Who Has the Cheapest Auto Insurance in Lubbock, Texas?

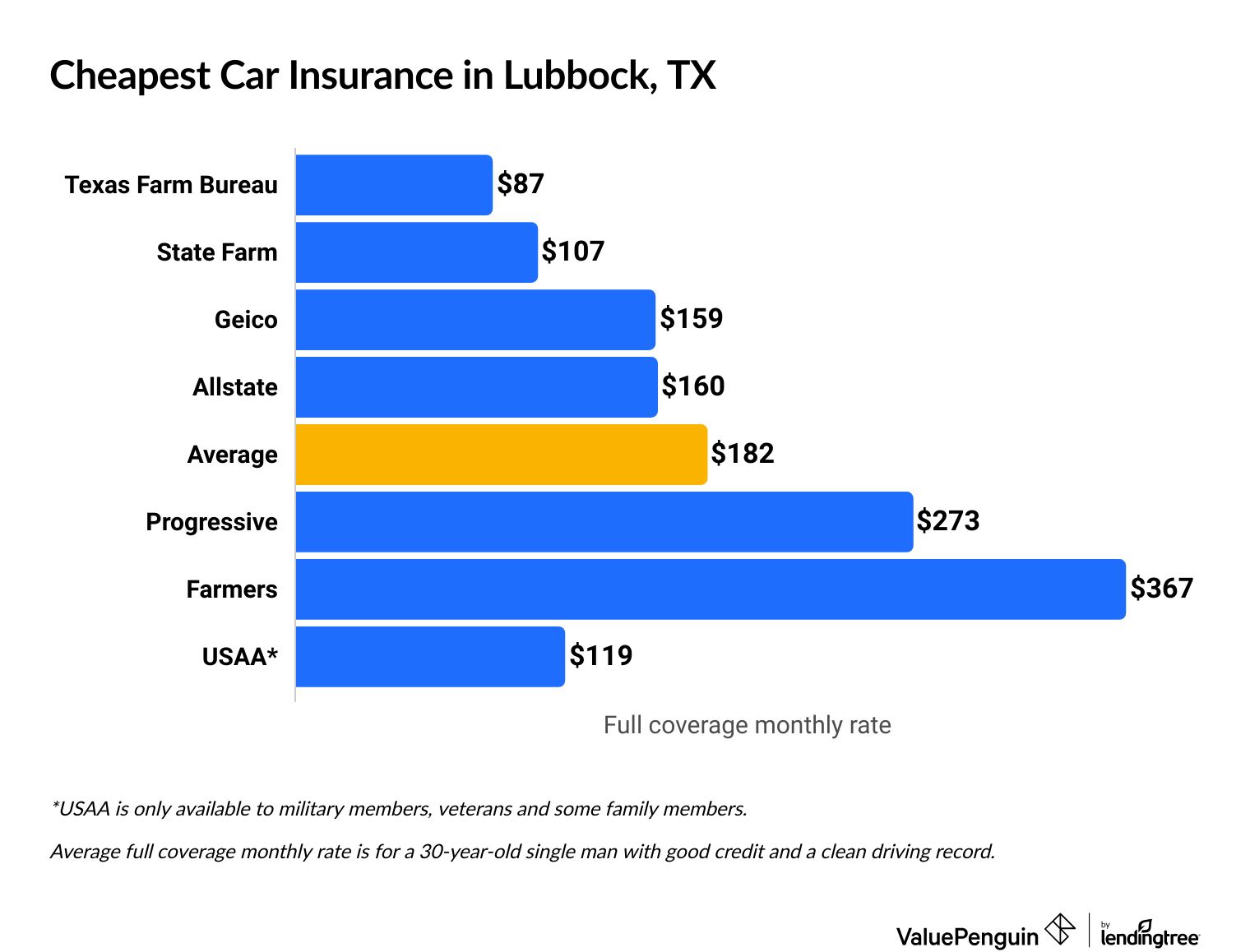

Texas Farm Bureau has the cheapest full coverage auto insurance in Lubbock, TX, at $87 per month, on average.

