drivers with a recent speeding ticket. At $248 per month, a full coverage policy from Amica is $63 per month cheaper than the state average.

Cheapest Rhode Island auto insurance after a speeding ticket

Company | Monthly rate |

|---|---|

| Amica | $248 |

| Progressive | $275 |

| Travelers | $294 |

| Allstate | $326 |

| Nationwide | $338 |

*USAA is only available to current and former military members and their families.

Rhode Island drivers with a speeding ticket spend an average of $310 per month on full coverage auto insurance. That's 31% more than drivers with a clean driving record.

Cheapest Rhode Island auto insurance after an accident: Progressive

Progressive has the most affordable car insurance for drivers with a recent accident in Rhode Island. Full coverage from Progressive costs $217 per month after an accident, which is $88 per month less than the Rhode Island average.

Best cheap car insurance companies in RI after an accident

Company | Monthly rate |

|---|---|

| Progressive | $217 |

| Travelers | $221 |

| Allstate | $268 |

| Geico | $324 |

| Amica | $392 |

*USAA is only available to current and former military members and their families.

In Rhode Island, car insurance rates increase by an average of 29% after a single at-fault accident.

You don't need to worry about switching insurance companies right after your accident. Your rates won't go up until your current policy renews. However, any quotes you get now will likely be more expensive than your current rate, because they include your accident.

Instead, you should start shopping for quotes when you get your renewal offer in the mail, which is typically a few weeks to a month before your current policy expires.

Cheap insurance in RI for teens with a ticket or accident: Allstate

Allstate has the cheapest rates for Rhode Island teens with a bad driving record. Minimum coverage from Allstate costs $331 per month after a speeding ticket and $299 per month after an accident. Those are each more than $150 per month cheaper than the state average.

Cheapest RI car insurance for teens with a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Allstate | $331 | $299 |

| Geico | $478 | $399 |

| Amica | $480 | $606 |

| Progressive | $482 | $471 |

| Nationwide | $536 | $544 |

*USAA is only available to current and former military members and their families.

Teens with a bad driving record can save on car insurance by:

- Comparing rates from multiple companies. The difference between the most and least expensive insurance for a young driver is around $430 per month after a ticket or accident.

- Sharing a policy with your parents. Their auto insurance rates will increase, but it should still be much cheaper than getting two separate policies.

- Looking for discounts. Most insurance companies have discounts for young drivers, including ones for getting good grades.

Affordable car insurance in Rhode Island after a DUI: Progressive

Progressive has the cheapest quotes for Rhode Island drivers with a DUI, at an average cost of $247 per month for full coverage. That's less than half the Rhode Island average after a DUI.

Company | Monthly rate |

|---|---|

| Progressive | $247 |

| Travelers | $312 |

| Allstate | $392 |

| Nationwide | $574 |

| Farmers | $615 |

*USAA is only available to current and former military members and their families.

Car insurance rates in Rhode Island more than double after a DUI. In addition, you may have to get SR-22 insurance after a DUI. Most insurance companies charge between $15 and $50 to file an SR-22 form for you. That fee is on top of any increase to your car insurance rates.

Cheapest car insurance for RI drivers with poor credit: Geico

Geico has the most affordable car insurance in Rhode Island for drivers with bad credit. A full coverage policy from Geico costs $359 per month, which is $71 per month less than the Rhode Island average.

However, Amica is the often best choice for Rhode Islanders with poor credit. That's because Amica has some of the best customer service reviews in the state. It could be worth paying $6 per month more for the peace of mind that your insurance company will take great care of you after an accident.

Cheapest auto insurance quotes in RI for poor credit

Company | Monthly rate |

|---|---|

| Geico | $359 |

| Amica | $365 |

| Progressive | $366 |

| Travelers | $375 |

| Nationwide | $467 |

*USAA is only available to current and former military members and their families.

Drivers with a bad credit score pay $194 per month more for full coverage insurance in Rhode Island than those with good credit. Having poor credit shows nothing about your driving, but insurance companies believe drivers with poor credit are more likely to file claims.

Best car insurance in RI

USAA has the best car insurance in Rhode Island because of its affordable quotes and dependable service.

However, USAA is only available to current and former military members and their families.

