Average Cost of Homeowners Insurance (2025)

The average cost of home insurance in the United States is $2,151 per year, or $179 per month.

Find Cheap Homeowners Insurance Quotes in Your Area

How much is homeowners insurance?

The average cost of homeowners insurance is between $1,450 per year to $5,287 per year, depending on how much coverage you need.

Companies also consider your location, the age and building materials of your home, your credit score, insurance history and other factors to calculate homeowners insurance rates.

How ValuePenguin calculated these rates

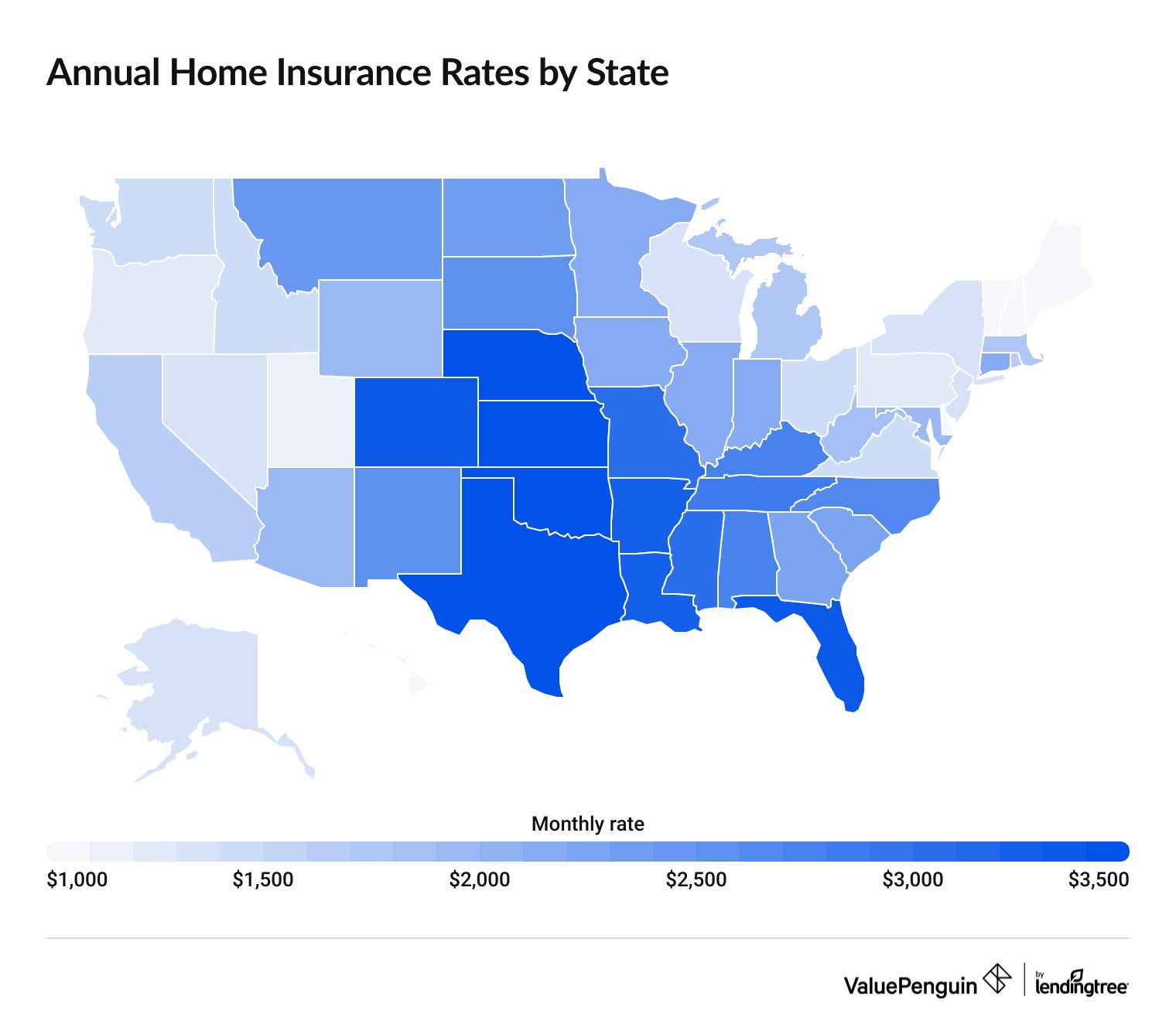

Average price of home insurance by state

A policy in Hawaii, the least expensive state, costs $601 per month. Coverage in the most expensive state, Oklahoma, costs $4,799 per year. That's a difference of

$4,198 per year.