Compare Car Insurance Rates in Lubbock, TX

Best cheap car insurance in Lubbock, TX

How we chose the top companies

Cheapest auto insurance in Lubbock: Texas Farm Bureau

Texas Farm Bureau has the cheapest full coverage car insurance in Lubbock, Texas, at $87 per month, on average.

That's less than half the average cost of full coverage auto insurance in Lubbock, TX.

State Farm is also a good option for cheap coverage. The company charges $107 per month, on average.

Find Cheap Auto Insurance Quotes in Lubbock

USAA has cheap rates and a reputation for quality service. But, the company only sells coverage to current and former members of the military and their families.

Cheapest full coverage car insurance in Lubbock

Company | Monthly rate | ||

|---|---|---|---|

| Texas Farm Bureau | $87 | ||

| State Farm | $107 | ||

| Geico | $159 | ||

| Allstate | $160 | ||

| Progressive | $273 | ||

*USAA is only available to current and former military members and their families.

Cheapest minimum coverage in Lubbock: Texas Farm Bureau

Texas Farm Bureau has the cheapest minimum liability car insurance in Lubbock, at $35 per month, on average.

That's 45% cheaper than the Lubbock citywide average of $63 per month.

State Farm also has cheap rates, at $43 per month, on average.

Best cheap liability auto insurance

Company | Monthly rate |

|---|---|

| Texas Farm Bureau | $35 |

| State Farm | $43 |

| Progressive | $53 |

| Geico | $60 |

| Allstate | $66 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Lubbock

Cheapest car insurance for teens in Lubbock: Texas Farm Bureau

Texas Farm Bureau has the cheapest full and minimum auto insurance for 18-year-old drivers in Lubbock.

The company charges $67 per month, on average, for minimum liability coverage. That's roughly one-third the Lubbock city average of $206 per month.

Texas Farm Bureau also has the most affordable full coverage auto insurance, at $146 per month, on average. That's about three-quarters cheaper than the Lubbock city average of $561.

Monthly car insurance rates for teen drivers

Company | Liability only | Full coverage |

|---|---|---|

| Texas Farm Bureau | $67 | $146 |

| State Farm | $147 | $312 |

| Geico | $148 | $348 |

| Allstate | $218 | $496 |

| Progressive | $270 | $1,159 |

*USAA is only available to current and former military members and their families.

Teen drivers in Lubbock can save on their monthly rate by taking advantage of common discounts, such as student away from home and good student discounts.

Cheapest coverage in Lubbock after a speeding ticket: Texas Farm Bureau

Texas Farm Bureau has the cheapest auto insurance in Lubbock for drivers with a speeding ticket on their record.

The company charges an average of $87 per month for full coverage, which is less than half the citywide average of $220 per month.

Cheapest coverage after a speeding ticket

Company | Monthly rate |

|---|---|

| Texas Farm Bureau | $87 |

| State Farm | $107 |

| Allstate | $160 |

| Geico | $190 |

| Progressive | $357 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance in Lubbock after an accident: State Farm

State Farm has the cheapest auto insurance in Lubbock for drivers with an accident on their record.

The company charges drivers $125 per month, on average, for a full coverage policy after an accident. That's 62% cheaper than the Lubbock city average of $327 per month.

Cheapest car insurance after an accident

Company | Monthly rate |

|---|---|

| State Farm | $125 |

| Texas Farm Bureau | $139 |

| Allstate | $172 |

| Geico | $254 |

| Progressive | $412 |

*USAA is only available to current and former military members and their families.

Your car insurance rates will usually go up after a crash. Shop around and compare quotes at your next policy renewal to get the best rates for car insurance in Lubbock, TX.

Cheapest quotes for teens after a ticket or accident: Texas Farm Bureau

Texas Farm Bureau has the cheapest auto insurance in Lubbock for teens with a speeding ticket or accident on their record.

A minimum liability policy from Texas Farm Bureau costs $67 per month, on average, for a teen driver in Lubbock who has a speeding ticket. That's less than a third of the city average.