Amica is the best choice for Rhode Island drivers who don't qualify for USAA. Amica has excellent customer service, and it's typically one of the more affordable options.

Best Rhode Island car insurance

Company |

Editor's rating

|

JD Power

|

AM Best

|

|---|---|---|---|

| USAA | 739 | A++ | |

| Amica | 709 | A+ | |

| Nationwide | 641 | A | |

| Geico | 637 | A++ | |

| Farmers | 619 | A |

Average auto insurance quotes in Rhode Island by city

Newport East, a neighborhood in Middleton, is the cheapest city in Rhode Island for car insurance.

Drivers in Newport East pay an average of $181 per month for a full coverage policy.

Providence, the state capital, has the most expensive rates in Rhode Island. At $320 per month, full coverage car insurance in Providence is $84 per month more than the state average. That could be because Providence has higher rates of car theft than the other parts of Rhode Island.

Car insurance quotes by Rhode Island city

City | Monthly Rate | % from average |

|---|---|---|

| Adamsville | $231 | 2% |

| Albion | $232 | 2% |

| Ashaway | $199 | -12% |

| Barrington | $222 | -2% |

| Block Island | $199 | -12% |

Full coverage insurance rates in Rhode Island vary by up to $139 per month depending on where you live. You might pay more if your area has narrow or dangerous roads, while you might pay less if crime is low.

Rhode Island minimum car insurance coverage

Rhode Island drivers must have a minimum amount of auto insurance to legally drive in the state, which is often written as 25/50/25. Rhode Island isn’t a no-fault state, so drivers don't need to have personal injury protection (PIP).

Minimum coverage limits required in Rhode Island

- Bodily injury liability: $25,000 per person/$50,000 per accident

- Property damage liability: $25,000

- Uninsured and underinsured motorist coverage: $25,000 per person/$50,000 per accident for bodily injury, $25,000 for property damage

What's the best car insurance coverage for RI drivers?

Full coverage car insurance is the best choice for most people in Rhode Island.

One reason for this is that full coverage car insurance includes comprehensive and collision coverage, which pay for many types of damage to your car.

For that reason, most lenders require you to have full coverage if you have a car loan or lease. It's also a good idea if your car is over eight years old or worth more than $5,000.

In addition, full coverage car insurance can have higher liability limits than the state requirement. This is important because the minimum requirement may not be high enough to cover the cost of a major accident.

For example, if you hit and total a new or expensive car, $25,000 of property damage liability coverage probably won't cover the cost to replace it. That means you'll have to pay the difference out of pocket.

Frequently asked questions

How much is car insurance in RI?

The average cost of car insurance in Rhode Island is $236 per month for full coverage and $99 per month for minimum coverage.

Why is Rhode Island car insurance so expensive?

Rhode Island is the sixth-most expensive state in the country for both minimum- and full coverage car insurance. Rhode Island has a higher percentage of uninsured drivers compared to other states, which can make insurance more expensive. It also has a higher percentage of traffic deaths caused by DUIs than many other states.

How much is car insurance in Providence, RI

The average cost of car insurance in Providence is $320 per month. That's $84 per month more than the Rhode Island state average.

Who has the cheapest car insurance in Rhode Island?

Travelers is the cheapest auto insurance company in Rhode Island for a full coverage car insurance quote, with an average rate of $158 per month. For comparison, Rhode Island's average full coverage car insurance rate is $236 per month.

Methodology

ValuePenguin collected thousands of quotes from ZIP codes across Rhode Island for the largest insurance companies in the state. Quotes are for a 30-year-old man with good credit who owns a 2015 Honda Civic EX.

Rates are for a full coverage policy and include liability limits above the minimum, as well as collision and comprehensive coverage.

- Bodily injury liability: $50,000 per person/$100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured/underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Uninsured/underinsured motorist property damage: $25,000

- Comprehensive and collision: $500 deductible

To determine the best-rated insurance companies in Rhode Island, our experts evaluated companies based on their overall levels of customer service, price and coverage options. They also reviewed complaint index numbers from the National Association of Insurance Commissioners (NAIC), J.D. Power's customer satisfaction survey and AM Best's financial strength ratings.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.