Find Cheap Homeowners Insurance Quotes in Your Area

Average cost of homeowners insurance by state

$200,000 dwelling coverage

State | Annual rate | Monthly rate |

|---|---|---|

| Alabama | $1,831 | $153 |

| Alaska | $1,011 | $84 |

| Arizona | $1,403 | $117 |

| Arkansas | $2,197 | $183 |

| California | $1,201 | $100 |

$350,000 dwelling coverage

State | Annual rate | Monthly rate |

|---|---|---|

| Alabama | $2,717 | $226 |

| Alaska | $1,374 | $115 |

| Arizona | $1,993 | $166 |

| Arkansas | $3,235 | $270 |

| California | $1,624 | $135 |

$500,000 dwelling coverage

State | Annual rate | Monthly rate |

|---|---|---|

| Alabama | $3,630 | $303 |

| Alaska | $1,768 | $147 |

| Arizona | $2,634 | $219 |

| Arkansas | $4,169 | $347 |

| California | $2,048 | $171 |

$1 million dwelling coverage

State | Annual rate | Monthly rate |

|---|---|---|

| Alabama | $6,915 | $576 |

| Alaska | $3,036 | $253 |

| Arizona | $4,749 | $396 |

| Arkansas | $7,247 | $604 |

| California | $3,699 | $308 |

There are several reasons why rates differ by state, like severe weather and crime rates. Your rates will likely differ from the state average, as well.

Which states have the highest home insurance rates?

Oklahoma has the highest home insurance rates in the U.S.

Oklahoma's severe weather, including tornadoes and hail, push its prices much higher than the national average. The states with the highest home insurance costs are generally where natural disasters occur often.

Nebraska, Kansas, Texas and Florida round out the top five most expensive states for home insurance. Homeowners in these five states spend 58% more per year on home insurance than the typical U.S. resident.

Most expensive states for home insurance

Rates are for a home insurance policy with $350,000 of dwelling coverage.

Compare ratesWhat state has the cheapest home insurance rates?

Hawaii, Vermont, Maine, New Hampshire and Delaware are the cheapest states for home insurance.

These states tend to have either fewer natural disasters or lower costs to rebuild a home, and sometimes both. The average cost of insurance for a typical home in these states is $920 per year. That's half the average price nationwide.

- Hawaii: $601 per year, or $50 per month

- Vermont: $929 per year, or $77 per month

- Maine: $977 per year, or $81 per month

- New Hampshire: $1,002 per year, or $84 per month

- Delaware: $1,091 per year, or $91 per month

Rates are for a home insurance policy with $350,000 of dwelling coverage.

Compare ratesHomeowners insurance price by city

Corpus Christi, TX is the most expensive major city for homeowners insurance, at $5,842 per year.

Oklahoma City, Miami, Houston and Wichita round out the five cities with the highest home insurance rates, compared to the 100 largest cities across the U.S. These cities all have a high risk of severe weather damage from hurricanes or tornadoes.

Average price of homeowners insurance by city

City | Annual rate |

|---|---|

| New York City, NY | $1,986 |

| Los Angeles, CA | $1,957 |

| Chicago, IL | $2,496 |

| Houston, TX | $4,661 |

| Phoenix, AZ | $2,276 |

Rates include $350,000 of dwelling coverage.

Average home insurance cost by company

Home insurance rates can vary by $1,408 per year from one company to the next.

State Farm typically has the cheapest home insurance rates. Quotes from State Farm are generally 25% to 38% cheaper than average. Cincinnati, AAA and Heritage also typically offer affordable rates.