For teen drivers who've been in an accident, Texas Farm Bureau charges $96 per month, on average, which is also less than a third of the Lubbock city average.

Monthly minimum coverage rates for teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Texas Farm Bureau | $67 | $96 |

| State Farm | $147 | $166 |

| Geico | $166 | $218 |

| Allstate | $218 | $221 |

| Progressive | $274 | $280 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for Lubbock drivers with a DUI: State Farm

State Farm has the cheapest car insurance in Lubbock for drivers with a DUI on their record.

In Lubbock, State Farm charges drivers who've had a DUI an average of $114 per month for full coverage. That's less than half the citywide average of $252 per month.

Cheapest Lubbock car insurance after a DUI

Company | Monthly rate |

|---|---|

| State Farm | $114 |

| Texas Farm Bureau | $168 |

| Allstate | $207 |

| Geico | $282 |

| Progressive | $308 |

*USAA is only available to current and former military members and their families.

In Lubbock, getting a DUI will increase your monthly rate by an average of $70 per month. It's a good idea to shop around after a DUI to get the best rate.

Consider taking extra steps to lower your monthly auto bill, such as enrolling in a defensive driving course.

Cheapest auto insurance in Lubbock for drivers with poor credit: Allstate

Allstate has the most affordable rates in Lubbock for drivers who have a low credit score, at $160 per month, on average.

That's 60% cheaper than the Lubbock city average of $395 per month for full coverage.

Cheap car insurance in Lubbock for poor credit

Company | Monthly rate |

|---|---|

| Allstate | $160 |

| Texas Farm Bureau | $198 |

| Geico | $415 |

| Progressive | $480 |

| Farmers | $608 |

*USAA is only available to current and former military members and their families.

A driver with poor credit in Lubbock pays more than twice as much as a driver with good credit for the same coverage.

In Texas, car insurance companies can use your credit score when setting auto insurance rates. That's because these companies believe people with lower credit scores are more likely to file claims in the future.

Average cost of car insurance in Lubbock by neighborhood

Your monthly auto insurance rate depends in part on where you live. Certain neighborhoods in Lubbock have higher average rates because they experience more crime, vandalism and traffic, among other reasons.

The most expensive area in Lubbock for car insurance is the southeastern portion of the city, which includes neighborhoods like Chatman Hill, Harwell and Southgate. The cheapest area for auto insurance in Lubbock is the southwestern part of the city, and it includes neighborhoods like Maedgen, Melonie Park, Caprock, and Wheelock and Monterey.

Full coverage quotes by Lubbock ZIP code

ZIP | Monthly rate | % from average |

|---|---|---|

| 79401 | $177 | 2% |

| 79403 | $177 | 2% |

| 79404 | $180 | 4% |

| 79406 | $169 | -3% |

| 79407 | $168 | -3% |

Frequently asked questions

What's the cheapest auto insurance in Lubbock, TX?

Texas Farm Bureau has the cheapest auto insurance in Lubbock, Texas. The company charges $87 per month, on average, for full coverage car insurance.

What's the best car insurance company in Lubbock, Texas?

State Farm has the best car insurance in Lubbock, Texas, because it offers an attractive combination of cheap rates and high-quality customer service.

USAA is also a good choice for auto insurance, but you can only get a USAA policy if you or your immediate family member is a current or former member of the military.

How much is car insurance in Lubbock, Texas?

The average cost of car insurance in Lubbock is $182 per month for full coverage. That's the same as the statewide average.

Methodology

To find the best cheap car insurance in Lubbock, TX, ValuePenguin collected quotes from seven of the most popular insurance companies in Texas. Rates are for a 30-year-old single man with good credit and no accident history who drives a 2015 Honda Civic EX, unless otherwise noted.

Full coverage policies include comprehensive and collision coverage, plus liability limits that exceed the legal requirements for Texas.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection: $10,000

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates came from public insurance company filings and should be used for comparative purposes only. Your own quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.