Cost of homeowners insurance by dwelling coverage

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | |

|---|---|---|

| State Farm | $1,084 | |

| Cincinnati | $1,084 | |

| AAA | $1,092 |

| Erie | $1,246 | |

| Heritage | $1,314 | |

ValuePenguin only included companies with data available in five or more states.

$200,000

Company | Annual rate | |

|---|---|---|

| State Farm | $1,084 | |

| Cincinnati | $1,084 | |

| AAA | $1,092 |

| Erie | $1,246 | |

| Heritage | $1,314 | |

ValuePenguin only included companies with data available in five or more states.

$350,000

Company | Annual rate | |

|---|---|---|

| State Farm | $1,514 | |

| Cincinnati | $1,646 | |

| AAA | $1,735 |

| Heritage | $1,784 | |

| Erie | $1,979 | |

ValuePenguin only included companies with data available in five or more states.

$500,000

Company | Annual rate | |

|---|---|---|

| State Farm | $1,976 | |

| Cincinnati | $2,295 | |

| Heritage | $2,316 | |

| AAA | $2,424 |

| Allstate | $2,615 | |

ValuePenguin only included companies with data available in five or more states.

$1 million

Company | Annual rate | |

|---|---|---|

| State Farm | $3,295 | |

| Westfield | $3,751 | |

| Heritage | $4,007 | |

| Cincinnati | $4,202 | |

| PURE | $4,421 |

ValuePenguin only included companies with data available in five or more states.

Find Cheap Home Insurance Quotes in Your Area

Average homeowners insurance rates by dwelling coverage amount

The amount of dwelling coverage you have plays a big role in how much you pay for home insurance.

A policy with $200,000 of dwelling coverage costs an average of $1,450 per year, while $1 million in coverage costs around $5,287 per year.

Average home insurance prices by coverage amount

Annual rate | |

|---|---|

| $200,000 | $1,450 |

| $350,000 | $2,151 |

| $500,000 | $2,891 |

| $1 million | $5,287 |

How do companies calculate home insurance rates?

Insurance companies look at many factors to decide how much to quote for homeowners insurance. This includes things like your home's building materials, where you live and your age.

You have control over some of these factors, like how much coverage you get. But you can't change some of these factors, like the age of your home.

Factors you can control that affect your home insurance estimate

The amount of coverage you want plays a major role in determining your home insurance costs.

Your dwelling coverage limit is based on the cost of rebuilding your home, so you don't have much control over your coverage limit.

But, there are two different types of dwelling coverage to choose from: actual cash value and replacement cost.

- Actual cash value coverage pays for repairs based on the current condition of your home. So you may not get enough money to fully fix or rebuild your home after a disaster.

- With replacement cost coverage your insurance payout stays the same, even as your home ages and needs more upkeep. For that reason, replacement cost is generally a better choice. However, it's typically much more expensive than actual cash value coverage.

Your personal property and liability coverage also affect your home insurance rates.

- Standard liability coverage generally starts at $100,000.

- Your personal property coverage limit is usually 20% to 50% of your dwelling coverage limit.

Raising either of these coverages will cost you more.

Your deductible is the amount you must pay towards fixing or rebuilding your home when you use your insurance. Choosing a higher deductible means lowering your potential benefit, which makes your rates cheaper.

Renovations that make your home more safer or more resistant to damage could lower your rates. This could include replacing an old roof or installing a security system.

On the other hand, increasing the square footage of your home could get you higher rates.

Insurance companies view a good credit score as a sign of financial stability. In some states, companies may reward a good credit score with lower rates.

While improving your credit score takes time, it might help you get more affordable rates.

Other factors that affect home insurance rates

Older homes are more likely to have wear and tear that increases both risk and your rates.

Certain materials are more vulnerable to fire, rotting and other dangers. For instance, homes with metal or tile roofs will likely have lower insurance rates than homes with asphalt roofs.

In addition, some materials are more expensive to replace than others, such as a marble countertop versus laminate.

If you live in an area with high crime rates or stormy weather, or you’re far from a fire department, you may pay more for home insurance. That's because your home and belongings are more likely to experience damage, which makes you more expensive to insure.

Liability insurance covers any injuries your pets may cause. If you have a particularly "aggressive" breed as a pet, your insurance company may increase your rates.

Your claims history shows how likely you are to file a claim in the future. The more claims you have made, the higher your rates.

You might see a hot tub, swimming pool or trampoline as a perk. But, these amenities typically cause your home insurance rates to go up. That's because guests at your home are more likely to hurt themselves by slipping on a wet pool deck or falling off a trampoline.

These injuries could result in lawsuits, so insurance companies tend to charge more to protect themselves against the added risk.

How can you lower the cost of your homeowners insurance?

There are four main ways to lower your insurance costs: shop around for quotes, qualify for discounts, raise your deductible or update your home.

The best, easiest way to make sure you're not paying too much for homeowners insurance is to get quotes from multiple insurance companies. It's especially easy to do this when your policy is up for renewal or if you've made major changes to your policy.

Next, be sure to ask about homeowners insurance discounts. While discounts vary from company to company, some common ones include:

- Multi policy discounts

- Claim-free discount

- Loyalty discount

- Home safety discount

- Roof discount

- Retiree discount

Another option is to raise your deductible, which is the amount you pay before insurance kicks in. A higher deductible directly results in a lower rate.

However, you should only raise your deductible to an amount you can easily afford to pay after an emergency. If you couldn't afford an unexpected $5,000 expense, you should keep your deductible below that amount.

Some home renovations can lower your insurance rates, or get you a discount.

For example, replacing an old roof or outdated electrical system can help make your home safer and lessen the likelihood that you'll file a claim for a leak or electrical fire in the future. So these renovations would likely save you money on home insurance.

However, not all renovations result in a lower home insurance rate. If you remodel your kitchen with marble countertops and high-end cabinetry, your home insurance rates will probably go up. That's because these materials cost more to replace than builder-grade materials.

What does homeowners insurance cover?

Basic homeowners insurance protects the structure of your home, property and belongings. It also provides liability protection and pays for temporary housing if something happens to your home.

Dwelling coverage pays to fix or rebuild your home if it's damaged by a covered event, like a fire. This typically includes your:

- Roofing

- Walls

- Floors

- Foundation

- Built-in appliances

- Garages

- Sheds and other structures

Personal property coverage protects your belongings from any damage caused by a covered event. A standard policy usually includes coverage for:

- Furniture

- Clothing

- Electronics

- Jewelry

Liability coverage pays for property damage or injury to others that you accidentally cause. This can include:

- Legal expenses if your dog bites a guest

- Legal expenses if your tree falls and damages your neighbor's roof

- Repairs to your neighbor's window if you break it while playing ball

Loss of use coverage pays your expenses if your home becomes unsafe and you have to temporarily move out. This can include:

- The cost of living in a hotel or motel

- Meals out while living in temporary housing without a kitchen

- A credit check fee for renting out a temporary home

- Transportation reimbursement for increased miles needed to travel to your workplace

Frequently asked questions

How much is home insurance?

The typical homeowners insurance cost in the United States is $2,151 per year, or $179 per month. Rates can vary by $350 per month, depending on which state you live in.

How is homeowners insurance calculated?

Homeowners insurance companies calculate rates using a number of different factors. Some of the most important are your home's location and building materials, your claims history and the amount of coverage you buy.

How much is homeowners insurance on a $350,000 house?

The average cost of home insurance for a $350,000 house is $2,151 per year nationally. However, rates vary depending on the company you choose, where you live and your personal info.

How much is homeowners insurance on a $500,000 house?

A $500,000 home costs an average of $2,891 per year to insure. State Farm has the cheapest rates for $500,000 homes, at around $1,976 per year.

What state has the highest home insurance rates?

Oklahoma is the state with the most expensive home insurance quotes, at $4,799 per year, on average. That's more than double the national average, which is $2,151 per year.

Methodology

ValuePenguin collected home insurance rates for every residential ZIP code in the United States, from the largest homeowners insurance companies in every state.

Quotes are for a 45-year-old married man with no history of home insurance claims and a good credit score. Rates include the following coverage limits:

- Dwelling coverage: $350,000

- Personal liability coverage: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes will likely be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.